Oulaphone Sonesouphap/iStock via Getty Images

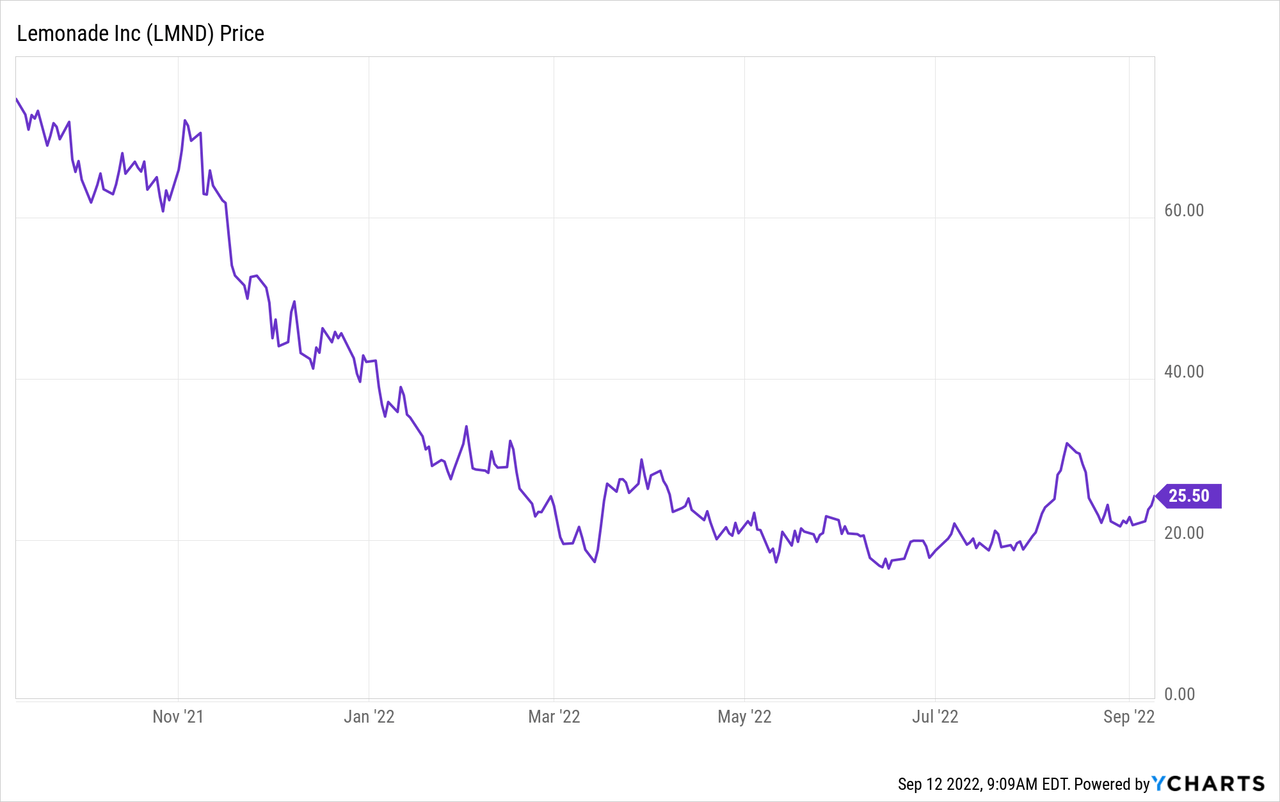

During hyper-volatile markets, it’s very scary to buy into small-cap growth stocks that may seem like falling knives. Lemonade (NYSE:NYSE:LMND), in particular, has seen a scary correction from peaks over the past year. Year to date, the stock is down 40%, and over the trailing twelve months, Lemonade has lost 65% of its value. The key drivers here are decelerating growth, waning confidence in the profitability of Lemonade’s business model, and uncertainty over the fate of its Metromile acquisition.

Recently, however, the market’s tune seems to be starting to change. After posting strong Q2 results in which Lemonade also committed to improving its profitability, shares of Lemonade rallied sharply in August (while most tech stocks went the other way). In my view, the beginnings of a long rebound rally in Lemonade is here:

A vibrant bull case for Lemonade

I remain solidly bullish on Lemonade. Again, I’ll reinforce that for most of Lemonade’s earlier life as a public company when the stock was trading at egregious levels above $100, I recommended that investors steer clear. Now, however, I believe investors have a great opportunity to buy into an innovative InsurTech leader while it’s scaling toward profitability, and still at a great price.

Here is my long-term bull case on Lemonade:

- Enormous growth rates showcase the largesse of its market opportunity. Lemonade is nearly doubling its revenue on a y/y basis. And though the current market is very nonchalant about impressive growth rates, to me this shows a business that is still very much in its nascency and able to scale to much greater heights.

- Lemonade is the new way to buy insurance. Gone are old-school insurance agencies and insurance agents; nowadays, just like everything else, we buy insurance online. As the new generation of tech-savvy millennials and younger cohorts dominate the consumer base, insurtech vendors like Lemonade will gain market share versus their legacy counterparts.

