guvendemir/E+ via Getty Images

The last time I covered Lockheed Martin (NYSE:LMT) was in October 2021. Back then I noted that while there would be some pressure because the F-35 would not reach full potential, there were other areas such as space that would offer growth potential. Not long after, shares of Lockheed Martin tumbled as the company lowered expectations for the year and the next and would also reassess its five-year plan. Especially, the reassessment news sends a ripple through the defense industry turning it into an underperformer.

Looking back now, Lockheed Martin had a total return of over 22% since I published my article highlighting space as a growth opportunity despite F-35 pressures while the broader market has lost 2%. Obviously, the war in Ukraine has played a huge role and that was not something I had on my “2022 bingo card.” However, in December 2021 I noted the following:

…I believe that in the longer term continued tension with China and Russia in combination with evolving requirements in defense capabilities should bolster results.

Since then, shares of Lockheed Martin gained 33.5%. Even before that in a February piece on Northrop Grumman (NOC) I highlighted that the tensions with China and Russia should be beneficial for Defense companies. So what we’re seeing is that while there have been concerns on the budget landscape, the impact of the pandemic and some items specific to Lockheed Martin, shares of Lockheed Martin easily outperformed the broader market.

Following its Q1 2022 earnings results, shares once again declined but modestly. In this piece, I will have a look at those results to assess whether a decline is justified.

Results below expectations

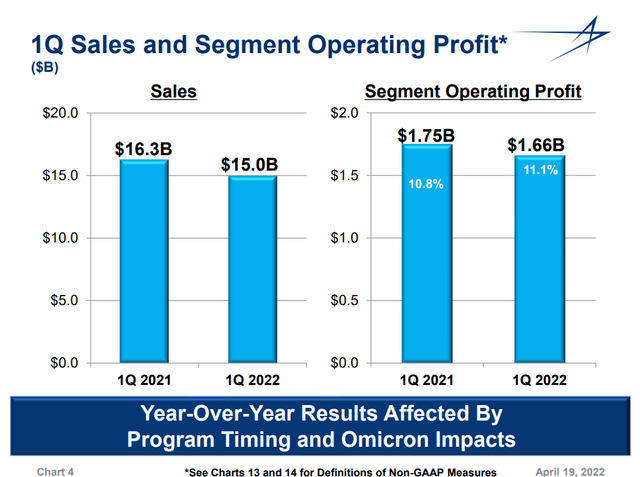

Sales Lockheed Martin Q1 2022 (Lockheed Martin)

Overall, Lockheed Martin had a revenue of $14.96 billion, marking an 8.2% decline compared to a year ago. That, itself, was already reason why shares of Lockheed Martin headed lower as Wall Street was expecting a decline of 4%. Noteworthy, however, is that around $240 million to $250 million was driven by supply chain struggles and a spike in COVID-19 cases. Absent of this pressure, the revenue miss would be $285.5 million instead of $530 million. It’s also important to realize that Lockheed Martin also said these results were below their expectations but their 2022 guidance remains intact as they expect to fully make up for the missed $250 million in the remainder of the year.

Segment operating profits declined 5.2%, but margins were higher which can be considered a positive though we should note that non-recurring adjustments drove the margin expansion. Overall, the $6.44 earnings per share beat expectations by $0.28 of which $0.08 cents came from a lower tax rate and $0.19 cents came from the non-recurring positive adjustment on one of the segments. So, the beat while strong really was driven by two items.

Segments results

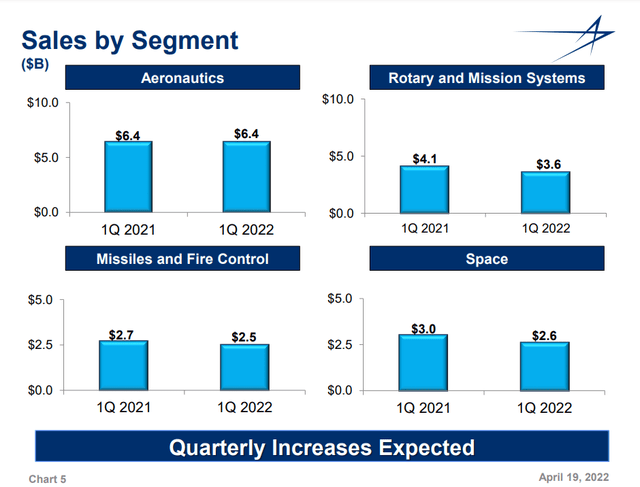

Segment Sales Q1 2022 Lockheed Martin (Lockheed Martin)

Looking at the segment results, we saw stability in Aeronautics where higher F-16 sales were offset by lower volume on the F-35 and lower positive adjustments. Missiles and Fire Control revenues were 11% lower driven by lower volumes and lower net favorable adjustments. Rotary and Mission Systems saw a bigger decline of 14%, which was driven by over 55% due to the delivery of a training system, 27% for lower volume for integrated warfare systems and sensors, 9% by lower volume on C6, intelligence and surveillance systems, 7% lower volume on helicopters.

