akinbostanci

Lemonade (NYSE:LMND) is a small, but quickly growing insurance company attempting to disrupt the insurance industry by leveraging digital technology and artificial intelligence. At the end of 2020, LMND stock began to catch the attention of investors who eventually drove the share price above $163 in early 2021. Since then the share price has collapsed 86% to $21.97. The company continues to lose money, expects losses to grow in Q3, trades at a P/B ratio ~1.60, and still must prove their AI gives them an edge. Despite myself being a shareholder, I do not think it is time to buy.

The Best Lemonade

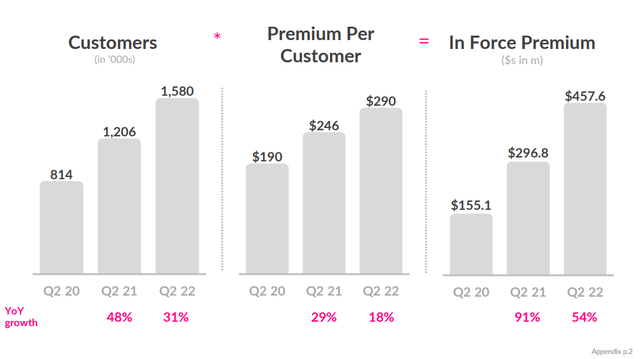

Lemonade is a small, but rapidly growing, insurance company that is doing several things well. First, they have rapidly expanded their customer count and their in-force premiums. Over the two year period shown in the chart below, their customers have nearly doubled and in-force premiums have increased 195%. They’ve also maintained a high level of communication to customers and investors that I have enjoyed. They have a Founder’s Letter, maintain a blog, and write shareholders letters, all providing plenty of information for investor’s to better understand management’s vision.

Lemonade 2022 Q2 Shareholder Letter

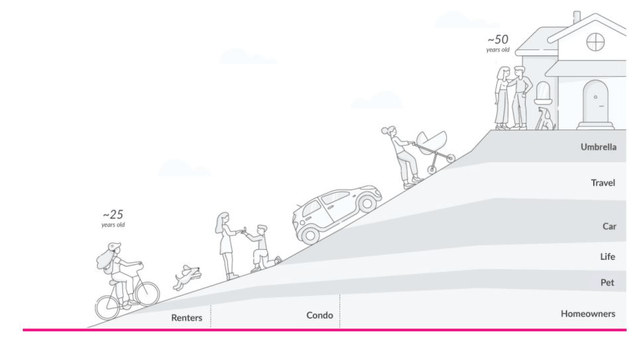

Through these channels, they have done a good job of communicating aspects of their strategy. One key to their strategy is building the company around their tech stack and attempting to leverage AI in multiple areas. Their strategy is also focused on building long-term customers. They want to attract young customers just entering the insurance market for the first time, such as those needing renters insurance, and then grow their offering with these customers. Since they want to keep these customers for life, they are designing their platform to delight customers. In fact, in their 2021 Annual Report they reported a Net Promoter score of 70.

Lemonade 2021 Annual Report

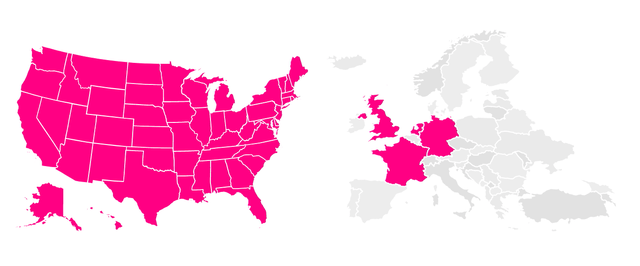

As they seek to grow with their customers, they now offer multiple types of insurance including Renters, Homeowners, Life, and Pet Insurance. They are also expanding their car insurance, which will be helped by their recent acquisition of Metromile. Lemonade is also spreading geographically, both in the US and globally. In the US, with insurance premiums representing 11% of US GDP, LMND offers at least one type of insurance in every state and D.C. exposing LMND to this huge market.

