Covalto leverages e-invoice and digital tax services for a proprietary data mine. Hispanolistic/E+ via Getty Images

LIV Capital is a Mexico City based private equity fund manager. LIVB (NASDAQ:LIVB) is their second SPAC with a stated focus on “Mexican target businesses (or non-Mexican target businesses with a significant presence in Mexico)”. The SPAC IPOd in February for $100m and just last week announced a merger with Covalto, a Mexico-based fintech. The valuation implied of Covalto is $547m. The company is described as “a leading digital banking and services platform for SMEs.”

Given my recent exploration into a peer fintech also seeking a bank charter the announcement piqued my interest. So I decided to take a deeper look and while potential is there, Covalto is a strong sell given overvaluation and lack of profitability.

Covalto Business Overview

The press release announcing the deal goes into a bit more detail about Covalto. They describe:

Formerly known as Credijusto, Covalto was an early innovator in building the technology infrastructure in Mexico to leverage digital tax, e-invoice and other financial data to underwrite and service SMEs at scale. Covalto provides a one-stop solution for SMEs by bringing together a multi-product credit offering, banking services and a full suite of business analytics tools. Through the combination of rigorous and near-instant data analysis with superior underwriting processes, the company supports the banking needs of thousands of SME clients and has maintained one of the lowest loan loss ratios in the Mexican fintech industry.

The company has a robust track record of growth dating back to its founding, as originations grew at a 152% CAGR from 2015 to 2021. Loan originations reached $189 million in 2021 and the company is projecting over $270 million for 2022 and $400 million for 2023. Last year, Covalto became the first Mexican fintech to acquire a regulated bank, providing the company direct access to Mexico’s interbank payment system and significantly lowering its cost of funding.

What I note from the above is that the company is leveraging a data driven strategy generating a data pile from their e-invoice and digital tax services. When partners process their data through Covalto’s service Covalto then turns those data points into insights gleaned for their underwriting process. Their target audience is clear as they are looking to exploit a trend of underserved banking needs for Mexican SMEs. And the detail of them being the first fintech with a bank charter allows them to drive even further low-cost funding to grow.

Covalto IR: Business Opportunity

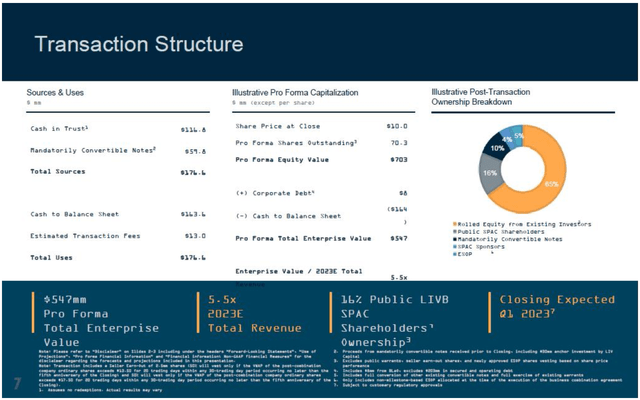

The acquisition which gave Covalto a bank charter happened last year in June which I take to mean they are still in the process of ramping their banking services. Once combined the company will have $164m in fresh capital to deploy and just $8m in debt.

Covalto IR: Transaction Summary

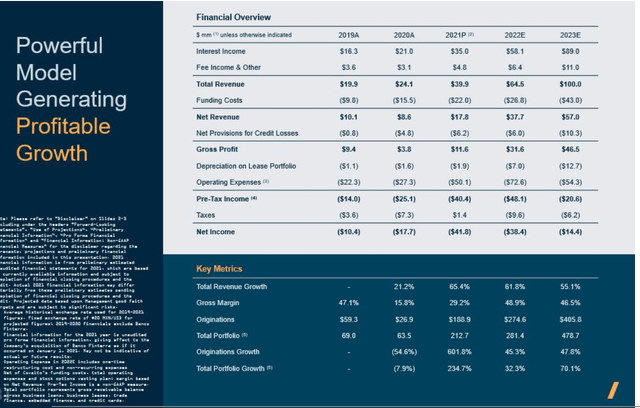

A key detail that I note in terms of valuation is the EV/2023 estimated revenue of 5.5x. It seems that valuation is a bit high when we consider that the company has not generated a profit. Unaudited 2021 net income for Covalto was -$41.8m and the last three years they’ve averaged a net loss of $23.3m a year. In their own presentation they estimate losses to continue this year and 2023.

Covalto IR: Financial Overview

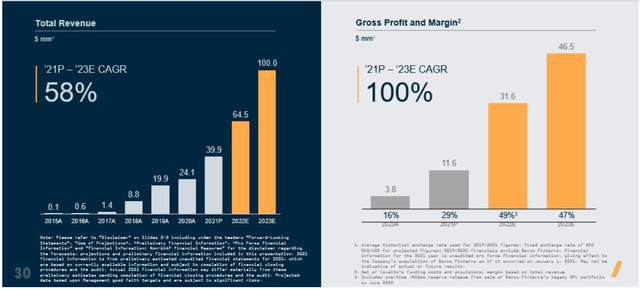

These losses are somewhat balanced by the impressive revenue growth from 2017 to today which increased from $1.4m to $39.9m in 2021 or 688% annually. Gross margins have started to tick up since 2020 which to me suggests the company is nearing an operational scale that is profitable – but they aren’t quite there just yet. And with losses expected the next two years I suspect that company is likely to trade downward.

