Michael Vi/iStock Editorial via Getty Images

Don’t Throw the Baby Out with the Bath Water (Yet)

Despite beating expectations, the market “spoke” in critical terms of Walgreens’ (NASDAQ:WBA) Q2 FY ‘22 earnings results posted on March 31, driving shares down ~(8%) when comparing the close prices of the prior and following market days. The bearish narrative, which has teeth and bites hard, notes diminishing tailwinds from the COVID-19 pandemic and depressed earnings heading into FY ‘23 as investment in WBA’s new Health segment continues to increase. Furthermore, as management tries to offload Boots in the UK to streamline the overall business, WBA is likely to swallow a significant loss on any such transaction.

While shares have since recovered some of their losses following the earnings announcement, the current calendar year has proved challenging for long WBA investors.

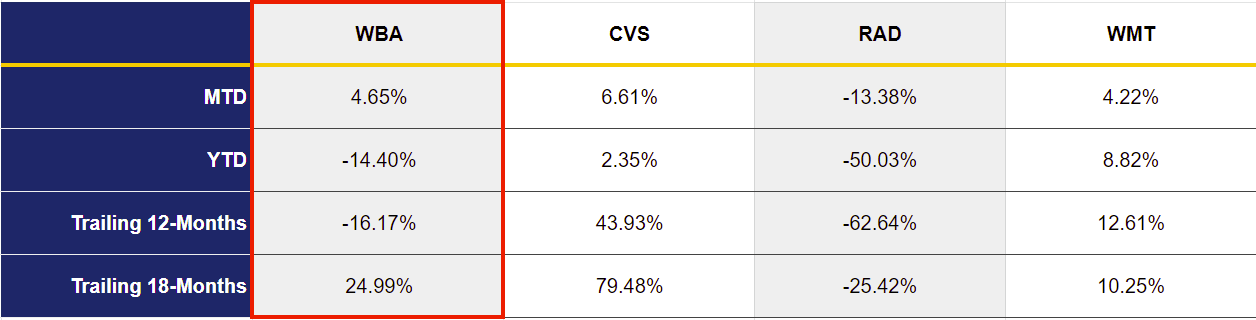

Figure 1: WBA and Selected Competitor Performance (Yves Sukhu)

