Bet_Noire

Li-Cycle (NYSE:LICY) recently reported their recent quarterly result and while it may appear that the delay in the start-up of its spokes is negative, I would argue that this is a temporary setback that is beneficial for Li-Cycle in the long run.

Investment thesis

I have written previous articles on Li-Cycle that can be found here. The investment case for Li-Cycle is as follows:

The opportunity to invest in Li-Cycle comes at a time when the lithium-ion battery market is expanding rapidly due to the rapid rise of electric vehicles. As such, as an early mover in the lithium-ion battery recycling space, Li-Cycle can be the leader in the industry with huge growth prospects in the years to come. The company’s technology advantage as well as its patented business model will provide a competitive moat against competitors in the near term as it begins commercialization and ramping up.

Commercial progress

During the second quarter, there were 2 projects that Li-Cycle announced as it gains traction commercially. Firstly, a leading US energy provider chose Li-Cycle for its decommissioning of its energy storage where more than 1,400 metric tons of battery materials were decommissioned. This project was significant in the sense that it was among the largest energy storage decommissioning projects in North America. Secondly, Li-Cycle was selected by an emerging electric vehicle OEM with manufacturing capabilities in the US as its global battery recycler. Although the electric vehicle OEM is not large nor was it disclosed which company this is, it brings further confidence that Li-Cycle’s battery recycling capabilities add value to the up-and-coming electric vehicle companies.

Delay in Arizona Spoke by 1 to 2 quarters

The main focus and drawback in the current quarter was the delay in Arizona Spoke and thus, a delay in Alabama Spoke as well. As there were optimizations that needed to be done in the Arizona Spoke, the estimated delay in black mass production is about 1 to 2 quarters. As the Arizona Spoke is the first of its kind and all the other subsequent spokes follow the exact same design, I think it is reasonable to perfect the Arizona Spoke before continuing with the next spoke, the Alabama spoke. After this optimization was done, I think it’s positive that the target throughput rate was achieved for the Arizona Spoke. However, as a result of this delay and optimization of the Arizona Spoke, the guidance for 2022 black mass production was reduced from a range of 6,500 to 7,500 tons to a range of 3,500 to 3,800 tons. While this may seem material for 2022, I think it is important to look at the grand scheme of things and note that this is good for the future rollout of other identical spokes, as highlighted below.

It is important to note that this delay for the Arizona Spoke does not affect the timeline for the Rochester hub and it is expected to meet the schedule of commissioning in stages in 2023.

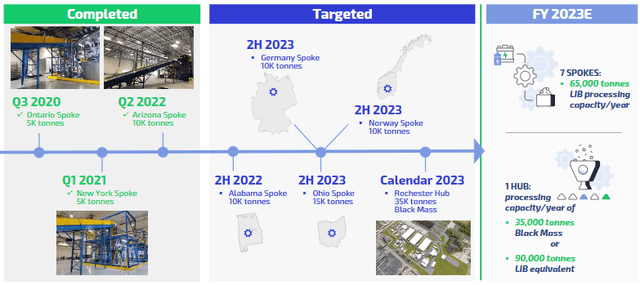

Timeline for future operational milestones (Li-Cycle 2Q22 Slides)

In terms of the improvements that were needed to be made in the Arizona Spoke, the team needed to ensure that the process at which the materials was flowing through were at a fast enough rate that achieves Li-Cycle’s target throughput. As a result, with the improvement in the rate at which the materials flowed through the spoke, this had to be integrated with the standard spoke design that the other spokes will copy and follow like for like. As such, with the current adjustment made during the quarter, these learnings and improvements can ensure that future spokes hit the desired throughput rates as per the Arizona Spoke. In addition, management does not expect that these adjustments will result in higher costs needed for each spoke.

As such, I am of the view that the slight delay in the current quarter, while slightly disappointing, is great for the many more spokes it is rolling out in the next few years. It is better to finetune the process and to have the ability to reach the desired throughput rate in the spokes than to go according to the timeline and use the inefficient spoke designs, constructing future spokes that are less efficient and productive as they should be. As such, for the future spokes, given that they utilize the same spoke design, I would expect a smoother ramp-up process.