Where Lemonade Offers Policies (Lemonade.com)

Source: Lemonade Goes Global

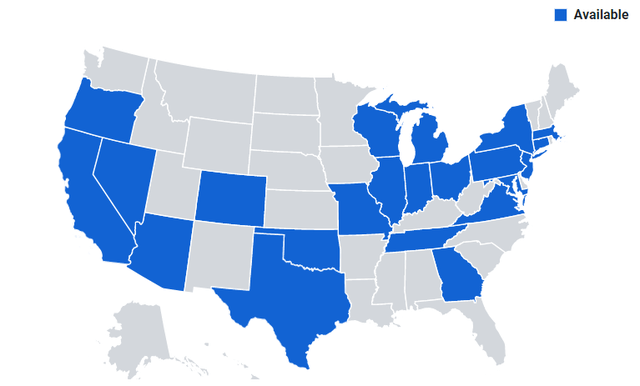

Within the US, there is still plenty of room to grow as Lemonade does not offer all their products in every state. The map below illustrates that Lemonade only offers home insurance in 22 states and D.C. Additionally, Lemonade Car is only available in three states and ~12 states do not have renters insurance. As more policies become available in each state, cross selling will become a huge opportunity, which Daniel Schreiber, Co-Founder & CEO, mentioned on the 2022 Q2 Earnings Call:

While accounting for a quarter or even one-third of new sales only about 4% of our approximately 1.7 million customers have more than one Lemonade product today.

Where Lemonade Offers Homeowners Insurance (US News)

Source: US News

Lemonade is Tiny

The Insurance market is massive with ~$5 trillion in annual premiums globally. If we look at some of the giants in the industry, State Farm had $70B in direct premiums written in 2021, followed Berkshire Hathaway’s (NYSE:BRK.B, NYSE:BRK.A) $51B and Progressive’s (PGR) $47B. Lemonade is tiny in comparison to these industry leaders, guiding to in-force premiums of $595M-$600M for the quarter ending Sept. 30th. Investors need to keep this size in mind both in terms of future opportunities, but also potential risks.

One of these risks is concentration risk, and Louisiana and Florida are perfect examples. Since 2020, Louisiana has experienced direct hits from multiple hurricanes, including Hurricane Laura, Delta, and Ida, resulting in over $18.4B of insurance claims. These claims have contributed to eight insurance companies going bankrupt and others leaving the state. A similar story could play out in Florida as Hurricane Ian has devastated the state and insurers are expecting claims ranging from $28 B to $47 B.

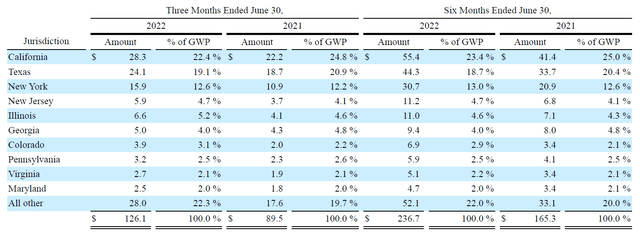

Geographical Breakdown of Gross Written Premium (2022 Q2 10-Q)

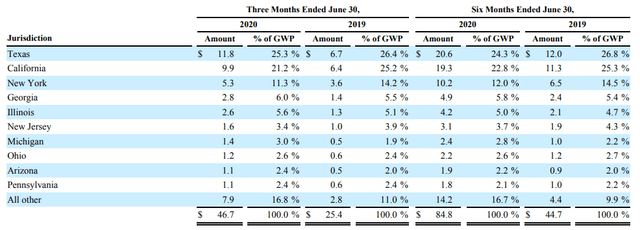

Lemonade, despite offering policies in all 50 states, still has a concentration risk. As seen in the table above from their Q2 2022 10-Q, we can see 54.2% of their premiums are from California, Texas, and New York. If we jump back to their first 10-Q from 2020, these three states represented 57.8% of premiums in June of 2020 and 65.8% of policies in June of 2019. Lemonade is aware of this concentration risks. As they expand products to more states and grow their brand, investors should hope this concentration reduces, but know that highly populated states could always remain a higher percentage of their premiums.

