baona/iStock via Getty Images

Investment Thesis

Lynas Rare Earths (OTCPK:LYSCF) showed up on our radar while we were researching potential investment opportunities in forward-facing commodities. While we are enthused in the role of rare earths in clean energy transition and like the soundness of the company’s standing, we feel current valuations are lofty considering the projected size of its future footprint, and the sense that rare earths price appreciation is priced into the stock.

The Company

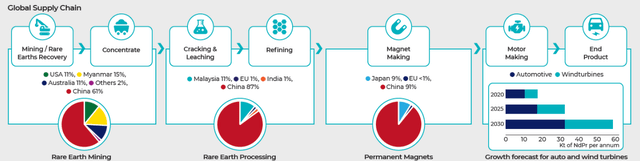

Lynas is a rare earths materials extraction and processing company, and recognised as the world’s largest processor outside of China. Of the numerous elements classified as rare earths, Lynas is primarily focused on production of NdPr, notable for its applications in wind turbines and automotives for a renewables-transitioned future.

Its current operations consist of a mine in Western Australia and a processing plant on the Eastern coast of the Malaysian peninsula. It recently updated a strategic plan to expand annual NdPr production capacity from 7,000t to 12,000t (~70% increase) by 2025 through capex spend predominately in Australia. Also scheduled for 2025 is the commencement of a separation facility for light and heavy rare earths in Texas, which notably secured support from the US Department of Defense.

The rare earth markets, and Lynas’ position within it, is intriguing. China dominates the supply chain from upstream to downstream. Of the small piece of the pie remaining for the rest of the world, Lynas is the largest player. With the global focus on energy transition, the overall rare earths market is forecasted to triple by 2030.

China takes up a substantial portion of market share, and Lynas is the largest player of what remains. Overall market growth is expected to triple grow by 2030. (from Lynas presentation materials)

The US, Japan and the EU have viewed China’s near-monopoly of rare earths as a national security concern, and Lynas is a beneficiary of the support from these like-minded countries. This leaves Lynas in somewhat of a niche: restricted in its ability to be more influential in the market, but protected by powerful organisations who welcome its geographical alignment.

Valuations

Lynas reported record earnings for Financial Year 2022 of A$541m, buoyed by robust NdPr prices during the period. This equates to an EPS of A$0.60 and P/E ratio of 15x. We calculated implied forward P/E in the range of 10-11x (pay off within 10-11 years) when factoring in the 2025 production expansion plans, as well as assuming rare earth prices stay at current levels.

We wish to highlight that we made no estimation on the US facility’s earnings ability at this moment. Quoted NdPr production capacity of 1,250t is marginal relative to the Malaysian operation. Furthermore, we assume unit costs will be higher than current levels, and that would in turn constrain margins. In our view, the US expansion reflects a longer-term strategic decision rather than a shorter-term commercial one.

Rare Earths And Peers

We’ve been fascinated in trying to understand the nuances in the supply and demand dynamics of forward-facing commodities, and how it transmits through to spot price movements.

For argument’s sake, we’ve looked to compare Neodymium (Nd)’s prior 3-year price movement to Lithium and Copper. This period was interesting because of the energy transition undercurrent amidst the macroeconomic changes of demand destruction from COVID-19 lockdowns in 2020, the supply disruptions of 2021, and recession concerns in 2022.

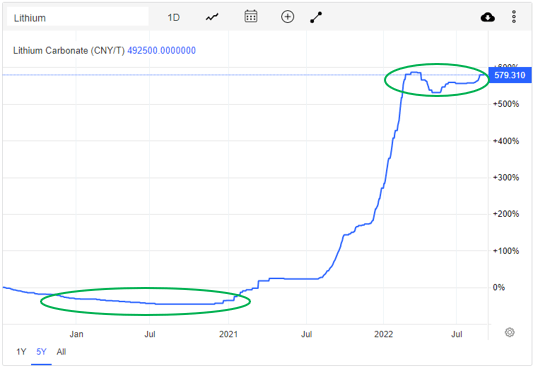

Lithium demonstrated resilience during economic slowdowns in 2020 and 2022… (tradingeconomics.com)

Lithium didn’t experience a demand shock in early 2020 but did see gradual price weakness over the entirety of the year. It wasn’t until the re-opening trade/high EV demands, and subsequent supply-chain disruptions in 2021 that Lithium saw prices rocket, and have remained elevated since despite global growth contraction this year.

