Editor’s note: Seeking Alpha is proud to welcome Maksymilian Bogdanski as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

House with Blue Siding victor baiardi

Investment thesis

Industries related to the housing market traditionally suffer from mortgage rates being high. These rates are expected to reach 5.1% in 2023, and are then estimated to start declining, hitting 4.1% in 2024. This will make 2023 a bleak year for those industries, and 2024 a year of recovery. Louisiana-Pacific Corporation’s (NYSE:LPX) earnings are forecast to take a hit next year, with analysts expecting the company’s revenue to decrease by as much as 58% on an annual basis. However, I deem this number to be inaccurate, due to the resilience and growth of the Siding segment which is already expected to partly offset the OSB revenue decrease in Q4’22, and I expect the same to happen in 2023.

Company background

Louisiana-Pacific Corporation manufactures and markets building products used in new home construction, repair and remodeling, and outdoor structure markets. The company’s offering is summarized in three segments.

The first segment is the oriented strand board (OSB) segment; where the company sells OSB material. This is a material formed out of compressed layers of wood strands with adhesives (wax and synthetic resin). It serves many of the same uses as plywood, including roof decking, sidewall sheathing, and floor underlayment. The second segment, the Siding segment, consists of products that are installed on the exterior of the building to protect it from the elements. These products include engineered wood siding, trim, soffit, and fascia. Finally, the South America segment manufactures and distributes OSB and siding products within the region. With operating sales offices in Chile, Brazil, Peru, Colombia, Argentina, and Paraguay, the company is positioned to capitalize on the growing demand for wood-based residential construction in South America. The OSB and the Siding segments are the main revenue drivers and makeup 90% of total sales.

Business strategy

Louisiana-Pacific Corp. seeks to grow its Siding segment to benefit from the growth in demand, as the company’s siding products continue to displace alternative siding materials. In addition, the Siding segment is less sensitive to new housing market cyclicality due to 50% of demand coming from repair work and remodeling. Growing this segment will make the company less dependent on the housing market conditions, and the OSB segment. Furthermore, the company uses its sales offices to make the customers aware of its “easy to work with” products, and it has an efficiency program in place called the “Overall Equipment Effectiveness” (OEE) program. This program focuses on operating efficiency, cost reduction, and portfolio optimization. You can read more about the company’s business strategy in the Annual Report 2021.

Recent quarterly highlights

The Siding and the OSB Segment

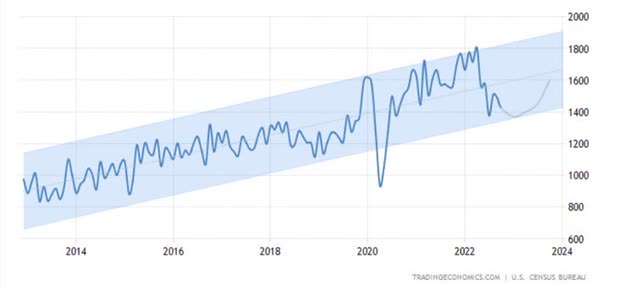

Siding sales increased by 27% in Q3, driven by a 6% volume increase, and a 13% increase in price. The segment managed to grow during adverse housing market conditions, which includes the 5% decrease in the ‘U.S. Single-family Housing starts’ from 2021 to 2022 Q3. It was not significantly affected by the decreasing number of building projects. These projects are down in 2023, and expect to recover in 2024, as shown in Figure 1 below.

The OSB segment, which generates 50% of total revenue, is notably affected by the decrease in projects. Management expects this segment’s revenue to decline by 30% in Q4’22 on a quarterly basis, which, on an annual basis, is a 42% decrease. The Siding segment is expected to grow by more than 30% in Q4 on an annual basis. This segment’s growth, as discussed previously, is thanks to its demand mainly coming from the repair and remodeling market. This market is expected to keep growing, owing to an increase in the number of houses starting to fall in “the prime remodeling age” (homes aged 20 to 40 years old). The average home in the U.S. is over 40 years old, and the number of homes over 20 years old is projected to grow steeply in the next few years. With that in mind, the sum of revenue for OSB and Siding is forecast to decrease by 15% in Q4’22 on the annual basis. The Siding growth will partly offset OSB’s revenue decline, in the next quarter.

