Bet_Noire

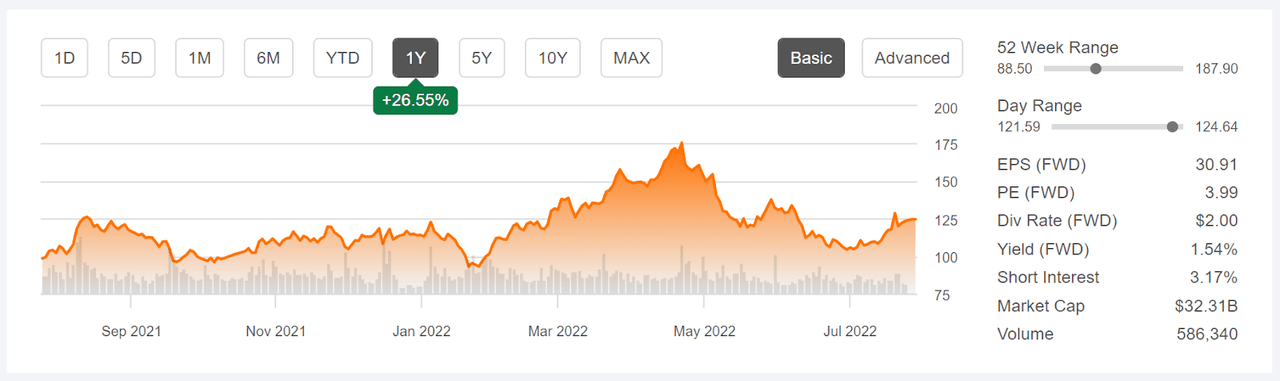

Nucor (NYSE:NUE) is the 15th-largest steel manufacturer in the world in terms of tonnage produced, and the largest in the U.S. by a considerable margin. The shares have gained 26.6% over the past 12 months and the total return is 28.1%, as compared to -13.9% for the steel industry as a whole. NUE has tracked with the ARCA Steel Price Index, reaching a 12-month high in April and then dropping quite dramatically in the subsequent months. NUE is currently about 29% below the April high close, as compared to a decline of 28% from the April high for the ARCA Steel Price Index. The falling price of steel reflects declining demand and growing fears of a global recession.

Seeking Alpha

12-Month price history and basic statistics for NUE (Source: Seeking Alpha)

NUE’s earnings have skyrocketed since late 2020, reaching an all-time high in Q2 of 2022, the most recent quarter reported. The outlook, however, is for a comparably-rapid decline in EPS in the coming year. The consensus estimated EPS for Q2 of 2023 is only 37% of the reported EPS for Q2 of 2022.

ETrade

Trailing (4 years) and estimated future quarterly EPS for NUE. Green (red) values are amounts by which EPS beat (missed) the consensus expected value

Nucor has been repurchasing its own shares in substantial quantities, boosting the share price. At the end of 2021, the board of directors approved additional buybacks of up to $4 Billion in shares, a substantial fraction of the company’s market cap. From the start of 2022 through Q2, the company spent $1.7 Billion to repurchase shares. The remaining $2.3 Billion in potential buybacks represents an additional 7.1% in effective yield for shareholders.

In analyzing NUE, a great deal depends on the broader economic outlook. The Wall Street consensus rating and price target provide the prevailing view among equity analysts. Options prices reflect the overall forward view among buyers and sellers of options. By analyzing the prices of call and put options on NUE, I can infer the consensus outlook from the options market, the market-implied outlook.

The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. Using the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have relied on the market-implied outlook in previous analyses of two other huge metals companies, ArcelorMittal (MT) and Rio Tinto (RIO), and the results have borne out the value of this approach – so far.

