Welcome to the February 2020 edition of the lithium miner news. February saw January lithium prices slightly lower again, and a coronavirus led conventional and electric car sales slowdown in China in January. February was a busy month for lithium market and company news.

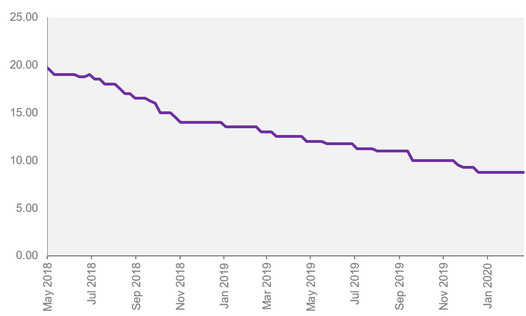

Lithium spot and contract price news

During February, 99.5% lithium carbonate China spot prices were not updated (down 0.54% the past 60 days). Spodumene (5% min) prices were not updated (down 0.76% the past 60 days), and spodumene (6% min) prices were reported in December 2019 by Mineral Resources at US$520/t.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan, and Korea of US$8.75/kg (US$8,750/t), and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan, and Korea of US$10.25/kg (US$10,250/t). These prices are now slightly out of date.

Benchmark Mineral Intelligence has January prices at US$7,922 for Li carbonate, US$10,002 for Li hydroxide, and US$480 for spodumene (6%).

Lithium hydroxide, battery grade, cif China, Japan, and Korea

Lithium carbonate, battery grade, cif China, Japan, and Korea

Source: Fastmarkets

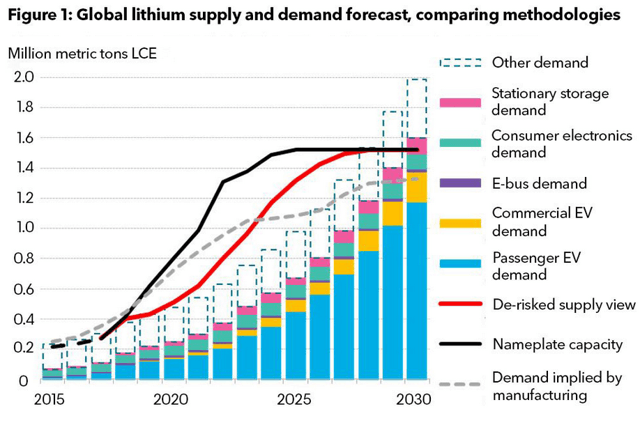

Lithium demand versus supply outlook

On January 28, Mining Weekly reported:

Key EV markets to start growing again – WoodMac. This is according to consultancy firm Wood Mackenzie (WoodMac), which notes that interest around electrification shows “no signs of slowing”. Several major automotive manufacturers are launching ‘mass-market’ EVs on dedicated platforms, aimed at breaking down range and cost barriers. Mindful of consumer concerns around range, automotive manufacturers are opting for bigger batteries, offering more kilometres per charge and WoodMac notes that the trend of bigger batteries should continue over the short term. Turning to lithium, which in an oversupplied market had a particularly weak year in 2019, the research firm says that it does not expect any tightness in the market in the short term, despite several closures and expansion cuts last year. WoodMac expects (lithium) price decline to extend over the next 12 months.

On January 28, Business Korea reported:

Hyundai Motor, LG and POSCO groups may launch an EV battery (manufacturing) Joint Venture. They are reportedly considering setting up a joint venture not only in Korea but in other countries. “LG Chem is currently pushing forward with joint venture projects with several automakers, and Hyundai Motor Group is also aiming to sell one million units of electric vehicles by 2025. So the two companies share common interests,” said a battery industry insider.

Source: BNEF

Lithium market and battery news

On January 28, Nikkei Asian Review reported:

Japan to lift stockpiles of metals for EVs, wary of China’s clout. Tokyo looks to secure access to lithium, cobalt and rare earths. Japan will expand its reserves of metals crucial to the production of electric vehicles and high-tech gadgets, aiming to keep pace with rising demand and ensure access as China gains increasing control over global supplies …..Tokyo looks to secure access to lithium, cobalt and rare earths.

On January 30, Reuters reported:

Australia’s lithium producers see tough market conditions persisting well into 2020. Orocobre, Pilbara see continued tough conditions. Producers target 2H pick up, once stockpiles are drawn down. Further delays to investment decisions flagged.

