guvendemir

The F-35 most likely is one of the most ambitious military projects ever pursued, and realistically it is one of the most plagued defense programs. One could say that in an effort to address several sets of capabilities with a single defense platform. Costs have risen dramatically and timelines have shifted.

It also seems that the F-35 is so advanced that it was a bit ahead of its time, infusing the timeline with risks that are chasing Lockheed Martin to this day. From an engineering perspective, if you can’t match technological design capabilities of a product with the available and mature technologies at the time, you are going to end up increasing the risk of time delays and cost growth. To me, the F-35, while I am impressed with the product, is a schoolbook example of that.

Also in 2022, we saw some pressures regarding the F-35. However, besides some bad news, there also have been some positive developments. In this report, I will discuss both, demonstrating how an in-demand platform is struggling nearly 16 years after its first flight.

Fewer F-35s Requested

The F-35 program started the year in a somewhat disappointing fashion. While the war in Ukraine unleashed just a month earlier, the Pentagon slashed its budget request by 33 F-35 stealth fighters from a previously planned 94, setting the program back by around $5.8 billion, according to my calculations, from the procurement that was initially anticipated. There are two reasons for that.

The first is that, with a limited budget, choices have to be made, and the F-35 is not on the better side of the spectrum in that regard. There are hundreds of aging F-15C/D fighter jets used for homeland defense which need to be replaced. Those could be replaced by the F-35A, but it would be an overkill replacement. The F-35 is built with stealth capabilities in mind, which you don’t need for homeland security.

So, instead, more funds – $1.4 billion to be precise – have been allocated to the F-15EX, bringing the FY2023 budget to $2.8 billion for the type. That, to some extent, makes sense, as the F-35 has higher sustainment costs over it lifecycle, which is in part driven by its mission capabilities. The F-35 is a stealth fighter, which comes at a cost and for homeland defense, you don’t need that capability. The F-15EX, which does not require a stealth bay to carry weapons, is better equipped as an F-15C/D replacement. By 2019, the F-35 was also more expensive to operate per flight hour, but that is expected to come down significantly in the years to come, though Lockheed Martin has not had the best of success with bringing costs down. So, from a budgetary point of view, getting fewer F-35s make sense as well as from a mission requirement point of view. Simultaneously, it also puts more pressure on Lockheed Martin to deliver cost savings to operators.

Additionally, Lockheed Martin is running three years behind on Block 4 capabilities for the F-35 due to funding constraints and the complexity of the software, which also complicated the Technology Refresh 3. The software for fighter jets, without doubt, is highly complex, as fighter jets cannot be flown just by the aerodynamic properties of the jet and require augmentation. On top of that, you can layer the complexity of the F-35 itself and efforts to modernize the platform. That means that, while the operators seek Block 4 capabilities, they will have to retrofit that later on. By procuring fewer fighter jets now, the operators will have lower retrofit costs for Block 4 capabilities when that becomes available in the targeted year of 2029 and budget space is release for the F-15EX. So, it does make sense that fewer F-35s have been requested.

Inflationary and COVID-19 Pressures Lead To Low Flying Production

Next to that, COVID-19 put a damper on output. Lockheed Martin initially shielded its production system and chain quite well against the pandemic, but the reality is that Lockheed Martin is struggling to boost production. It will be in the 147-153 range in the next two years and production will remain at 156 jets in the years after, whereas production was expected to peak at 180 units previously. In the near term, that damper comes from supply chain constraints, but going forward it is mostly driven by what capabilities operators prefer with the available budget.

Lockheed Martin also went through a tough round of negotiations for production Lots 15 through 17, of which it warned a $500 million cost growth could be triggered due to timing of the agreement or a lack thereof on the back of higher costs driven by inflation and supply chain challenges. This ended up being $325 million due to incremental and international funding softening the cost growth.