- Building a full insurance flywheel. When it started out, Lemonade just offered home and renters insurance. Now, the company is also offering bundles with pet insurance and car insurance as well (the latter through its acquisition of Metromile). Perhaps in no other industry is diversification more vital than in insurance, so Lemonade’s ability to continue growing into other insurance streams will be critical to its success.

- Loss ratios are set to improve. Lemonade filed for ~100 rate changes that are pending approval. Once these are in place, the company’s loss ratios will move closer in line with its long-term targets.

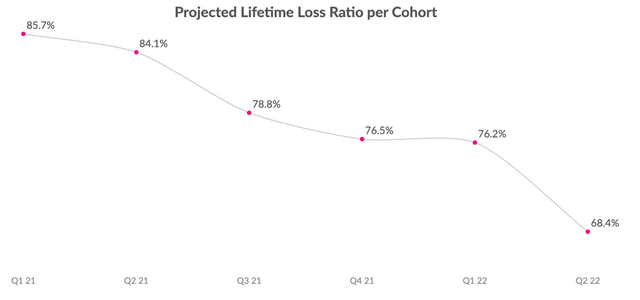

More to the latter point: it’s important to understand that customer loss ratios improve over time. The chart below shows how a customer cohort’s loss ratios get better with each quarter they are on the platform:

Lemonade loss ratio over time (Lemonade Q2 shareholder letter)

Right now, more than 70% of Lemonade’s premiums come from customers who have tenures of under two years – which is the opposite of most incumbent insurance players, most of whom have had clients for years and decades. Over time, as Lemonade ages as a service and as a product, more of its policyholder base will mature and shift its loss ratios downward. This is especially true now, as Lemonade intends to slow down marketing spend and customer acquisition: more of its “installed” customer base will skew towards longer tenures, and hence better profitability.

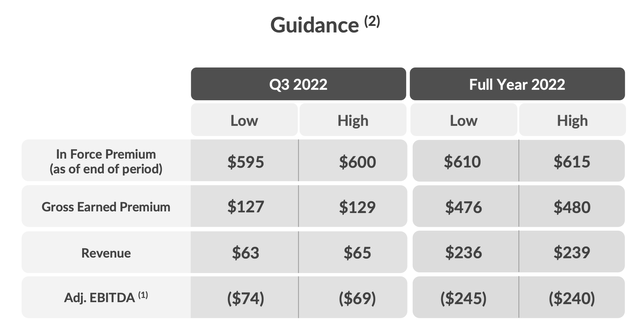

Guidance update and valuation check

Alongside its Q2 earnings print, Lemonade also updated its full-year 2022 guidance to include the recently-closed acquisition of Metromile. The company is now expecting $610-$615 million of in-force premium at the end of the year (versus $535-$545 million previously), $236-$239 million of revenue (versus $205-$208 million previously), and most notably: a shrunken adjusted EBITDA loss projection of -$245 to -$240 million, versus a prior -$280 to -$265 million forecast.

Lemonade guidance update (Lemonade Q2 shareholder letter)

This is especially notable as Lemonade noted that Metromile’s first half 2022 adjusted EBITDA loss was -$45 million. We would have expected that the inclusion of Metromile into the consolidated company guidance would have dragged Lemonade’s overall profitability downward, not up – suggesting that the company is banking on some organic operational improvements through a slice-down of marketing spend as well as rationalization of hiring.

Lemonade’s valuation also remains quite cheap. At current share prices near $25, the company trades at a market cap of $1.76 billion. After we net off the $959.6 million of cash and investments on Lemonade’s most recent balance sheet, the company’s resulting enterprise value is $799.4 million.

This represents a 3.4x EV/FY22 revenue multiple, and if we look ahead to FY23 where Wall Street analysts are expecting consensus of $375.1 million (+58% y/y; data from Yahoo Finance), Lemonade’s multiple shrinks to 2.1x EV/FY23 revenue.

The bottom line here: investors still have a chance to get in at ground-floor pricing into a rapidly growing and rapidly scaling company.

Q2 download

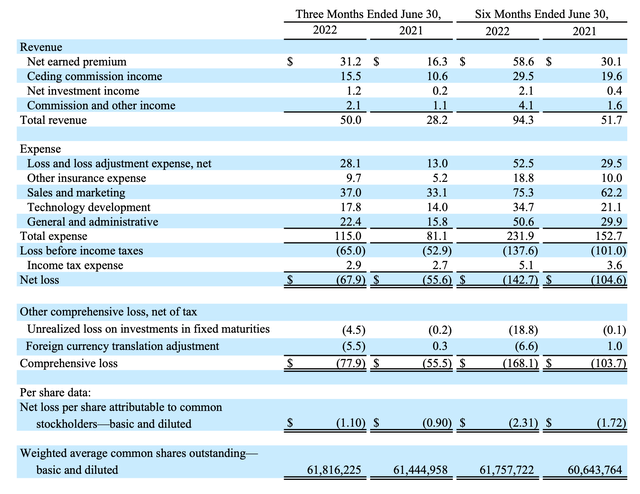

Let’s now go through some of the highlights of Lemonade’s most recent quarterly results. The Q2 earnings summary is shown below:

