Alvin Man/iStock Editorial via Getty Images

Lufthansa (OTCQX:DLAKF) was one of the companies that I followed throughout the darkest days of the pandemic and what I particularly liked about the company is how it was managing its liquidity as an airline group with aid from various governments while also shaping up for the future. However, Lufthansa is currently walking back from some of its strategic decisions which says a lot about the current state of the market. In this report, I have a look at the earnings, some reversals on its strategy and how Lufthansa aims to benefit from some of the current market dynamics.

Lufthansa Closes In On Break-Even Point

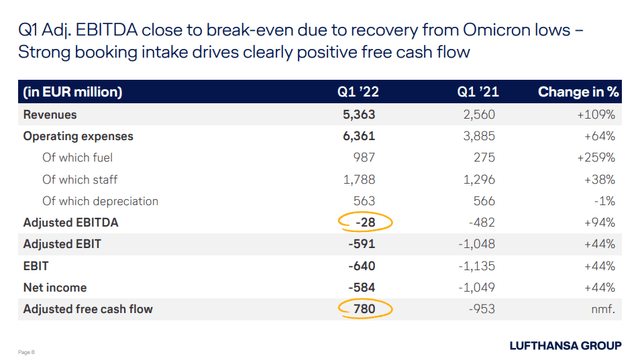

Lufthansa Q1 2022 results (Lufthansa)

The year-over-year story for Lufthansa is not an exceptional one. It is really what we have been seeing throughout the industry this year. Revenues more than doubled providing a €2.8 billion increase while costs increased by €2.5 billion. That is where things might be a bit different between Lufthansa and other airlines as I have also analyzed airlines where the topline growth was completely absorbed by the rise in fuel costs.

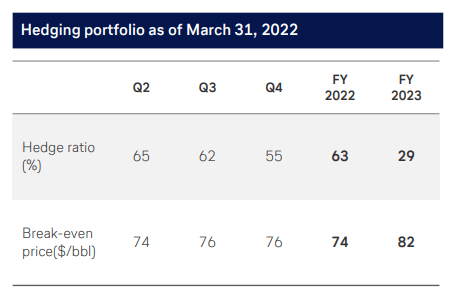

Lufthansa fuel hedge portfolio (Lufthansa)

Fuel costs are some of the watch items going forward and we see that Lufthansa hedged a significant portion of its jet fuel requirements against appreciable prices. So, Lufthansa is shielded to some extent against the higher fuel prices but the unhedged part is reason for concern as it is for any airline. Overall having some of the fuel requirements hedged is a big plus for Lufthansa, but the increases in unhedged fuel requirements are leading to higher ticket prices.

In the current demand environment that is not a problem, but it could become a problem if pent-up demand being released to the market starts losing momentum while jet fuel prices remain elevated. As a result, the current cost and demand environment creates a lot of uncertainty despite the upbeat expectations for the year.

Nevertheless, Lufthansa saw a strong improved in its adjusted EBITDA tapering from a €482 million loss to a €28 million loss in Q1 2022.

Continued Strong Liquidity And Debt Management

Lufthansa saw its bookings tick up as well in as the quarter progressed. In January, corporate bookings were 20% of 2019 levels and by March that already exceeded 50% while the number of passengers carried increased by over 50% and Lufthansa Technik is also providing more services as airline customers bring their aircraft back to service and start logging more hours requiring more maintenance events. That is a momentum that will be carried over to the second quarter and likely the remainder of the year and had a positive impact on free cash flow.

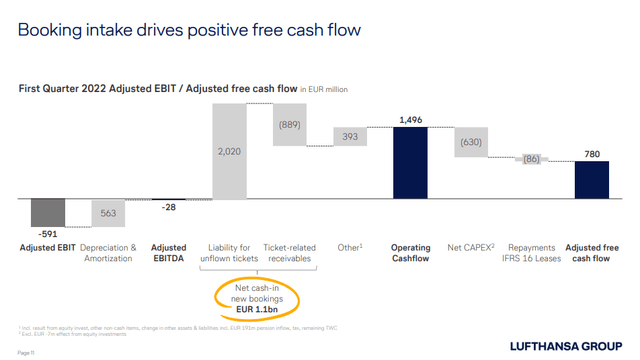

Lufthansa free cash flow (Lufthansa )

Lufthansa showed a strong operating adjusted free cash flow which was helped by €1.1 billion in net bookings. So, we are seeing that the strong demand for air travel that drives higher fares and higher number of passengers is translating into strong cash flows and that part of the demand translating into cash is important for Lufthansa’s liquidity position.

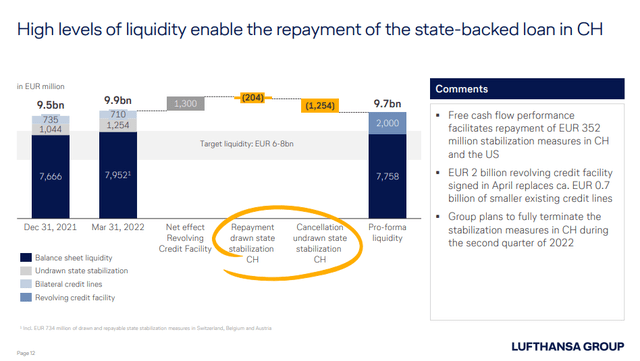

Lufthansa liquidity (Lufthansa)

Sequentially Lufthansa’s liquidity position improved by €0.4 billion. However, more important is that the strong demand for air travel is driving Lufthansa’s confidence to cancel the state-backed loan from Switzerland. During the start of the pandemic, airline operations came to a standstill and many airlines had to direct themselves to governments for state backed loans as obtaining commercial loans was nearly impossible at the time. What we are seeing now is that Lufthansa is actually paying back and cancelling its state-backed support as it is able to obtain credit facilities in the commercial market. So, the CH backed support is removed while the existing credit lines are replaced by a new €2 billion credit facility.

Lufthansa has up to €5 billion maturing from 2022 to 2024 and that is a lot of money, but we are also seeing that with it is liquidity position it is positioned comfortably to cover maturities until 2025-2026 and on top of that there are positive cash flow contributions.

Doing The Unthinkable

Airbus A380 Lufthansa (Lufthansa)

Possibly the most surprising move from Lufthansa this year is that is doing the unthinkable. Despite extremely high fuel prices, the company is bringing back the Airbus A380 next year. That is an extremely bold move from the German carrier that planned to remove all its quad-engine aircraft except for the Boeing 747-8 in the coming years. It says something about the current state of the market, not just from demand side but also from supply side.

The reactivation of the Airbus A380 shows that Lufthansa expects that strong demand for air travel is not just a thing we will see in 2022 and then cool off significantly in 2023. There is the expectation of continued strength in demand while Airbus and Boeing cannot supply jets to support that demand fast enough. That is a reality that jet makers and airlines face due to supply chain disruptions.

Inflation And Interest Rates

The current inflation levels also have an impact both positive and negative. The positive is that the rising interest rates to battle the current inflation levels provide a meaningful reduction in pension liabilities and positively impacted shareholders equity despite a loss-making quarter for Lufthansa.

The current inflation levels also have a negative impact or could have a negative impact. That is not so much related to demand at the moment as demand is strong despite elevated inflation levels, but it has to do with labor. The current system is already under significant pressure and Lufthansa has cancelled 900 flights for July plus another 3,000 flights during the summer holidays due to staff shortages. So, staff shortages are providing a limit to the revenues at this point. During the first quarter earnings call, Lufthansa said that it saw no inflationary pressures. However, just days ago unions demanded a 9.5% pay hike from Lufthansa which without doubt is to align the wages with inflation. So, to say that there are no inflationary concerns is not extremely realistic even more so when considering that there already are staff shortages and you want to attract and value employees at this point rather than alienating them.

Trading Volume Risk

It was observed that Lufthansa shares have a rather limited trading volume of several thousand shares per day which for me is a reason to provide a word of caution on the volume: Due to the low volume there might be a lack of liquidity, which makes quick buying and selling at constant prices more challenging and could possibly result in higher volatility when buying or selling occurs. This provides opportunity for investors, but associated risks should also be kept in mind.

Conclusion

Lufthansa continues to execute well and I am impressed with their bookings and liquidity management. During the quarter, the airline benefited from strong cashflow from bookings and the higher interest rate environment is reducing pension liabilities providing a boost to shareholders’ equity. The company also continues to execute strongly on its liquidity management and the Airbus A380 reactivation is a strong sign that demand momentum is expected to persist. For me these would be reasons to mark the company as a buy. However, I am rating Lufthansa as a hold due to existing staff shortages that drive flight cancellations and its rather unrealistic stance that it doesn’t suffer from inflationary pressures while ground workers are often hit hard by inflation. Lufthansa is currently benefiting from a strong demand and pricing environment, but it needs to realistically assess its staffing levels and how to continue attracting talented and productive employees and closing your eyes for inflation is not a step in the right direction.

Be the first to comment