Feverpitched

Finding the right balance with an investment opportunity can be rather difficult. As an example, you might have a business that is fundamentally not the best about that simultaneously is trading at a low multiple. On the opposite end of the spectrum, you might have a company that’s trading at a rather lofty price but it is a high-quality operator where the premium might be worth it. The first example here makes me think of Lazydays Holdings (NASDAQ:LAZY), an operator of RV dealerships that has fared reasonably well from a share price perspective as of late but has been generating mixed financial results as well. Ultimately, I do acknowledge that there are healthier prospects on the market to be had at this time, including firms that focus on the recreational vehicle market. But given how cheap shares are, it would take a further deterioration of business for me to turn bearish on the company.

Attractive but not attractive at the same time

Near the end of September of this year, I wrote a follow-up article in an attempt to reevaluate the investment worthiness of Lazydays Holdings. In that article, I talked about how the company had done well to grow its sales over the prior few months. At the same time, however, I also mentioned that the company’s attractive sales growth was accompanied by weakening profitability. Though it was also true that financial performance issues on the bottom line were, at that moment, largely the result of one-time things and the decision by management to spend more on advertising. Given all of these factors, I felt as though the company, especially given how cheap shares were, warranted a ‘buy’ rating to reflect my opinion that it should outperform the broader market for the foreseeable future. Since then, the company has not performed exactly according to plan. But at the same time, performance hasn’t been awful either. While the S&P 500 is up 9.2%, shares of Lazydays Holdings have generated upside of 6.7%.

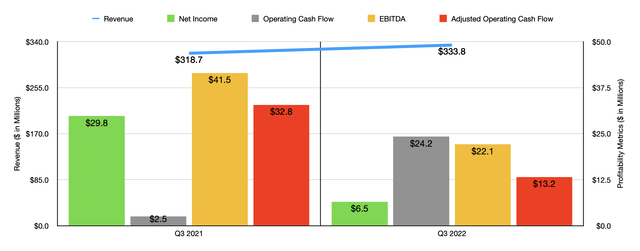

To see why this performance has been favorable, we need only look at data covering the third quarter of the company’s 2022 fiscal year. After all, this is the only quarter for which new info is available that was not available when I last wrote about the enterprise. During the third quarter, sales came in at $333.8 million. That’s 4.7% higher than the $318.7 million reported in the third quarter of 2021. The vast majority of this growth was driven, according to management, by revenue from new and pre-owned vehicles growing by 5.2% year over year. On the new vehicle side, growth of 12.2% was thanks largely to a rise in the average selling price per unit and by an increase in the number of new units sold from 2,192 to 2,377. The average selling price increase, meanwhile, was from $82,800 to $85,500. On the pre-owned vehicle side, sales actually dropped by about 6.8%, largely because of a decrease in the average selling price of units from $70,900 to $68,000. At the same time, however, the number of units sold under this category dropped from 1,417 to 1,335.

Even though revenue increased, the company did experience some issues with profitability. Net income plunged from $29.8 million to $6.5 million. Normally, you would have expected the sales growth to help the company in this regard. But unfortunately, the company faced pressures elsewhere. Increased costs from manufacturers and the aforementioned lower pricing for used units sold, were both excellent reasons why the company saw a decline in its gross profit The firm also increased its selling, general, and administrative costs to the tune of 15.5% year over year. Other profitability metrics though were a bit mixed. As an example, operating cash flow actually shot up from $2.5 million to $24.2 million. But if we adjust for changes in working capital, the metric would have fallen from $32.8 million to $13.2 million, while EBITDA was cut nearly in half from $41.5 million to $22.1 million.

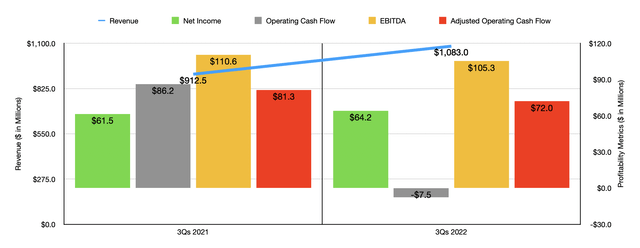

The volatility experienced during the latest quarter has been part of a larger trend. For the first nine months of this year, as an example, sales of $1.08 billion beat out the $912.5 million reported the same time last year. In this case, net income actually still managed to grow, inching up from $61.5 million to $64.2 million. But when it comes to other profitability metrics, the picture has been less than ideal. Operating cash flow drop from $86.2 million to negative $7.5 million, while the adjusted figure for this dropped from $81.3 million to $72 million. Even EBITDA took a step back, inching down from $110.6 million to $105.3 million.

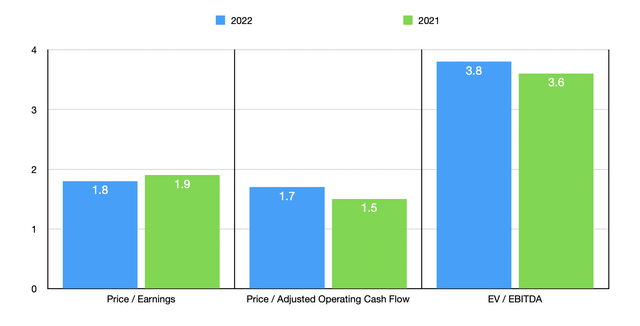

When it comes to the 2022 fiscal year in its entirety, we don’t really know too much of what to expect. Simply annualizing results seen so far for the year would give us net income of $80.6 million, adjusted operating cash flow of $85.5 million, and EBITDA of $138 million. Based on these figures, the company is trading at a forward price-to-earnings multiple of 1.8. The forward price to adjusted operating cash flow multiple is 1.7. Also, the EV to EBITDA multiple for the company should come in at 3.8. As you can see in the chart above, this pricing is not radically different from what we would get if we use data from 2021. Also, as part of my analysis, I compared the company to five similar businesses. On a price-to-earnings basis, these companies range from a low of 4.4 to a high of 126.7. The price to operating cash flow multiples of these companies was from 3.5 to 11.4. In both of these cases, our prospect was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 3.1 to 18.8. And in this case, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lazydays Holdings | 1.8 | 1.7 | 3.8 |

| Winnebago Industries (WGO) | 4.5 | 3.5 | 3.1 |

| Thor Industries (THO) | 4.4 | 5.0 | 3.4 |

| LCI Industries (LCII) | 5.4 | 7.5 | 4.5 |

| Camping World Holdings (CWH) | 6.1 | 11.4 | 4.8 |

| REV Group (REVG) | 126.7 | 7.4 | 18.8 |

Takeaway

Fundamentally speaking, Lazydays Holdings leaves a great deal of improvement to be had. The company is growing nicely, but bottom line results are problematic. Part of this has to do with management’s own spending on spending activities. But there is no denying that higher costs are also eating away at margins. if shares weren’t as cheap as they are today, I might even be tempted to take a negative stance on the business. But because the stock does look very cheap on both an absolute basis and relative to similar firms, I do think that it still warrants a soft ‘buy’ even after rising over the past few months.

Be the first to comment