petekarici/iStock Unreleased via Getty Images

Unsurprisingly given their similarities, much of what I opened with at recently covered NatWest Group (NWG) applies to Lloyds (NYSE:LYG) too. Its huge restructuring after the financial crisis; billions of pounds paid out in PPI mis-selling compensation; and most recently COVID – all have hampered the bank’s transition into what should be a very simple domestic retail & commercial story.

Those inclined might also add Brexit into the mix; perhaps not so much from an operational perspective, but it does feel like many U.K. stocks haven’t been getting their due in terms of valuation in recent years – something I feel applies here.

In any case, Lloyds has now dealt with most of these issues, and like most banks it sailed through the COVID downturn in pretty good shape. Sure, there’s still uncertainty ahead, with U.K. consumers braced for a serious hit to living standards on the back of high inflation, but by-and-large the bank is now free to get back to being the stodgy, profitable dividend-paying stock that it should be.

While I primarily like Lloyds for the dividend, there’s something for everyone here, and the discount to tangible book value offers plenty of mid-term upside in terms of capital appreciation.

A Pretty Straightforward Story

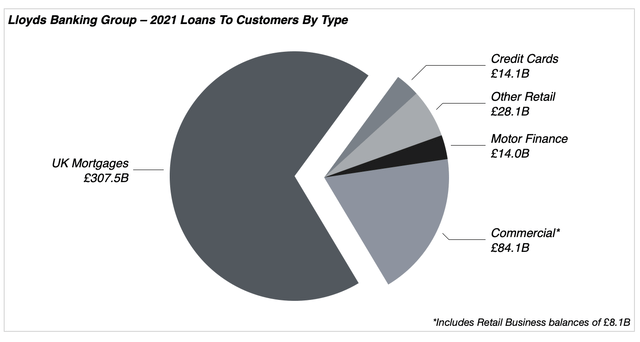

Lloyds is probably about as simple as it gets for a bank with a circa £885B asset base. It is almost entirely U.K.-based for one, where it is the top deposit gatherer in what is a fairly concentrated market. Also, Retail U.K. mortgages currently make up around two-thirds, or £310B, of its roughly £450B in loans to customers. Although the bank does have non-interest sources of income (e.g. wealth management, insurance, workplace pensions and so on), net interest income (“NII”) represents around 70% of the top line.

Data Source: Lloyds Banking Group 2021 Form 20-F

Being the leading player in a concentrated market, Lloyds has a very attractive core deposit franchise. Total deposits currently stand at around £475B, of which over £110B are in sticky, zero-cost retail current accounts. Of the roughly £350B in interest-bearing customer deposits it held last year, the bank paid just £426m, or 12bps, in interest expenses, helping it to offset lower yields on its interest-bearing assets brought about by the low interest rate environment and its own asset mix.

Furthermore, Lloyds’ leading position in the domestic market ultimately makes it a pretty efficient operator. Even with elevated remediation expenses the bank’s cost/income ratio came in well below 60% last year, and pre-COVID it was below 50%.

Seeing Off COVID In Decent Shape

As with most banks, events of the past couple of years have had multiple effects on Lloyds’ business. In terms of asset quality, the severity of the economic downturn initially led the bank to book impairment charges of £4.2B in 2020 as it set aside more for potential bad debt.

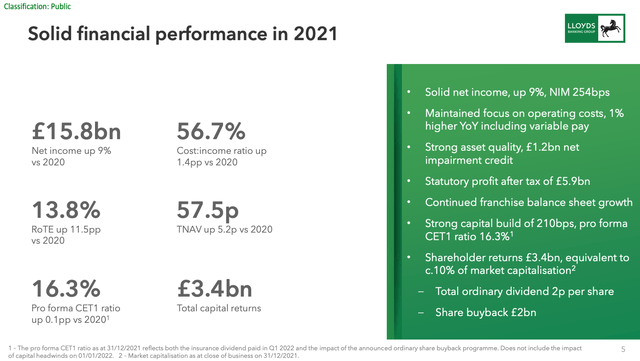

Thanks in part to government intervention, however, asset quality remained robust, with write-offs and non-performing loans remaining flat versus pre-COVID levels. That led Lloyds to record a £1.2B impairment credit last year, juicing the bottom line as it went on to post almost £6B in after-tax profit and a circa 13.8% return on tangible equity.

Lloyds Banking Group 2021 Results Presentation

On the income side of things, the bank has experienced pressure from both lower interest rates and sluggish loan balances, not helped by the relative lack of diversity in its revenue generation. The impact of lower rates speaks for itself, while at the same time Lloyds has seen balances of higher lending assets like credit cards and personal loans fall significantly versus pre-COVID levels as household savings rose during the downturn. Commercial lending has been weak too, with loan balances down around 2% last year.