Space saw revenues decline by 15%. The decline was for 96% driven by the UK nationalization of the Atomic Weapons Establishment in which Lockheed Martin was involved. Out of the $456 million decline, $100 million was due to lower volume on commercial civil space programs offset by higher sales for the Next Generation Interceptor.

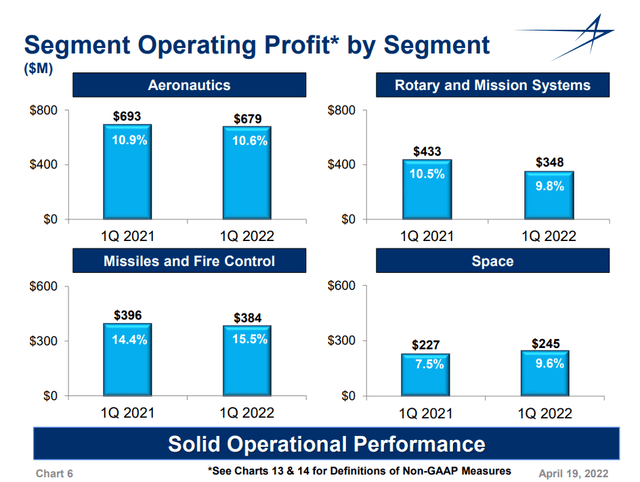

Segment Profit Q1 2022 Lockheed Martin (Lockheed Martin)

On stable revenues, Aeronautics saw margin contract somewhat resulting in lower profits driven by F-35 volume and lower favorable items for F-16 and F-35. For Missiles and Fire Control, lower revenues was offset by higher margins which was driven by $50 million in favorable items for an international program offset by $45 million lower favorable items for integrated air and missile defense programs, $10 million lower profits on tactical and strike missile programs due to lower volume and lower favorable adjustment on the SNIPER targeting pod. Interestingly, these items don’t quite add up to the $12 million in lower profits. Rotary and Mission Systems saw a steep decline of 20% or $85 million driven by lower net favorable adjustments. Space saw profits and margins improve driven by higher launch volume offset by lower commercial civil space adjustments.

Looking at the results, they are not bad or provide basis for lower share prices. Lower volumes is the reality many companies face today due to supply chain challenges and Lockheed Martin is no exception. For a while they have been able to shield their programs from these impacts, but it’s unrealistic to assume that this would remain as such. There are a lot of moving items but mostly the positive adjustment on Missile and Fire Control drove the earnings beat. Ideally, we see a broadly carried beat and that was not the case for Lockheed Martin but that does not warrant a reduction in share prices.

Guidance reaffirmed

The main reason why shares headed lower were not necessarily the results themselves. Indeed, Lockheed Missed analyst estimates on net sales but it will recover part of those missed revenues in the remainder of the year. What likely was more disappointing to the market was the fact that Lockheed Martin beat earnings estimates by 4.5% and it did not result into an improved guidance for the remainder of the year. I believe that’s what has been the main contributing factor the decline in share price.

Conclusion

Lockheed Martin beat estimates on earnings helped by a net positive adjustment on Missiles and Fire Control and a lower tax base but missed analyst estimates due to supply chain challenges and a spike in COVID-19 cases and lower volumes that go beyond the aforementioned constraints. Apart from that, the results were good given the current challenging environment for companies with elaborate supply chains and dependencies.

What has driven the 6% decline in share prices since Lockheed Martin reported its Q1 earnings vs. a flat market mainly seems to be the strong beat on earnings levels that was not accompanied by a guidance lift. That could either be seen as somewhat underwhelming performance in the remainder of the year or more likely an easier way to beat expectations and raise guidance in the remainder of the year. That also does make sense as supply chain challenges and COVID-19 still provide a dynamic uncertainty to the business. So, that’s a conservative approach I can appreciate. What might also have put pressure is a possible $500 million adjustment on tough negotiations with the Joint Program Office for the F-35 as negotiations for Lot 15 through Lot 17 are tough due to inflation and supply chain challenges resulting in a higher cost basis. However, this pressure would occur in Q2 and be balanced going forward.

What stands is what made my investment thesis for defense companies for a long time now and that’s continued tensions with Russia and China give reason to continue expanding defense budgets instead of stabilizing or cutting those budgets. We have seen more countries committing to higher defense spending due to the war in Ukraine and the sheer aggression. Lockheed Martin has not been able to quantify the impact of those increases, but it’s certain that this is a multi-year boost from which the company will benefit.

Be the first to comment