Covalto IR: Revenue and Gross Profit

The macro context also seems favorable for the company to grow into. Leveraging their proprietary data, they have been able to generate positive underwriting performance and currently their non-performing loans percentage of 3.8% is more than half the peer rate of 9.6%. No doubt the company intends to continue to leverage their data model and partnerships to originate further loans with the capital brought on hand. Covalto has shown origination strength growing 152% annually since 2015, so deploying the capital shouldn’t be an issue. And with their impressive underwriting results it’s likely that further revenue growth should drive out of that.

Rising interest rates should provide a bit of support as well in their lending revenue.

What I Like and What I Don’t Like

The transaction caught my eye after recently writing up another fintech seeking to acquire a bank charter in the US, BM Technologies (BMTX). By investigating Covalto I thought I might learn a bit more about the space overall and the different ways that fintechs are building their businesses. That starting point revolves around the theoretical value of having a bank charter for both and Covalto is already farther down the path.

The overall business model seems strong in that they’ve built a core servicing model around e-invoices and digital tax services which enables them proprietary data into many of their partners and customers. It seems that this strategy has paid off given their 1% historical loss ratio. Coupling that key data asset with a bank charter enables them to cut the cost of their funding by holding deposits while also opening up new data points for the company to improve their model.

So I like the business model they’ve developed and I think that down the line they will start to see profitability as long as underwriting results remain strong. The macro context seems strong as well as Covalto has secured a first mover advantage of fintech with a charter in Mexico. Additionally, there’s a funding gap for SMEs in Mexico which can help to fuel growth as well:

Mexico currently has the lowest credit penetration in Latin America, as outstanding loans represent only 38% of GDP – compared to 70% in Brazil and 216% in the United States. According to data from the International Finance Corporation, market concentration in Mexico has left a funding gap for SMEs amounting to more than $160 billion, underlying the growth potential for digital financial services.

Current shareholders of Covalto are rolling 100% of their interest into the combined entity and are expected to own over 72% of shares outstanding after closing. This implies that Covalto will trade as a controlled company and that management is incentivized to protect value in the stock. With very little debt and a pile of new cash to drive originations I suspect the company to be very busy in the coming year.

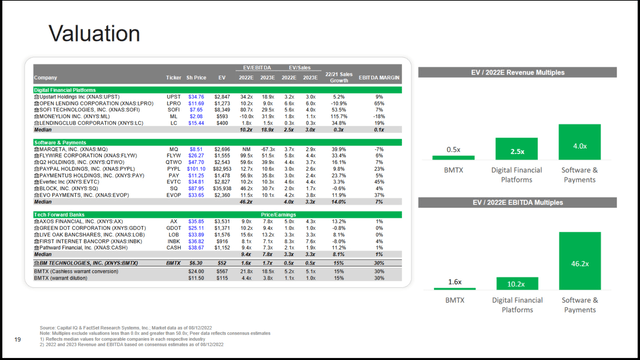

There is a key detail that I don’t like though which I’ve already noted: the valuation. For one, I’m not one to typically invest in companies that aren’t profitable yet. While the growth runway implied in terms of revenue and origination growth is there, I’d like to see actual cash flow to the business. Not only is the company not profitable, the EV/Revenue multiple for last year’s numbers is ~13x. Compare this to some peer averages provided in peer fintech BankMobile’s presentation. Covalto is more akin to the digital financial platforms which have a peer average EV/Revenue of 2.5x.

BMTX IR: FinTech Peer Group Data

No matter where you look in that chart Covalto seems overvalued by comparative metrics. In fact if you placed Covalto on the chart they would have the highest EV/Revenue multiple amongst the group. I don’t suspect this type of premium valuation is justified especially in light of the fact that there are companies in that chart that are actually profitable; BMTX is an example of this.

Instead I think what’s likely to happen is that as the business combination completes and details start to come out regarding the deal that the stock price will start to lose value. A reversion to the mean EV/Revenue multiple of 2.5x would imply downside of 80%. Downward momentum could build in the name until they start to generate profitability or demonstrate continued sizable growth.

So while I like the company’s business model, strategy, and macro context, I think at current valuations the company is a pass. There are better opportunities which expose investors to the growth possibilities of fintech without the risk of share price declines I think are inherent with Covalto. I do think it’s a company to keep an eye on and depending on how it evolves and how the stock trades it may become a candidate for investing sometime in the next year or two.

Performance of LIV Capital’s first SPAC

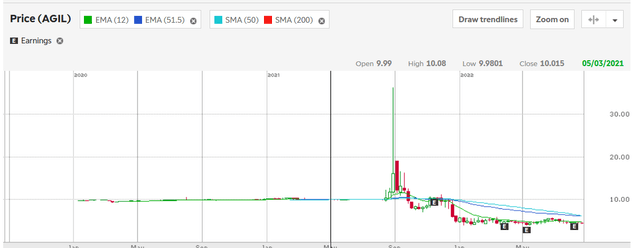

For reference, LIV Capital’s first SPAC brought AgileThought Inc. (AGIL) public and now trades under ticker AGIL. The business combination was announced in May 2021 and since then the stock has dropped from trading around $10.00 to $4.40 today – a loss of 56%.

TD Ameritrade AGIL 3-year price chart

While an entirely different company in a different sector, I note the performance of the SPAC post business combination as a reflection of LIV Capital’s historical performance with SPACs.

Covalto in Summary

Covalto has built an intriguing fintech business model and are now capitalizing on the recent bank charter acquisition to build out their lending platform even further. Using cash from this SPAC combination will help them to do so. While I think there is potential here in the company, particularly given the data driven approach, with EV/FY21 Revenue at 13x and expected continued losses for the next two years expected I think investors should approach with caution. A reversion to a peer group means of 2.5x EV/Revenue implies 80% downside with still no guarantee of a further fall given lack of profitability.

This is a strong sell for now. As the company evolves over the coming years, they may become an interesting play if they can start to generate a profit.

Be the first to comment