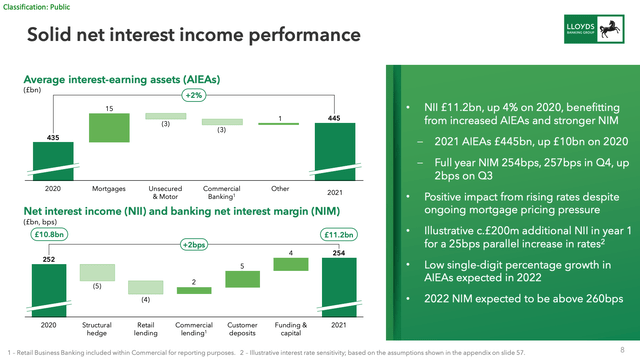

Despite this, NII has held up well, helped by mortgage lending and lower funding costs. Owing to its importance to the economy, the British government did what it often does during a downturn – stimulate the housing market. At Lloyds, that resulted in mortgage balances increasing by around £13.7B last year, good for circa 5% annual growth, helping to boost overall asset balances in the process. The lower rate environment also made for lower funding costs, with underlying NII ultimately up 4% last year to £11.2B.

Source: Lloyds Banking Group 2021 Results Presentation

Encouragingly, there were also tentative signs of a recovery in non-mortgage lending in the back part of the year, as the household savings rate continued to fall off alongside stimulus measures and a re-opened economy. Card lending balances were £14.1B in Q4, up 2% sequentially and 4% higher than in Q2. Period-end Corporate and Institutional balances had similarly inched up, increasing circa 3% versus Q2 to £46B.

No Growth, No Problem

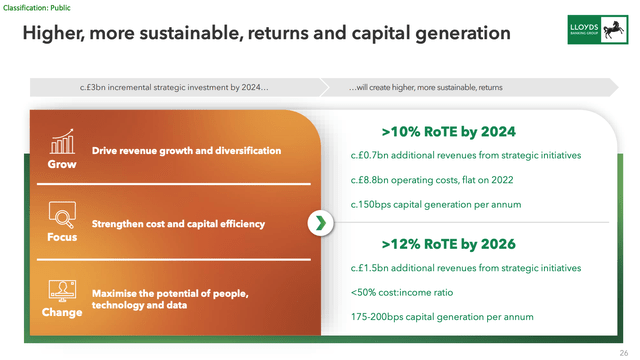

Being what (and where) it is, Lloyds is never going to set the world alight in terms of growth. Sure, it has its strategic initiatives, aiming to boost fee income and hold costs steady. Despite a largely fixed-rate loan book higher interest rates should be a boon as well, with a 50bps parallel increase in rates seen driving a circa £370m increase in NII in year one. But even in the best of times Lloyds is a stodgy business, and low single-digit annualized income growth is about as good as it gets.

Even so, growth is only one part of the equation, and Lloyds’ valuation more than makes up for the lack of it. Normalizing for higher provision expenses gets me to estimated FY22 EPS in the 6p per share range, putting the shares at under 8x forward earnings.

On a P/TBV basis, Lloyds trades at just 0.8x, even with management penciling in a double-digit ROTE this year (seen further improving to above 12% over the medium term). If it was a US bank, Lloyds could easily trade in the 1.0-1.2x TBV area, if not higher. Bears would point out that this has been the case for a while now, with European names typically trading at a discount on a P/TBV basis and American banks at a premium. While that is fair, there’s also no reason that sentiment can’t shift at some point in the future.

Source: Lloyds Banking Group 2021 Results Presentation

Regardless of any re-rating potential these shares are attractive. Lloyds declared a 2 pence per share dividend in respect of 2021, equal to a yield of circa 4.35%. This should rise substantially in 2022, with analyst estimates pointing to a FY22 dividend in the 2.35-2.40 pence per share region, boosting the forward yield to around 5%. With relatively low reinvestment needs and a strong balance sheet, the bank is in position to return the lion’s share of its earnings to investors, and buyback-fueled growth alone could be good for low-single-digit annualized per-share growth at the current stock price.

There are risks on the horizon: the U.K. consumer is seeing significant inflation for one, with energy bills basically set to double by the end of year versus 2021, and this might weigh a bit on loan growth and asset quality. But Lloyds is in strong shape and shouldn’t be facing anything existential. Buy.

Be the first to comment