Ultima_Gaina/iStock via Getty Images

Lincoln National (NYSE:LNC) is an insurance company – I cover and invest in quite a few insurance companies provided that the price for the company is right. Lincoln National is one of them. I invested in the company during the COVID-19 crash for the first time, and I’ve been slowly accumulating shares in the business since that time.

This is a highly-rated company with superb fundamentals. I view it as extremely underappreciated, and on par with some of the better insurance companies around.

Let’s look into the company’s latest results, and why I think there’s a significant upside to the business here.

Lincoln National – Revisiting the company

Those who follow my articles on LNC know why this company is so excellent. Lincoln National serves fast-growing US domestic markets with annuities, life insurance, and workplace solutions, namely health/group protection and retirement services.

This is something that a lot of insurance businesses do – so what makes LNC so good?

Well, the company has absolutely stellar fundamentals, first of all. LNC has superb risk management, an A-credit rating, and a strong tradition and marketplace/service presence.

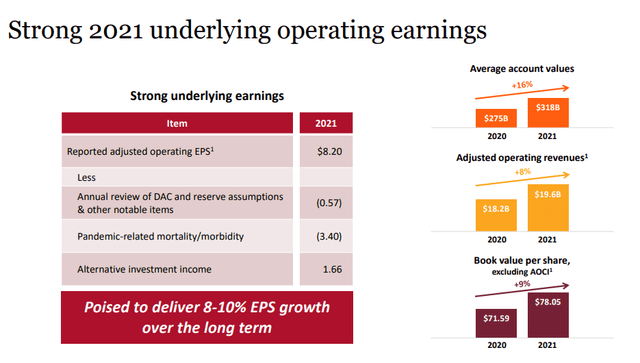

The company has a near-class leading RBC ratio of close to 430% while holding more than $1.1B in cash at the holding company level. The next company debt maturity isn’t until 2023, and the company has been executing deals left and right to improve its operations. The company’s investment portfolio remains at extremely low risk despite the current market, and 2021 earnings overall, came in at very solid levels.

LNC is a company that delivers EPS growth after EPS growth on the back of improved fundamentals and execution. Since adopting a virtual environment as well, using an omnichannel model for virtually all of its services, sales and meetings here have been increasing. This is especially true after COVID-19, which saw a change in how this business can be conducted.

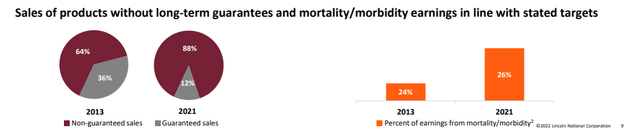

The market demand for protection and the company’s solutions continue to be high – and LNC proactively manages its repricing strategies for all of its products, managing 12%+ returns on all new business in the company’s segments during 2021. The company’s mix has shifted to segments that see higher consumer demand and returns, and LNC has added products that increase consumer choice and tailoring possibilities. The company has also been massively reducing its exposure to products with long-term guarantees.

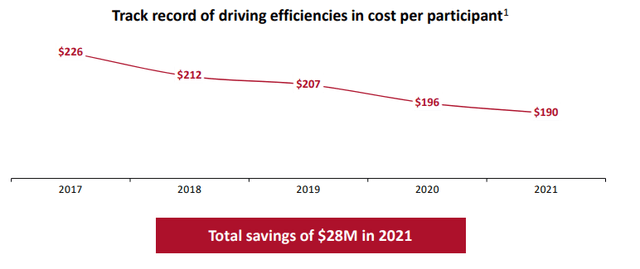

Furthermore, the company is very active in managing its expenses. There are multiple, simultaneous programs to manage excessive spending, including strategic digitizations in late 2020 as well as other programs, through which LNC is targeting total savings of upwards of $300M until 2024.

Despite being a good company, LNC has plenty of “fat” to cut.

However, to be frank with you, my baseline thesis for investing in LNC is simple. They’re one of the most capable risk-managers in the business not only in the core business, with minimal historical hedge breakage, but also one of the most disciplined investment strategies out there for its portfolio. 97% of the company’s investments are investment-grade, with almost 60% at AAA, AA, or A-grade credit. the company has a very high asset duration for its business lines, over 14 years on average for the life insurance business.

In short, LNC is a cash-minting machine that keeps printing sacks of money, one after another, over the past decades. The fact that it has managed a 30% CAGR increase in its dividend as well as bought back 51% of SO since peak share count, is another point in its advantage.

The company’s various business lines have been doing extremely well. Annuities, which is a segment many insurance companies are actually leaving behind, has seen a 6% 5-year CAGR growth rate, with an RoE of 25% for the 4Q21 period. Things are going very well here. Retirement Plans meanwhile have seen even more, 13% 5-year CAGR growth, with seven consecutive years of positive net flows. The company has a superb track record of driving efficiencies here as well with significant cost improvements over the past few years.

Life Insurance, meanwhile, is a segment that’s between retirement and annuities in terms of returns, at 11% 5-year CAGR, including, by the way, COVID-19. The company has driven expense ratio improvements here as well, and average account values are up 5% on an annual basis. This is despite an increased mortality rate due to the pandemic. The same is true for the company’s group protection segment, with excellent earnings despite COVID-19.

Company premiums are up 4% YoY. Diversification and scale are the drivers that make LNC great – that and doing what other insurers do but doing it better.

There are insurers that subsist on high returns but with risky blocks and assets. There are insurers that manage profitability through scale, even with volatile impacts. LNC has scale but also expertise and an impressive track record. It does what other companies do, but LNC does it better.

That, to my mind, is a superb differentiator to the rest of the market and other companies.

