metamorworks

|

Investment Results |

Full Year 2019 |

Full Year 2020 |

Full Year 2021 |

Year-To-Date 2022 |

Since Inception1 |

|

LVS Defensive Portfolio (net of fees) |

7.0% |

13.2% |

9.1% |

(1.0%) |

30.8% |

|

Benchmark: Barclays High-Yield Bond Index |

13.4% |

5.0% |

4.0% |

(14.8%) |

17.8% |

|

LVS Growth Portfolio (net of fees) |

– |

61.8% |

16.1% |

(36.2%) |

19.8% |

|

Benchmark: S&P 500 Total Return Index |

– |

18.4% |

28.7% |

(20.3%) |

21.5% |

Note: investment performance is presented net of all fees and expenses. Investment results are as of June 30, 2022.

(1) LVS Defensive was incepted on January 1, 2019. LVS Growth was incepted on January 1, 2020.

Dear Investors,

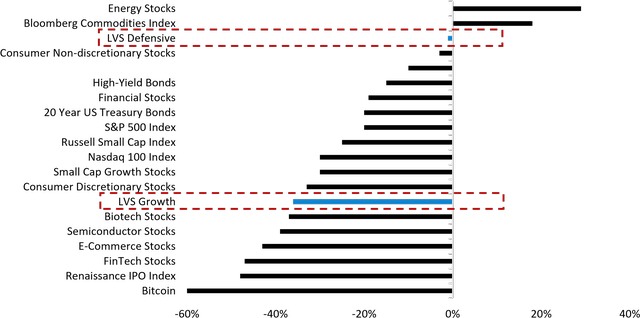

2022 has so far been the most challenging period of my investment career. The S&P 500 had its worst first half decline in over 50 years. It was the absolute worst first half in history for the Nasdaq 100, US Treasuries, and investment-grade bonds. Outside of energy stocks and commodities, there was no place to hide, and as we have discussed in prior letters, the indices mask even deeper losses for the median stock.

The performance at LVS Advisory has been mixed.

First Half 2022 Performance By Asset Class

For the first half of the year, the Defensive Portfolio declined 1% ((net)) which compares favorably to bonds, stocks, or really any benchmark that would make sense to compare it against. In short, the Defensive Portfolio has done its job to protect our investors’ capital during yet another tough period. Barring any further surprises, I expect the Defensive Portfolio to generate positive results in the back half of 2022, and I expect the portfolio to return to its normal pace of 5% to 15% annualized net returns in 2023.

The Growth Portfolio declined 36% ((net)) during the first half of 2022. This compares to the S&P 500 decline of 20% and the Nasdaq 100 decline of 30%. Our underperformance was driven by a few factors:

- We have a bias towards investing in industries that have been hit the hardest during this period, namely software, fintech, and consumer discretionary.

- At the start of the year, approximately one-third of our portfolio was invested in international stocks primarily held in foreign currencies. The US dollar strengthened by roughly 10% during the first half, detracting from our results on a mark-to-market basis.

- Our portfolio has a bias towards investing in small & medium capitalization stocks which have underperformed large cap stocks. In fact, the US small cap stock index has given back all of its gains from the past 2 years and is now trading at pre-pandemic levels.

- The Growth Portfolio runs concentrated with 10 to 20 stocks (compared to an index fund with hundreds of stocks). This results in more volatile performance and translates into our highs being higher such as in 2020 and early 2021 and our lows being lower as we are experiencing right now.

Generating outsized investment performance over the long run involves experiencing volatility (with greater risk comes greater reward). This is par for the course given our chosen investment style. In fact, our ability to withstand short-term volatility is a competitive advantage. Instead of worrying about the incremental downside that may or may not materialize over the next 12 months, we are focused on taking advantage of this incredible opportunity to buy world-class businesses at discounted valuations. We will reap the rewards of our approach on the other side of this bear market.

Is this a good time to buy stocks?

In our last several letters, we have discussed the rising risk of a recession and how persistent inflation has stoked the Federal Reserve to increase interest rates. As a result of these external factors, the economy appears to be weakening and our base case today is that a recession will occur within the next year.