On February 3, Bloomberg reported:

China’s CATL wins deal to supply batteries to Tesla. CATL disclosed the contract that runs from July 1, 2020, until June 30, 2022, in a statement Monday. CATL said the so-called production pricing agreement is still non-binding, and there is no certainty for the quantity that Tesla will purchase. Deal is a boost to CATL as it competes with LG Chem, Panasonic.

On February 10, The Drive reported:

Battery shortage halts Jaguar I-Pace production. The battery production issues are also affecting Audi and Mercedes-Benz. Jaguar Land Rover told its suppliers and employees that the Magna Steyr plant in Graz, Austria will pause I-Pace production for a week starting Monday, February 17 because LG Chem has struggled to supply enough batteries to sustain production. Though global battery manufacturing capacity was predicted in 2017 to double by 2021, the rapidly electrifying automotive industry still anticipates widespread battery shortages. Automakers have scrambled to ally themselves with suppliers such as LG Chem and Panasonic or kickstarted new businesses to produce batteries to circumvent existing supply chains. Both approaches have their shortcomings, however, and neither offers immunity to limited global supply of cobalt and lithium, each of which is needed to produce lithium-ion batteries.

On February 11, The Asian Miner reported:

Volatile battery minerals prices driving battery makers to invest in mines. The past few years have seen a large number of transactions that create a vertically integrated position in the markets for battery-based minerals such as lithium, cobalt, graphite and nickel, making the battery mineral and mining sector currently one of the hottest for mergers and acquisitions. Vertical integration is an attractive strategy for battery mineral miners and users in the current environment, and there are significant value benefits to be found in successful implementation.

On February 12, BASF announced:

BASF further invests in Europe to strengthen global leadership position for battery materials for electric vehicles. BASF is announcing a new battery materials production site in Schwarzheide, Germany, as part of its multi-step investment plan to support the European electric vehicle [EV] value chain. This state-of-the art plant will produce cathode active materials [CAM] with an initial capacity enabling the supply of around 400,000 full electric vehicles per year with BASF battery materials.

On February 21, Small Caps reported:

Bill Gates-led fund heads up investment in Lake Resources’ lithium processing technology partner Lilac Solutions. A Bill Gates-led fund called Breakthrough Energy Ventures has backed lithium brine explorer Lake Resources’ (ASX: LKE) technology partner Lilac Solutions during a series A U$20 million investment round. According to Lake, Lilac’s direct lithium brine extraction technology offers a “sustainable solution” in producing lithium carbonate. In lithium brine operations, Lilac’s technology involves removing the lithium from the brine then returning the processed brine to aquifer where it was extracted. This eliminates the need for traditional evaporation ponds, which are used in conventional lithium brine operations. Lake added Lilac’s technology is “significantly faster, cheaper and more scalable” than existing methods.

Lithium miner news

Albemarle (NYSE:ALB)

On February 5, Albemarle announced:

Albemarle Chairman and CEO, Luke Kissam, will retire for health reasons, effective June 2020. Albemarle Corporation, a leader in the global specialty chemicals industry, announced today that Chairman and Chief Executive Officer Luke Kissam has advised the Board of Directors that he will retire from his roles as an officer and director of Albemarle effective June 2020, for health reasons. The Board of Directors will be conducting a comprehensive search process, which will include internal and external candidates.

On February 19, Albemarle announced: “Albemarle Corporation finishes 2019 strong; announces 2020 outlook.” Highlights include:

Fourth Quarter 2019 Highlights (Based on year-over-year comparisons)

- “Net sales of $993 million increased ~8%, including an unfavorable currency exchange impact of ~1%.

- Diluted EPS of $0.85 decreased ~30%.

- Adjusted diluted EPS of $1.73 increased ~13%.

- Adjusted EBITDA of $295 million increased ~12%.”

Full Year 2019 Highlights (Based on year-over-year comparisons)

- “Net sales of $3.6 billion increased ~6%, including an unfavorable foreign exchange impact of ~1%.

- Diluted EPS of $5.02 decreased ~21%.

- Adjusted diluted EPS of $6.04 increased ~10%.

- Adjusted EBITDA of $1.04 billion increased ~3%.”

Notable Developments

- “Completed acquisition of 60% ownership in the Wodgina spodumene mine and formed MARBL Lithium Joint Venture with Mineral Resources Limited on Oct. 31, 2019.

