RHJ/iStock via Getty Images

The share price of Livent Corporation (NYSE:LTHM) has spiked 58.01% over the past year owing to a surge in demand in basic materials including lithium, specialty polymers and chemical synthesis compounds. Huntsman Corporation (HUN) has gained 27% in the last six months. In my previous article on HUN, I expressed optimism that the polymer industry would outgrow the supply bottlenecks that had plagued the market and destabilized manufacturing run rates.

Thesis

Livent Corp. plans to expand its Lithium production capacities through 2022 with its management optimistic that higher average pricing will overshadow flat volume sales in the year. Despite the challenge of increasing costs YoY due to logistics, raw materials and general inflationary pressure, the company sees higher profitability of its lithium products. In this article, we will explain why this stock is a buy.

Growing lithium market

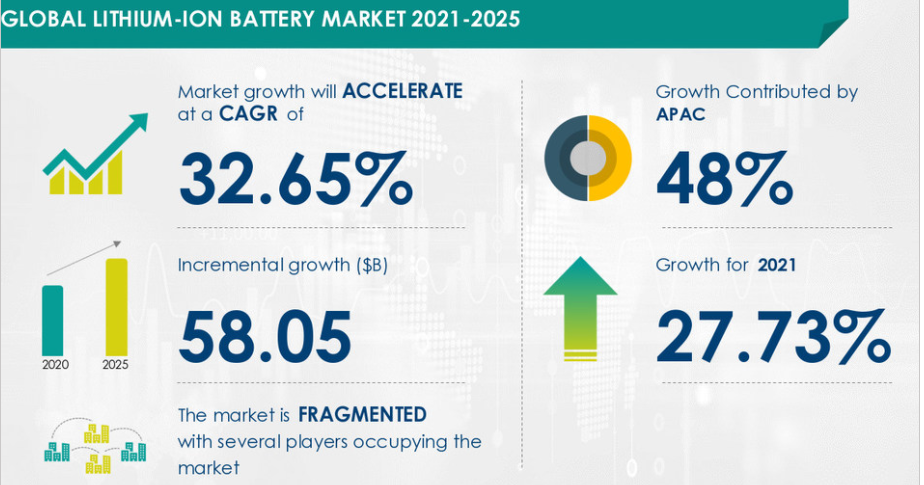

The lithium market is not slowing down buoyed by rising demand for consumer electronics. Devices such as smartphones, power tools, digital cameras and grid scale energy storage systems use lithium-ion batteries. Brands such as Samsung (OTC:SSNLF), Infinix, iPhone- designed and marketed by Apple (AAPL) and Nokia (NOK) are strong Lithium clients. Accordingly, the lithium-ion market is projected to grow by $58.05 billion from 2020-2025 at a CAGR of 32.65%.

PR News Wire

Analysis shows that 48% of the market’s growth is attributed to the Asia-Pacific region. That said, it was not a surprise that Tesla (TSLA), the leading EV manufacturer signed a deal with China’s Ganfeng (OTCPK:GNENY). The 3-year deal set to run from 2022 to 2024 will see Ganfeng supply battery-grade lithium hydroxide to Tesla. By the end of 2021, Ganfeng was said to produce 90,000 tons of lithium with an aim to boost its capacity to 200,000 by 2025. This would have been enough to handle 4 million electric-vehicle batteries. Overall, the company aims to lift its annual capacity to 600,000 tons.

On the same breath, Tesla had negotiated a deal with Livent Corp. for the supply of lithium hydroxide until the end of 2021. However, the company has not disclosed if it will extend the contract beyond 2021 and it somehow appears highly unlikely that it will consider renewal since Tesla is already looking elsewhere for more supply at arguably cheaper rates. Tesla has reportedly inked a 5-year deal with Liontown Resources (OTC:LINRF) of Australia to provide more than 100,000 tons of lithium spodumene concentrate every year beginning in 2024.

At the Kathleen Valley in Australia, Liontown is set to construct the A$473 million ($338 million) lithium mine in Q2 2022. The first production is in 2024, meaning that Liontown is specifically targeting Tesla as its premier clients.

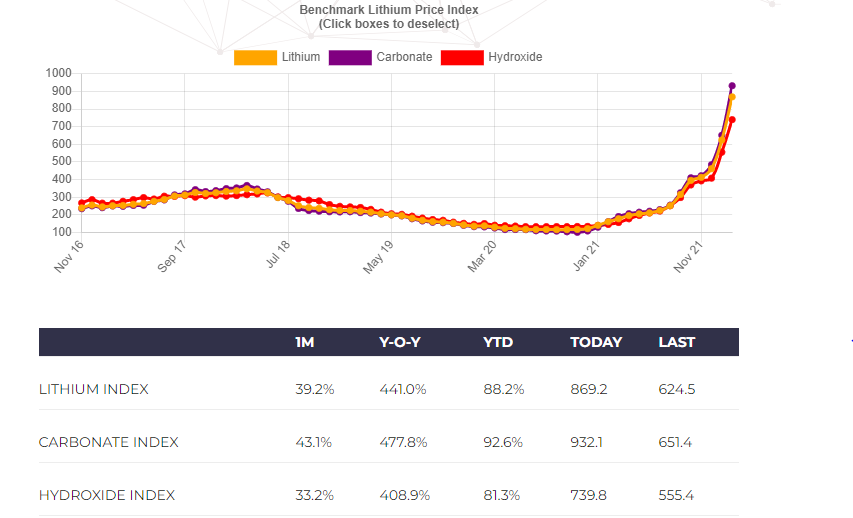

Benchmark Minerals

The graph above shows a rise in the prices of lithium and all its components including carbonate and hydroxide indices especially since January 2021.