Figure 1, U.S. Housing Starts Forecast (tradingeconomics.com)

Sale of EWP

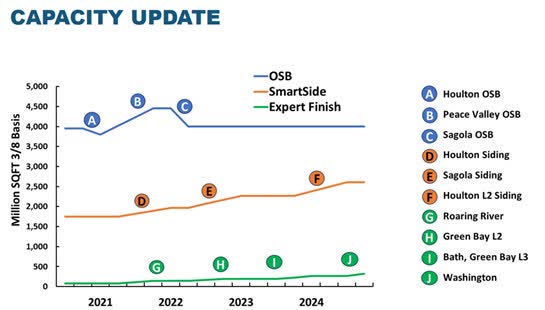

Louisiana-Pacific Corp. used to run a fourth segment named Engineered Wood Products (EWP). The company sold the segment for $210 million on August 1, 2022, in order to align its current operations to its business strategy of improving efficiency and growing the Siding business. To illustrate the latter, the Houlton siding mill, indicated with the letter D in Figure 2 below, used to operate for the EWP segment, and is now a part of the Siding business. Furthermore, the company plans to increase the capacity of its SmartSide and Expert Finish businesses, both of which fall within the Siding segment. The firm does not plan to make any capacity changes in the OSB segment, at least not until 2025.

Figure 2, LPX Mill Capacity (investor.lpcorp.com)

Industry outlook

Industries related to the housing market such as the timber industry, REITs, and building products & equipment industry, are negatively affected by higher mortgage rates. The 30Y-U.S. mortgage rate has reached 6.84%, levels not seen since 2008. Louisiana-Pacific Corp. and its peers including, PotlatchDeltic (PCH), and Weyerhaeuser (WY), who manufacture wood products, are the companies affected by these rates. This has led to their forecasted earnings decreasing by 58% (LPX), 67% (PCH), and 60% (WY) in 2023, on an annual basis.

PotlatchDeltic’s earnings are expected to decrease by 67%, due to its operations primarily consisting of harvesting trees, and manufacturing wooden products. The company’s business is extremely sensitive to lumber prices, and this lumber price is influenced by the housing market conditions. With that in mind, LPX has the Siding segment, which makes up 40% of revenue, and is resilient to housing market conditions, as discussed previously. This segment is expected to partly offset OSB’s revenue decreases, as predicted in Q4’22. This makes me believe that the 58% earnings slump is disproportionate in comparison to PotlatchDeltic’s situation. To make things clear, while the entire PCH operation is influenced by the housing market conditions, only half of LPX’s operations is affected. Therefore, I believe that the difference in expected earnings between these companies of merely 9% is not accurate, and should be higher. I believe that LPX’s forecasted earnings will not decrease as high as predicted in 2023.

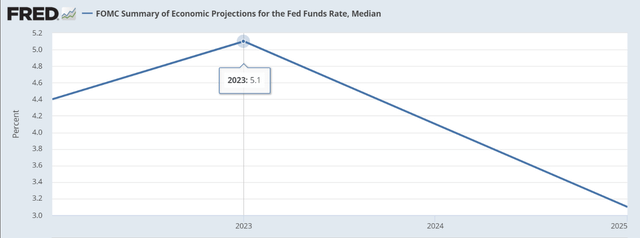

The above-mentioned earnings forecasts seem to be negatively correlated with the projected Fed Funds Rate (see Figure 3 below). The Fed Funds Rate peaks at the start of 2023 and then begins to steadily decline until 2025. This pattern corresponds with the expected earnings that fall in 2023, and start to recover in 2024, while the Fed Funds Rate is declining to lower levels. Since the last meeting on 14th December, the effective Fed Funds Rate is projected to reach 5.1% in 2023, 4.1% in 2024, and 3.1% in 2025 according to FOMC.

Figure 3, Fed Funds Rate Projections (fred.stlouisfed.org)

Financials

As mentioned in the section above, analysts expect a bad next year for all industries connected to the housing market. Louisiana-Pacific Corp. is prepared for the worst, with a current ratio of 2.3, an interest coverage ratio of 131 (TTM), and a $469 million cash position that fully covers the company’s debt. Based on the balance-sheet strength, I foresee the company will find no trouble in fulfilling its debt obligations in the near future.