- Issued a series of notes totaling ~$1.6 billion to repay 1) $1.0 billion balance of the unsecured credit facility primarily used to fund the Wodgina acquisition, 2) ~$350 million of commercial paper notes and 3) the remaining balance of $175.2 million of senior notes issued in 2010. Funds also used for general corporate purposes.

- In collaboration with Exxon Mobil, created the Galexia™ platform, a transformative hydro processing suite of catalyst and service solutions for the refining industry.

- Advanced cost-reduction program expected to deliver a run rate of over $100 million in sustainable savings by the end of 2021.

- Commenced process to divest Fine Chemistry Services and Performance Catalyst Solutions businesses and furthered prospective buyer evaluations.

- Named to S&P 500 Dividend Aristocrat Index in recognition of 25 years of dividend increases.”

Sociedad Quimica y Minera S.A. (NYSE:SQM)

On January 23, Sociedad Quimica y Minera S.A. announced:

Mt. Holland Lithium Project update. Sociedad Quimica y Minera S.A. publishes new information on the timing of the Mt. Holland Lithium Project in Western Australia. Following the completion of a definitive feasibility study (“DFS”). SQM and its partner on the project, Wesfarmers Limited, have decided to defer the final investment decision until the first quarter 2021.

Investors can read the company’s latest presentation here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772], Mineral Resources [ASX:MIN], International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

On January 24, Mineral Resources announced: “Quarterly exploration and mining activities report October to December 2019 [Q2FY20].” Highlights include:

- “On 1 November 2019, Mineral Resources Limited [ASX: MIN, MRL] completed the sale of a 60% interest in the Wodgina Lithium Project to Albemarle Corporation [NYSE: ALB, Albemarle]. MRL received as consideration US$820 million cash and a 40% interest in the first two 25,000 dry tonne per annum lithium hydroxide conversion units currently being built by Albemarle at Kemerton, Western Australia. The unincorporated MARBL Lithium Joint Venture [MARBL JV] has been established, with MRL and Albemarle holding a 40% interest and 60% interest respectively.

- Also on 1 November 2019, MARBL JV placed the Wodgina Lithium Project on care and maintenance. This decision was made in recognition of challenging global lithium market conditions and to preserve the value of the world-class Wodgina spodumene ore body. MARBL JV will regularly review market conditions with a view to resuming spodumene concentrate production as and when required; driven by market demand.

- Mt Marion Lithium Project shipped 99,000 wet metric tonnes [WMT] of spodumene concentrate and production was 8% higher than the previous quarter at 124,000wmt….”

On February 6, International Lithium Corp. announced: “International Lithium announces measured + indicated resource of 4.41 million tonnes LCE at Mariana Lithium Brine Project.” Highlights include:

- “4,410,000 tonnes of lithium carbonate (“Li2CO3“) equivalent [LCE] in the Measured and Indicated Resource categories, an increase of 253% over the 2017 estimate of 1,248,000 tonnes of Indicated Resource.

- 49,700,000 tonnes of potash (“KCl”) equivalent in the Measured and Indicated Resource categories.

- an additional 786,000 tonnes of Li2CO3 and 9,260,000 tonnes KCl in the Inferred Resource category.”

On February 12, Mineral Resources announced:

Half year profit announcement. During the period, MRL generated statutory Earnings Before Interest, Tax, Depreciation and Amortisation [EBITDA] of $1,575 million. This result included a $1,290 million gain on the disposal of a 60% interest in the Wodgina Lithium Project [Wodgina]. Underlying EBITDA was $330million, up 224% on the prior corresponding period [PCP], underpinned by strong growth in the Mining Services segment and record iron ore sales. Statutory net profit after tax [NPAT] amounted to $884million and underlying NPAT was $129 million, up 279% on pcp. Statutory NPAT included $114 million of post-tax impairment charges ($164 million pre-tax) in relation to capitalised exploration and mine development expenditure, plant and equipment and stockpiles.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

No news for the month.

