JHVEPhoto

Sometimes, when you buy into a company, all that is required is some patience in order for things to work out. In other cases, the situation improves rather quickly, resulting in a nice bit of upside. This latter scenario can best be seen by looking at diversified holding company Leidos Holdings (NYSE:LDOS). This firm, which has its hands in the healthcare space, civil infrastructure, and defense, has been doing incredibly well recently. Revenue and profitability seem to be climbing nicely and current guidance, while not great across the board, is far from bad. On the whole, shares with the company are trading either fairly valued or slightly undervalued relative to similar firms. And on an absolute basis, LDOS stock does look affordable at this point in time. Because of this, and in spite of the fact that shares have risen nicely since I last wrote about it, I have decided to retain my ‘buy’ rating on the enterprise for now.

Leidos Holdings’ performance remains strong

The last time I wrote an article about Leidos Holdings was in February of this year. In that article, I called the company an excellent way to play the defense industry. I acknowledged that it had exhibited attractive and consistent growth in the prior few years, essentially making it a paragon of stability. I saw that growth was likely to continue for at least the foreseeable future and I mentioned that shares were cheap compared to the competition and were quite affordable on an absolute basis. On the whole, I felt like the company offered investors with attractive upside potential and, as a result, I ended up rating it a ‘buy’ prospect. Since then, things have gone quite well. While the S&P 500 is down by 3.6%, shares of Leidos Holdings have risen by 10.2%.

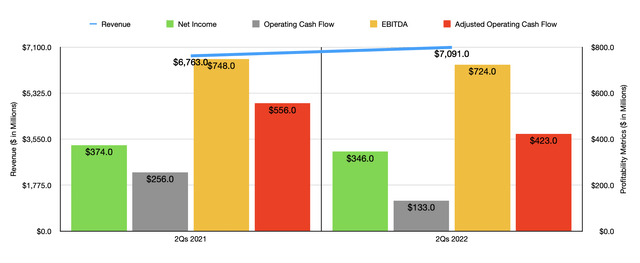

This increase for the company has not been without cause. First and foremost, the company has done well from a fundamental perspective for the most part. Consider revenue. In the first half of its 2022 fiscal year, sales came in at $7.09 billion. That’s 4.8% higher than the $6.76 billion generated just one year earlier. More likely than not, the future for the business will be even brighter. I say this because of multiple contracts awarded to the company, including the decision of the GAO to uphold the award of the $11.5 billion contract for the Defense Enclave Services project that was awarded by the Defense Information Systems Agency back in February of this year. That particular contract includes a four-year base period of performance followed by three two-year option periods for the company, likely granting shareholders a large and steady stream of income.

On the bottom line, things have been less than ideal. Net income weakened in the first half of the year, falling from $374 million last year to $346 million this year. Operating cash flow also declined, dropping from $256 million to $133 million. Even if we adjust for changes in working capital, it would have fallen, dropping from $556 million to $423 million. Even EBITDA took a hit, dropping from $748 million to $724 million over that same timeframe. Even though the company’s gross margin improved somewhat, it did experience some pain associated with its selling, general, and administrative costs. These rose by 26% year over year, climbing from $392 million to $494 million.

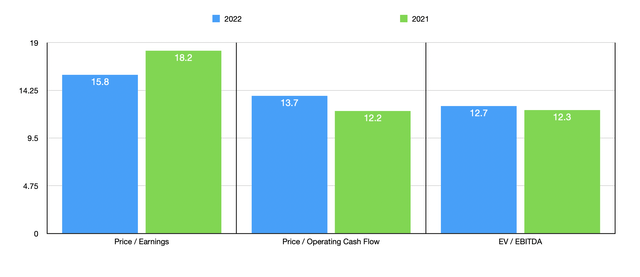

When it comes to the 2022 fiscal year as a whole, management has provided some guidance. For instance, revenue is expected to be between $13.9 billion and $14.3 billion. At the midpoint, that would translate to a year-over-year increase of 2.6%. It’s not exciting, but it’s not horrible either. The current expectation is for earnings per share to be between $6.10 and $6.50. At the midpoint, this would translate to net income of $869.4 million. Operating cash flow should be at least $1 billion, while EBITDA should come in at around $1.47 billion. Using this data, valuing the company becomes a fairly simple task. On a price-to-earnings basis, for instance, the firm is trading at a forward multiple of 15.8. This is down from the 18.2 reading we get if we rely on 2021 figures. The price to operating cash flow multiples should be 13.7. That’s slightly higher than the 12.2 reading we get using 2021 results. But of course, that comes with the caveat that I’m using the $1 billion bottom that management cited for this, since I don’t know what upper range might be anticipated. And the EV to EBITDA multiple should be around 12.7. That’s marginally higher than the 12.3 reading we get using 2021 results.

To put the pricing of the company into perspective, I compared it with five similar firms. Of course, finding perfect comparable firms for a diversified player like this is virtually impossible. So I did the best I could based on the company’s designation. On a priced earnings basis, these companies ranged from a low of 18.1 to a high of 180.6. In this scenario, Leidos Holdings was the cheapest of the group. Using the price to operating cash flow approach, the range was from 8.4 to 24.1. And using the EV to EBITDA approach, the range was from 8.8 to 25.1. In both of these cases, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Leidos Holdings | 18.2 | 12.2 | 12.3 |

| Neilsen Holdings (NLSN) | 18.1 | 8.4 | 8.8 |

| Jacobs Engineering Group (J) | 26.3 | 18.9 | 14.8 |

| Booz Allen Hamilton Holding Corp (BAH) | 23.4 | 17.9 | 15.6 |

| Dun & Bradstreet Holdings (DNB) | 180.6 | 9.5 | 11.9 |

| Transunion (TRU) | 20.9 | 24.1 | 15.1 |

Takeaway

At this point in time, it is clear to me that Leidos Holdings is struggling some from a profitability perspective. But that is relative in the sense that while profits are down, they aren’t down by much. The company still is generating a significant amount of cash and shares are still priced at fairly affordable levels. I wouldn’t expect the same kind of upside relative to the broader market to repeat itself in the near term. But I do think that for the foreseeable future, the company could outperform the market to some degree. And as such, I have decided to keep my ‘buy’ rating on the firm for now.

Be the first to comment