Geographical Breakdown of Gross Written Premium (June 2020 10-Q)

Digging a Moat

Insurance companies offer standardized policies which can be copied by anyone. Their only products are promises. It is not difficult to be licensed, and rates are an open book. There are no important advantages from trademarks, patents, location, corporate longevity, raw material sources, etc., and very little consumer differentiation to produce insulation from competition. – Warren Buffett, Berkshire Hathaway’s Shareholder Letters, March 14,1978

I wrote that quote down in a notebook 7 years ago and apparently completely forgot about it. Recently rediscovering it, I instantly regretted a few of my recent investments and wanted to do a deep dive into Lemonade Insurance. I don’t know if Warren Buffett has changed his thoughts on insurance moats since 1978, but I have been spending a lot of time thinking about this quote. Let’s work through Lemonade’s business and see if they are digging insurance a new moat.

Public Benefit Corporation

Many consumers want companies to be more socially responsible and are willing to pay for it. On the investment side, ideas such as conscious capitalism and socially responsible investing have been gaining traction, leading some to push away from the idea of shareholder primacy. Lemonade is joining in on these trends by registering as a certified B corporation, which means LMND’s management is letting investors know they will consider other stakeholders in their decisions.

Things like their Giveback program and not investing in coal are part of their B Corp status. While this effort can help attract customers and investors, it is certainly not a moat, as other companies can also enter the market as a B corp. As we’ll see in a minute, many of the large industry giants also do good things for their communities.

Giveback and Fraud Prevention

Lemonade is approaching their structure with a unique model that will attempt to smooth out profit and give back to charity. The want to take 25% of premiums as a fixed fee, which they will use to run the business and any remaining money will be profit. The other 75% will go to cover claims and pay for reinsurance. Any money remaining in this 75% will then be donated to charities selected by their customers.

Behind the scenes, customers who select the same charitable cause are classified as members of the same “cohort.” Once a year we look at the loss ratio of each cohort, and provided that we pass the financial ratio tests required by our regulators, we aim to donate the funds remaining, if any, to the charitable cause selected by that cohort. Cohorts with a loss ratio above 40% usually will not receive a Giveback. – 2021 Annual Report

Lemonade’s structure and giveback are a significant part of their claims of why they are better than incumbents. They claim it removes temptations for them to deny claims to make more money and creates alignment of goals with customers. I can absolutely see certain customers loving this part of the company.

But they also claim the giveback will help to decrease fraud because if a person defrauds LMND out of money, then their selected charity will receive less money. It is a unique idea to combat fraud, which is a major issue for insurance companies, but this idea is not yet a proven. In fact, charities themselves are challenged with fraud with estimates showing they lose 5% of their revenue from fraud.

There are also mutual insurance companies, which are insurance companies owned by the policy holders. State Farm and Liberty mutual are two examples. State Farm periodically gives dividends to policyholders and reduced premiums after fewer claims occurred during the early COVID lockdowns. If people defraud both mutual insurance companies and charities, then I question if giveback will meaningfully reduce fraud.

Additionally, Lemonade is not the only insurance company using profit to better this world. State Farm has the State Farm Companies Foundation and routinely donates to causes after disasters. Aflac has committed $154 million for sickle cell and childhood cancer. Progressives has given over 800 vehicles to veterans in need and allows each of their 5,000 employees to select a charity to receive a $100 donation.

Lastly, giveback may hurt their ability to build a strong balance sheet to prepare for catastrophic events, as excess money is donated. Typically, a property and casualty insurance will want to build their balance sheet when possible so they can survive catastrophic events.