Livent Corp. (NYSE:LTHM)[GR:8LV] – Spun out from FMC Corp. (NYSE:FMC)

On February 20, Livent Corp. announced:

Livent releases fourth quarter and full year 2019 results. For the year, Livent reported revenue of $388 million. On a GAAP basis, the company reported full-year net income of $50 million, or 34 cents per diluted share. Full-year Adjusted EBITDA was $100 million and adjusted earnings per share were 42 cents per diluted share. Fourth quarter 2019 revenue was $78 million. GAAP net income was $0 million, or 0 cents per diluted share. Fourth quarter 2019 Adjusted EBITDA was $16 million and adjusted earnings per share were 5 cents per diluted share. For full-year 2020, Livent expects revenue to be in the range of $375 million to $425 million, Adjusted EBITDA to range from $60 million to $85 million and adjusted earnings per diluted share to be between 18 and 31 cents. This guidance is based on the Company’s expected volume growth, on a total LCE basis, of roughly 30% versus 2019. Offsetting this volume increase is Livent’s view that market pricing will continue to remain depressed, and as a result, expects that its average realized pricing for lithium hydroxide in 2020 will be low-to-mid-teens percent lower than its average realized pricing in 2019. Additionally, Livent anticipates higher costs from using up to 5,000 tons of additional third-party lithium carbonate to sell higher volumes of battery-grade lithium hydroxide…..

Orocobre [ASX:ORE] [TSX:ORL] (OTCPK:OROCF)

On January 30, Orocobre announced: “Quarterly activities report – December 2019.” Highlights include:

Olaroz Lithium Facility (Ore 66.5%):

- “Production for the quarter of 3,586 tonnes was down 5% on the previous corresponding period [PCP] following the strategy of managing both brine quality in preparation for the upcoming seasonal rains and finished product inventories given the prevailing market conditions. New pond availability and tailoring of production resulted in brine with a more consistent lithium concentration being delivered to the plant and improved process recovery.

- Sales volume for the quarter was up 6% QoQ to 3,287 tonnes while sales revenue was down 19% QoQ to US$17.8 million. The realised average price achieved was US$5,419/tonne on a free onboard basis [FOB]. December quarter product pricing was below that of the September quarter following a decision to meet competitor pricing to ensure retention of market share.

- Cash costs for the quarter (on cost of goods sold basis) improved to US$4,109/tonne, down 16% QoQ, excluding the export tax of US$238/t for the quarter. This follows a significant focus on cost reduction across the business.

- Operations remained operating cash flow positive with gross cash margins (excluding export tax) of US$1,310/tonne, down 41% QoQ mainly due to the lower average price received, offset by better cost performance.”

Lithium Growth Projects

- “Construction of the Stage 2 Olaroz Lithium Facility Expansion has reached approximately 25% completion. Focus areas for this quarter included brine transport systems, ponds, rain diversion channels, new production wells and associated infrastructure.

- Naraha Lithium Hydroxide Plant construction is progressing with more than 40% of planned works now completed.”

Corporate

- “As at 31 December 2019, Orocobre corporate had available cash of US$171.9 million of which US$11.1 million has been set aside as a guarantee for the Naraha debt facility. Including SDJ and Borax cash and project debt, net group cash at 31 December 2019 was US$115.5 million, down from US$151.2 million at 30 September 2019 following provision of shareholder loans to fund Stage 2 Expansion activities….”

On February 19, Orocobre announced:

Orocobre agrees to acquire Advantage Lithium Corp. Orocobre shareholders will gain exposure to the 4.8 million tonnes [MT] of Measured and Indicated Resources and 1.5 Mt of Inferred Resources (expressed as lithium carbonate equivalent) at Cauchari developed by the Advantage and Orocobre joint venture. Under the terms of the Agreement Advantage shareholders will receive 0.142 shares of Orocobre per Advantage share. Based on the closing price of Orocobre shares on the ASX of A$3.29 this equates to a value of approx. C$0.42 per Advantage share.

On February 21, Orocobre announced: “Orocobre Limited reports H1 FY20 results.” Highlights include:

- “Statutory consolidated group net loss of US$18.9 million for H1 FY20 is down from a profit of US$24.1 million in the previous corresponding period [PCP]. The underlying net loss after tax for the group is US$9.9 million with adjustments for impairment, foreign exchange and other one-off items.

- Attributable group EBITDAIX is US$0.2 million, down from US$21.0 million, due mostly to lower product pricing.

- Total production of 6,679 tonnes of lithium carbonate, up 10% on pcp with improvements in operational performance.