If I were to derive the fourth quarter black mass production from the revised guidance, it implies that for the fourth quarter, we will see an increase in black mass production by 30% to 35% from the third quarter. The main contribution from this comes from the Arizona Spoke reaching target throughput this quarter. As a result of improvements made to the Arizona Spoke and with the results being that it has reached the target throughput, I think that this actually bodes well for the remaining spokes to be ramped up in the remainder of 2022 and 2023. For the upcoming Alabama spoke, since it is a direct copy of this new Arizona Spoke, the adjustments made in the current quarter for Arizona Spoke will have direct benefits to Alabama Spoke. Thus, with the lessons learned from the Arizona Spoke, I expect that the spokes coming up in not just Alabama, but also in Germany and Norway to be able to achieve their target throughputs as these spokes are a carbon copy of the Arizona Spoke.

Regulatory tailwinds

With increasing focus on clean energy as well as energy resilience, I think it’s no surprise that the regulatory environment for Li-Cycle and the battery recycling industry to be positive. With the recently announced Inflation Reduction Act, there are benefits that positively impact Li-Cycle, including the clean energy loans of $250 billion and production tax credits of $60 billion that can help Li-Cycle and the battery recycling industry further accelerate growth.

Sufficient funding for future growth pipeline

Management once again reiterated that with the approximately $650 million of cash Li-Cycle currently has as of this quarter, including $250 million from Glencore and LG, this enables Li-Cycle to be in an envious position for a relatively early-stage company with huge growth and capital expenditure plans. As per management’s commentary, this strong balance sheet is enough liquidity for Li-Cycle to meet its current operating and liquidity needs for the currently announced project pipeline.

Valuation

As Li-Cycle will see material revenue acceleration in 2024 and beyond, my DCF model is based on financial forecasts until 2025. I apply a 40% discount to Li-Cycle’s peers in the recycling and waste industry to provide conservatism to my model given these are established players. For reference, these peers are trading at 12x EV/EBITDA. With this assumed 2025F EV/EBITDA of 7x for Li-Cycle, I apply a WACC of 10% to discount Li-Cycle to present-day value. As a result, my target price for Li-Cycle is $13.10, implying an upside potential of 132% from current levels.

Risks

Execution risk

As with all early-stage companies with relatively little track record, these companies have a risk that management does not execute its strategy or plans well or in an efficient manner. As the delay in the spokes rollout has demonstrated, Li-Cycle may face further risk of execution slippage given that ramping up of the spoke and hub strategy for battery recycling has never been done before.

Competition

While Li-Cycle is currently the only pure-play battery recycler that is currently listed, there are other players that may be looking to enter the battery recycling business given the increasing demand for battery materials. One example is that of Albemarle (ALB), which is currently studying ways to recycle batteries in North America.

Commodity price risk

As Li-Cycle’s end products have prices that are largely benchmarked to commodity prices of cobalt, nickel & lithium, if there is a significant decline in the prices of these metals, there could be a material impact on profitability of the company

Litigation risk

As there are some proposed lawsuits due to a short report that was published, this might pose some sort of legal risk for Li-Cycle which should be highlighted to potential investors.

Conclusion

I am of the view that Li-Cycle continues to move toward its production targets and roll out of its spoke and hub model. While there may be temporary hiccups along the way, I think that the delay in spoke roll out as a result of the Arizona Spoke need for optimization is a much-needed one given that this is a new generation spoke and all other spokes to be rolled out will be following a similar design. As a result, with the adjustments made, all other spokes can then be rolled out and ramped up more successfully.

I think it’s important to monitor the progress of construction and the timeline of events for Li-Cycle as although there are sufficient funding and liquidity for the development planned the main risk remains on timeline and execution. That said, I remain convicted in the Li-Cycle story as battery recycling is crucial for governments and the EV supply chain given the increasing need for battery materials and energy resilience, which plays right down to Li-Cycle’s forte. My target price for Li-Cycle is $13.10, implying an upside potential of 132% from current levels.

Be the first to comment