cemagraphics

Here at the Lab, we have analyzed Legal & General Group Plc (OTCPK:LGGNF; OTCPK:LGGNY) twice already, and we advise our readers to have a look at our previous publications so that they are well-informed of the story up to now:

- 03/17/2022 – Mare Evidence Lab’s initiation of coverage with a comps analysis versus Aviva plc;

- 08/09/2022 – Half-year results performance.

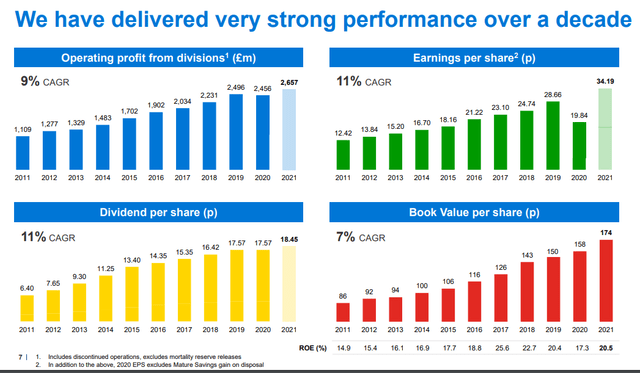

In our last paragraph, we conclude that L&G performances have been consistent and reliable across the cycle. In addition, the company is well-managed and demonstrated a strong track record of profitability during the last 10 years (Fig. 1). Despite the negative ongoing challenges, the half-year results were also a positive confirmation of L&G trends.

Legal & General Group Track Record (Legal and General Fiscal Year Result 2021 (Fig. 1))

In the last several days, L&G stock price performances were not in line with our expectations, and it was a continuous decline day by day.

Legal & General Group Plc Stock Price Development (Yahoo Finance)

What’s going on?

Of course, there are many ongoing tailwinds (energy crisis, interest rate expectation with inflation and economic activities slowdown, etc.) but what happened last week at the Bank of England is something to remember. Firstly, it is worth highlighting that since the appointment of British Prime Minister Liz Truss, the UK stock markets have lost approximately $500 billion. This coupled with the new tax reform has almost caused the collapse of a few British pension funds. Going to the details, Prime Minister Liz Truss has decided to move on with the tax cut and this will inflate the United Kingdom’s deficit to 1972 levels. As a first consequence, this has caused the British Pound to reach a new low level compared to the US dollar and to move the 30-year bond yield to 5% from 3.6%. In a few minutes, this has almost led to the British government bonds’ value held in the Pension Fund portfolio asset side to a massive margin call to fulfill to remain solvent. Such a move was completely unexpected, and pension funds were really under stress, without a sufficient level of liquidity requested by the clearing houses.

This prompted the BoE (Bank of England) to intervene with a purchase program in 13 open market sessions, for a total consideration of £65 billion in order to avoid a collapse of the British pension funds that almost risked a default worth £1.7 trillion.

Prime Minister Truss explained that this is not the time to turn the tide and emphasized how higher taxation is more likely to slow down the British economy. She also adds that “we had to act urgently to grow our economy, and that means making controversial and difficult decisions“. However, her fiscal policy is not shared. For instance, Moody’s Investors Service warned that the plan could cause permanent damage to public finances and reduce growth. The same opinion is shared by the former Bank of England governor Mark Carney, who accused Liz Truss’s decision to cut off the legs of the country’s economy, adding that these will create more damage in the long run.

L&G implication and conclusion

We believe that Mare Evidence Lab’s buy case recap still holds.

Legal & General: Buy Rating Confirmed (Mare Evidence Lab’s Previous Publication)

Today, we would like to add more color to the L&G investment case:

- Interest rate increases coupled with credit spread widening are generating further growth in the L&G’s PRT market (pension risk transfer) because the fund level materially improved (we already experienced that in the HY comment);

- Related to the higher interest rate, L&G’s solvency requirement will benefit from this environment – it is pretty clear looking at the comparison between FY 2021 and HY 2022 results;

- L&G is looking to other geographies to diversify its turnover and is targeting the US;

- The top management commented that it is “confident and comfortable” with its BBB bond portfolio;

- Here at the Lab, we are confident that L&G’s excess capital will be used for higher dividend growth. Looking at the past, earnings growth outpaces shareholder distribution and this trend will reverse;

- The company also confirmed the 2023 outlook and 7.6% dividend yield is a superb margin of safety to reiterate our buy rating.

Be the first to comment