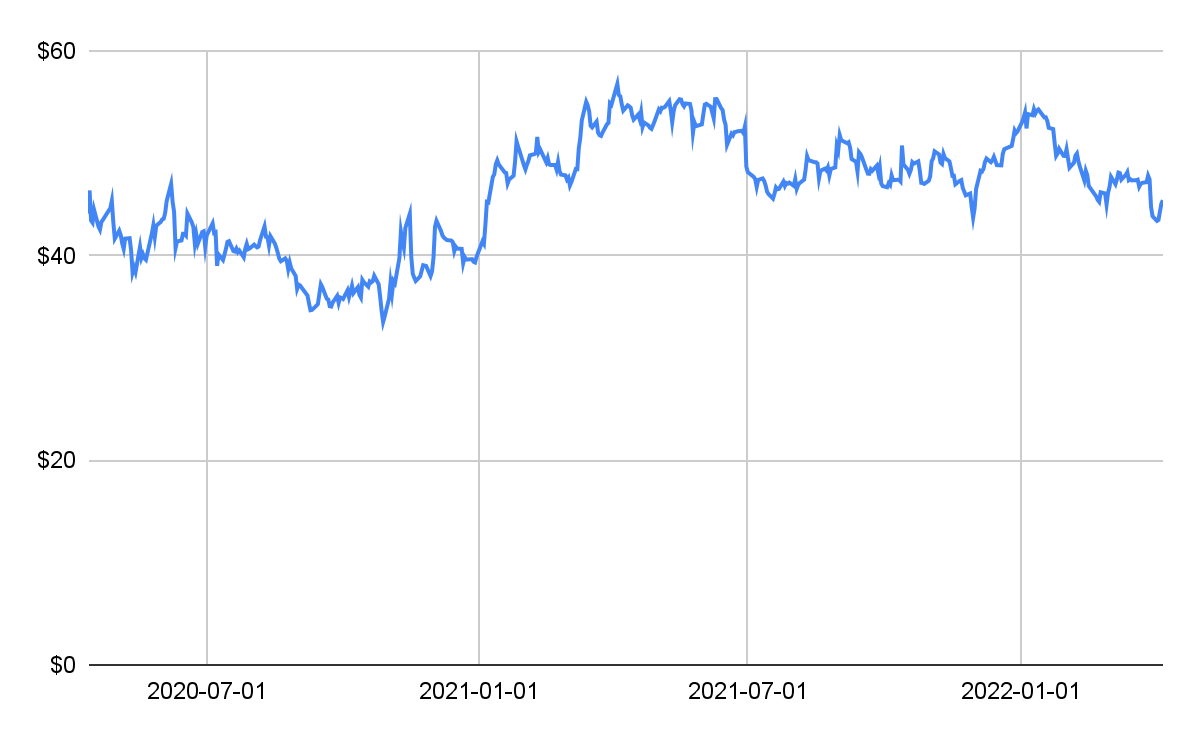

Figure 2: WBA 2-Yr Share Price Performance (Yves Sukhu)

Notes:

-

Data for Figures 1 and 2 as of market close April 8, 2022.

But before we “throw the baby out with the bath water”, consider a handful of results from the second quarter, ended on February 28, 2022:

-

Sales from continuing operations of $33.8B and $67.7B for Q2 FY ‘22 and 1H FY ‘22, respectively. Sales increased 3.8% and 5.7% for the quarter and first-half respectively in constant currency versus prior periods.

-

Non-GAAP operating income of $1.7B and $3.4B for Q2 FY ‘22 and 1H FY ‘22, respectively. Non-GAAP operating income increased 35.9% and 42.1% for the quarter and first-half, respectively, in constant currency versus prior periods. GAAP operating income, inclusive of transformational cost program and acquisition-related charges, stood at $1.2B and $2.5B for the quarter and first-half respectively.

-

Non-GAAP adjusted EPS of $1.59 representing a 26.5% increase in constant currency QoQ. GAAP EPS, however, stood at $1.02, reflecting a ~(4%) decrease versus the prior period.

-

Free cash flow (“FCF”) of $669M in the quarter. FCF in the quarter dipped by $431M compared to the prior period due to “…phasing of working capital, repayment of COVID-19 related government support, and increased capital expenditures in growth initiatives, including rollout of new automated micro-fulfillment centers and the VillageMD footprint expansion.”

-

US retail and UK Boots retail comparable sales up 14.7% and 22.0%, respectively, versus the prior period, with “…[Q2] US retail comps.. the highest in 20 years”. Comparable sales for the first-half period also improved with increases of 12.8% and 19.2% for the US retail and UK Boots retail operations, respectively. Despite the positive trend, UK Boots foot traffic was noted to still be ~(15%) below pre-pandemic levels, with an expectation for full foot traffic recovery exiting 2022 and a full sales recovery heading into 2023.

-

Accelerating expansion of Walgreens Health. Health segment revenue was $527M at the end of Q2 FY ‘22, inclusive of VillageMD sales of $446M and Shields sales of $81M. Management notes that the rollout of new VillageMD locations has “…accelerated to an average pace of one opening every three days in calendar year 2022” with 102 locations operating at the end of the quarter.

