AJ_Watt/E+ via Getty Images

Water can be both fun and relaxing at the same time. This is why there’s a rather large industry dedicated to products and services centered around swimming pools, spas, and other related things. According to one estimate, the industry today is worth about $11 billion. However, investors are currently concerned about the broader economy. And the sad truth is that this is the kind of industry that can be hit hard during a true downturn. So far, that has not stopped one of the largest players in this space, Leslie’s (NASDAQ:LESL), from continuing to grow. But it has had the negative impact of pushing the company’s share price down quite a bit further than even the market has experienced. Although investors are currently experiencing some pain, shares are finally starting to reach the point of looking fundamentally undervalued. Short term, it is possible that these fundamentals could worsen and shares could drop further. But for investors focused on the long haul, now might be the time to start considering a stake in the enterprise.

A quality player that continues to grow

The last time I wrote an article about Leslie’s was in January of this year. In that article, I finally made the decision to downgrade my rating on the business from a ‘buy’ to a ‘hold’. After seeing a few months of stronger turns, shares had finally reached the point that I felt they were fairly valued. Even so, I called the company a quality operator with a bright future. Unfortunately, my ‘hold’ rating seemed to have been a bit too bullish in the short run. I say this because, since the publication of that article, shares of Leslie’s have dropped by 30.4%. That compares to the 18.6% decline experienced by the S&P 500 during the same timeframe.

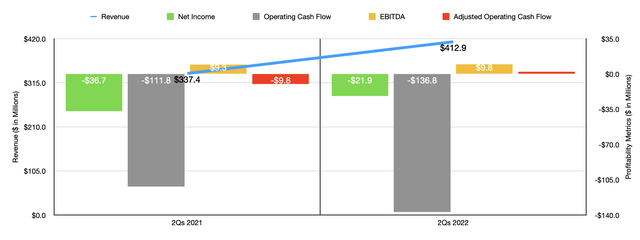

Given how hard shares have dropped, you might think that fundamental performance since the publication of that article has been bad. But I don’t think that has been the case. Consider, for instance, how the company has fared during the first half of the 2022 fiscal year. For context, the most updated data that I had for the business in my last article covered the entirety of its 2021 fiscal year. So what we have for 2022 is entirely new. According to management, revenue during the first half of the year came in at $412.9 million. That represents an increase of 22.4% compared to the $337.4 million generated one year earlier. Management attributed this upside to two key factors. First and foremost, the number of locations the company has an operation grew from 940 to 965. And second, comparable-store sales rose significantly. The year-over-year growth rate was an impressive 16.4%.

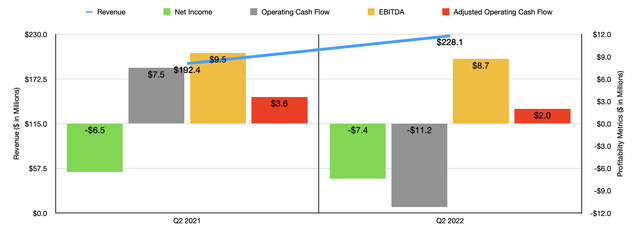

It is worth noting that growth did slow in the most recent quarter. Revenue during that time frame came in at $228.1 million. That’s 18.6% above the $192.4 million generated the same time of the 2021 fiscal year. Although still impressive, this growth was slowed by a slight decline in the increase of comparable-store sales. Year-over-year, this metric expanded by a more modest 13.3%.

When it comes to the bottom line, the picture has been a bit more complicated. Consider net income. In the first half of the year, the company generated a loss of $21.9 million. That represents an improvement over the $36.7 million loss achieved the same time of 2021. However, in the latest quarter, the net loss for the company actually widened a bit, growing from $6.5 million to $7.4 million. We should also pay attention to other profitability metrics. Operating cash flow, for instance, went from negative $111.8 million in the first six months of the company’s 2021 fiscal year to negative $136.8 million the same time this year. If, however, we were to adjust for changes in working capital, the metric would have actually improved, turning from a negative $9.8 million to a positive $2.3 million. Meanwhile, EBITDA for the business also expanded, inching up from $9.3 million to $9.8 million. Once again, the data in the most recent quarter was a bit weaker than it was one year earlier.

Despite the recent pain, management does have high expectations for the current fiscal year. At present, they anticipate revenue of between $1.575 billion and $1.61 billion. At the midpoint, this translates to $1.59 billion. That would represent an increase of 5.6% compared to what the company previously anticipated. What’s more, it would also translate to a year-over-year growth rate of 18.6%. In order to reach this target, total revenue for the second half of the year would have to come in about 17.3% above what the company generated at the same time of its 2021 fiscal year.

From a profitability perspective, management also expects some improvement. At present, net income should be between $178 million and $190 million. This compares to the prior expected range of $170 million to $180 million. Meanwhile, EBITDA has also been revised higher, with the metric ultimately expected to come in at between $315 million and $330 million. Previously, the company thought it would be between $300 million and $310 million. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, we should anticipate a reading for the business of roughly $202.1 million.

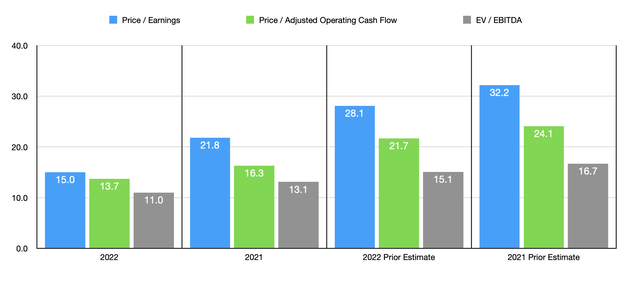

Taking these figures, we can easily value the business. On a price-to-earnings basis, our estimates give the company a multiple of 15. This is down from the 21.8 reading that we get if we rely on 2021 results. The price to adjusted operating cash flow multiple should drop to 13.7. That would represent an improvement over the 16.3 I calculated using the firm’s 2021 results. Meanwhile, the EV to EBITDA multiple should also improve, declining from 13.1 to 11. It’s also worth noting that these numbers are far lower than what I calculated in my prior article on the company. This much can be seen in the chart above. To put this pricing into perspective, I also decided to compare the company to rival Pool Corp (POOL). On a price-to-earnings basis, is currently trading at a multiple of 20.5. The price to operating cash flow multiple is even higher at 42.5, while the EV to EBITDA multiple comes in at 15.5. Clearly, Leslie’s is the cheaper of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Leslie’s | 21.8 | 16.3 | 13.1 |

| Pool Corp | 20.5 | 42.5 | 15.5 |

Takeaway

Based on the data provided, I understand why investors are concerned. It is likely that the firm could experience some pain, particularly on its bottom line, should the economy slow or even tip into a recession. At the same time, long-term investors should understand exactly how cheap the business looks today. And between that and management’s current outlook for the company, it’s likely that attractive value now exists. Because of this, I have decided to increase my rating on the company from a ‘hold’ back up to a ‘buy’.

Be the first to comment