Moreover, the industry’s most crucial metrics such as the dividend yield, revenue growth, earnings growth, and debt leverage ratio have been put into perspective in Table 1 (see below). Louisiana-Pacific Corp. appears to primarily focus on growth, with above-average historical revenue, and earnings growth, and the lowest dividend yield. The company also seems to use less debt to finance its operations relative to its peers, which decreases operational risk. PotlatchDeltic seems to be a stable dividend stock, with the highest dividend yield, average growth, and average debt-to-equity ratio. Weyerhaeuser seems to fall short in all areas against its peers. Hence, in comparison, LPX is a less risky investment with greater growth prospects.

|

Dividend yield |

Revenue growth |

EPS growth |

Debt/Equity |

|

|

PCH |

3.65% |

10% |

20% |

0.41 |

|

LPX |

1.36% |

10% |

53% |

0.25 |

|

WY |

2.23% |

5% |

17% |

0.46 |

Table 1

Valuation

Fair price

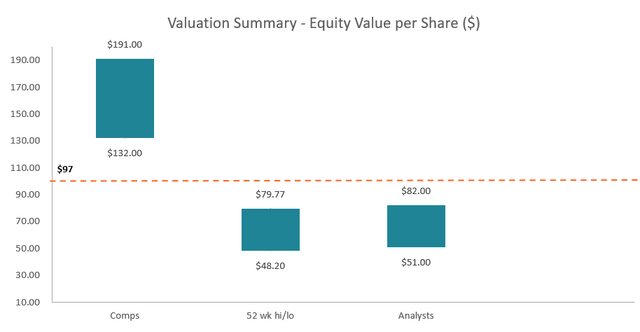

I estimate the fair value of LPX stock to be $97. I arrived at this share price by averaging out three different valuation methods, as can be seen in Figure 4. The first method was “comparable analysis,” in which the stock is reevaluated based on the industry median multiples. The second method involved the “52-week high-low price” of the stock to increase the reliability of the final valuation (average of all methods). Finally, the “analysts’ forecasts” was the third valuation method.

Figure 4, Football field chart valuation (Author’s calculations)

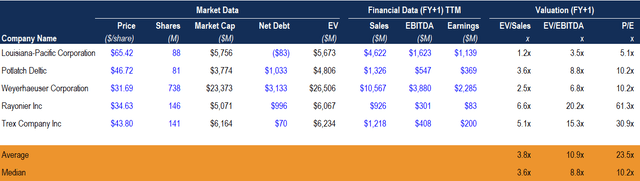

Figure 5 shows the “comparable analysis” in detail, with blue numbers indicating inputs and black numbers signifying outputs. The spotlight lies on the lower-orange area with the three multiples: EV/Sales, EV/EBITDA, and P/E ratio. The median of these multiples has been used to re-calculate the LPX stock value, to discover its worth; would it be trading at the industry median multiples. The calculations below show that the price estimates are $191, $163, and $132 for the median EV/Sales ratio, EV/EBITDA ratio, and P/E ratio, respectively. These three estimates have been summed up and divided by three to establish an average price estimate, which equals $162.

1) (($4,662 Sales * 3.6 Median EV/Sales) + -$83) / 88,000,000 Shares = $191

2) (($1,623 EBITDA * 8.8 Median EV/EBITDA) + -$83) / 88,000,000 Shares = $163

3) 10.2 Median P/E * ($1,139 Earnings / 88,000,000) = $132

4) ($132 + $163 + $191) / 3 = $162

Furthermore, the 52-week high-low price range for the stock has ranged between $79.77 and $48.20. The highest and lowest price have been added together, and divided by two, resulting in the average price of $64. In addition, the analysts’ price targets have been used in the same way. The lowest and highest price target for the company were $51 and $82. These estimates have also been added together, and divided by two, which produced another estimate of $66.5. Lastly, the mean of all the above “end estimates,” has been taken, resulting in the fair stock value of $97.5.

Figure 5, Comparable analysis (Author’s calculations)

Growth and performance

The comparable analysis above shows that some stocks trade at a premium multiple; investors were inclined to pay a higher price for a unit of profit. Investors generally buy stocks at premium multiples, because they believe that the future earnings growth will recompensate for that premium.

