IvelinRadkov/iStock via Getty Images

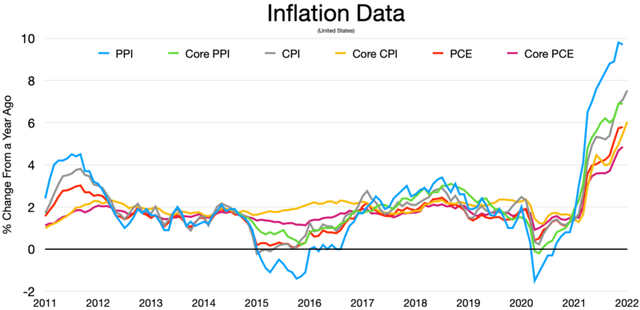

Inflation is soaring. After beginning 2022 at 40-year highs of 7.5%, it has only gotten worse since then. The global economy is facing a perfect storm of lingering COVID-19 related supply chain challenges, massive stimulus payments creating distortions across the economy, and now a war in Ukraine and the sanctions and soaring geopolitical tensions that come along with it.

The war in Ukraine and the accompanying sanctions are particularly problematic, because Ukraine is a major exporter of agricultural resources and software engineering services and Russia is also a major exporter of food and energy resources. This has sent energy and food commodity prices soaring.

Of course, if China, North Korea, and/or Iran – all of which have been increasingly aggressive in exhibiting their military prowess in their respective regions – decide to join Russia in making a move, inflation could spiral even further out of control.

Some are now even predicting the death of globalization and globalism, which could have profound implications for the world economy, including higher prices for finished goods.

A Stark Warning On Inflation

While all this might sound like gloom and doom fearmongering from someone trying to sell you gold and silver, highly respected economist and former Treasury Secretary Larry Summers recently issued a stark warning on inflation of his own, stating:

I think policy is rather overdoing it. The sense of serenity and complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced… We’re taking very substantial risks on the inflation side. The Fed’s idea used to be that it removed the punchbowl before the party got good. Now, the Fed’s doctrine is that it will only remove the punchbowl after it sees some people staggering around drunk…

We are printing money, we are creating government bonds, we are borrowing on unprecedented scales. Those are things that surely create more of a risk of a sharp dollar decline than we had before. And sharp dollar declines are much more likely to translate themselves into inflation than they were historically. In a super permissive fiscal environment, if inflation expectations are allowed to rise, the process of putting them back and restoring normality is likely to be uncontrolled, expensive and costly…

Why on God’s Earth are we projecting that we are going to hold interest rates at zero for three years?…The probability that the Fed achieves the sort of soft landing that it forecast last week, with unemployment at 3.5% for the next three years and inflation falling close to 2%, I think that’s way, way odds off.

Bear in mind that this is someone who served in the Obama and Clinton administrations, is a former President of Harvard University, and was even the Chief Economist of the World Bank with a Bachelor’s degree from MIT and a PhD from Harvard University. He is a Keynesian economist who leans to the left on the political spectrum, so he is likely not motivated to criticize the Biden administration nor to fret about any government intervention in the economy like the Austrian school of economics at places like the Mises Institute is known to do.

For this reason, this stark warning on inflation gets my attention and I think it should get yours too. When someone so well educated and accomplished in economic circles who also has been on the side of cheering for more government economic stimulus and intervention his entire life is pumping the breaks on those very policies, it is truly a sign to sit up and take notice.

If policymakers fail to get their act together soon, it is very likely that inflation could soar even higher, which could be disastrous for investor’s portfolios. Tech (ARKK) has already taken a beating as rising inflation has forced interest rates a bit higher and likely will continue to do so and the S&P 500 (SPY)(VOO) has also seen increased volatility (VIX) in recent months alongside a flat-lining performance.

As a result, we would like to take the opportunity to introduce three of our top inflation-proof dividend stocks for you to consider for further due diligence, which could lead to alpha for your portfolio in the current environment.

#1. Unum Group (UNM)

UNM is a diversified insurance business that operates in the U.S. and internationally and offers a wide range of insurance products via its Unum US, Unum International, Colonial Life, and Closed Block business segments.

In addition to boasting a solid investment grade credit rating with strong liquidity, an attractive dividend yield that is well-covered by free cash flow, solid dividend growth, and an increasingly aggressive share buyback program with shares trading at a deep discount to book value, UNM is poised to benefit from rising inflation and interest rates as well as declining COVID-19 fatalities.

As UNM stated when it reported its Q4 FY2021 results:

For the first time in many years, we released reserves at year-end and were able to pay a dividend to our holding company. This is an example that the funding needs for LTC can turn particularly as interest rates move up. Overall, we wrapped the year with a very strong capital picture.

Meanwhile the forward profitability outlook continues to improve as public health figures are forecasting that the worst of the pandemic appears to be behind us.

Furthermore, rising inflation on the net should benefit the workers compensation business as premiums increase with increased wages from inflation, leading to higher profit margins.

Given that the company remains on strong financial footing, is buying back shares at a pretty solid clip, its profitability outlook is improving, and the company is positioned to benefit from three strong macro themes (rising inflation, rising interest rates, and declining COVID-19 deaths), there is little reason to doubt that dividend growth will continue to be strong in 2022.

In fact, as an analyst pointed out on the earnings call, management looks like they are being conservative with only allocating $200 million towards buybacks in 2022 as they should have substantial cash above that, even after pre-funding other commitments. We recently interviewed the management and had our confidence in the dividend growth story strengthened considerably.