- Positive results from the Olaroz Lithium Facility: Revenue of US$39.4 million, on sales of 6,395 tonnes of lithium carbonate (up 24% on pcp). EBITDAIX of US$6.1 million, down from US$36.6 million mostly due to price. Average price received of US$6,157/tonne FOB2, down from US$12,295/tonne FOB2 in PCP. Gross operating cash margins of 25% with lithium production costs of US$4,643/tonne. Olaroz remains one of the lowest cost producers of lithium chemicals in the world-gross cash margin of US$1,514/tonne, despite lower prices.

- As of 31 December 2019, Orocobre Group (corporate + 100% SDJ PTE) had cash of US$195 million.

- Long term contracts announced for battery grade lithium carbonate.”

Upcoming catalysts include:

- H2 2020 – Olaroz Stage 2 (42.5ktpa) commissioning.

- H1 2021 – Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

You can read the latest investor presentation here, or my article “An Update On Orocobre.”

Galaxy Resources [ASX:GXY] (OTCPK:GALXF)

On February 21, Galaxy Resources announced: “Financial results for the year ended 31 December 2019.” Highlights include:

- “….Mt Cattlin achieved a record-breaking year for production volume, product quality and unit costs.

- Annual production volume of 191,570 dry metric tonnes (“dmt”) of lithium concentrate grading an average of 5.93% Li2O.

- Annual production unit cash cost of US$3911/dmt, making Mt Cattlin one of the lowest cost spodumene producers.

- Total sales volume of 132,687 dmt achieved despite an oversupply of lithium concentrate in the market.

- EBITDA before inventory write down of US$6.8 million.

- Net loss after tax of US$283.7 million, predominately driven by non-cash write downs and impairment.

- Proceeds of US$217.2million (after tax) received from the sale of tenements to POSCO.

- Cash and financial assets of US$143.2 million as at 31 December 2019, and nil debt.

- Adoption of a simplified flowsheet for Sal de Vida unlocked an accelerated development path. The project is advancing solidly with engineering works underway and site activities on track.”

Upcoming catalysts include:

2020 – Construction progress at SDV. James Bay FS.

Investors can read my recent article “Galaxy Resources Plan To Be A 100,000tpa Lithium Producer By 2025″, and my CEO interview here, and the latest company presentation here.

Pilbara Minerals [ASX:PLS] (OTCPK:PILBF)

On January 30, Pilbara Minerals announced: “December 2019 quarterly activities report. Significant improvement in lithia recoveries achieved, while moderated production campaign continued in support of disciplined cash management.” Highlights include:

Production and sales

- “Campaign mining and processing continued in response to current market conditions.

- Shipments totalled 33,178 dmt of spodumene concentrate to offtake customers (September Quarter: 20,044 dmt).

- Material improvement in lithia recovery following completion of plant improvement works, including: A 63%-73% recovery range (average 67% sustained lithia recovery) during an 18-day period of steady-state production. A 36-hour lithia recovery rate of 70% prior to closing the process campaign on 23 November 2019.

- Further lithia recovery optimisation and improvements are expected with additional plant operating time and a return to continuous production.

- Production of 14,711 dry metric tonnes (dmt) of spodumene concentrate (September Quarter: 21,322 dmt).

- Highest quarterly tantalite concentrate sales, with a total of 78,156 lbs sold (September Quarter: 10,765 lbs), which included the first sale of secondary ~30% tantalite concentrate.”

Corporate

- “$111.5M equity raising completed during the Quarter following receipt of $50M from Contemporary Amperex Technology [CATL] and closure of the oversubscribed $20M Share Purchase Plan during October 2019.

- Cash balance as at 31 December 2019 of $105.5M (30 September 2019: $60.9M) inclusive of the final $70M of proceeds received following completion of the successful equity raising.”

On February 20, Pilbara Minerals announced: “December 2019 half-year financial report.” Highlights include:

- “Moderated production strategy preserves both cash flow and working capital, resulting in an improvement in cash gross margin in the December 2019 Quarter to $11.5M (September 2019 Quarter: cash gross margin loss of $13.3M).

- Existing stockpiles drawn down during the half-year to support sales of 53,222 dry metric tonnes (dmt) of spodumene concentrate, underpinning sales revenue of $37.8M.

- Significant improvement in lithia recoveries following the completion of plant optimisation and improvement works during September 2019 Quarter.

