I wrote an article this week that had a mildly bullish tone to it. I was surprised at the backlash I received from some who follow my work, as though I’d thrown my bear suit in the closet to become a raging bull. Trust me fellow bears, I haven’t left the cave just yet. To the contrary, I am as uncertain about the future as anyone, but I need to respond to what has been a significant revaluation in risk asset prices. The S&P 500 index (NYSEARCA:SPY) has fallen more than 30% from its all-time high of 3,386 on Feb. 19. The bear market may not be over, but it rarely falls from coast to coast in a straight line.

If you want to know how bearish I was as recently as January of this year, please read my warning that we were in the latter stage of a 1999-like melt-up in stock prices that was going to end as badly as it did in 2000. It wasn’t very popular at the time. I only share it to add credibility to what I am forecasting today.

Keep Eyes On The Forest While Climbing Trees

It wasn’t rocket science. The warnings signs were everywhere from valuations to technical analysis to sentiment. The Fed was pumping tens of billions into the plumbing of the banking system every day in overnight repo markets, because it couldn’t control short-term interest rates. At the same time, it was telling us that the economy was strong, the expansion would continue, and that valuations were not unreasonable.

The forest was not burning, but it was clearly smoldering, yet very few were paying attention. When the risks are that high, all it takes is an exogenous event to prick the bubble that was blown by a Federal Reserve hell-bent on inflating financial asset prices well above what fundamentals would normally dictate. We didn’t have to know what that exogenous event would be, although I concluded that the coronavirus would be it just a few days before we hit the all-time high in February. Then, we had a second come crashing down two weeks ago when oil prices collapsed. That could not have come at a worse time.

Whereas the forest was smoldering in January, it is now on fire and burning down. In the process, the Fed has seemingly lost the manipulative control it had over financial asset prices, which are no longer responding to its monetary stimulus or rhetoric from its members. Thankfully, I think the stock market is once again a discounting mechanism. This means that is declining in advance of fundamentals that will continue to deteriorate moving forward, as well as ominous headlines related to the coronavirus that we know lie ahead. Yet it will also bottom and rebound, at least temporarily, well in advance of any improvement in the fundamentals or headlines. Therefore, I am starting to look for green chutes while the forest is burning.

The fact that volatility has exceeded the highest levels we saw during the Great Financial Crisis, with the S&P 500 index posting moves of 4% or more for eight consecutive days, I think we may be approaching a near-term bottom. It makes sense, given that the Fed has thrown every tool in its toolbox at markets to ease the liquidity crunch. It has done so much faster than it did in 2008, and to the benefit of a banking system that is far sounder from a fundamental standpoint. The next step is a fiscal package that we should see over this weekend. Congress is moving much faster than it did during the last crisis to roll out stimulus for the businesses and consumers that will be hardest hit by the complete collapse in economic activity expected over the coming weeks.

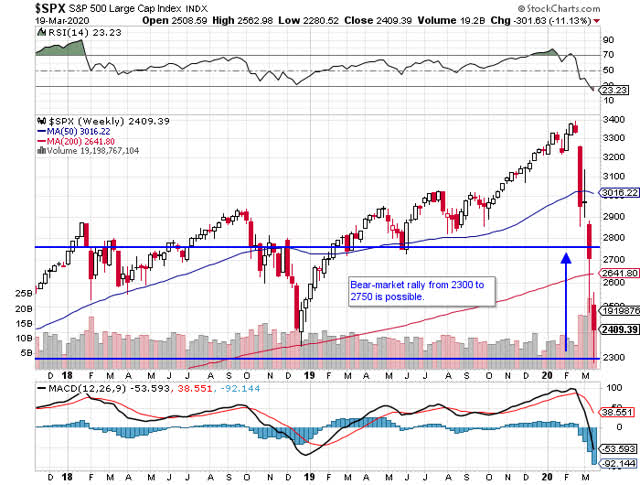

This could be the catalyst for a bear market rally that resolves a deeply oversold short-term condition. It could potentially be a 20% move from the lows to 2,700 for the S&P 500. It does not mean that we are headed to new all-time highs, and it certainly doesn’t mean that we have seen the lows. In fact, looking at the chart below, it appears that we could see that happen in just a couple of weeks, given how explosive the recent moves have been in the market.

The same type of rally could also begin from much lower levels if Congress doesn’t succeed in a bi-partisan stimulus and the federal government doesn’t take decisive action to contain the virus. If these two things do occur, then I think markets will look forward, albeit temporarily, and start to see some light at the end of the tunnel before the consensus of consumers, businesses, and investors. Therefore, I started to look for green chutes a week ago the same way investors like Warren Buffett and Carl Icahn have been doing in recent days.

For example, the airlines are bound to receive some form of assistance, but most are trading as though they are headed for bankruptcy. I decided to add Delta (NYSE:DAL) as a new position because I know that Warren Buffett was paying more than twice today’s share price just a month ago. Buffett is usually good company to keep when investing. The dividend, which is approximately 7.5%, will surely be suspended, but as one of our largest airlines, this company will return to business when life returns to our new normal, and the share price should recover substantially. The dividend will also likely be reinstated. The decline in oil prices, which is the most significant input cost, is also a tailwind when business is restored.

Another name I have nibbled on in recent days is Molson Coors (NYSE:TAP), which has shed one-third of its value in this bear market. I like the defensive nature of this stock trading at ten times expected profits with a yield of 5.7%. The first thing I did a week ago when the pubic started to stock up on groceries in preparation for the pandemic is fill my basement fridge with my favorite cold brews. While Coors Light doesn’t make that list, I know it does for most cost-conscious consumers, as well as many of their other more than 100 brands.

Because I am not certain that we have seen the lows in the current selloff, nor do I think a market recovery will mark the beginning of a new bull market, I am position sizing accordingly. My discipline dictates that a full position can be no more than 4% of my stock allocation. I have very few full positions today. If I was optimistic in the long-term outlook for the stock market, I might take 1-2% positions in these two names, but today, I am establishing pole positions with just a half of one percent. I will add in increments of a half a percent at lower levels should the market decline to my downside target for the S&P 500 of 2000. Regardless, at some point, I expect to see a powerful bear-market rally.

Should we realize that rally, then I will determine if I want to take my short-term gains, should they materialize, or sell other stocks that are not as well positioned at my new buys. I am hoping to use this bear market as an opportunity to upgrade my portfolio holdings. Ideally, I would like to hold what I see as green chutes over the long term to see them grow into tall trees.

In addition to reducing my position size on new purchases, I am also always looking to hedge my exposure to risk in other ways. Two weeks ago, I shared with my subscribers in The Week Ahead my new position in the ProShares Short High Yield ETF (NYSEARCA:SJB), in anticipation of a dramatic widening of spreads that would crush the high-yield bond market. That has served my bond portfolio well, and should continue to do so, as I add risk to the stock portfolio.

The Portfolio Architect is a Marketplace service designed to optimize portfolio returns through a disciplined portfolio construction and management process that focuses on risk management. If you would like to see how I have put my investment strategy to work in model portfolios for stocks, bonds and commodities, then please consider a 2-week free trial of The Portfolio Architect.

Disclosure: I am/we are long TAP, SJB, DAL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Lawrence Fuller is the Managing Director of Fuller Asset Management, a Registered Investment Adviser. This post is for informational purposes only. There are risks involved with investing including loss of principal. Lawrence Fuller makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by him or Fuller Asset Management. There is no guarantee that the goals of the strategies discussed by will be met. Information or opinions expressed may change without notice, and should not be considered recommendations to buy or sell any particular security.

Be the first to comment