Now, unfortunately, this does come at a price. The price you pay is yield. LNC has a lot lower yield than most of its peers, and even undervalued comes in no higher than 2.78%. This is less than half of what some larger insurance businesses have – but you do get excellent levels of safety and upside despite this.

Let’s look at the specifics here.

Lincoln National – The upside

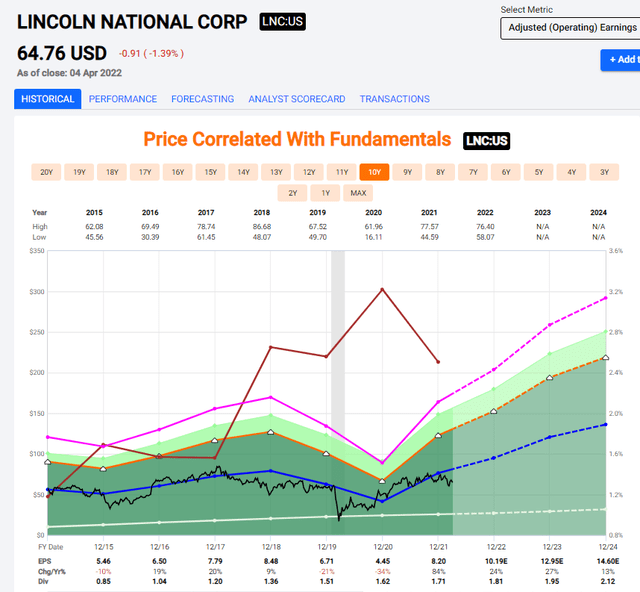

Because of the company’s underperformance relative to, and in direct contradiction to its actual operating results, the potential for LNC is now larger than at any time after COVID-19.

The company, despite a massive EPS recovery to pre-pandemic levels, is currently being traded at less than 7.5X P/E. This is a massive undervaluation to its typical range of 9.5-11X.

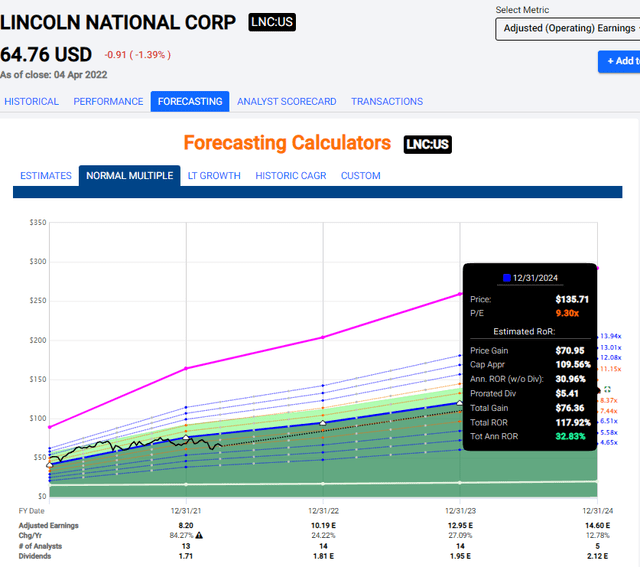

Outside of financial crises and troubled times, analysts have had little issues forecasting the company’s earnings here. So when forecasts say ~25% EPS growth in 2022, 2023, and 13% in 2024, that’s a pretty high-conviction forecast to me, and I’m willing to value the company at a 9-11X P/E multiple here.

Doing that means that, based on such a forecast, we could see a potential upside of no less than 32.8% here, or 118% in 2-3 years.

And that’s based only on a 9.3X forward P/E ratio. The company can, historically, go as high as 11-12X. That would enhance this RoR to almost 48% annually, or 180% total RoR until 2024E.

There is a lot to like about LNC – but safety and conservative fundamentals are among the most admirable attributes here. The company has a massive upside to anything involving a continued positive trajectory at this point, and because I view that reversal and growth not only as possible but likely, I’m on board in calling LNC a “BUY” here.

How underappreciated LNC is, is visible in the company’s coverage on SA. I’m the only contributor that has covered LNC to any degree since March 2021, or over an entire year.

I’m not saying LNC does not have risks. Bears have been pointing plenty of fingers at the life/health segment due to COVID-19 unease – but I view this as being quite exaggerated at this time, giving the results the company is reporting. Furthermore, it must also be said that life insurance sales are skyrocketing due to the pandemic, with more and more people interested in the company’s products.

Not only does this allow the company to significantly boost its premiums, it’s also indicative of potential shifts for the coming few years. Volumes have soared over 20% on a YoY basis, and this is the largest percentage gain since the 1980s (Source: Limra Research).

So – overall, LNC is doing extremely well – and the catalysts seem to be in place for the company to continue doing just that.

S&P Global gives the company a share price target based on a range of $45-$100 of $78/share, which implies an upside of 20% from today’s valuation. 6 out of 14 analysts have a “BUY” or “Outperform” rating on the company here. The implication is potential near-term risk from the geopolitical tensions as well as some more industry-specific trends.

Me, I see a massive, continued upside for the company on a 2-3 year basis. While the company hasn’t outperformed the S&P 500 for any of my articles on a comparative basis yet, I believe that upside is to come when earnings and upside continue to materialize.

I’m at a “BUY” – and my PT continues to be at least $75/share.

Thesis

Lincoln National is one of the more appealing financial stocks available at this time, due to its valuation and large upside, grounded in extremely strong fundamentals.

Its forward potential return is based on very conservative assumptions. In fact, LNC could underperform significantly, and the implication would still be a 10%+ upside from today’s levels.

That, to me, is worth the investment – and that’s why I’m buying more LNC here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Lincoln National Corporation is currently in a position where #1 is possible in my process, through #3 and #4.

Thank you for reading.

Be the first to comment