#2. Barrick Gold (GOLD)

Given that inflation rates are soaring and interest rates seem to be taking their time in keeping up, we expect negative real interest rates to remain in place for the foreseeable future. According to recent history, this has proven to be an overwhelmingly bullish indicator for gold prices. Add to that the soaring geopolitical risks and tensions facing the global economy, and the outlook for gold prices looks very rosy.

| Year | Real Interest Rate | Gold Performance |

| 2010 | Clearly Positive | Up Significantly |

| 2011 | Clearly Negative | Up Significantly |

| 2012 | Clearly Negative | Up Significantly |

| 2013 | Clearly Positive | Down Sharply |

| 2014 | Slightly Positive | Down Slightly |

| 2015 | Clearly Positive | Down Sharply |

| 2016 | Clearly Positive | Up Slightly |

| 2017 | Roughly Zero | Up Slightly |

| 2018 | Slightly Positive | Flattish |

| 2019 | Slightly Negative | Up Significantly |

| 2020 | Roughly Zero | Up Significantly |

source: Author’s calculations comparing CPI, Long-term U.S. Interest rates, and Gold Price movements

GOLD offers one of the most attractive risk-adjusted ways to gain access to gold prices as it boasts one of the finest asset portfolios in the world given its focus on tier-1 assets and operating excellence, has a pristine balance sheet, and trades at a discount to its blue chip peers like Newmont (NEM) and Agnico Eagle Mines (AEM).

The company currently trades at 8.19x on an EV to forward EBITDA basis, 22.47x on a price to normalized earnings basis, and 18.8x on a price to free cash flow basis. In contrast, close peer NEM trades at 9.81x on an EV to forward EBITDA basis, 25.01x on a price to normalized earnings basis, and 24.77x on a price to free cash flow basis. Another close peer – AEM – trades at 9.22x on an EV to forward EBITDA basis, 26.47x on a price to normalized earnings basis, and 25.09x on a price to free cash flow basis.

This clear valuation gap – as well as its strong balance sheet and strong free cash flow yield – led management to hike its quarterly base dividend by 11% on its most recent Q4 earnings release, announce a $1 billion share buyback program, and implement a net cash-based dividend policy:

| Performance Dividend Level | Threshold Level | QuarterlyBase Dividend | QuarterlyPerformance Dividend | QuarterlyTotal Dividend |

| Level I | Net cash less than $0 | $0.10 per share | $0.00 per share | $0.10 per share |

| Level II | Net cash greater than $0 and less than $0.5 billion | $0.10 per share | $0.05 per share | $0.15 per share |

| Level III | Net cash greater than $0.5 billion and less than $1 billion | $0.10 per share | $0.10 per share | $0.20 per share |

| Level IV | Net cash greater than $1 billion | $0.10 per share | $0.15 per share | $0.25 per share |

source: GOLD Q4 Earnings Release

This positions the company to deliver rich shareholder capital returns alongside a disciplined investment program for years to come.

We recently interviewed the company’s CFO and found him to be very transparent about the company’s plans and prospects and had our investment thesis strengthened considerably.

#3. Energy Transfer (ET)

Our top pick in the midstream sector, ET has been on a tear lately and we expect it to continue as it remains deeply undervalued relative to its midstream peers like Enterprise Products Partners (EPD), Magellan Midstream Partners (MMP), Enbridge (ENB), Kinder Morgan (KMI), and MPLX (MPLX). Another potential catalysts are that it should have several significant distribution hikes coming up in the near future and also could see a credit rating upgrade from BBB- to BBB.

We expect the company to allocate its massive distributable cash flow yield towards deleveraging the balance sheet, increasing the distribution, and continuing to invest in opportunistic growth projects.

In addition to the cheap valuation, improved unitholder capital return profile, and increasingly strong balance sheet, ET has a well-diversified asset portfolio that is positioned to benefit from inflationary forces for two reasons:

1. Virtually all of its pipeline contracts are indexed to inflation, meaning that a high percentage of its income is directly linked to inflation.

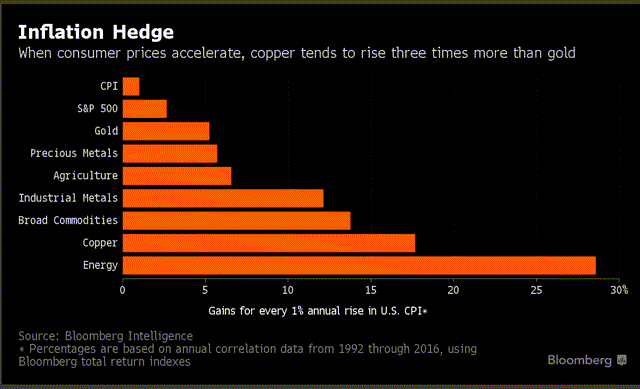

2. Inflation has proven to be a tremendous tailwind on energy prices.

While ET does not have much direct exposure to energy commodity prices, its contracts will be strengthened considerably and the demand for its infrastructure will increase substantially with high energy prices as its clients become financially stronger and are incentivized to increase oil and gas production.

Between its attractive distribution yield and distribution growth potential, improving risk profile, massive multiple expansion potential, and substantial inflationary tailwinds, ET is one of the best ways to invest in a rich income producer while also hedging one’s portfolio against inflation.

Investor Takeaway

Inflation has become a huge problem, so much so that even one of the leading Keynesian economists of our time has begun to side with Austrian economists in opposing the easy money policies of our government and central bankers. If we continue on our current course, Mr. Summers’ dire warning about runaway inflation could come to fruition and investors who are merely invested in S&P index funds like SPY or VOO, or even worse in speculative tech funds like ARKK could see the purchasing power of their portfolios decimated.

As a result, investors might want to consider adding inflation-proof income stocks to their portfolios as an inflation hedge. GOLD, ET, and UNM are three of our top 26 conviction holdings at High Yield Investor that have enabled us to crush the market in the current environment and we believe will continue to fuel our outperformance in the future.

Be the first to comment