Wall Street Consensus Outlook for NUE

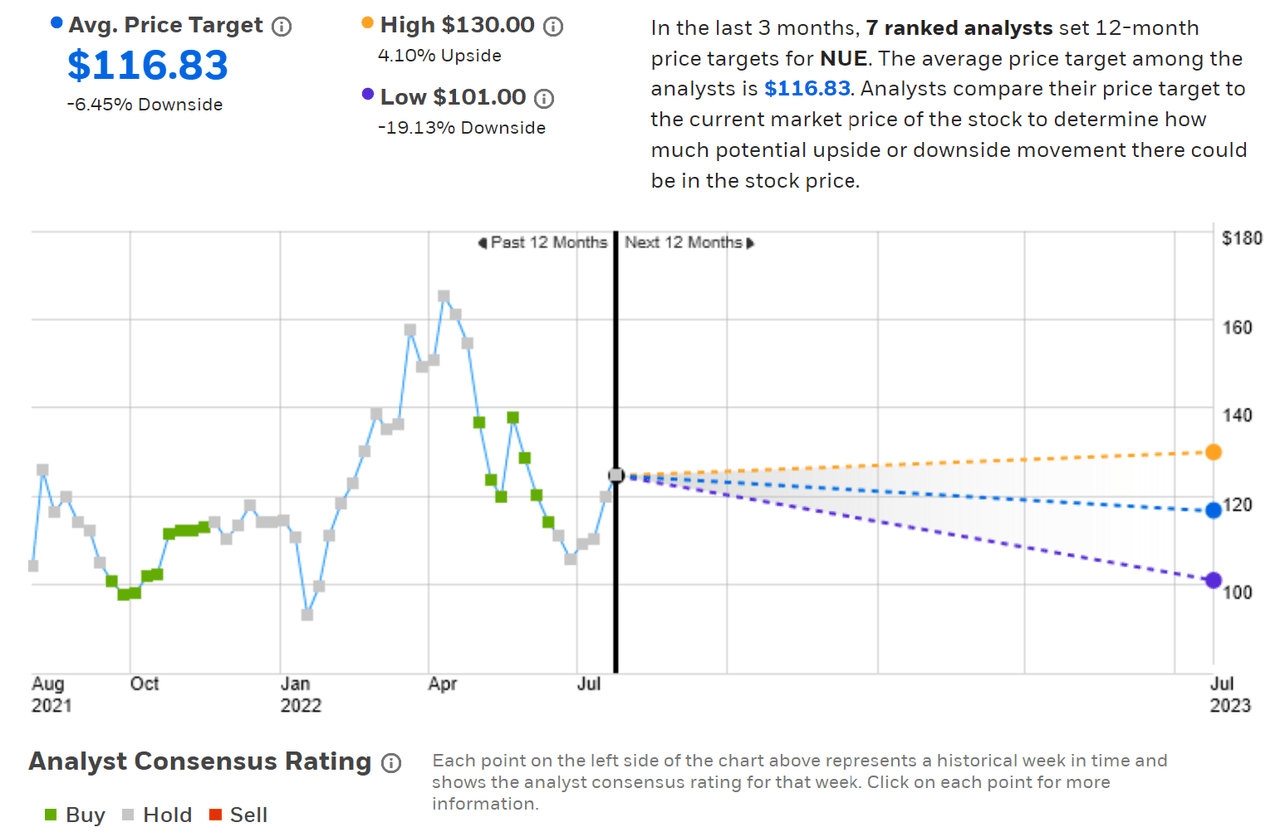

ETrade calculates the Wall Street consensus outlook using ratings and price targets from 7 ranked analysts who have published their views over the past 3 months. The consensus rating is neutral, as would be expected given the overall muted outlook for steel demand and prices over the next year. The consensus 12-month price target is 6.5% below the current share price.

