deepblue4you/E+ via Getty Images

Elevator Pitch

I continue to retain a Hold investment rating for Lear Corporation’s (NYSE:LEA) stock. I evaluated LEA’s financial performance for the third quarter of last year in my earlier November 12, 2021 update for the stock. I touch on Lear Corporation’s recently disclosed above-expectations Q2 2022 financial results with this latest article.

LEA’s better-than-expected Q2 2022 financial results have been overshadowed by the weak financial performance of one of its automotive supplier peer and worries about the impact of a recession on the auto market. In addition, Lear Corporation’s current P/E valuations aren’t very attractive compared to its historical averages. In conclusion, a Hold investment rating for Lear Corporation is reasonably fair in my view.

Lear Corporation’s Revenue And Earnings Beat For Second Quarter Were Encouraging

Lear Corporation’s bottom line for the recent quarter was much weaker as compared to its earnings achieved in the quarter a year ago, which was to be expected, considering the challenging operating environment for the automotive industry. But LEA managed to beat market expectations with its financial performance for Q2 2022, and its share price actually rose in the two trading days post-results announcement.

LEA issued a media release on August 2, 2022 before trading hours announcing its Q2 2022 financial results.

Lear Corporation’s top line rose by +7% from $4,761 million in the second quarter of 2021 to $5,071 million in the recent quarter, which came in +1% higher than the market’s consensus projection of $5.01 billion. In fact, LEA’s YoY revenue growth for Q2 2022 would have been even higher at +8%, if adjusted for effects relating to “foreign exchange, commodities and acquisitions” as indicated in its second-quarter results press release.

In terms of the bottom line, LEA’s non-GAAP adjusted earnings per share or EPS fell by -27% YoY from $2.45 in Q2 2021 to $1.79 in Q2 2022. Lear Corporation mentioned at its second-quarter earnings briefing on August 2, 2022 that “the decline in (core operating) margins (from 4.9% in Q2 2021 to 3.7% in Q2 2022) reflected primarily higher commodity costs and the impact from the strengthening dollar.” However, it came as a positive surprise that Lear Corporation’s actual Q2 2022 adjusted EPS turned out to be +24% better than the consensus bottom line estimate of $1.44 per share.

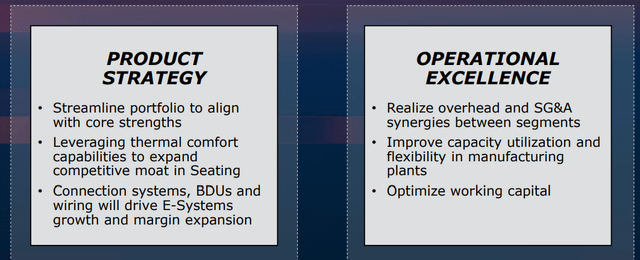

Lear Corporation’s efforts to improve its operational excellence and product strategy, as indicated in the chart below, have paid off. LEA specifically noted at its Q2 2022 investor call that its initiatives in these key areas have “offset about two-thirds for the commodity headwinds” in the last two years.

LEA’s Initiatives In The Areas Of Product Strategy And Operational Excellence

Lear’s Q2 2022 Earnings Presentation

There were also other positive short-term factors at play for LEA. At its most recent quarterly results call, Lear Corporation noted that a more favorable product mix and earlier-than-expected negotiations with certain clients on cost recovery issues were supportive of the company’s higher-than-expected earnings for Q2 2022.

The above-mentioned allowed Lear Corporation to achieve better-than-expected profitability in the most recent quarter.

Investors were clearly pleased with LEA’s EPS beat. Lear Corporation’s stock price increased by +2.5% from $151.36 as of August 1, 2022 to $155.21 as of August 2, 2022, before rising by an additional +0.7% to close at $156.23 at the end of the August 3, 2022 trading day.

Worries About Negative Effects Of Recession Won’t Go Away

The happiness for LEA’s shareholders didn’t last that long. On August 4, 2022, Lear Corporation’s shares corrected by -5.3% to end the trading day at $148.00, which is below where the stock traded at ($151.36 as of August 1, 2022) prior to its Q2 2022 earnings announcement.

Lear Corporation’s poor share price performance on August 4, 2022 is very likely linked to the disappointing results of its automotive supplier peer, Aptiv PLC (APTV). APTV’s shares fell by -9.7% on August 4, 2022, after its normalized EPS for the second quarter of 2022 came in -64% below the Wall Street analysts’ consensus bottom line forecast. Aptiv revealed at its most recent quarterly earnings call that it “did start to see decreases in European production schedules” in Q2 2022 which it attributed to both “macroeconomic concerns” and “supply chain constraints.” Poor economic conditions are most probably going to hurt the automotive industry, and LEA is unlikely to able to emerge unscathed from a downturn in the auto sector.

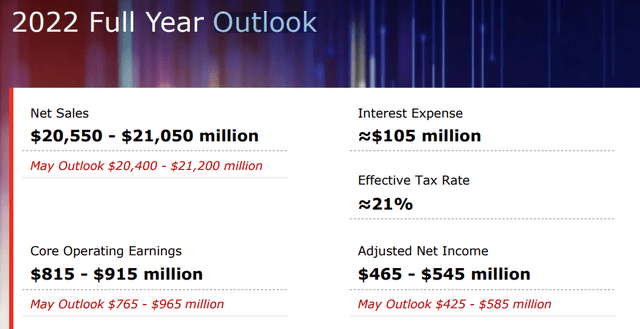

LEA’s Updated Full-Year FY 2022 Management Guidance As Of Early-August 2022

Lear’s Q2 2022 Earnings Presentation

As highlighted above, Lear Corporation has chosen to leave the mid-point of its net revenue, core operating profit, and normalized net profit guidance for full-year fiscal 2022 unchanged, even though it provided narrower guidance. The sell-side analysts have gone with LEA’s guidance, forecasting net sales, core operating income, and non-GAAP adjusted earnings of $20.9 billion, $868 million, and $521 million, respectively for the current fiscal year as per S&P Capital IQ consensus data.

In other words, there could be negative surprises in store for LEA. The bear case scenario will see headwinds relating to a decrease in volume as a result of weaker-than-expected economic growth outweigh the positives associated with an improvement in commodity costs and supply chain issues.

More importantly, Lear Corporation’s current valuations don’t seem to have priced in recessionary economic conditions yet. According to valuation data sourced from S&P Capital IQ, LEA used to trade between 6 times and 13 times consensus forward next twelve months’ normalized P/E between the beginning of 2011 and the end of 2019. In comparison, the market values Lear Corporation at a consensus forward next twelve months’ normalized P/E multiple of 11.8 times now, which is at the high end of its historical P/E valuation range.

Concluding Thoughts

I rate Lear Corporation as a Hold. On one hand, I am encouraged by LEA’s ability to deliver above-expectations results in tough times like these. On the other hand, Lear Corporation’s valuations have not factored in the headwinds relating to a recession, and potential earnings misses in subsequent quarters are key downside risks for the stock.

Be the first to comment