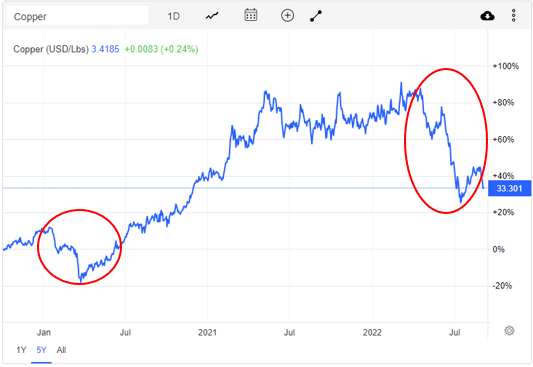

…whereas Copper has shown more vulnerability (tradingeconomics.com)

In contrast, Copper quickly retraced its spike down in early 2020 as the industrial activity downturn was not as bad as feared. It too participated in the re-opening trade and supply-chain disruption narratives, however has rolled over in 2022 in line with economic slowdown.

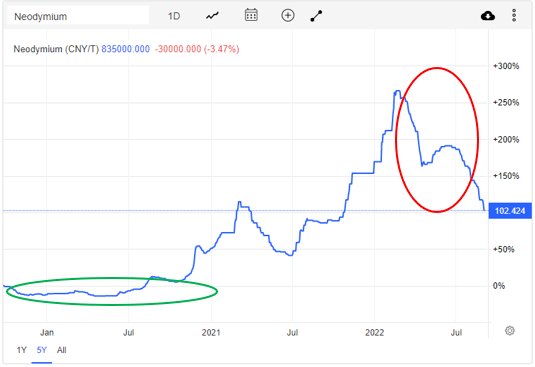

We see Neodymium as having a mixture of Lithium and Copper’s characteristics (tradingeconomics.com)

We view Neodymium’s recent performance within the middle ground of these two comparisons: initially avoided severe impact by the outbreak of the pandemic, a beneficiary of 2021 tailwinds but now fading on macroeconomic worries.

Our view is that rare earths prices will continue to benefit from the clean energy transition, but can be swayed by the broader business environment, and therefore is perhaps less of a renewables pure-play than it is first thought to be.

With that said, our value-oriented approach looks to limit speculating on commodity price movement as a means to form an investment decision. Instead, we look to find opportunities at attractive valuations first, and then seek out broader narratives in the underlying commodity’s outlook to underpin our conviction.

Specific to Lynas, our estimated implied forward P/E of 10-11x assuming no change in rare earth prices is not sufficiently attractive. This would change if we strongly believed that rare earth prices would substantially appreciate over time, however this conflicts with our investment philosophy.

Risks

Having excluded commodity price volatility from our thinking, we feel the remaining risks are moderate.

Market Share: As alluded to above, Lynas enjoys the support of customers and so is at less risk of losing market share, but by the same token it is constrained both by capacity and its lack of presence in China to substantially rival Chinese counterparts.

Rare Earth Demands: Long-term demand for rare earths increasing will protect Lynas’ sales volume. Unfortunately, we note that Lynas’ production is close to full capacity and its pipeline production increases are modest, which caps its ability to fully capitalise on this rising demand.

Future Production Volumes: Although we view the increased production plans as good news, we are less excited about the 2025 timeline, as well as the magnitude of these increases (70% of current production).

Potential Production Disruptions: Our base case relies on FY2022 earnings, a year in which the company operated at around 80% capacity due to supply chain issues, COVID-19 restrictions, and water shortages in Malaysia. We’ve assumed future utilisation at roughly these levels, although more generally we are uncomfortable with the single-point-of-failure risk of the current business model.

Conclusion

We find the fundamentals of the company attractive, and expect continued earnings resilience. However, in our opinion, current valuations do not make sense unless speculating that rare earth prices will continuously trend upwards over the next 10 years.

We will be monitoring rare earth prices to see if we can attribute future movements to macroeconomic events, and pinpoint if market conditions turn favourable. We will also be keeping a look-out for clarity on the commercial prospects of expansion projects due 2025, and simultaneously hoping that a more compelling entry point presents itself within the next three years.

Be the first to comment