ETrade

Wall Street analyst consensus rating and price target for NUE

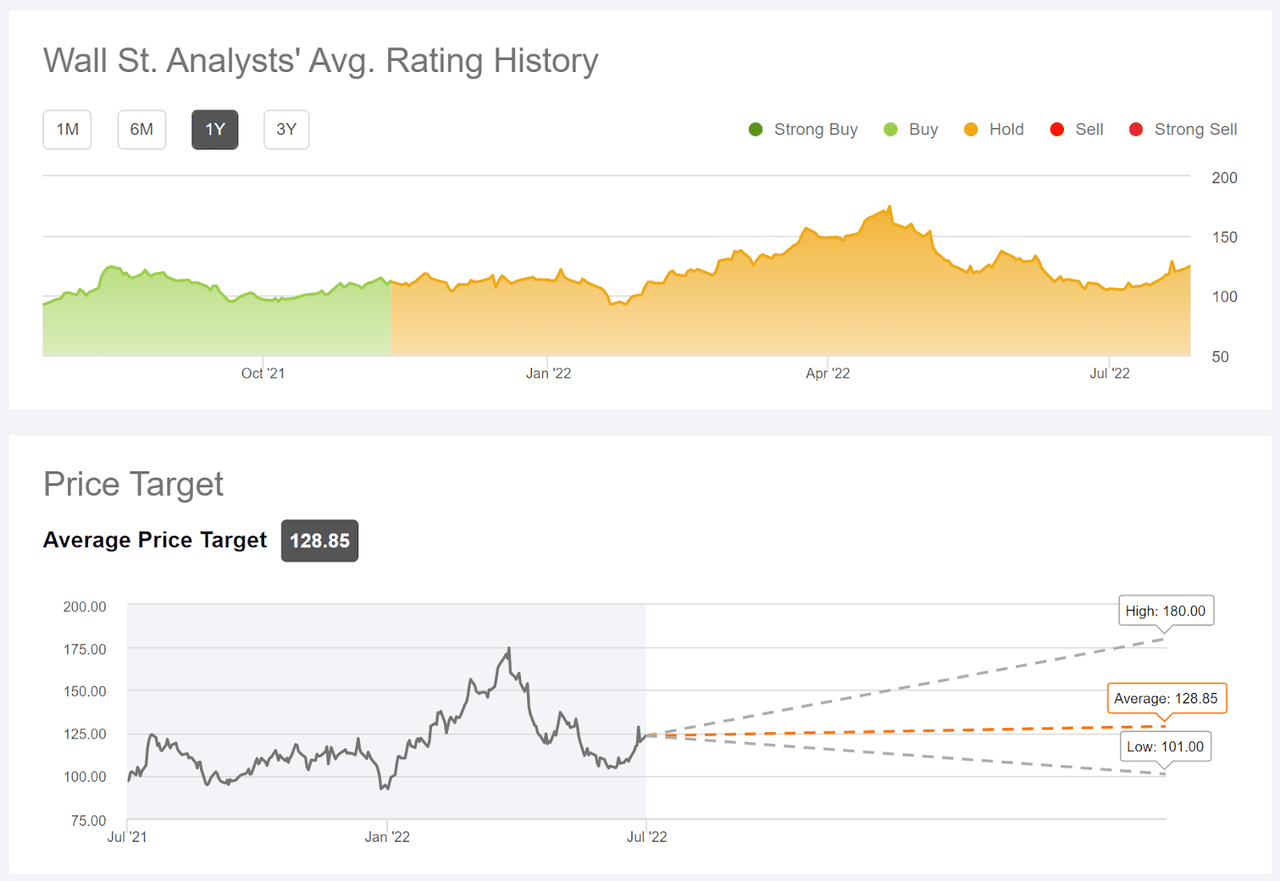

Seeking Alpha’s version of the Wall Street consensus outlook is calculated by combining the views of 13 analysts who have published ratings and price targets within the past 90 days. The consensus rating is neutral, consistent with ETrade’s result, and the consensus 12-month price target is $128.85, 3.2% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and price target for NUE

While the consensus price targets from ETrade and Seeking Alpha differ by about $12, this spread is relatively insignificant given the stock’s volatility.

