JannHuizenga/iStock Unreleased via Getty Images

Lucid Motors Inc. (NASDAQ:LCID) plans to open a new manufacturing plant in Saudi Arabia, which will not only allow the EV company to enter new and promising markets, but will also diversify its manufacturing footprint.

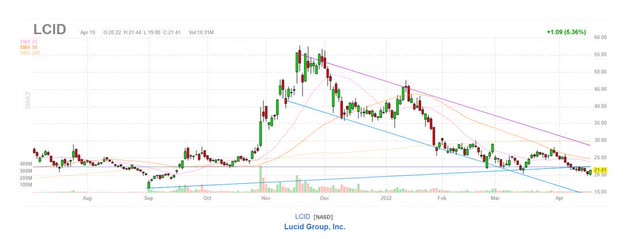

With first-quarter earnings not far away, I’m looking at what investors might expect in terms of pre-orders and estimated order value. Lucid Motors’ stock is consolidating, and the current correction may provide a new opportunity to purchase the stock.

Hype Has Faded, But Lucid Motors’ Potential Is Huge

Lucid Motors’ stock began to rise after the EV company announced that it would begin making customer deliveries in October 2021. The stock reached new highs in November 2021, but investors were quick to cash out, and Lucid Motors’ long-term potential in the electric-vehicle market may now be undervalued. If the $20-21 support level holds, LCID could gain new momentum and surge higher once 1Q earnings and new pre-orders are released.

Lucid Motors is still impacted by the company’s revised production forecast, which has been weighing on the EV manufacturer since it was made public. In February, Lucid Motors revised its production forecast for the Lucid Air to a range of 12K to 14K units in 2022, effectively lowering its forecast by 6K to 8K electric-vehicles. Many investors were taken aback by the outlook, causing the stock to plummet.

With that said, I believe Lucid Motors’ long-term potential in the electric-vehicle market is now significantly undervalued, owing largely to the company’s plans to begin international production of the Lucid Air and enter new markets.

Putting A Value On Lucid Motors’ Investment In Saudi Arabia

Earlier this year, Lucid Motors signed an agreement with the Ministry of Investment of Saudi Arabia that pave the way for the construction of Lucid Motors’ first manufacturing facility outside of the United States.

Lucid Motors anticipates producing up to 150K electric-vehicles per year at its King Abdullah Economic City facility in Saudi Arabia. Lucid Motors’ expansion strategy differs from that of other EV manufacturers, which is likely due to the company’s production of high-end luxury electric-vehicles, which are likely to find buyers in the cash-rich Kingdom.

While most EV manufacturers focus on Europe and China as their first overseas markets, Lucid Motors deviates from the tried-and-true expansion strategy. By doing so, the company takes a significant risk at a time when it is beginning to scale up production in the United States, but it also creates a significant opportunity to gain market share in a largely untapped market.

The Saudi government announced the “Saudi Green Initiative” a few years ago, calling for aggressive investments in green energy (including electric-vehicles) and setting net-zero emission targets for 2060. Saudi Arabia, an oil-rich country, has long attempted to diversify its economy, investing billions of dollars to transform the country into a tourist destination and investment hub.

Saudi Arabia could become one of the hottest markets for electric-vehicles in the Middle East as the Kingdom invests more money in its electric-vehicle infrastructure, a development Lucid Motors could capitalize on.

By 2030, Saudi Arabia intends to have 30% of its vehicles be electric. Saudi attitudes toward electric-vehicles are also rapidly changing, making Saudi Arabia an appealing market to enter for Lucid Motors from both an investment (production) and potential sales standpoint.

Including Lucid Motors’ Arizona production capacity, which is expected to scale to 365K electric-vehicles, the EV company could produce more than 500,000 electric-vehicles per year once each facility reaches its full estimated output potential.

With an annual production capacity of 150K electric-vehicles in Saudi Arabia and an average selling price of $100,000, Lucid Motors could generate $15.0 billion in sales from its new manufacturing hub in Saudi Arabia alone.

Pre-Order Estimates For 1Q-22

Because Lucid Motors’ earnings date isn’t far away, I’d like to quickly include my estimates for pre-orders and estimated order book value for 1Q-22. In February, Lucid Motors received over 25K pre-orders and added an average of 2.7K new monthly reservations to its order book over the previous three months. Because orders were strong in the previous quarter, I believe Lucid Motors’ order book will grow to 33-34K Lucid Air customer reservations by the time earnings are reported (end of May).

At a $100K average sales price, the estimated order book value is $3.3-3.4 billion. The estimated order book value for all of Lucid Motors’ models combined was more than $2.4 billion in February. Moving forward, I wouldn’t be surprised if Lucid Motors added about $1.0 billion to its order book value each quarter.

What Could Drive Lucid Motors’ Stock Lower?

In February, Lucid Motors significantly reduced its production forecast. The market was unprepared for the revised production forecast, and the stock plummeted. If Lucid Motors reduces its production forecast once more, the stock will struggle with investors. If the EV company encounters difficulties abroad, faces delays in its international expansion, or is forced to raise electric-vehicle prices, investors may react forcefully and avoid the stock.

My Conclusion

Lucid Motors has a billion-dollar sales opportunity in Saudi Arabia, but the stock does not reflect this. The EV company’s expansion strategy differs from that of other EV manufacturers, who tend to prioritize markets with already high levels of electric-vehicle adoption (Europe and China).

With that said, I believe it is a high-risk, high-reward strategy that further distinguishes Lucid Motors from the EV competition.

Be the first to comment