Petri Oeschger/E+ via Getty Images

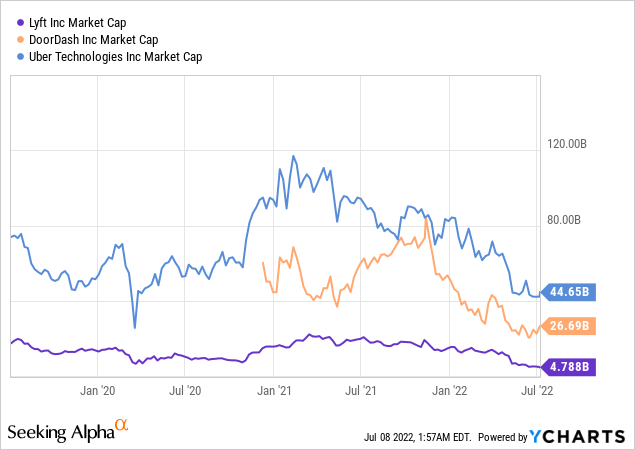

Lyft (NASDAQ:LYFT) is an American transport company that was established in 2012 and is headquartered in San Francisco, California. The stock debuted on the NASDAQ exchange in March of 2019 and has a market cap of $4.66 billion as of July 2022. Market volatility has driven the price down to attractive levels despite the steady underlying business performance.

Company Outlook

The company became popular with investors during the pandemic when fears of a prolonged impersonal economy brought ridesharing companies to their knees. They responded by pushing delivery services which turned out to be an inspired move. Lyft hasn’t really pushed that side of the business but the stock has benefited from a generally positive sentiment from similar operators like DoorDash (DASH) and Uber (UBER) during the pandemic trade.

As the economy reopened, the ridesharing industry began to recover, but the recent market turmoil has battered these stocks, which begs the question. Should investors be buying this dip?

With a US market share of about 29%, Lyft is the second-largest ride-sharing company next to Uber. But the two companies aren’t the same. Uber has been much more aggressive with growth targets and developing its food delivery business unit. In fact, Lyft opted not to build out a dedicated food and food delivery interface like some of its peers. They give drivers the option of selecting food pickup in the normal rideshare interface, but it hasn’t been the main focus. This is understandable as there are signs that the delivery market may be becoming saturated as the delivery companies make very little per order. There are also geographic differences.

As of now, Lyft only operates in the United States and Canada, which it expanded into in 2017. Lyft is available in more than 645 cities in the US and 10 major cities in Canada. This pales in comparison to its primary rival, Uber, which is available in 71 countries around the world across over 10,000 cities.

Post-Pandemic Recovery for Lyft

The COVID-19 pandemic was detrimental to ridesharing companies. Rules and regulations about social distancing and wearing masks meant that most people were not using these platforms. As the world emerges from the pandemic, Lyft has seen a strong rebound in demand amongst riders. In the recent earnings, release management mentioned that despite omicron softening demand in January the recovery has been robust. There was also a 40% YoY increase in the number of active drivers and driver earnings were up despite the elevated gas prices which should have been a major deterrent for drivers. Drivers also gave more rides than in 2019, which really drives home the idea that the business model still works for its drivers. In the past, the reopening was touted as a possible barrier to the growth of ridesharing companies as it was expected to effectively reduce their pool of drivers as people went back to conventional employment. This debate has plagued the stock for some time, and it’s great to see the company respond with solid performances as this really is a core component of their business model. For the time being, people still seem to love working for Lyft, which is great news for shareholders.

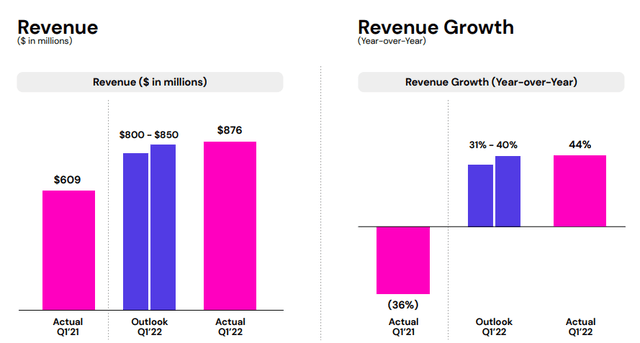

The results were evident in its Q1 2022 earnings, where the company saw a robust 44% year-over-year growth in total revenues.

Lyft

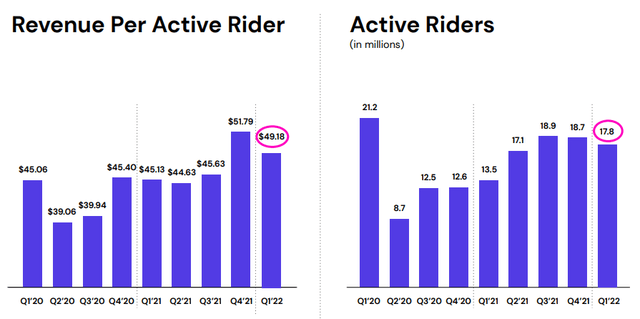

The company also reported a 9% year-over-year growth in revenue per active rider, although this declined on a sequential basis from the fourth quarter of 2021. Omicron was called out as a reason for the hiccup in sequential growth, with the virus impacting January demand numbers before seeing a strong recovery in February.

Lyft

Lyft’s active riders also rose by 32% year over year, which illustrates that it is well on its way to a return to normalcy.