For investors, I do not yet see the giveback program as a moat. They need to prove it will meaningfully reduce fraud, increase customer retention, and prove it will not hamper their ability to survive catastrophic events.

Digital Tech Stack

Powered by artificial intelligence and behavioral economics, Lemonade’s full stack insurance carriers in the US and the EU replace brokers and bureaucracy with bots and machine learning, aiming for zero paperwork and instant everything. – Q2 2022 Shareholder Letter

There are potentially two parts of Lemonade that I believe could become a long-term moat and their digital tech stack is the first. It is not the tech stack itself, but the fact that they are building the company around digital technology. Unlike a large incumbent that must pivot to more digital workflow, LMND will have all their internal processes designed to leverage technology. It is possible this could give them an efficiency advantage by continuing to support more customers with fewer employees.

Competitors are not ignoring technology, though. Many of the incumbents have money to invest and are using more digital technology. Most have mobile apps and online portals for paying bills, submitting claims, sending messages, and uploading documents. Allstate has a chatbot Abie for helping with business insurance, they are leveraging AI for fraud detection, and offering Drivewise, which is an auto insurance telematics program. State Farm has Drive Safe and Save for their telematics program and they even sponsored a competition on Kaggle for a Distracted Driving algorithm. Geico is also working with Tractable for visual AI to inspect auto damage.

For investors, I do not think this is a moat at this time, but it is certainly something to monitor and watch. Combined with the next topic, it could be a major advantage, depending how well incumbents are able to digitize.

Artificial Intelligence

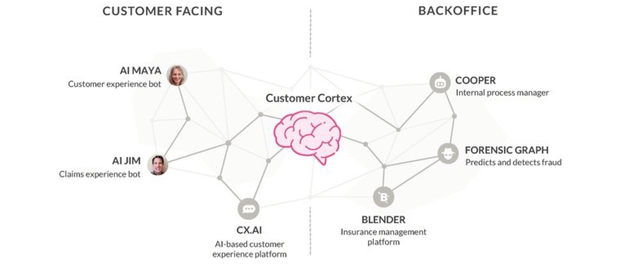

Lemonade wants AI to touch every part of their business. It is used in their two chat bots, AI Jim and AI Maya, but also in back-office work. Their Project Watchtower monitors satellite photos for potential events and can suspend writing new policies in areas having an immediate risk and help employees assist customers in these areas.

Lemonade S-1 Statement

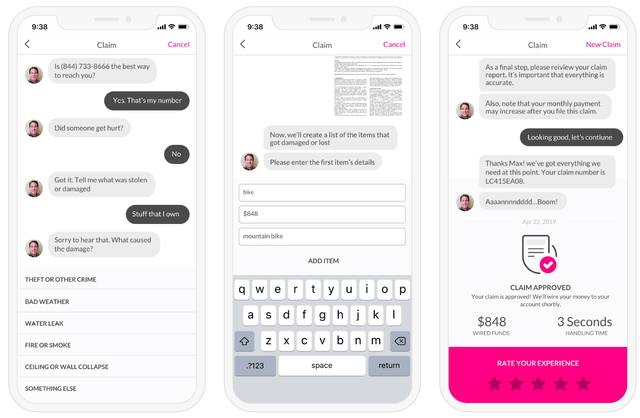

AI Jim, Lemonade’s artificial intelligence “claims experience bot”, can accept claims, request documentation, approve claims, and send them for manual review, all on its own. It’s easy to see how this type of bot can provide a faster experience for customers and streamline claims processes even if it has to go to manual review.