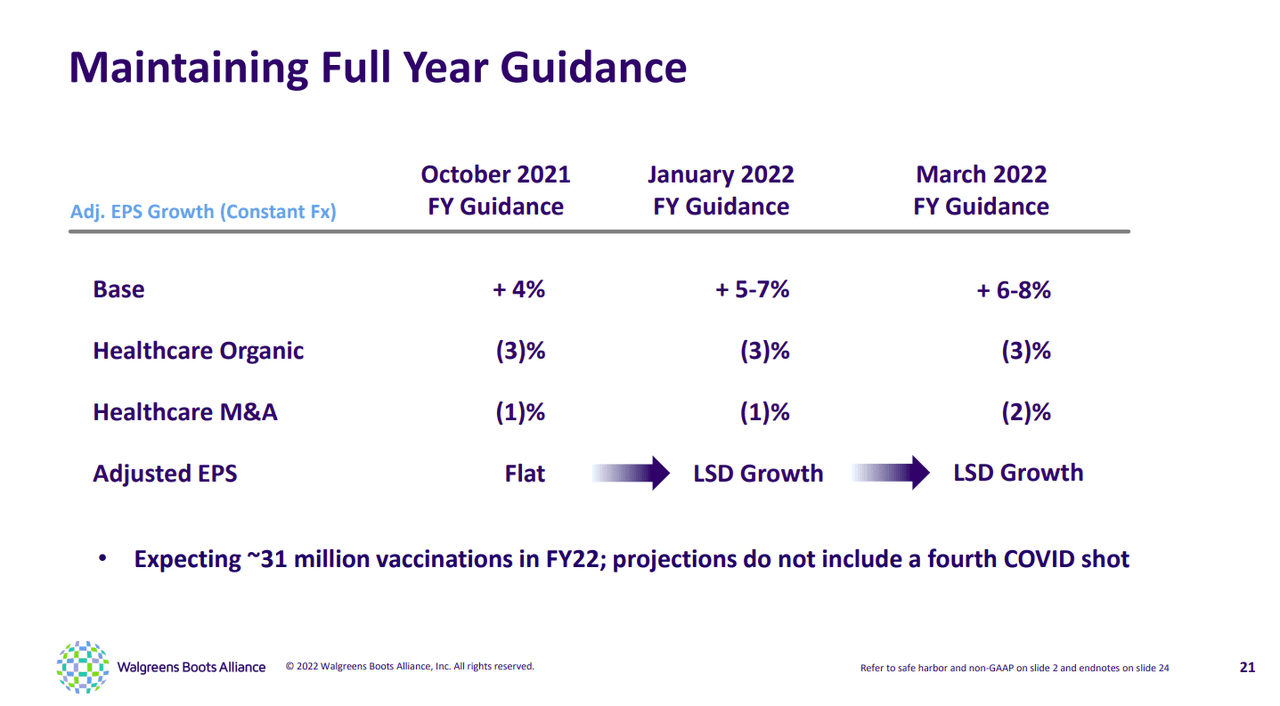

Obviously, the news was not all good, particularly with the decline in GAAP EPS. But, the news was not all bad either. To that end, management has reaffirmed their EPS guidance for FY ‘22, with the expectation of low single-digit growth. Excluding healthcare investments, EPS is expected to grow in the high single-digits.

Figure 3: WBA FY ‘22 EPS Guidance (Walgreens)

What are we, as long investors, to make of the “mixed” picture that colors WBA?

Putting Bear Arguments in Context

Again, I do think the bears have some strong arguments. A recent CNBC article quotes Raymond James analyst John Ransom who offers a succinct assessment:

John Ransom [offers that] Walgreens’ performance in the first half of the year coupled with its guidance foreshadow a sharp drop in the coming quarters and into 2023. Plus, he said, the drugstore industry is challenged by rising labor costs, reimbursement pressure from insurers and stale assortment in the front of stores. ‘This new management team is taking a shot — and I commend them for that — but the problem is I can name five things wrong with the core business and not much right’ he said.

Let us zero-in on these general areas and explore some of the counter-arguments. Any quotes below without specific links are attributable to WBA’s Q2 FY ‘22 earnings transcript.

1. Rising labor costs. Labor costs have been and will continue to be a variable expense that the firm has to do its best to manage, as evidenced by the 8.3% increase in SG&A during the quarter. However, management notes that Q1 FY ‘22 results included “…$120 million of investments that [were] made for wage premiums…[and] updated guidance [includes] $40 million of additional [labor] expense in the back half of the year.” Thus, WBA’s labor costs, at least through the end of FY ‘22, should be in line with existing expectations, barring any unforeseen near-term events in the labor market. Obviously, FY ‘23 SG&A costs may prove to be, for any number of reasons, materially higher. Yet, keep in mind that WBA has expanded its Transformational Cost Management program and now expects to reap $3.3B in savings by FY ‘24. The program is bolstered by efficiency-related investments, such as WBA’s micro-fulfillment centers with management explaining:

“We have 3 automated micro fulfillment centers open and are on pace to have 22 by the end of fiscal ’24, driving significant efficiencies and cost savings over time. We expect these centers to ultimately cover 40% to 50% of prescriptions for [the pharmacies] served, removing routine tasks and excess inventory from the local sites.”

As management continues to optimize the core business, this obviously helps to manage the variability in labor costs.