International Expansion

Lyft has slowly followed in the footsteps of Uber but has not fully opened its services in the same way. Some have branded this as hesitation, but I believe it has more to do with the firm wanting to focus on its core business and core markets. I would like to see the firm be more aggressive with international expansion, but it’s not a straightforward endeavor. Many of the other developed nations have their own regional versions of the delivery and ride-sharing services offered by Lyft. There are also cultural preferences along with issues like regional crime spots that complicate the process. I would urge shareholders to be patient on this front.

Partnerships

Lyft has even partnered with global companies to provide transport services for users and guests. These brands include Airbnb, Salesforce.com, Delta Airlines, and SAP. My favorite is the Hertz and Lyft Rideshare Program, which helps would-be drivers with rental rates so they can earn with the company without owning a car. The delivery segment is partnered with the restaurant software platform, Olo, to provide streamlined delivery orders that Lyft drivers can pick up and deliver. This jives well with the company’s overall focus. Put another way, Lyft isn’t an ordering system but rather a pure-play delivery service for restaurants.

Earnings Outlook & Valuation Commentary

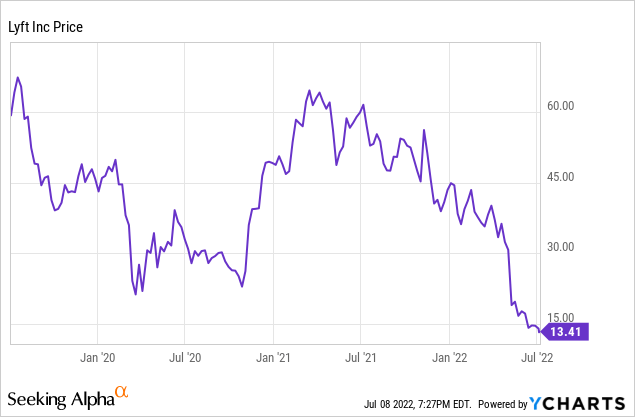

Lyft’s stock has struggled this year with a particularly painful sell-off following a weaker-than-expected guidance forecast following its earnings call. Shares are down 66.7% year to date and over 75% during the past 12 months. The stock is currently trading lower than its IPO price, so value investors may see a significant upside from its current levels.

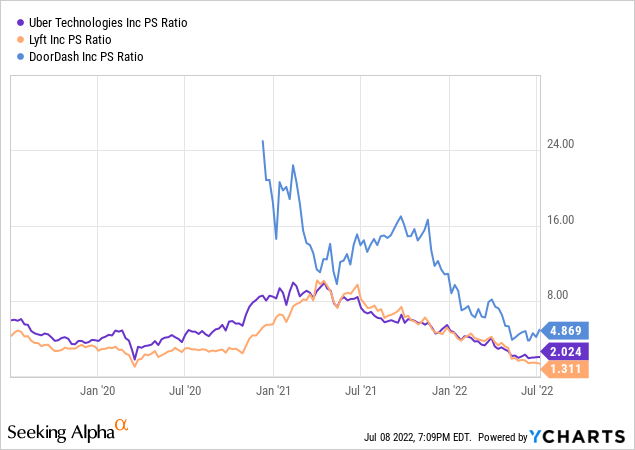

In terms of price multiples, Lyft is certainly trading at a discount. At current levels, investors would be paying one dollar and thirty-one cents for each dollar of the company’s revenue which suggests the company is attractively priced.

The company is also trading at a lower PS ratio than its peers, Uber and DoorDash.

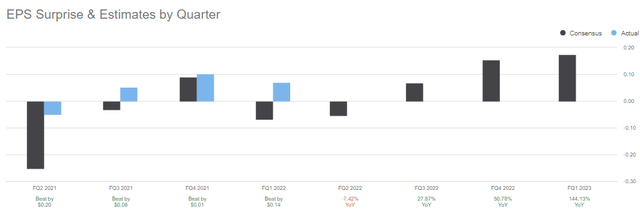

The difficult thing with Lyft lately has been pinning down EPS and EBITDA estimates. With work from home changing consumer behavior post-pandemic, the company’s EPS figures, compared to estimates, have been a mixed bag.

Seeking Alpha

Lyft is expected to report Q3 earnings on August 3rd. Based on strong sequential EPS trends and the departure from the impersonal economy brought about by the pandemic. Investors should pay attention to growth in revenue on the west coast as this has lagged behind some regions. I also look forward to guidance on the company’s incentives to secure its driving fleet. The incentives have clearly worked, and the company may have been able to pass costs on to the customer as oil prices and inflation will have softened the customers’ expectations on order fees. There is an awful lot of bad already baked into Lyft’s stock price, and it will be interesting to hear what the growth plan is going forward, as the focus was on retaining drivers in the past. A concrete plan for broader international expansion would be great news – even if it is just big cities for the time being, but this is unlikely. Instead, the company will likely focus on taking domestic market share from Uber and overall category growth, which won’t be anything new.

In the longer term, I am looking for FY22 revenue to come in around $4.2Bn, a roughly 30% increase from the 3.21bn in FY21 and less than the 44% increase YoY last quarter. I expect bad conditions for growth stocks to persist through the end of 2022, with things beginning to turn around in early 2023. Should this play out, I believe Lyft should be able to get to a PS multiple of 3, which is good for $36 per share. We will take a 20% margin of safety for a price target of $29 per share. This is good for a roughly 120% upside.

Conclusion

Lyft is an excellent company at a super price. The company is well run and has a solid liquidity position. The recent market volatility has rewritten valuation stories across the board, but we will likely see some sort of a reprieve in 2023. For the time being, conditions are poor for growth stocks, and earnings estimates could very well bring us lower. Despite this, Lyft is in value territory. Long-term investors should feel comfortable starting a position at these levels.

Be the first to comment