Andrii Borodai/iStock via Getty Images

By Srineel Jalagani

Luxury Lies In The Eyes Of The Consumer

The term luxury summons a variety of ideas to mind. The range spans from caviar to corvettes, and gin to jewelry. While luxury products are varied, the brands behind them are well-known and etched into our cultural memory. Brands like Gucci, Luis Vuitton and Porsche are nearly a century old. The luxury segment’s durability is echoed in its revenues that grew by 6% CAGR according to some estimates1 during the 1996-2018 period, highlighting the positive impact of globalization on luxury markets from the opening of the Asian economies.

Outperformance Retracement Rather Than Underperformance

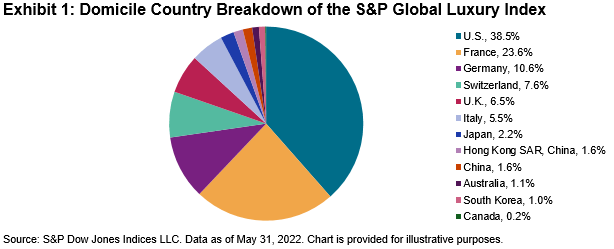

Our S&P Global Luxury Index is designed to measure stocks that are engaged in the production, distribution or provision of luxury goods and services, from specific GICS® industries that align with the luxury theme.2 Our index construction methodology assigns a score to indicate the relevance of a company to the current luxury theme, and this process incorporates the evolving nature of consumer preferences. The current index is composed mainly of companies from Developed Markets (see Exhibit 1), and it has a mid-cap size tilt and is skewed toward Consumer Discretionary firms.

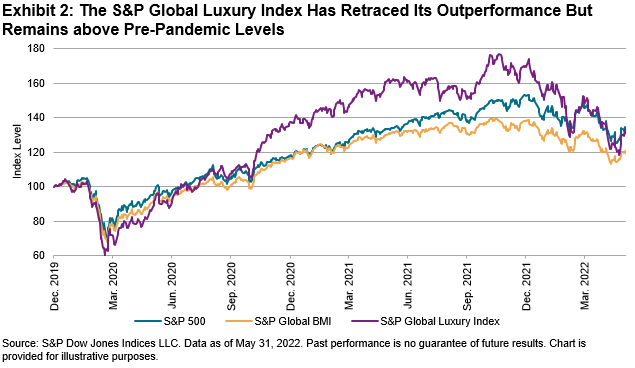

Luxury segment revenues are significantly dependent on the discretionary component of consumer spending, which in turn is influenced by macro risk, inflation and labor markets, the first two of which have not been supportive of the recent market performance. Unsurprisingly, the index was down ~35% from its November 2021 peak and was underperforming the S&P Global BMI by ~12% (almost entirely due to the allocation effect of being overweight the Consumer Discretionary sector). However, this recent underperformance comes after the index nearly tripled during the March 2020-October 2021 period, outperforming S&P Global BMI by ~100%. This strength during a period of rolling global shutdowns emphasizes the resilience of the global luxury market.

Diversification Underpins Versatility

The following characteristics advocate for why the luxury segment could be an attractive theme, notwithstanding near-term pressure from continued weakening consumer sentiment.

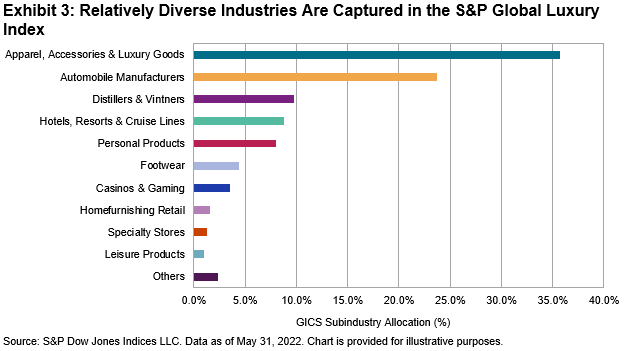

- Breadth within the luxury ecosystem: As we referenced earlier, luxury’s subjective nature necessitates its breadth across various economic industries when constructing a robust index. The S&P Global Luxury Index’s composition is diversified, with Apparel, Accessories & Luxury Goods (36%) and Automobile Manufactures (24%) forming the largest sub-industries, followed by Distillers & Vintners (10%) and Hotels, Resorts & Cruise Lines (9%). The range of industries included within the index also provides a broader consumer base that acts as a buffer during weaker phases of the economic cycles.