- Half-year EBITDA loss of $24.1M before non-cash inventory write-down of $21.2M, depreciation and amortisation of $6.8M and net financing costs of $11.3M.

- Statutory net loss after tax for the half-year of $63.4M.

- $111.5M equity raising completed during the half-year strengthens balance sheet. 31 December 2019 cash balance of $105.5M, with working capital of $94.8M.”

Upcoming catalysts:

2021 – Stage 2 commissioning timing to depend on market demand.

Investors can read my recent article “An Update On Pilbara Minerals“, and an interview here.

Altura Mining [ASX:AJM] (OTCPK:ALTAF)

On January 31, Altura Mining announced: “Quarterly activities report December 2019.” Highlights include:

- “Record monthly production of 17,951 wet metric tonnes [WMT] in October 2019.

- Record quarterly production of 47,181 wmt of lithium concentrate.

- Record quarterly sales and shipping of 41,680 dry metric tonnes (dmt) of lithium concentrate.

- Average quarterly operating cash cost reduced to US$354/wmt (FOB basis), from US$365/wmt in the September 2019 quarter, reinforcing Altura’s position as one of the lowest cost lithium concentrate operations globally.”

On February 12, Altura Mining announced: “Altura financing package to significantly strengthen balance sheet.” Highlights include:

- “Three-year extension of existing Loan Note Facility.

- Equity raising underway.”

Investors can read a company presentation here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

No significant news.

Upcoming catalysts:

2020/21 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 90ktpa) to begin. No recent timeline updates on this.

Neometals (OTCPK:RRSSF) (OTCPK:RDRUY) [ASX:NMT]

On January 30, Neometals announced: “Quarterly activities report for the quarter ended 31 December 2019.” Highlights include:

Corporate

- “MOUs signed with globally recognised partners across battery recycling and titanium/vanadium projects.

- Successful execution of corporate strategy with partners now secured across all core development projects to co-fund final evaluation studies through to development decisions and potential operating joint ventures.

- Cash $100.7 million, receivables and investments at $9.9 million and no debt.”

Core Development Activities

Lithium-ion Battery Recycling Project

- “MOU with global processing plant manufacturer, SMS Group, granting an exclusive due diligence period to form 50:50 incorporated JV to commercialise Neometals’ recycling technology.

- Recycling pilot test-work outcomes surpass earlier study assumptions -strongly supporting technical and economic feasibility. Very high recovery rates achieved on the key payables (cobalt and nickel) with excellent purity on the sulphate chemical products generated for the battery supply chain.

- Commercialisation and market evaluation running in parallel with preparations for European JV showcase demonstration plant trial at SMS Group facilities.”

Lithium Refinery Project

- “Ongoing jointly funded evaluation activities for the development of the first lithium refinery in India under an MOU with leading Indian power trading conglomerate, Manikaran Power.

- Successful production of multiple commercial quality synthetic zeolite products (molecular sieves) from lithium refinery residue recognised by the award of an Innovative Manufacturing CRC Grant to co-fund a pilot scale manufacturing plant project with Queensland University of Technology.”

Exploration Activities

- “Acquisition, additional drilling and re-estimation of the geological and mineralisation models at the Munda deposit has seen the total Mt Edwards Nickel Mineral Resources exceed 130,000 tonnes of contained nickel.

- Targeted drilling intercepted nickel sulphides in a recognised nickel camp that hosts four historic mines.

- Nickel exploration at Mt Edwards continues to increase the quantity and quality of the Mineral Resources.”

On February 18, Neometals announced:

Lithium-ion battery recycling update….(Confirms) an extension to the decision date for formation of its proposed recycling joint venture (“JV”) with German company, SMS Group GmbH (“SMS”)……It was originally contemplated that the JV formation decision would be made in mid-February 2020 and this date has been extended to 30 April 2020.

Lithium Americas [TSX:LAC] (NYSE:LAC)

On February 7, Lithium Americas announced: “Lithium Americas and Ganfeng Lithium announce Caucharí-Olaroz JV transaction and provide construction update.” Highlights include:

- “Ganfeng Lithium has agreed to subscribe for new shares of Minera Exar for cash consideration of US$16 million increasing its interest from 50% to 51%, with Lithium Americas owning the remaining 49%.

- Both parties have agreed to the 2020 funding schedule, including investment of up to US$400 million, in accordance with the 2019 approved construction plan.

- Caucharí-Olaroz remains on budget and schedule to commence production in early 2021.

