Kannan D

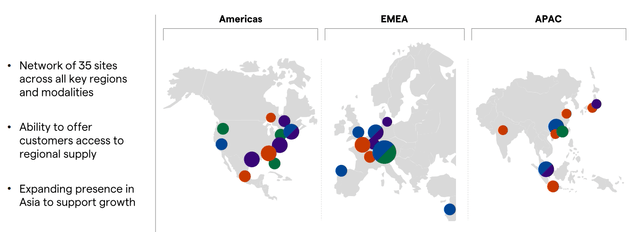

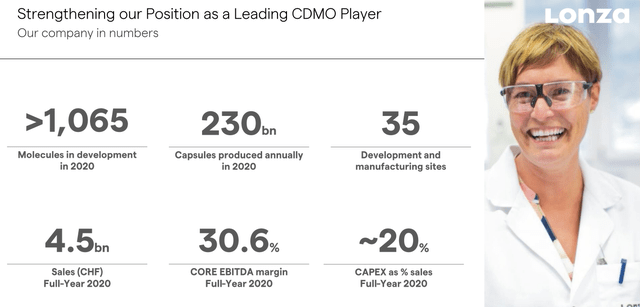

Our most devoted readers know that at the Mare Lab we have a sweet spot for the pharmaceutical sector. The healthcare earnings season looks positive and so far has shown robust and resilient numbers. We already commented on Roche and Novartis’ Q2 performance, today we initiate coverage on Lonza Group AG (OTCPK:LZAGY). The company delivers its products thanks to four divisions in the pharmaceutical, nutrition, and biotech markets across the globe. The company operates its activities thanks to 35 manufacturing sites and its sales are split into three regions: EMEA, APAC and AMER respectively representing 40%, 13%, and 47%. Lonza is headquartered in Switzerland and was founded in 1897.

Source: Lonza Capital Market Day 2021

Before moving on with the specific company comments, our internal team believes that healthcare valuations remain attractive in the medium term with earnings growth at double-digits. The pharmaceutical sector is defensive and not cyclical and is also one of the best-positioned thanks to the secular opportunity growth trends. Lonza’s activity in genetic technologies is simply a fantastic example of that.

Source: Lonza Capital Market Day 2021

Why are we positive?

- New pharmaceutical products and higher research and development investment will support revenue growth for contract development and manufacturing (‘CDMO’). After having analyzed the most important pharmaceutical companies in Europe and in the USA, we believe that the strong pipeline activities will further boost Lonza’s earnings over the short-medium term;

- CDMO agreement structure usually mitigate inflationary pressure trends, more in detail, third-party inputs are directly delivered to Lonza’s facility and are expensed by the same client;

- Lonza has a limited COVID-19 exposure. Looking at the 2021 results, we see that annualized top line sales were at CHF 100m, roughly 2% of the total revenue;

- APAC revenue trends and future investment in the region,

- We appreciated the fact that Lonza has a diversified clientele and product base. Looking at the capital market day, we see that the top 10 customers represent 38% of the company’s top-line sales.

Comments on Q2 Results

Lonza’s half-year results were impacted by some confusion related to a CDMO contract termination. During the call, this was quantified in CHF 90 million in sales with an EBITDA impact of almost CHF 60 million. Our internal team believes that this was due to the negative outcome of lirentelimab’s late-stage development. Payment termination is not news within the sector, but more importantly, Lonza explained that has no concern in re-sell the manufacturing facility given the significant demand in the sector. During the Q&A, a specific question on EPS growth was raised, but Lonza’s management confirm the non-financial impact. Looking at the negative news, in the first half-year, the company lost almost CHF 20 million in EBITDA level in the Small Molecules division. This was due to supply chain constraints but it is expected to be offset in the second half of the year.

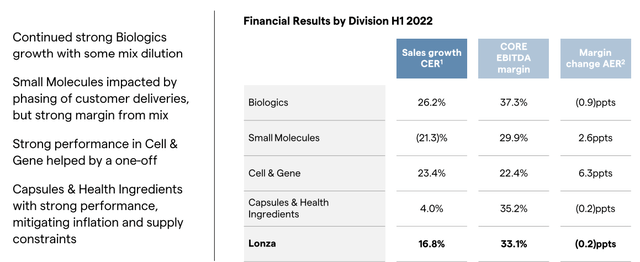

Concerning the Q2 results, the Swiss CDMO giant delivered a solid set of numbers. Revenue was up by almost 17% at CER with a 4% outperformance compared to Wall Street analyst expectations. This was driven by biologics and Cell & Gene division. The core EBITDA grew by 16.5% to CHF 987 million with a margin of 33.1% compared to the 33.3% recorded in the 2021 first half year. There was a one-off impact due to the LSI disinvestment that was recorded in the corporate revenues.

Source: Lonza Q2 Results

Conclusion and Valuation

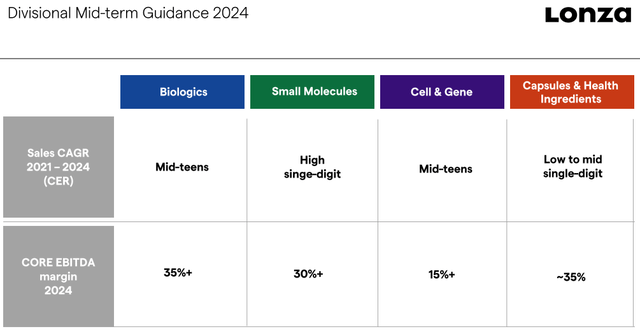

As already mentioned, there was a distraction over the CDMO contract termination, but the company offers positive fundamentals and the CEO reaffirmed the company’s guidance. Our internal team forecast a strong industry demand especially in the biologics division, coupled with a superb marginality. Compared to the global CDMO competitors, the Swiss company is currently trading in line with the 2023 price/earnings ratio, but with a 20% discount on EV/EBITDA. We believe that this is not justified and based on the P/E, we are valuing Lonza at CHF 650 per share versus the current stock price of CHF 538. Risks to our target price are: LSI proceeds, currency effects, higher cost of capsules, and the ongoing gas emergency in Europe that might translate into less pharmaceutical production from Lonza’s customers.

Source: Lonza Capital Market Day 2021

Mare Evidence Lab’s latest EU Pharma coverage:

- Sanofi: Expect price appreciation going forward

- AstraZeneca: Our next value pick

- Grifols: Short-Term Turbulence But Long-Term Upside

Be the first to comment