AI Jim Takes and Approves a Claim (Lemonade Statements)

Lemonade is also sharing other successes with their AI. Their latest version, called LTV6 and discussed in their Q2 2022 Shareholder letter, now provides predictions for customers including “likelihood to churn, claim, and cross-sell” resulting in a calculation of their lifetime value. They are also using the new model to analyze risks and profitability:

For example, LTV6 flagged that many homeowner policies in California, that LTV5 scored favorably and appeared to enjoy compelling marketing efficiency, would actually prove loss making over time. Conversely, LTV6 showed that much of our Pet business promises to be more profitable than LTV5 assessed. Accordingly, in Q2 we dramatically slowed our California homeowners business in several locals, while accelerating our Pet book across most states. – Q2 2022 Shareholder Letter

While these are great successes, investors will need to see how they play out over the long term. We must also mention that competitors are not ignoring AI, but may discuss it under other terms such a predictive analytics.

AI is also hard and sometimes doesn’t work as expected. We’ve had Google say dogs are horses, Google’s AI also did something else extremely horrible that I’m not sure what to write here, Amazon’s AI showed a bias against women, and there was the massive failure of IBM’s Watson. Unfortunately, this is just to name a few of AI’s failures. With some of these potential issues, there could also be concern from regulators, either not allowing certain activities to go through AI if they are suspect of unknown biases or even having Lemonade’s secrets exposed.

Once again, for investors, LMND’s AI is not yet a moat. I can certainly see how this can become a major advantage. Additionally, even if regulators began to heavily regulate AI and remove its advantages for policy approval and pricing, LMND still has an advantage with AI. Using AI just for policy pricing means the maximum benefit is the differences between what actuaries calculate and the real cost of the policy. Since Lemonade is using AI for more than just risk analysis, they would maintain an edge even in a highly regulated situation through their AI chat bots and streamlined back-office work.

The Moat is Still Price

We can see some potential for Lemonade to build a moat, but most of these will eventually come down to price, just like Warren Buffet said 44 years ago. Ultimately, there just isn’t that much unique about an insurance policy. They make a promise to pay when a loss occurs for a certain price. If a company can offer some level of customer support and trust they can and will pay a claim, then many people will select based primarily on price. It is part of the reason many insurance ads focus on this only advantage, switch companies and save.

Valuation

There is a lot of focus on Lemonade’s tech but unfortunately they should not be valued like a tech company, where each new user typically carries a lower marginal cost. They are still an insurance company and must find a way to be profitable selling insurance.

With this in mind, we can look at their current P/B value of ~1.60. This ratio is not necessarily expensive, but for a company facing the challenges of LMND, investors might want to consider it high. They continue to dilute shareholders and are burning a non-trivial amount of cash. While they expect losses to peak in Q3, they are guiding to an adjusted EBITDA loss of $245-$240 MM. Additionally, their Q2 2022 10-Q statement of cash flows shows a net decrease in cash of $71 MM for the 6 months ending June 20th, 2022.

At this point, for investors, the choice to invest is not about valuation. It is about what you see in the future of LMND and their ability to disrupt the insurance industry. If their AI and tech never give them an advantage, they could potentially stay a small insurance company for a long time.

Is Lemonade a Buy or a Sell?

Our analyses led us to conclude that a new kind of insurance company, built from scratch on an unconflicted business model and cutting-edge technology, will enjoy structural advantages that will manifest ever more powerfully over time.

In the above quote, I think the founder’s succinctly describe Lemonade and their goal. They are building the company around their digital tech stack and trying to leverage as much technology as possible.

While in the long-term these could give LMND a sufficient moat to disrupt the industry, they are not at that point yet. They could be extremely close, but traditional insurance companies won’t go down without a fight. Many of the incumbents are not ignoring technology and are looking at ways to also embrace it.

At this point, LMND is a buy only if you believe in the long-term vision and that there is not a better entry point in the future. For myself, several times now I’ve looked at my position in LMND and thought about putting in a sell order. If I had done my research, I likely would not have bought LMND originally. Now that I’ve done my research, I would not buy LMND today, but would wait until their tech is more proven. For now, these shares shall remain in my portfolio as a reminder to not get caught in FOMO and to do my own research.

And as always, use my article only as a starting point for your own research. I am not an investment advisor, and this article is not investment advice. Please do your own research before any investment decisions.

Be the first to comment