- Joint venture and related agreements will be amended as a result of the new ownership structure to preserve joint approval for substantive matters involving Minera Exar and to maintain the existing construction plan and management team.

- In addition, Lithium Americas will receive US$40 million in cash from the proceeds of non-interest-bearing loans from Ganfeng Lithium.”

Construction Status Update:

- “The Project remains on budget and schedule to commence production in early 2021…..”

Upcoming catalysts:

- 2020 – Cauchari-Olaroz plant construction.

- Early 2021 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa.

- 2022/23 – Possible 2022/23 lithium clay producer from Thacker Pass Nevada (full ramp by 2025/26). Also any possible JV announcements prior.

NB: LAC owns 49% of the Cauchari-Olaroz project and partners with Ganfeng Lithium (51%).

Investors can read my article “An Update On Lithium Americas.”

Nemaska Lithium [TSX:NMX] [GR:NOT] (OTCQX:NMKEF)

On January 29, Nemaska Lithium announced: “Nemaska Lithium progresses in its restructuring efforts under the CCAA.” Highlights include:

- “The Corporation implements a sale and investor solicitation process.

- Settlement of the Court case with holders of the Senior Secured Bonds.

- Claims procedure begins in collaboration with the Monitor.”

Upcoming catalysts:

- 2020 – Company restructuring under the Companies’ Creditors Arrangement Act (“CCAA”).

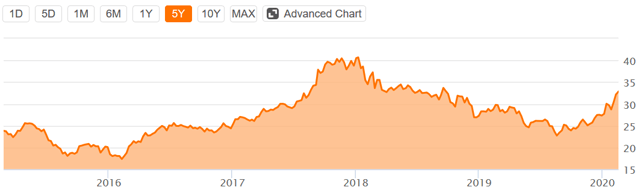

Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) – Price = US$32.86.

The LIT fund moved significantly higher again for the month of February. The current PE is 26.92. Lithium demand is forecast to approximately triple between 2020 and end 2025 to ~1 to 1.2m tpa.

Source: Seeking Alpha

Conclusion

February saw January lithium prices slightly lower again, with the irony that some battery manufacturers such as LG Chem cannot meet demand for batteries. Meanwhile, the coronavirus has severely disrupted car (ICE & EV) sales in China in January and February.

Lithium stocks have had a strong past 2 months helped by the UK ICE car ban from 2035 and the US-China Phase 1 trade war deal. Unfortunately, just as recovery of the sector has begun, the coronavirus has shut down much of China. We will need to see what happens next with the virus and if car sales can soon recover. Many lithium producers are well cashed up, so should be able to ride through any short-term slowdown.

Highlights for the month were:

- Key EV markets to start growing again – WoodMac. WoodMac expects (lithium) price decline to extend over the next 12 months.

- Hyundai Motor (OTCPK:HYMLF), LG and POSCO groups may launch an EV battery (manufacturing) Joint Venture.

- Japan to lift stockpiles of metals for EVs, wary of China’s clout. Tokyo looks to secure access to lithium, cobalt, and rare earths.

- Battery shortage halts Jaguar I-PACE production. The battery production issues are also affecting Audi (OTCPK:AUDVF) and Mercedes-Benz. LG Chem cannot keep up with demand.

- BASF (OTCQX:BASFY) further invests in Europe. The plant will produce cathode active materials with an initial capacity enabling the supply of around 400,000 full electric vehicles per year.

- China’s CATL wins a 2-year deal to supply batteries to Tesla (NASDAQ:TSLA).

- Bill Gates-led fund heads up investment in Lake Resources’ lithium processing technology partner Lilac Solutions.

- SQM and Wesfarmers defer/delay Mt Holland development investment decision until Q1, 2021.

- Orocobre agrees to acquire Advantage Lithium Corp.

- International Lithium announces measured + indicated resource of 4.41 million tonnes LCE at Mariana Lithium Brine Project. An increase of 253%.

- Ganfeng Lithium increases stake in Cauchari-Olaroz by 1% to 51% and LAC decreases by 1% to 49%.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long NYSE:ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], SQM (NYSE:SQM), ASX:ORE, ASX:GXY, ASX:PLS, ASX:AJM, AMS:AMG, TSX:LAC, TSXV:NLC, ASX:AVZ, ASX:CXO, ASX:NMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Be the first to comment