Lemonade Q2 results (Lemonade Q2 shareholder letter)

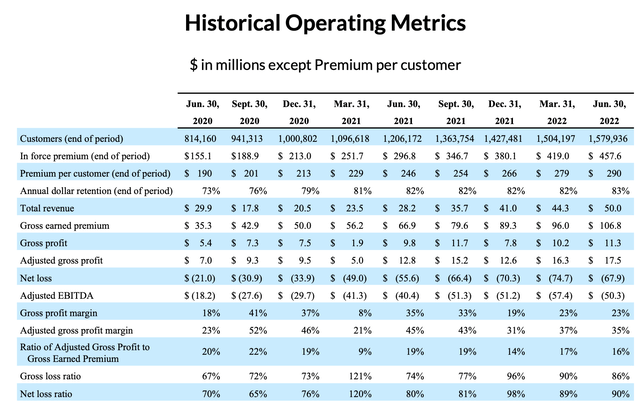

Lemonade’s revenue grew 77% y/y to $50.0 million, beating Wall Street’s expectations of $47.6 million (+69% y/y) by a solid eight-point margin. The company added $38.6 million of in-force premium in the quarter (on pace with $38.9 million in Q1) to end the IFP pace at $457.6 million, up 54% y/y. Q2 metrics don’t yet include contribution from Metromile, which carries roughly $113 million in IFP (as the acquisition closed in July, after the Q2 cutoff).

Lemonade key metrics (Lemonade Q2 shareholder letter)

As shown in the chart above as well, the company added roughly 76k net-new customers in the quarter to end at 1.58 million customers, up 31% y/y. Gross loss ratio improved slightly to 86% in the quarter – and as previously mentioned, as more of Lemonade’s customer base becomes tenured as customer acquisition slows, we should see loss ratios improve over time.

Cross-selling is also another big highlight for Lemonade. Excluding Lemonade Car products, 21% of the company’s sales were from cross-sell deals, up two points from 19% in Q1. Once Metromile/Lemonade Car is folded in, the company expects that ratio to rise to 36%.

The company’s go-forward strategy, mindful of the current tightening macro and rising costs of capital, is to slow down its growth progression by reining in spending – though, per the company’s words in its Q2 shareholder letter, it still expects “double digit growth as far as the eye can see.”

Commenting on the pivot in strategy on the Q2 earnings call, CEO Daniel Schreiber noted as follows:

The upside is that even as we continue to launch new products in new territories to new customers, we have tender corner. We expect our losses to peak this quarter, Q3, and to continue to shrink thereafter, starting a clear path to profitability. And that path to profitability brings me to my final update. Being public with a highly liquid stock means that capital is readily available to us, but the cost of capital have jumped considerably, and with about $1 billion in the tank, we see no need to be dependent on further capital raisers.

So we’ve changed gears with the aim of reaching profitability without having to top up. This means we’ve decelerated our spending on growth and hiring. As Tim will detail in our guidance, this will result in a more rapid improvement in our EBITDA, a slower rate of growth, and we believe no need for further fundraising.

To be clear, we will continue to execute on our strategy just at a moderated clip. We’re changing pace, we’re not changing course. And even as our losses shrink, we will continue to grow, though not at our full potential. We think that’s the right trade-off while cost of capital are elevated though it’s a trade-off we will revisit as the cost of capital wax and wane.”

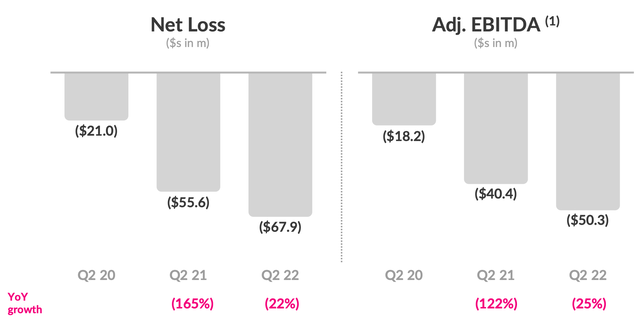

We’ve actually already seen adjusted EBITDA margins improve this quarter: the -$50.3 million in adjusted EBITDA represents a -101% adjusted EBITDA margin, versus -143% in the year-ago Q2.

Lemonade adjusted EBITDA (Lemonade Q2 shareholder letter)

Key takeaways

Be patient as Lemonade continues to build out its multi-product insurance flywheel and waits for its customer base to mature. Lemonade is easily the most prominent “new” and tech-based insurance offering in the market, and as millennials and Gen Z move into prime home/renters/car insurance buying markets, Lemonade is well-positioned to gain.

Be the first to comment