Market-Implied Outlook for NUE

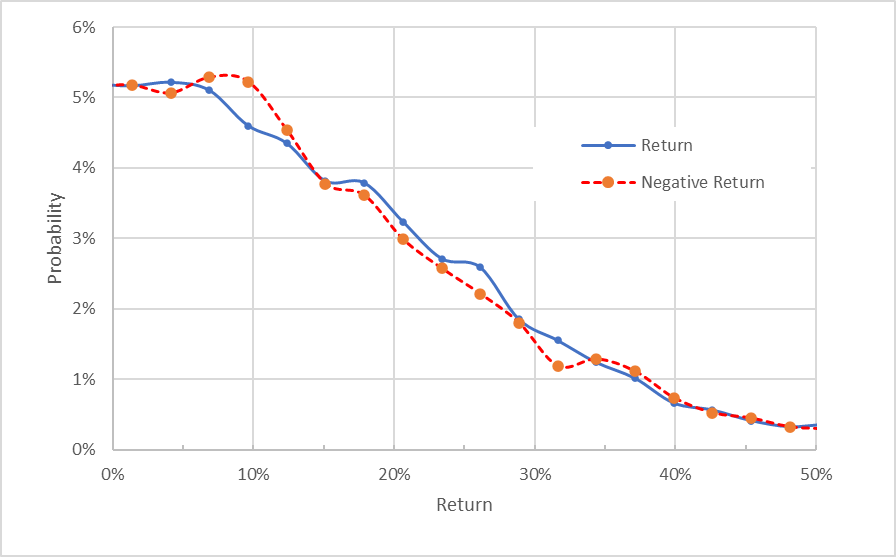

I have calculated the market-implied outlook for NUE for the 2.8-month outlook from now until October 21, 2022 and for the 5.8-month period from now until January 20, 2023, using the prices of call and put options that expire on each of these dates. I selected these two dates to provide an outlook just beyond the Q3 earnings report (October 19, 2022) and through the end of the year.

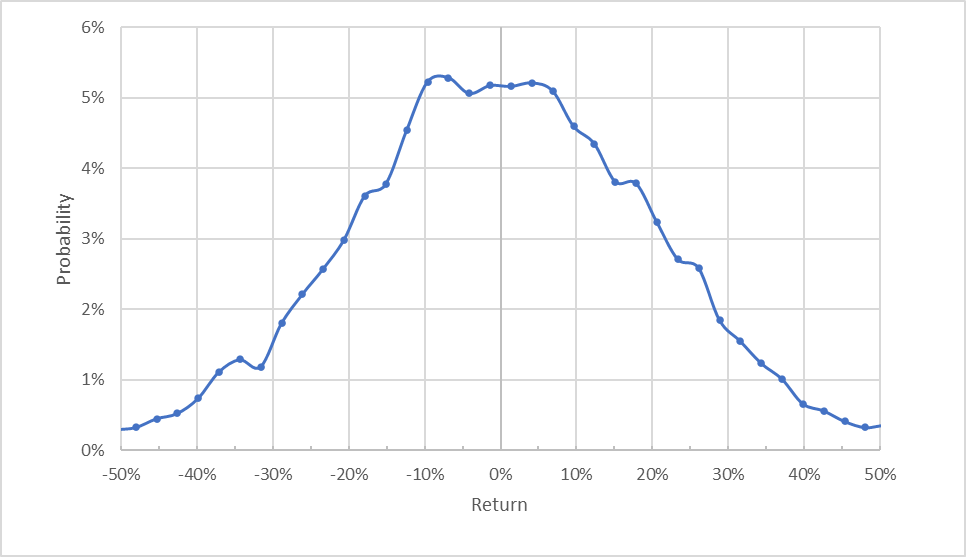

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for NUE for the 2.8-month period from now until October 21, 2022

The outlook for the next 2.8 months indicates comparable probabilities of positive and negative returns of the same magnitude. The expected volatility calculated from this outlook is 50% (annualized).