The PEG ratio analysis was included to determine whether the stocks that traded at a premium (higher multiple than the industry median) were justified by the growth prospects. The stocks with the highest growth are LPX and Trex Company Inc. (TREX), as shown in Table 2 (below). The first stock trades at discount multiples, which makes it very attractive, considering an investor does not have to pay a premium for the above-average growth of 53%. The latter trades at premium multiples, which are justified by the 57% growth. The PEG ratio shows that LPX is the best buy within the industry.

|

10Y EPS CAGR |

P/E |

PEG |

|

|

LPX |

53% |

5.1 |

0.10 |

|

PCH |

20% |

10.2 |

0.51 |

|

WY |

17% |

10.2 |

0.60 |

|

TREX |

57% |

30.9 |

0.54 |

|

RYN |

– 7% |

61.3 |

– |

Table 2

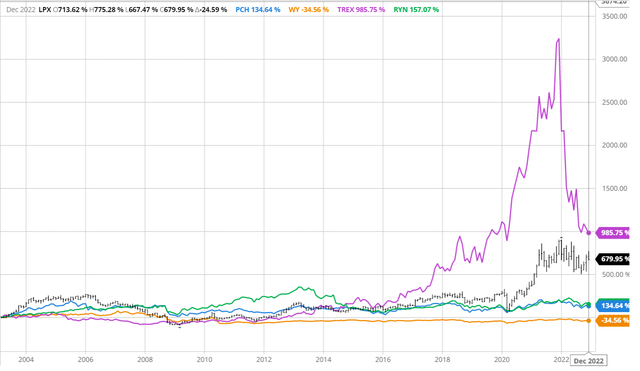

Besides the fair price value, it is equally important to examine the relative stock performance. As shown in Figure 6, TREX outperformed its peers by a large margin, with a return of 985% during a 20-year period. The second-best performer was LPX with a 680% return. PCH and Rayonier Inc. (RYN) both returned 135% and 157%, respectively, and WY saw a negative return of 35%. Based on stock performance, it seems that Trex Company Inc. and Louisiana-Pacific Corp. are the more interesting stock picks within the industry.

Figure 6, 20Y Stock performance analysis (barchart.com)

Risks

Continuous high interest rates

The company’s business relies on the North American new home construction, and repair market, which is impacted by risks associated with fluctuations in the housing market. The housing market is affected by the macroeconomic environment, and is sensitive to factors such as the interest rate, inflation levels, and growth of the gross domestic product. Any negative developments in regard to these factors could see a decrease in demand for the company’s products.

Commodity prices

Wood fiber is a crucial raw material that the company uses. It is subject to commodity pricing, which fluctuates based on market factors. The supply of the material might be impacted by external natural events, such as floods, forest fires, and severe weather. These adverse events decrease the supply, and raise the cost of the material. Furthermore, resin product is another significant material used by the company. The resin product is influenced by the price fluctuation of the raw materials used to manufacture the product and the availability of resin products. A cost increase in raw materials might create a problem as the company has not always raised its product prices in line with the costs going up. Therefore, there is uncertainty about whether an increase in the cost of raw materials can be passed on to the customer. The inability to pass on the cost increases to the customer could have a negative effect on the operation results. The above-mentioned materials are mostly used in the OSB segment which generates approximately 50% of the total revenue; which brings us to the third risk factor.

OSB concentration

The firm’s operations are concentrated in the OSB segment. OSB accounted for about 57%, 47%, and 39% of all North American net sales in 2021, 2020, and 2019, respectively, and the company expects OSB sales to continue to account for a substantial portion of future revenue, and profits. The concentration of the operations in the OSB segment further increases the company’s sensitivity to commodity price volatility, and can lead to adverse effects on the firm’s financial position and operations.

Conclusion

In conclusion, I do not expect LPX’s earnings to fall as high as 58% in the next year, due to the resilience, and growth of the siding business, which will partly offset the OSB earnings decrease. Hence, I believe the company will beat its earnings estimate for next year. Although, at this moment the operations are concentrated in the OSB segment, which forms operational risk, the firm is working on expanding its Siding segment to decrease its dependency in the future. Furthermore, Louisiana-Pacific Corp. has a strong balance sheet; trades at the best valuation; has the second-best stock performance, and carries great growth prospects. Therefore, I rate LPX as a Buy, with the notion in mind that this stock might not reach its estimated fair price value of $97, until the expected housing market recovery in 2024.

Be the first to comment