Phynart Studio

This is one of the ongoing large-cap merger arbitrage cases where the spread has recently widened. Healthcare and insurance giant UnitedHealth Group (UNH) is buying in-home healthcare company LHC Group (NASDAQ:LHCG) at $170 per share. Board/shareholder approvals are already in-the-pocket. The only remaining hurdle is antitrust approval.

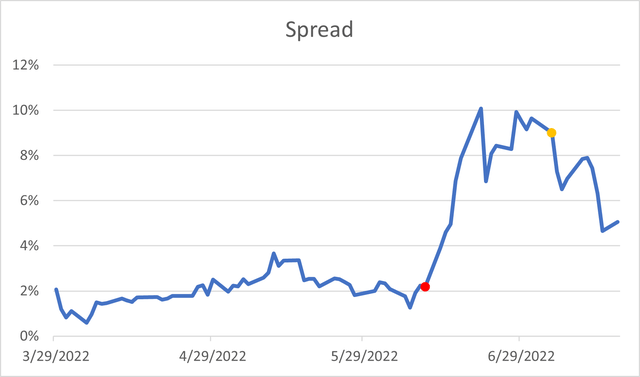

Until recently, the market was not pricing in any regulatory risk as the spread was around 2%. In June, however, the merger received a second information request from the FTC. Since the news, the spread has jumped and is currently at 5%. In early July, rumors appeared that the FTC’s probe is focused on workers’ pay. Regulatory investigation is currently ongoing and the FTC will have 30 days to finish the review once the companies submit all the required information.

Red dot represents FTC’s second request date. Yellow dot is where rumors appeared that FTC’s request is focused on labor pay.

FTC’s inquiry comes in light of several industry developments.

Firstly, UNH’s other ongoing $13bn merger with Change Healthcare (CHNG) has received pushback from the DoJ. The trial is set for August. However, CHNG operates in a different industry (medical billing software) than LHCG and the UHN-CHNG transaction has a much higher business overlap compared to UNH-LHCG merger.

Secondly, since Joe Biden’s executive order on promoting competition in 2021, antitrust regulators have been putting increasing attention on healthcare mergers, highlighting impact on workers’ wages and the degree of vertical integration. These two concerns could be at play in the LHCG-UNH transaction. Also, as of May, the FTC has shifted to a majority-democratic commission, possibly pointing to tighter regulatory scrutiny.

Despite these risks, I see several reasons why the LHCG merger is likely to receive regulatory clearance:

-

UNH and LHCG have a low service overlap.

-

The home healthcare market is highly fragmented.

-

The Kindred-Humana merger is a comparable transaction in the home healthcare space.

-

Recent FTC ruling history suggests that healthcare mergers are blocked due to geographical overlap/dominant market shares – largely not applicable to UNH-LHCG. Moreover, seemingly no mergers were blocked solely on labor pay grounds.

Let’s go through these one-by-one.

Limited Business Overlap

LHCG operates in the post-acute healthcare market. The primary focus is on home-based healthcare services which have historically made a lion’s share of revenues at ~80%. This includes two reportable segments – home health (~70%) and home-/community-based care (~10%). The company operates home nursing agencies through which it provides post-acute nursing, medically-oriented social services and therapy. Other segments (~20% of revenues) are hospices, facility-based healthcare services and other healthcare businesses.

Meanwhile, UNH is a vertically-integrated multinational company – it runs both health insurance (UnitedHealthcare) and health services (Optum) businesses. The Optum arm provides a continuum of healthcare services, including primary care, virtual care, behavioral health and ambulatory surgery. Even so, the company’s presence in the post-acute in-home care market has been limited. Apparently, ever since the pandemic, UNH has sought to expand the segment. Still, some overlap with LHCG remains – UNH launched its own service HouseCalls as well as acquired start-ups Landmark Health and naviHealth.

-

HouseCalls in an annual in-home medical assessment and not a post-acute care service. Having said that, the number of patient visits in 2021 were at ~2.1m compared to 12m+ patient encounters at LHCG, though the latter include hospice patients.

-

NaviHealth is a software business. The company operates a platform which helps hospital systems and healthcare providers manage clinical decision-making and track patient data. It should be noted that the focus is also on post-acute healthcare services.