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for NUE for the 2.8-month period from now until October 21, 2022. The negative side of the distribution has been rotated about the vertical axis

This view illustrates that, aside from small divergences, the odds of positive and negative returns of the same size are extremely close. The market is not pricing in any elevated risk of decline following Q3 results. That said, the 50% annualized volatility means that the range of possible outcomes is large. The estimated 20th percentile price return over the next 2.8 months is -17%. This means that there is a 1-in-5 chance of having a return of -17% or worse over this period.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering this potential bias, the outlook for the next 2.8 months looks neutral to slightly bullish.

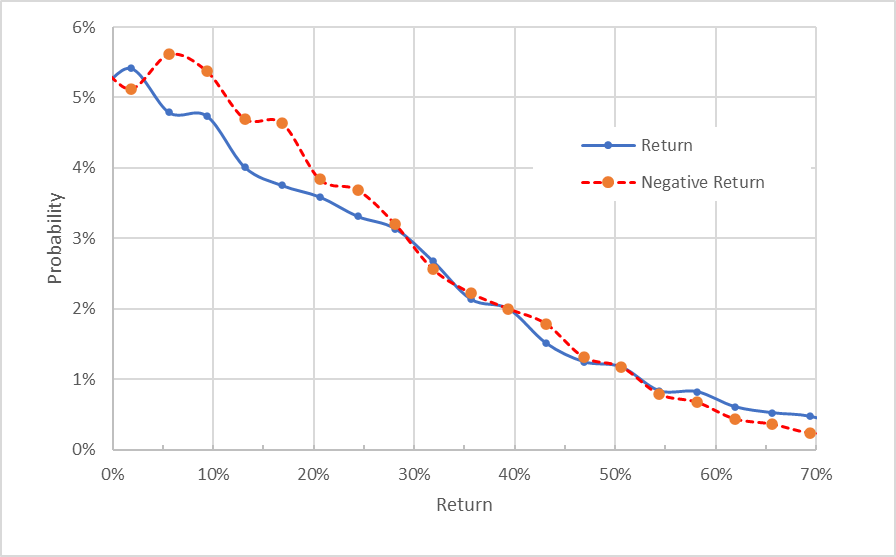

The market-implied outlook to January 20, 2023 is tilted to favor negative returns over a range of the most probable outcomes (the dashed red line is above the solid blue line over almost all of the left third of the chart below). That said, the odds of large-magnitude returns positive and negative returns match very closely. The expected volatility calculated from this outlook is 46% (annualized). Given the expectation that the market-implied outlook will have a negative bias, this outlook is interpreted as neutral to slightly bearish.

Geoff Considine

Market-implied price return probabilities for NUE for the 5.8-month period from now until January 20, 2023. The negative side of the distribution has been rotated about the vertical axis

The market-implied outlooks to early 2023 are predominantly neutral, shifting from a slightly bullish orientation through the end of Q3 to a slightly bearish tilt to January of 2023. The expected volatility is high but stable, shifting from 50% in the near term to 46% through the end of the year.

Summary

NUE has performed well in recent years, and management is certainly due some credit, but the company’s earnings are largely determined by the demand and pricing for steel. This, in turn, is driven by global economic conditions. We are in a period of high inflation, but concerns about a possible widespread recession is putting a damper on steel demand and steel prices have dropped substantially in the past several months.

The Wall Street analyst consensus outlook for NUE is neutral, and the consensus 12-month price targets imply something close to a 0% gain over the next year. This accounts for the potential additional buybacks. The market-implied outlook is mainly neutral, shifting from a small bullish tilt to a small bearish tilt as 2023 approaches. The expected volatility, unsurprisingly, is high. My overall rating on NUE is neutral/hold.

Be the first to comment