Manufacturing Issues Plagued F-35

By the end of July, the U.S. Air Force grounded the bulk of its F-35 fighter over potential issues with the seat ejector cartridges, commanding a 90-day timeframe to inspect 706 cartridges on 349 jets. The checks were concluded several weeks later without any issues found, but it does show that the F-35 still suffers from some flaws as, in the isolated case, the explosive component of the cartridge was missing. This means that the ejector would likely not have functioned in case it was needed. The issue set a review in motion at the company in Lockheed Martin’s supply chain that manufactures the cartridges: two defective cartridges were found.

This month, Pentagon halted deliveries over the use of a Chinese alloy which is not a safety or security threat but may potentially violate acquisition regulations. It is another instance where even after years of production things seem not to be fully under control or in compliance in the supply chain on the most advanced fighter jet flying around today. The delivery stop has thus far delayed the handover of 8 fighter jets.

Not Only Bad Things For Lockheed Martin

While the F-35 without doubt has more than its fair share of problems driven by the way the project was set up and the complexity of the resulting product, it is not all that bad. While budget ceilings and technological timelines do provide some constraints on the number of jets the U.S. military will take in the coming years, demand for the jet can be labeled as robust. In fact, the F-35 is so advanced that not all countries that want to procure the jet will actually be allowed to, and for some countries, the life cycle costs might simply be too high to support the jet. An example of that is Romania (where I currently live); the country is charmed by the F-35 and intends to buy the jet in the future, but its budget is insufficient. This resulted in the country purchasing F-16s that were previously in service with the Norwegian Air Force.

The war in Ukraine has also reshaped defense budgets of NATO members. Canada has for years been evaluating its options, and in November 2021, evidently before the invasion of Ukraine, the F-35A and Saab 39 Gripen E were left as the remaining candidates to replace the CF-18 Hornets. Ultimately, in March 2022, that led to the selection of the F-35A, of which 88 will be procured. Similarly, in 2021, the Swiss decided to buy 36 F-35s in a deal worth $6.5 billion, but a contract was not signed until a few days ago.

There is little doubt that the escalation in Ukraine has accelerated the process of signing purchase agreements. Germany, which went on a buying spree following the invasion of Ukraine, said it will purchase 35 F-35s in a deal worth $8.4 billion, going against years of evaluating options in a competition that the F-35 was knocked from in 2019. Also, the Czech Republic declared an intent to buy the F-35, of which it aspires to procure 24, which I estimate to be worth at least $4 billion.

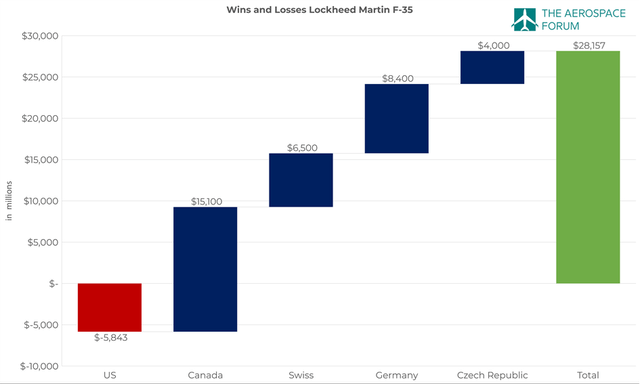

Wins and losses F-35 competition (The Aerospace Forum)

When we put things together, what we quickly see is that the loss of business in 2023 from the U.S. is offset by the wins Lockheed Martin booked for the coming years. Nearly $6 billion in business was lost for now, but the net positive is $28.1 billion.

Conclusion: Lockheed Martin Stock Still In A Buy Spot

While the F-35 has had problems and there are problems and delays still popping today, I do believe that overall Lockheed Martin is positioned well with its stealth fighter jet. There are, of course, concerns regarding the willingness of the U.S. to buy the jet in the quantities previously anticipated, as budgetary constraints exist and other platforms might provide better mission-suitable replacements.

While operators in the U.S. are charmed by the F-35 and intend to buy more jets once Block 4 capability is integrated, I do see that as somewhat of an overhang. However, in Europe, we are seeing that the invasion of Ukraine has led to faster decision-making processes and bigger budgets benefiting the F-35, and there is more to come.

Be the first to comment