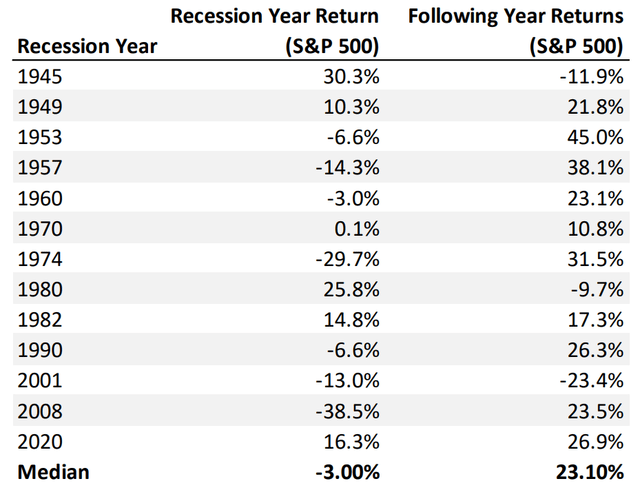

Given that a recession is now our base case, what should we expect from here regarding financial market performance? The table below shows returns for the S&P 500 during all 13 recessions that have occurred during the modern post-WWII period.

Source: CFRA Research, NBER, S&P Global.

Over the last 100 years, the S&P 500 has roughly appreciated by 9% per year on average. According to the table above, the stock market declined during the recession years. However, the year following a recession tends to show strong outperformance in the market.

The severity of the decline during a recession can range anywhere from down 15% to down 40%. Markets are already down over 20% this year, suggesting that much of the medicine has already been taken. If history is any guide, there may be an incremental 10% to 20% more for the markets to decline but is it also possible that we are closer to the bottom than many realize.

The stock market downturn has been driven by high inflation which has resulted in rising interest rates. Therefore, the key to figuring out when the stock market will bottom is determining when inflation will be under control so that interest rates won’t need to be further increased. Inflation has continued to run hot which had caused investors to continue to sell down their stocks; however, there are signs that inflation may be easing.

Since mid-June, the prices of many key commodities including crude oil, copper, soybeans, and cotton have declined substantially. Furthermore, the inflation expectations gauge as tracked by the US 5-year breakeven interest rate has declined from its March peak.

Although we won’t know for at least 6 months, evidence is building that inflationary pressures are starting to ease. If true, it would give central banks and governments breathing room to apply fiscal and monetary stimulus to boost the economy and reset the economic cycle. This would be bullish for asset prices including stocks.

The importance of a multi-year investment time horizon

While it is fun to speculate on the macro environment, business fundamentals drive equity returns.

For example, take Endor AG (OTC:ENDRF), a stock we purchased in the Growth Portfolio last summer and pitched in this presentation and in this podcast. Endor has a long runway for continued growth because its video game and esports end-markets are far from mature. Further, the company has been under-earning over the past 18 months due to supply chain issues that have left it shortchanged on inventory but with a large backlog of demand.

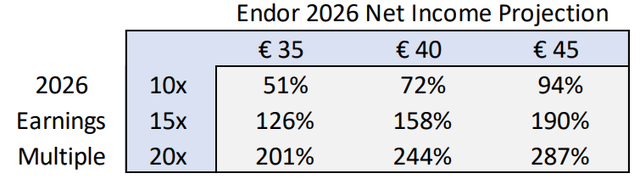

We expect Endor’s net income to grow from approximately €12 million this year to around €40 million by 2026. The stock’s current earnings multiple is 21x. If Endor can maintain its current market multiple and hit our earnings expectations, the stock will more than triple within 5 years. Of course, we do not have a crystal ball regarding the exact net income figures or what the market will be willing to pay for those earnings, but a scenario analysis shows an attractive range of outcomes.

Upside in Endor’s Stock Under Different Scenarios

A severe recession in 2023 could cause earnings growth at Endor to disappoint, and higher interest rates could cause the multiple to come down from 21x to 15x. Therefore, if you have a 1-year time horizon, you would be justifiably worried about the near-term macro-economic impact on the stock price. But if you have conviction in the longer-term trajectory of the business, Endor at its current stock price is a steal relative to its earnings potential 3 to 5 years out.

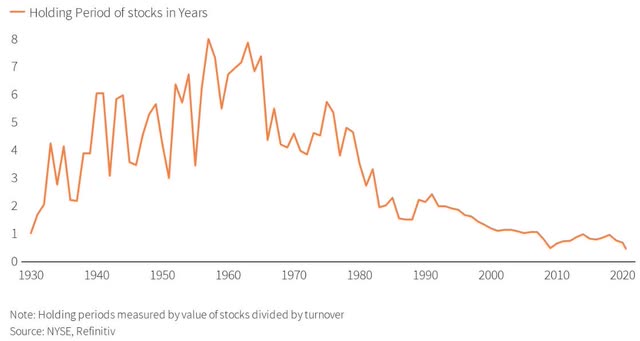

The short-term game is a difficult one to play although it appears to be getting more popular. According to a study conducted by the New York Stock Exchange and Reuters, the average investor’s holding period for a stock is shrinking. The average holding period was 5 years in the 1970s but has collapsed to just 5 months today.