-

Landmark Health provides in-home care, however, the focus is exclusively on the sickest and most complicated patients. Services are offered in addition to regular primary care providers, such as LHCG. As of 2019, the number of annual visits was at 400k.

Home-Care Market

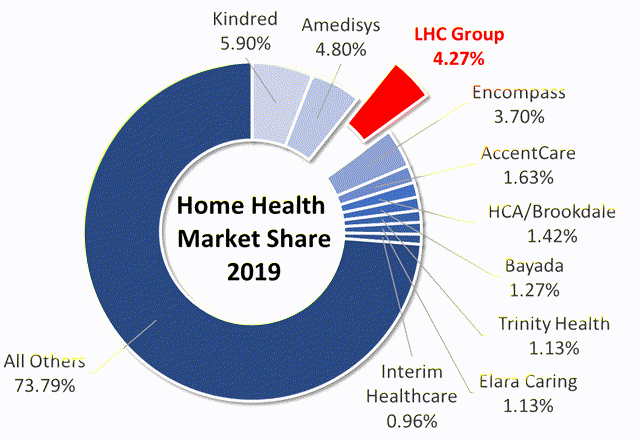

The in-home care market in the US is highly fragmented. To illustrate this, the largest market share captured by Kindred at Home (not publicly-listed) in recent years has been stable at only around 6% while other largest peers (Amedisys and Encompass) have occupied only ~4%-~5%.

|

Company |

LHCG |

AMED |

EHC |

Kindred at Home |

|

Market Cap |

5.0 |

4.1 |

4.9 |

– |

|

Enterprise Value |

5.8 |

4.5 |

8.0 |

– |

|

FY2021 Home Care Revenues ($bn) |

1.6 |

1.4 |

0.9 |

– |

|

Market Share |

4.4% |

5.0% |

3.9% |

6.0% |

Sources: Company filings and HealthCare Appraisers.

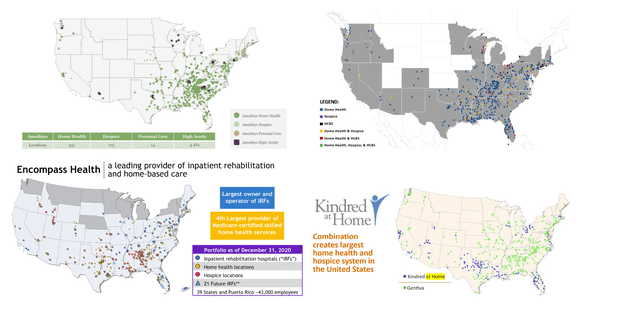

Visually, LHCG (top-right) appears to cover similar geographies as the largest peers Kindred, Amedisys and Encompass:

AMED 8-K Filing, LHCG Investor Presentation, EHC Investor Reference Book, Kindred Healthcare Investor Presentation (Kindred acquired Gentiva in 2015)

Looking more specifically, LHCG’s share of the number of home care agencies in several states is significant at ~70% in Mississippi and ~50% in Kentucky. However, these areas have relatively low numbers of total home care providers. Plus, total agency number includes only Medicare-registered providers whose count stands at ~11k compared to a rough estimate of ~35k+ including non-licensed agencies. With this in mind, the merger is unlikely to result in UNH obtaining any alarming market power other than in several specific geographies where divestitures, if needed, could be reasonable to expect. This makes any antitrust pushback very unlikely.

Market shares in states where LHCG has the most health care agencies:

|

State |

Total Medicare-Registered Home Health Agencies, Apr’22 |

LHCG’s Share of Total State Home Care Agencies |

|

Mississippi |

44 |

~70% |

|

Kentucky |

92 |

~50% |

|

Tennessee |

129 |

~37% |

|

Alabama |

118 |

~26% |

|

Louisiana |

186 |

~21% |

|

Pennsylvania |

422 |

~7% |

|

Florida |

989 |

~5% |

|

Ohio |

784 |

~4% |

|

All States |

11401 |

~5% |

Sources: The Centers for Medicare & Medicaid Services and LHC Group.

Kindred/Humana Merger

Kindred at Home acquisition by Humana, one of the largest US healthcare insurers, seems like a very comparable and recent merger case. Short timeline:

-

July 2018 – Humana teams up with two PE firms to acquire Kindred Healthcare. The deal spins-off the Kindred At Home division and Humana gets a 40% ownership stake in the spun-off company for ~$800m.

