Ethan Miller/Getty Images News

Introduction

I published an analysis of the Ouster (OUST) results separately, leaving the recommendation of “Hold.” I look at peers’ results to determine their successes and failures and where the lidar segment of the economy is heading. The current article is a follow-up to the Q1 article on cash runways. It is part one of the analysis, and I will publish part two after three more companies announce their results: Innoviz (INVZ), AEye (LIDR), and Quanergy (QNGY).

LIDAR Industry in the Second Quarter

Investing thesis sees advancing the product as more attractive to the market than selling it. Describing the path to production offers more interest from the market than actually producing the product. A gross margin for selling sensors plays no catalytic role because, perhaps rightfully so, today, it is understood it does not represent the end game.

Investors continue to recognize the value of cash and ways of getting it. Ouster’s draw of ATM has been perceived as a weakness: a lack of confidence versus Luminar (LAZR) buying its shares.

Each company selected a different method to get there. Luminar’s line of debt shows $627M in convertible debt and Ouster’s $19.1M. While both companies are in different places with cash, Ouster’s production is already ongoing. Luminar is setting up production with a significantly higher target in mind.

Lidar technology is evolving. Aeva’s (AEVA) path to production video shows that the sensor Aeries II released in February is also getting on the path of mass production. Luminar, speaking about Iris, described a bill of materials cost of $100 as an ultimate target. Still, Austin Russell had added the critical catalyst to get there is the design and the volume:

” And then ultimately, for once ahead and beyond when you get to the one million-plus unit, like basically seven-figure volumes per year, that’s where the long-term BOM market remains at $100. So, — we’re still tracking ultimately to be $500 and then over the longer term, with the really high volumes towards that $100 as well. So, a lot of work still hasn’t been done, but the key catalysts are obviously starting with the design of a single laser or single receiver-based architecture. “

A $500 bill of material is tracking in a production of 250K units per year, sometimes in the second part of 2023. To remind investors, the cost of goods also includes shipping and labor, which will adjust the gross margin calculation. Luminar predicts the average selling price for the Iris sensor as $1000.

Yet, new conversations and agreements indicate much lower pricing for the consumer auto market.

According to Velodyne’s (VLDR) CEO, the price needs to be $500 per unit or less for consumer autos, preferably between $300 and $400. We can say nobody today is in this operating dynamic. Furthermore, once heralded as a solution to a solid form (not so solid as we know from the architecture) forward-facing sensor, Velarray H800 leaves the scene too expensive to make, according to the company. With a 74% negative gross margin for all products sold this year, Velodyne appears to be losing money on every sale.

As a remedy, Velodyne plans to release new products sometime in the next two years. And as points of interest, it emphasizes $229M cash and the demand, which by its admission, cannot supply due to supply chain woes.

Financial state

Luminar spent $187M cash in the year’s first half. $85M went to operations, $80M was spent on buyback shares, and $18M for acquisitions and capital spending.

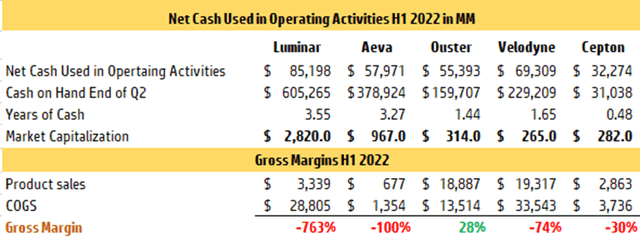

Net Cash Used in Operating Activities H1 2022 in MM (Author, Financial Statements)

The net cash used in operations indicates strong 3.5 years of runway. However, if the company continues the path of spending at $85M per half a year, by the time 2024 arrives, $255M of $605M will be spent, leaving an estimated $350M cash. The plans of $500 BOM per unit would require $125M to pay for 250K unit production. In addition, labor at modest 15% plus 4% shipping costs, the company would require $148M for COGS in total.