The ‘short-termism’ of the market is on full display right now. Investors are acutely worried about what will happen in the next 2 quarters and are willing to abandon otherwise good businesses set up for strong performance over the next 3 to 5 years.

We focus on underwriting Growth Portfolio investments on 5-to-10-year outcomes. Having a multi-year view gears us to the long-term business drivers and helps us rise above the short-term noise. Sometimes a market rout will expose a business model weakness and cause us to sell one of our holdings (as we discussed in our April 2022letter), but we strive to be opportunistic when other investors are myopic.

Managing risks in merger investing

In the Defensive Portfolio, we primarily invest in merger arbitrage situations. Merger investors make money as long as the deals they are betting on are completed. This translates into a strategy that performs well regardless of macroeconomic factors – hence why the Defensive Portfolio has performed relatively well so far in 2022.

When financial markets are volatile, merger investors start to get nervous that certain deals may not close as expected. First, for deals reliant on financing to be completed, the financing may not be available. Second, many acquirers suffer from buyer’s remorse and try to back out of deals.

When we invest in deals, we are very focused on avoiding situations where something can go wrong. We study the contractual strength of merger agreements, profile the buyers to understand their motives, and avoid deals contingent on shaky financing. Due to our careful and conservative approach, we are confident in the deals we have invested in.

A good example of a situation we avoided was Elon Musk’s deal to acquire Twitter (TWTR). In this case, the merger agreement is contractually very strong. However, Elon Musk is an impulsive and unpredictable buyer. In 2018, he offered to acquire Tesla and backed away from the offer a few months later. Furthermore, the $44 billion acquisition was originally to be financed by taking out a sizable margin loan on his Tesla stake that could be impacted by a decline in Tesla’s stock. Finally, it quickly became clear that Musk struck a bad deal when the technology market crashed in the weeks following his Twitter deal signing.

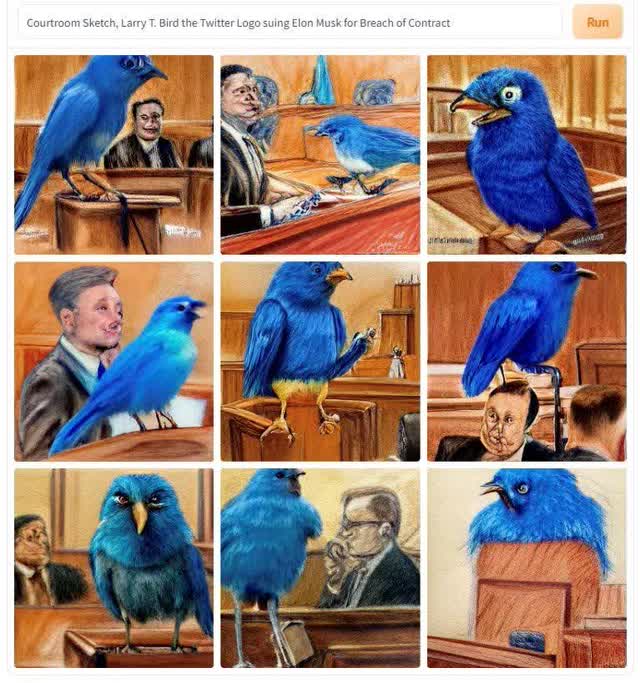

Dall-E AI-Generated Image of Twitter Suing Elon Musk

We were not surprised when Musk attempted to terminate his deal with Twitter just a few months after agreeing to it. Because the deal is legally binding, Twitter is taking Musk to court. Merger agreements are rarely tested in court, so we are watching this situation intently from the sidelines to see how it will play out.

Instead of betting on impulsive deals with questionable motives, we prefer betting on deals that are clear win-wins for the buyers and sellers. For example, a situation where the buyer is willing to pay a healthy price to lock in the strategic benefits & synergies of a deal and the seller’s shareholders are exiting from a position of strength.

The merger arbitrage asset class is currently offering historically attractive returns because investors are worried about more situations like Twitter resulting in busted deals. While there are many deals that we are avoiding due to heightened risks, we are excited about the current opportunity set. In fact, we estimate that our portfolio is currently offering a yield exceeding 10%. We faced a similar situation in 2020 during the covid crash. 2020 ended up being our strongest year of performance for the Defensive Portfolio since inception.

Until next time

Thank you for your continued interest in and support of LVS Advisory. This is both a difficult and exciting time to be an investor. I will do my best to maintain close and clear communication as we navigate this dynamic market environment. We are taking a measured but constructive approach to balance risk management with opportunistic risk taking and I am confident that we will come out of this bear market stronger than we came in.

Best regards,

Luis V. Sanchez CFA

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment