Michael Vi

Recessionary fears continue to plague shares of financial stocks, creating an opportunity to buy profitable and growing franchises at large discounts to intrinsic value. I wrote about LendingClub (NYSE:LC) in early July and if anything, I’ve gotten more optimistic on the company after the company reported its 2nd quarter earnings results. I have to give credit to IP Baking Research, whose article in April of 2021 brought my attention to the company. The company’s transformation after the acquisition of Radius Bank, combined with its unique loan marketplace, has the company poised to continue robust profit growth into the future. At recent prices, I believe the stock should double over the next three years.

While I personally believe we are in a recession, I think we are in a fairly unique one with low unemployment, and both businesses and consumers in stronger financial position going into it than is typical. My takeaway from reading dozens of earnings reports this quarter is that we have a bifurcated consumer credit environment, with lower income borrowers having far more trouble due to the inflationary environment. I touched on this in a recent podcast with the guys at Value After Hours. Credit has had a very strong run since the pandemic, as stimulus money allowed consumers to improve their balance sheets. The negative for banks was that people weren’t running as much of a loan balance, but this trend has changed with strong loan growth to start the year. Most LendingClub originations are to achieve a lower cost of capital, often on credit card consolidations. I’d expect loan demand to still be high from consumers, although investors in the marketplace will likely want higher interest rates given the environment. LendingClub sells 75-80% of its loans via its marketplace where it earns attractive origination and servicing fees. Funded by its low-cost deposit base that stemmed from the Radius Bank acquisition, LendingClub is putting 20-25% of its loans on to its own portfolio, generating recurring net interest income. Management is taking a conservative approach going into the recession, focusing on prime and super prime loans for its balance sheet. The marketplace accounts for about 59% of revenue, versus 41% for the loan portfolio.

LC Q2 Earnings Presentation

LendingClub posted a fantastic second quarter with net revenue up 61% YoY to $330.1MM. Marketplace revenue was up 36% to $213.8MM, while net interest income was up 153% to $116.2MM, as the company continues to grow its consumer loan portfolio. Net income was $46.8MM, or $.45 per share, excluding a $135.3MM income tax benefit, which was still good for 400% YoY growth. Both revenue and net income outperformed the company’s guidance, which has been a continual theme over the last year. LendingClub’s net interest margin expanded to 8.7% from 5.5% a year ago, and the bank loan portfolio grew by 64% to $3.7B on average. This consists of nearly $3B in consumer loans and roughly $800MM of Commercial/PPP loans. Over time I expect LendingClub to diversify into other asset classes, where it can benefit from cross-selling products to its 4MM customer base. Total equity was up 42% YoY, or $317MM, helped significantly by the tax valuation allowance.

LendingClub’s held-for-investment loans generated an 11.61% yield in Q2, while its other interest-earning assets generated a 3.03% yield, for a total average of 9.18%. This was partially offset by a .6% interest-bearing liability cost, leaving an 8.7% net interest margin, which is simply exceptional. This is a substantially higher net interest margin than just about any bank in the United States, speaking to the uniqueness of the company’s business model. Management is doing a great job creating positive operating leverage as expenses were only up 31%, against the 61% revenue growth. Total non-interest expense of $209.4MM, was less than marketplace revenue, allowing net interest income to flow to the bottom line. I believe the best way to understand the underlying value of a bank’s earnings power is pre-tax, pre-provision income, which rose by 173% YoY to $120.7MM. LendingClub posted a $70.6MM provision for credit losses, mostly due to its strong loan growth. As I’ve mentioned in the previous article about LendingClub, CECL accounting requires that banks provision for total expected losses over the life of the loans. It is a conservative accounting rule that frontloads losses. The reserves will fluctuate on loan growth and changes in the modeling assumptions. The company forgoes maximizing current quarter income when it keeps a loan on the balance sheet instead of selling it, but over the life of the loan the company expects to make three times as much money.

LC Q2 Earnings Presentation

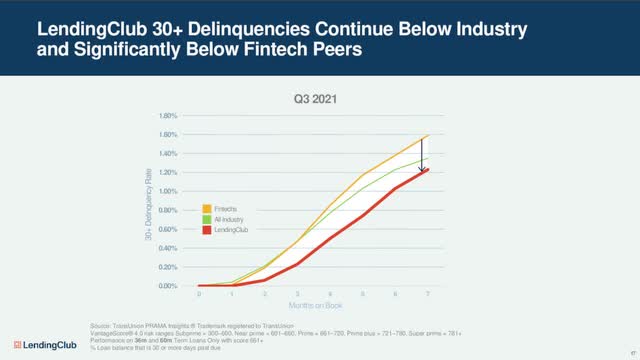

While credit quality across the industry is likely to be pressured from the inflation-induced recession, LendingClub’s held-for-investment portfolio has a strong average FICO of 730, with average income of $113K. These figures are slightly higher than the servicing portfolio, while the yield is a bit lower at 11.1%. Delinquency rates remain well below pre-pandemic levels in accordance with the company’s expectations. LendingClub has seen better credit performance than most of its competition.

Since reporting what I believe to be fantastic earnings, the stock has taken a bit of a dive. One potential reason for this might be that the company maintained its 2022 guidance, instead of raising it after it has beaten guidance in the first two quarters. Management is expecting $280MM-300M in Q3 net revenue, along with $30-40MM of net income. For the full year, net revenue is expected to be $1.15-1.25B, along with net income of $145-165MM. This revenue range would bring 40-53% growth, while net income would be 8-9 times higher than last year. Obviously, this is a major growth company and I see no reason why that profitable growth should not continue.

At a recent price of $13.85 and with 105MM diluted shares outstanding, LendingClub has a market capitalization of approximately $1.45B. This puts the P/E ratio at just 10x the low-end net income guidance, which I think the company is likely to beat by a good margin. This multiple might be appropriate for a slow-growth bank going into a recession, but it is immensely attractive for this high-growth fintech/bank. LendingClub has increased its unsecured consumer loans in its HFI portfolio by $2B over the last year, at a yield of 14.19%. This growth should continue, and with a net interest margin that has been growing to 8.7% in Q2, each $1B of growth should bring close to $90MM of net interest income. While credit will indubitably decline in a recession, LC is poised to generate strong profits and growth, far beyond most companies in its industry. The stock trades at just 1.4x its $9.68 tangible book value per share, despite a high-teens ROE at the minimum. There is no reason this stock can’t double over the next 3 years as earnings grow and we likely see an increase in the multiple accorded to the company. For investors looking to take a more conservative approach, one can take advantage of the high volatility on the stock by selling cash-secured puts. One can sell a January 2023 $10 put for about $.85, which is a 9.3% return on the maximum risks of $915, or 19.7% on an annualized basis. This is clearly a fantastic potential return and the stock could drop by 34% before you would lose a penny, assuming you hold the option till expiration.

Be the first to comment