2. Reimbursement pressure from insurers. Reimbursement rates, like labor costs, will always be a challenge given the nature of the healthcare industry in the United States. This fact, however, helps us understand – in part – management’s decision to transform the business into a leading primary care destination. As I noted in a prior article on Walgreens, WBA’s expectation via its VillageMD rollout is to ultimately capture increasing scripts volume. Prior management had suggested the company could eventually capture as much as 50% of the prescription drug market, with the latter potentially worth ~$500B or more by 2030. While that goal may be a bit ambitious given strong competition from CVS (CVS), Walmart (WMT), and others, it nonetheless helps to articulate the point that WBA can offset reimbursement rate pressures via scripts growth. That is to say, they can keep growing in spite of payer pressures by capturing a larger piece of the pie. Admittedly, comparable prescription sales growth of 4.7% for the second quarter was “ho-hum”, and not necessarily indicative of management’s claim that the VillageMD strategy is working (i.e. driving scripts growth). But, we must recognize the VillageMD rollout is still in its early phase. Management assures us the firm is on track to end FY ‘22 with 200+ locations, and is similarly tracking to the original objective of 500-700 locations by the end of FY ‘25. Accordingly, even if WBA finds itself under increasing insurer pressure moving forward (as we would all expect), this trend may be more than offset via scripts growth. Also, bear in mind that the company is expanding within the specialty pharmacy market and thus able to exploit the higher-revenue and higher-margin opportunities in that market segment, which is also expected to grow considerably faster than the overall prescription drug market.

3. Stale retail assortment. As a Walgreens customer (as well as being a long investor), I tend to agree with Mr. Ransom’s point. But, WBA management has already indicated that the rollout of co-located VillageMD locations will “eat” into the available retail square footage of many stores, thus forcing a reduction in SKU count. Conceivably, then, we (consumers) may “see” an optimized retail assortment moving forward – not only at those locations with VillageMD offices, but non-primary care locations as well.

4. 1H FY ‘22 performance foreshadows a lousy 2H FY ‘22 and FY ‘23. With the understanding that ongoing Health segment investments will continue to drag on the overall business for quite some time, let us also be clear that the firm’s initiatives in healthcare represent a fundamental transformation of the business. If I had a crystal ball and could see 20 years into the future, I wouldn’t be at all surprised if WBA’s retail operations become subordinate to the healthcare business. As such, Mr. Ransom may be correct that near-term fiscal periods will indeed be lackluster. But, if we believe management, then we should be optimistic with respect to a long-term view as CEO Roz Brewer notes “…[Walgreens Health will]l hit a $4 billion run rate level of sales as we exit the year. And we still have long-term plans to hit a $9 billion to $10 billion number in 2025.” That being said, recall from the first section that, for example, second quarter US retail comparable sales growth was the highest in 20 years. While we might attribute that result to the strong tailwinds offered by COVID-19 vaccinations, it is not a foregone conclusion that retail performance is going to “fall off a cliff”. For one thing, while the COVID-19 situation around the world has largely improved (thankfully), it would likely be premature to assume that the pandemic is squarely behind us. Also, while still depressed as compared to pre-pandemic performance, the Boots UK business is recovering, with management noting particularly strong performance from boots.com in the second quarter. This is all to say, even if 2H FY ‘22 and the start to FY ‘23 are nothing to write home about, we must keep the bigger picture in mind; and, with a little luck, perhaps retail-side performance moving into the back-half of the year and into FY ‘23 won’t be all that bad, thus bolstering support for Health segment investment.

No Guarantees But a Measured Approach May Prevail

Obviously, betting on WBA today is a gamble on the firm’s broader ambitions in healthcare. There are certainly no guarantees that their strategy will work. However, as I have noted in the past, management was cautious with their VillageMD rollout, initially testing the concept with only a handful of locations. While some questioned if the company was moving too slowly, perhaps we, as long investors, should place some value on this deliberate and measured approach. Arguably, a careful, more thoughtful strategy has a greater chance of success than one that is rushed and haphazard. The company certainly faces formidable competition from the likes of CVS and WMT, each of whom have their own similar healthcare initiatives. In the case of CVS, who is betting on a bold, vertically integrated strategy based on their multi-billion dollar acquisition of Aetna, I have argued that their approach to the market may be more prone to failure simply due to its sheer breadth and complexity. To a certain extent, WBA’s strategy is simpler, largely focused on driving scripts growth via primary care centered on the massive multi-trillion dollar opportunity associated with chronic care patients. In the case of WMT, WBA’s smaller footprint may prove more attractive with patients. That is, perhaps primary care patients may prefer visiting a location that has more of a “neighborhood” feel versus a large supercenter format as is usually the case with WMT.

Overall, I think the bears make some strong points about WBA but I personally am not convinced that the arguments are sufficiently strong so as to precipitate a move out of a long position.

Be the first to comment