hapabapa

Thesis

Lucid Group, Inc. (NASDAQ:LCID) stock has continued to move lower, threatening to upend the lows it formed in May, which underpinned a robust relief rally toward its July highs.

However, we maintain our conviction that LCID’s May bottom should continue to hold resiliently, despite the steep selloff from its July highs, down more than 35% through this week’s lows.

We encouraged investors to leverage downside volatility in our previous update and add exposure. Therefore, we believe the current levels look fantastic for investors who have been biding their time to add positions.

Our analysis indicates that the de-rating in LCID is justified, as the market needed to de-risk its execution risks, given the worsening macroeconomic headwinds. Notwithstanding, we assess that the selldown has likely reached peak pessimism, providing investors with less aggressive entry levels to consider.

We continue to observe a constructive bottoming process in LCID, predicated on its May lows. However, we urge investors to layer in over time, as LCID is a highly volatile stock.

Accordingly, we reiterate our Buy rating on LCID, with a medium-term price target (PT) of $19, implying a potential upside of 35%.

The Market Needed To De-rate LCID Due To Macro Headwinds

Given the Fed’s aggressive rate hikes, the market remains tentative in re-rating fledgling EV stocks like LCID, given their underlying negative free cash flow profitability, even though Lucid remains well-capitalized.

The market is concerned whether new car sales could be hit further as the Fed’s rate hikes impact consumer discretionary spending. In addition, used car sales have continued to fall, with rising loan rates. As such, we assess the market could be anticipating that new car sales could follow the weakness in the resale market moving ahead, as Bloomberg reported after CarMax’s (KMX) recent sales performance:

New-car sales are expected to rise in the just-ending third quarter, but a deteriorating market for used vehicles suggests trouble ahead for automakers. The resale market often indicates where new-car demand is headed — and CarMax said vehicle sales dropped in the three months ended Aug. 31. Both consumers and wholesalers — they all buy from CarMax — pulled back, the company said. – Bloomberg

Despite Lucid’s higher-end target market, we assess the market anticipated that it’s not immune to these challenges. Moreover, given Lucid’s current subscale manufacturing, it could further impact its profitability if the recession turns out worse than anticipated.

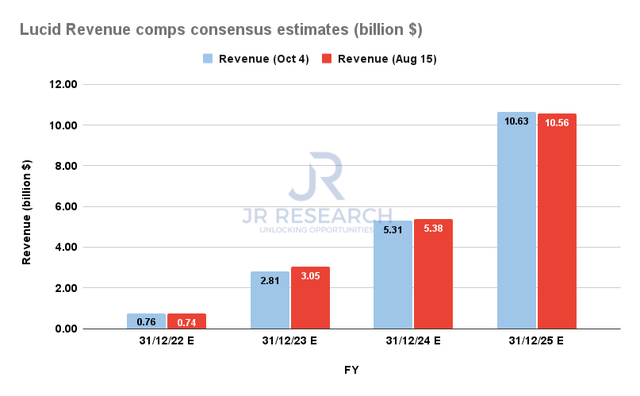

Lucid Revenue comps consensus estimates (S&P Cap IQ)

The revised consensus estimates (bullish) suggest that Lucid’s medium-term manufacturing ramp remains on track, while near-term estimates were reined in. For instance, Lucid’s FY23 revenue estimates were cut by nearly 8%. We deduce that the reduction is necessary to reflect the near-term macro challenges, despite Lucid’s higher-end focus.

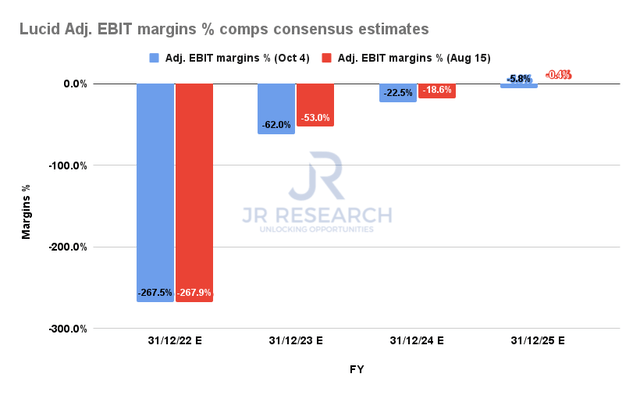

Lucid Adjusted EBIT margins % comps consensus estimates (S&P Cap IQ)

However, investors should note that Lucid’s adjusted EBIT margins for FY25 were cut markedly down to -5.8% from -0.4% in August. Therefore, the Street has revised its model, suggesting that Lucid’s EBIT breakeven could extend further to FY26.

Therefore, it’s clear that the Street has markedly de-risked the assumptions on Lucid’s operating performance further through September. As a result, we believe it justifies the battering seen from its July highs.

Hence, the critical question facing investors is whether the hammering is near completion.

Is LCID Stock A Buy, Sell, Or Hold?

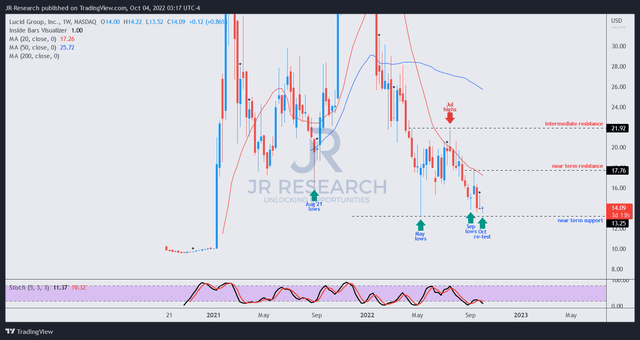

LCID price chart (weekly) (TradingView)

LCID’s May bottom is highly significant. Note that its May lows took out the lows from August 2021 before forming a bullish reversal. Hence, we expect substantial buying interest at LCID’s May lows to defend that level.

As seen above, LCID attempted to form a bottoming process in September after a bull trap (indicating the market denied further buying upside decisively) rejected its buying momentum at its July highs.

However, September’s bullish reversal was taken out by this week’s lows, which appeared to form a re-entry level based on September lows. Re-entries are potent signals that corroborate the validity of September’s bullish reversal, but the market needed one more steep selloff to create massive panic.

Hence, we continue to see highly constructive price action signals that suggest the market will likely defend its May lows robustly. As such, we believe the current buy zones offer investors significant reward-to-risk potential and reiterate our Buy rating.

Be the first to comment