Livent is expected to honor its $334 million deal with BMW (OTCPK:BMWYY) for the supply of lithium carbonate and hydroxide in 2022. LTHM uses an innovative mining mechanism that adopts sustainable water use. It also minimizes the environmental impacts to nearby communities making the company a top option for BMW.

Lithium and the Clean energy mix

As part of its goal to include clean energy in infrastructural development, the Biden administration has indicated its intention to commission about 500,000 EV charging stations. Further, it seems likely the President will invoke the Defense Production Act, that would see the US produce more minerals for EV batteries and long-term energy storage.

On its part, Lithium Americas (LAC) plans to start a new lithium mining project as more lithium is required to satisfy the EV being churned out into the world. With this new Presidential directive, LAC and LTHM, will benefit from among other things, cheap government loans lower project costs and expansion opportunities. The year 2021 saw Tesla deliver more than 1 million cars. Globally, about 6.5 million EVs were sold in 2021 with projections that it could reach 15 million units by 2040. It is apparent that the world is moving towards a climate friendly energy mix. But the US seems to have a lithium supply shortage.

Only one operating lithium mine exists in the US, the Albemarle Silver Peak mine in Nevada. The mine said to produce 3,500 metric tons of lithium carbonate per year and, with the capacity to produce 6,000 MT is facing a call for closure by the American native tribes on arguments that it is located on sacred grounds.

Even so, the US produces less than 2% of the world’s lithium supply even so it contains at least 4% of the global reserves dominated by South America, Australia and China. While expanding production would mean open pit mining, extraction of brine or pumping the mineral from the ground which is environmentally hazardous, it would still help reduce the number of cars operating on fossil fuels.

Expanded production capacities

In its 2021 10-K SEC filing, Livent Corp. stated that it was well advanced on its 5,000 MT lithium hydroxide in North Carolina. The company was also expanding its 20,000 MT lithium carbonate facility in Argentina. In Q1 2022, it began engineering on its second 20,000 MT lithium carbonate facility expected for completion in 2025. In the end, Livent will have tripled its production capacity to 60,000 MT.

Still in Argentina, South Korean firm Posco announced plans of investing $4 billion in a novel lithium mining project called Salar de Hombre Muerto. The company cited an increase in demand for rechargeable batteries. However, this amount was inflated since the company had originally planned an initial investment of $830 million. To make matters worse, the project is scheduled to produce 25,000t of lithium hydroxide annually before it increases to 100,000t. As seen, $4 billion against an initial production of 25,000t.

Argentina’s lithium mineral capacity was estimated at 6,200 MT in 2021, an increase of 5% YoY. However, it has declined 3.1% since 2018 when it reached a peak of 6,400 MT. South America’s mineral production is, however, facing labor headwinds characterized by a series of unrests.

Livent cited industrial action among the main impediments of mining in Chile and Argentina. Notwithstanding, Chile has the highest amount of lithium reserves at 9.2 million metric tons but Livent is yet to announce expansion measures in this South American nation.

Liquidity and Revenue Upside

Livent Corp. reported full year revenues at $420.4 million indicating a 45.87% increase from 2020 when it has $288.2 million. Adjusted EBITDA in 2021 was $70 million and in Q4 2021 was also four times higher YoY. Despite an increase in cost of revenues by 31.67%, Livent still registered a 134% increase in gross profit at $93.6 million in 2021 from $40 million in 2020. In our view, Livent emerged from the Covid-19 pandemic stronger, despite the increase in industrial action in South America.

As of December 31, 2021, Livent’s cash and its short-term equivalents stood at $113.0 million. This amount was almost a 900% increase from $11.6 million recorded in December 2020. With total current assets at $399.3 million and current liabilities at $131.3 million. This leaves out operational capital at $268 million expected for expenditures in Fiscal Year 2022.

In its 10-K, Livent stated that its cash balance of $113 million was sufficient to handle the company’s operations for the next 12 months, preferably until February 2023 or sometime in Q1 2023. The total expenditures used by the company in the four quarters leading to 2022 from operations and investing totaled to $74.5 million. True to form, the company has 12 months until it exhausts the current supply.

Available to the company is a $600 million revolving credit facility which was reduced to $385.5 million as of December 31, 2021 owing to an increase in operational expenditures.

Risks to the Downside

Livent resumes its capital expansion in Argentina and in the US in Q2 2021, that may work to deplete the funds even before the 12 months are completed. The company estimated the capital expenditure to range from $280 million and $320 million in 2022. However, if the company maintains its financial flexibility through adequate cash flow management and proper capital allocation, then it will be able navigate through the murky waters of expansion.

Still, Livent is yet to replicate extraordinary financial strength exhibited in 2018 when it had an operational income of $165.7 million. It has since declined by 75.26% in December 31, 2021 at $41 million.

Bottom Line

Livent’s cash balance plus its remaining revolving credit is sufficient to push the company until February 2023 or early Q1 2023. The company is confident that higher pricing of its lithium products in the fiscal year 2022/23 will continue to drive its EBITDA. Further, demand for battery-grade lithium is expected to grow beyond 2022. Livent has begun engineering on its Argentine mine with an intention to triple its carbonate supply to up to 60,000 MT beyond 2025. For these reasons, we suggest a buy rating for this stock.

Be the first to comment