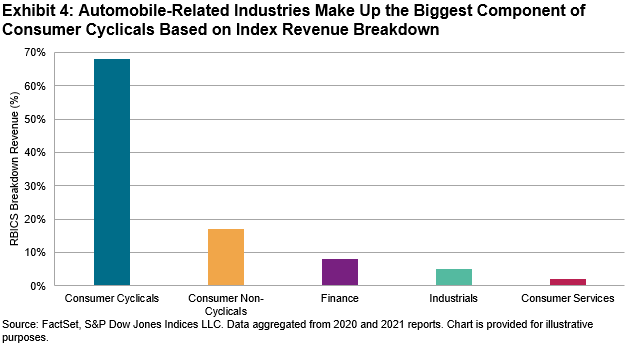

- Diverse revenue streams: Revenue from U.S. and Chinese markets account for roughly 45% of the index revenue,3 areas that are relatively less affected by the Russia-Ukraine conflict. Non-European countries within the top 10 revenue generators account for an additional 15%, underscoring the curtailed impact of the ongoing geopolitical fallout. The index revenue aggregated at the RBICS4 sub-sector level also shows that Automobile Manufacturers was the largest portion (~40%), followed by the more “traditional” luxury segment of Apparel, Accessories & Luxury Goods (~25%).

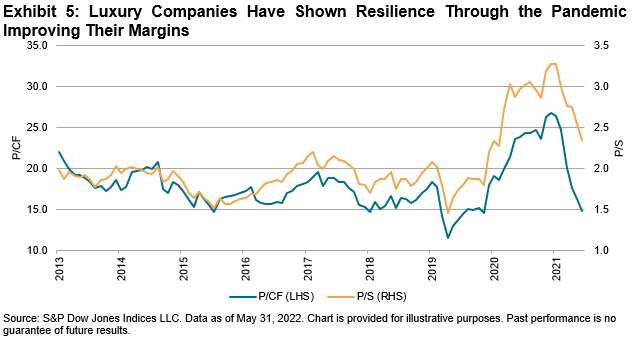

- Resilience through the pandemic: The worldwide shutdown saw revenues of the luxury industry fall by ~20%.5 Nonetheless, the industry was adept in using the shutdowns as a transformative opportunity—like pivoting further toward online sales channels, increasing focus on the Gen Z and Gen X consumer segments, and targeting near-home purchases, especially in China. In terms of index fundamentals, while valuations (P/CF, P/S) looked relatively expensive in February-March 2021 during the height of Growth outperformance, recent market weakness has pared the ratios. In fact, the P/CF has normalized more than P/S YTD, hinting at improving cashflows at a faster clip than sales, underscoring the industry’s adaptability.

- Embracing the future: Luxury companies have continued innovating across various fronts to appeal to brand-conscious consumers with changing habits.6 While sustainability, ethical fashion and biomaterials are becoming focus areas within real-world fashion, NFTs and avatar skins are the new frontiers being tested by luxury companies in the digital world. The automobile segment of the luxury market has increasingly adopted the switch to electric motors and battery technology, ensuring their relevance and market share as the world marches toward a greener economy.

In conclusion, S&P Global Luxury Index’s approach to incorporate breadth and diversification when targeting the luxury market, enhances the appeal of a durable industry that demonstrated adaptability and nimbleness during the COVID-19 pandemic. Investors could benefit from exposure to the luxury theme, as the affluence of global consumers rises, and brands align more closely with their patrons’ ethics across the digital and real worlds.

1Luxury Goods Worldwide Market Study, Fall-Winter 2018, Bain & Company

2S&P Global Luxury Index Methodology

3 FactSet GeoRev data. Data aggregated from 2020 and 2021 reports.

4 FactSet RBICS is a comprehensive, structured taxonomy designed to offer a precise classification of global companies and their individual business segments. More details can be found here.

5 The Future of Luxury: Bouncing Back from Covid-19

6 Global Powers of Luxury Goods | Deloitte | global economy, Luxury Consumer

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment