zhnger/iStock Editorial via Getty Images

Thesis

LVMH (OTCPK:LVMUY) stock is down 20% YTD and accumulating and equity position looks attractive at < $120/share. In my opinion, there is no better name to buy, if an investor would like to gain exposure to the attractive luxury industry. Moreover, given LVMH’s history of outperforming the market with regards to both business growth and value accumulation, a < x20 P/E multiple looks cheap.

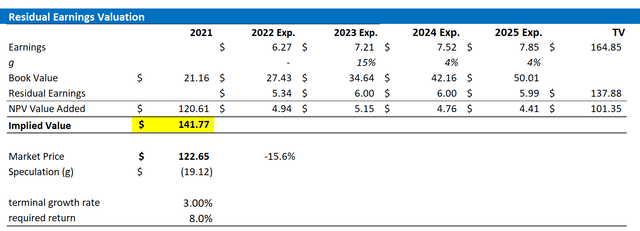

I value LVMH based on a residual earnings framework – anchored on analyst consensus estimates – and calculate a fair share price of $141.77/share, implying approximately 15% upside.

About LVMH

LVMH is a holding company based in France and arguably the world’s leading luxury conglomerate. The company develops manufactures and distributes some of the world’s most popular luxury goods in five core segments: Wines & Spirits, which is about 45% of sales; Fashion & Leather Goods with approximately 10%; Perfumes & Cosmetics with another 10%; Watches & Jewelry with 5%; and Selective Retailing accounting for the rest. Furthermore, LVMH is also active in hospitality (Bulgari Hotels & Resorts). Most notably, LVMH’s portfolio comprises more than 70 brands, including names such as Louis Vuitton, Bulgari, Dior, Kenzo, Givenchy. In 2021, LVMH also closed the acquisition of Tiffany & Co. From a geographical perspective, LVMH’s main target market is Asia, accounting for 40% of sales, EMEA accounting for 25%, North America with about 25%. LVMH has outperformed the market considerably in the past 5 year—stock is up about 170%, vs the Eurostoxx being flat over the same time.

The Opportunity

LVMH stock is down approximately 20% YTD, as the company was pressured by multiple headwinds: 1) rising yield, inflation, and cautious sentiment towards risk assets, 2) slowing consumer confidence, and 3) macroeconomic headwinds, including the Covid-19 lockdowns in China. That said, as the stock is now trading at a one-year forward P/E below x20, the stock has never been cheaper in the past decade.

There are good fundamental reasons why LVMH stock might be a good buying opportunity, in my opinion. First LVMH’s luxury offerings are less cyclical—or at least less vulnerable to recessions–than most investors might expect and assume. During Covid-19, for example, LVMH’s sales only fell from $60.1 billion to $51.0 billion and net-income margins only compressed by approximately 2 percentage points. Notably, in 2021 the company recorded a net-income of $5.77 billion and cash from operation of more than $12 billion. Second, the Chinese economy is showing signs of strengthening consumer confidence and business activity, as Covid-lockdowns ease and the government is pushing more economic stimulus. I believe LVMH is in a prime position to benefit from the China’s reopening story. Thirdly, in my opinion LVMH is poised to continue seeing a strong multi-year tailwind from the globally accelerating demand for luxury products. According to BCG, the global luxury market is expected to grow at a 6% CAGR between 2022 and 2026. Finally, investors rightfully consider LVMH as one of the world’s best managed companies, as LVMH’s founder-led culture, driven by creativity and premiumization, sustained – over a long period – high-brand equity, pricing power, accreditive M&A transactions, steady volume and revenue growth, and steady value accumulation.

Financially, LVMH is doing very well. In 2021 the company generated revenues of $75.95 billion and net income of $14.2 billion (18.7% margin). Cash from operation was $22.06 billion. The company closed Q1 2022 with $12.02 billion of cash and cash equivalents and $39.3 billion of total debt. According to the Bloomberg Terminal as of July 2022, analyst consensus forecast estimates LVMH’s 2022 and 2023 revenues at $83.25 billion and $90.80 billion. Respectively, EPS are estimated at $6.27, $7.10.

Residual Earnings Valuation

Let us now look at LVMH’s valuation in more detail. I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS ’till 2025, a WACC of 8% and a TV growth rate equal to nominal GDP growth (3%).

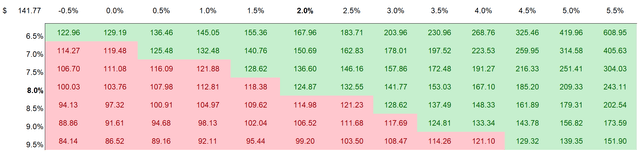

In my opinion, the long-term growth assumption equal to GDP growth might definitely be an underestimation, in my opinion, but I prefer to be conservative. If investors might want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to LVMH’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $141.77/share, implying approximately 15% upside potential based on accounting fundamentals.

Analyst Consensus; Author’s Calculation

Analyst Consensus; Author’s Calculation

Risks

In my opinion, LVMH stock is significantly de-risked at a P/E (FWD) below 20 and the risk/reward looks favorable. However, investors should note the following risks that might cause LVMH stock to significantly deviate from my target price: 1) slowing consumer confidence due to inflation outpacing wage growth, rising interest rates and increasing unemployment; 2) LVMH’s significant exposure to China, which is especially Covid-19 lockdowns; 3) macro-economic uncertainty relating to the monetary policy actions of the ECB and actions of the European government against Russia.

Conclusion

While 15% upside does not seem much, I see LVMH as a buying opportunity. My recommendation is based on LVMH’s undisputed leadership in the luxury sector. In my opinion, LVMH ranks amongst the best-managed companies with a proven track-record of EPS growth, successful M&A execution, and genuine business creativity. Moreover, brand equity is unmatched in the fashion industry. In that context, a P/E <x20 looks highly attractive. Buy.

Be the first to comment