-

April 2021 – Humana agrees to buy out the remaining 60% stake in Kindred at Home for $5.7bn, which values Kindred at Home at $8.1bn.

Neither of these acquisitions have received any regulatory pushback. Admittedly, both Humana-Kindred transactions occurred before antitrust regulators have started to put more attention on vertical mergers. Still, a lack of regulatory issues in Humana-Kindred merger is encouraging given similarities with the UNH-LHCG:

-

Both UNH and HUM are mammoth healthcare insurers, ranked first and fifth among US healthcare insurers by revenues. Admittedly, UNH is more vertically-integrated than Humana – in addition to health insurance, UNH offers significantly more healthcare services.

-

Targets, Kindred at Home and LHCG, are direct peers. Kindred has even captured a larger national home health market share.

-

At the time of the first acquisition, Humana already had an in-home care division. As of 2017, Humana had ~795k patients enrolled in its post-acute home care program compared to ~176k served by UNH’s Landmark Health as of 2021. Given this, UNH’s recent moves in the segment do not appear problematic.

-

The latter transaction size is also comparable – $5.7bn for a 60% stake compared to $5.4bn for the whole of LHCG.

Vertical Integration

Vertical integration could be the main concern in the eyes of the regulators. LHCG acquisition will allow UNH to expand its footprint in healthcare provider services. Combined with an already massive insurance operation, the company will have more control over both insuring and providing healthcare to patients.

To assess this risk, I went through healthcare merger cases reviewed by FTC since Jan’21. My findings – healthcare mergers were mostly rejected because of dominant combined company market shares and/or geographical proximity (examples here, here and here). Importantly, only one vertical healthcare merger was blocked – Illumina buying a cancer biopsy test maker Grail for $7.1bn. FTC argued that Illumina would be the only provider of DNA sequencing for cancer protection – hard to find parallels to UNH-LHCG deal.

Granted, a majority-democrat FTC is a risk and could lead to a change in how mergers are evaluated. In fact, the democrats previously had a 3-2 majority in June-October of 2021 and during that time span the commission already withdrew its approval for “flawed” vertical merger guidelines. The reviewed guidelines are to be released before the end of 2022 which implies that there is a good amount of uncertainty here.

Having said this, it is important to touch on vertical integration benefits that the regulators could consider. UNH has sought to shift to a value-based care healthcare model where providers are paid based on patient health outcomes. This model is considered less costly and more efficient than the traditional fee-for-service approach. Value-based care, however, needs insurance payers and healthcare providers to have aligned interests and/or be the same entity. In this context, the merger will allow UNH to optimize for more home value-based care and could potentially even lower healthcare prices and/or improve quality for consumers.

Other Risks

-

UNH’s other ongoing acquisition of CHNG. CHNG has agreed to divest its claims editing business but the DoJ has said any divestitures are not enough to consummate the transaction. Nevertheless, there seems to be a much higher overlap compared to UNH-LHCG. UNH and CHNG both sell competing claim processing software and when combined would serve 38 of 40 largest health insurers in the US.

-

UNH’s labor pay history. UNH owns two subsidiaries – Surgical Care Affiliates (SCA) and DaVita Medical Group – that have been indicted of agreeing not to solicit each other’s senior employees. However, here it is important to note that UNH acquired both subsidiaries after the alleged illegal activity periods. Both litigations are ongoing with trials expected in 2023. Overall, FTC merger review history suggests that no merger has been denied solely due to labor/wage concerns. Moreover, LHCG appears to be an industry leader in employee retention which could to a degree soften merger labor concerns. Here’s LHCG’s COO during the Q4’21 earnings call:

“And then shifting gears to retention, I’m pleased that we continue from all the data that we have access to, not only for the industry but across our peers, to be the leader in the industry when it comes to the voluntary turnover for our frontline staff. Although it has been up a little bit throughout the pandemic, it seems to have stabilized, and we’re continuing to perform well there.”

Conclusion

I see a good chance of this merger receiving an FTC go-ahead and closing. The home care market is fragmented, there is low overlap and recent healthcare merger history does not suggest regulatory issues. The timeline is not definite but the FTC’s review has to end in a month once the companies have submitted all the required materials. Assuming a somewhat conservative 6-month timespan, the setup would still provide a 10% annualized return. Given this, I will open a position in LHCG.

Be the first to comment