An estimated 2024 spending would then become about $148M on COGS, and $170M on Opex, leaving the company with $32M of Cash by the end of the year. The gross margin of $250M * 31% would put back about $77.5M.

At the end of 2024, in this estimate, Luminar would have $110M in cash if all went well. By 2025, the company’s spending patterns would require additional capital, in my opinion.

I foresee a similar impact on Aeva, which plans to mass produce its lidar solution in 2024. The quick math estimate shows $53M left by the end of 2024 on operating expenses alone. Then to add 20% of the total operating expenses for marketing and selling would add $28M per year, leaving about $25M for COGS. At an estimated 50% gross margin, it would produce $50M revenue and require 50K sensors’ yearly production, using the same as Luminar, $1000 ASP per unit. In this scenario, Aeva would require financing in my model through debt or equity sales.

Despite being the two most robust cash holders, I consider both companies financially depleted at the end of 2024. Fortunately, the current value of the equity on the market is at the high end of valuation. To illustrate, a book value for Luminar is at $0.25 per share, while the market price is currently nearing $9.00. Aeva’s book value is at $1.83, so share trading for more than $4 would have a reasonable selling point if an equity issue is considered. Equity sales, or as in the case of Aeva debt, can provide solutions for the cash need. The companies are firm market favorites considering their valuations. While the cash runway will end at one point, the access to cash using current market calculations seems favorable and likely easily obtainable via ATM or various offering options when the time comes.

The cash needs for Cepton (CPTN) are in a more immediate timeline. The company has $31M in Cash and spent over $32M in the first part of the year.

It is unclear how Cepton will enter 2023 based on the cash runway. The company has $18M in liabilities on the balance sheet, including $9M of debt. Cepton’s condition is on the opposing end of the status of Luminar or Aeva. The company will likely seek financial resolutions this year.

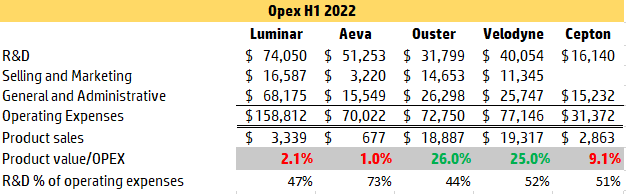

Opex H1 2022 (Author, Financial Statements )

At $229M cash at the end of Q2, using the spending pattern, Velodyne will enter 2024 with roughly $34M cash in my estimate. Two years for the new product counting from today would land on Q2 2024 when my estimated cash runway ends. In June, Velodyne sold 6.7M shares at $1.17, triggering its at-the-market offering, as Ouster has done. Both companies’ timelines include those actions in the “Years of cash line in Net Cash Used in Operating Activities” table.

Velodyne and Ouster are in much better shape than Cepton when looking at the cash runway. Yet, they sold their shares using ATM almost at the book value, $1.16 for Velodyne, and Ouster, at a book value of $1.27; the company sold shares at $2.16 on average. The companies are not the favorites of the sector, and the implied developments at Ouster, which has the best gross margins in the sector, do not resonate with the market at the magnitude of Luminar or Aeva.

Conclusion

The bottom line is that all four companies discussed will likely look or continue, as in Velodyne’s case, to reach the market for cash. All four will be entering production cycles, while Velodyne, experienced with production, will facilitate new product adoption. Velodyne will have a chance to increase sales in 2023, but if they improve, the current gross margin on product sales at negative 74% is a tall order to overcome and an immediate priority.

Luminar and Aeva have strong valuations and are liked by the market. In my opinion, both companies continue to increase in value, but those valuations are too rich to quantify those future developments. Cepton is certainly well valued based on a book value of $0.16; in my view, it is not an investment I would recommend. Similarly, I see Velodyne representing the struggles of the sector today, reflected by its low valuation and risks associated with the state of the gross margins and unclear new product path. I would put Velodyne on hold with more negative bias than Ouster.

Be the first to comment