peshkov/iStock via Getty Images

The way the management of Laredo Petroleum (NYSE:LPI) has opportunistically pursued acquisitions, shareholders will likely benefit significantly from a continuation of the strategy. So far, the debt ratings of the company debt have increased while the percentage of oil produced has also risen. Profitability is likely to make a big jump this year aided by both far stronger commodity prices and the management acquisition strategy.

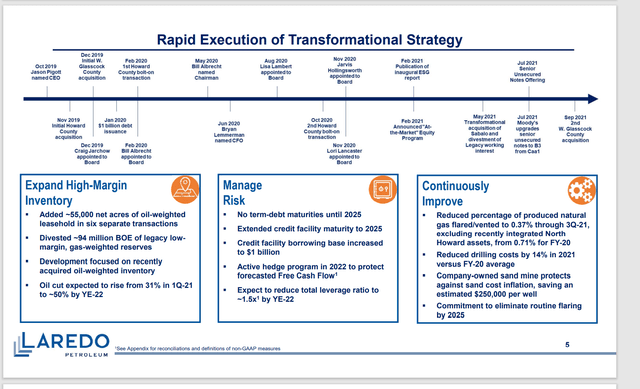

Laredo Petroleum Transformational Acquisition Strategy And Management Changes (Laredo Petroleum January 2022, Corporate Presentation)

The key to this strategy is the acquisitions that were made of acreage that was too small to really be considered a sufficient size for the market. Management has pieced together smaller locations with an occasional larger location to come up with a significant position in more profitable areas.

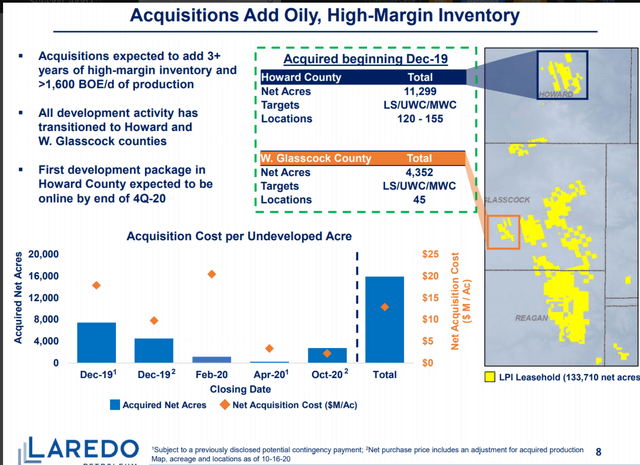

Laredo Petroleum Summary Of Small Acquisition Costs (Laredo Petroleum November 2020, Corporate Presentation)

The smaller acquisitions made (like the ones shown above) tend to be safer because they are easier to integrate. Because the small acreage positions are a specialized market, there is less competition for the acreage. A company like Laredo can profit from small “bolt-on” acquisitions. The discount from the “going price” for small acreage positions is likely to persist well into the future. Few managements want to do what this management did by purchasing enough small positions to combine into one very marketable position.

The discount pricing for small acreage positions is likely to persist. This management is in a position to shop for “bolt-on” positions while avoiding the competitive pricing of far larger acreage holdings. It is significant for management to grow the acquired acreage with acquisitions of 5,000 acres or less. Even though sales prices will rise in an improving commodity price market, the discounts that small positions sell at should allow for accretive purchases. Therefore, small and sub-optimal lease size acquisitions can be done during just about any part of the industry cycle. Bolt-on acquisitions can be extremely profitable anytime when they are small positions.

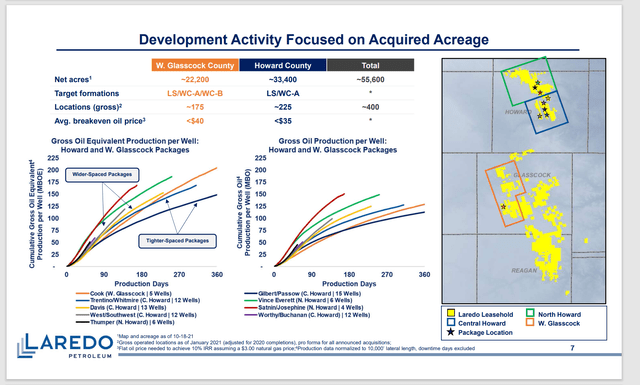

Laredo Petroleum Acquired Acreage Performance Characteristics And Location Map (Laredo Petroleum January 2022, Corporate Presentation)

The end result is the highly desired (largely) continuous position in some very desirable areas that management highlights. Now the best part about this is shareholders have gained considerable value through the work management did to piece together smaller acreage holdings into the present situation shown above. Small positions properly combined are worth far more in a marketable large piece as shown above.

The latest company March 2022 corporate presentation goes into far more detail on this. The results shown are not that significantly different. However, the company on several slides is showing improvement over the previous fiscal year as expected. I picked the slide above because there is a summary of all the acquired acreage on one slide.

Shareholders will also benefit from the ability of management to drill longer horizontal wells in the combined holdings. The net result is shown above in the lower left-hand corner. The Howard County wells are tremendously profitable because they produce roughly 200,000 barrels of oil in the first year. Most companies I follow wish they could report that result.

But in the meantime, the Western Glasscock County wells are going to be decently profitable as well. The production shown for these wells is slightly lower but still far above the average well production of the companies I follow.

The best part about these acquisitions is the low breakeven prices shown above. This gives the company a flexibility it did not have on the legacy acreage. Rising natural gas prices have definitely aided the profitability of the production on the legacy acreage. But now there is some flexibility for management to produce more or less oil as is dictated by market conditions. That will help future average profitability considerably.

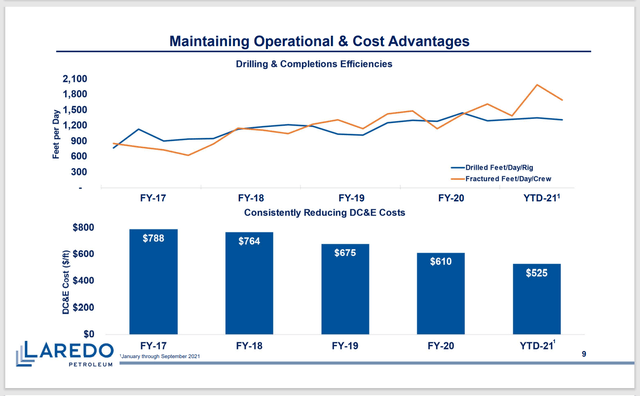

Laredo Petroleum Well Cost Progress (Laredo Petroleum January 2022, Corporate Presentation)

In the meantime, management is making some solid progress that will also improve the profitability of the legacy acreage. Long-term followers of the company may remember that the criticism of the previous management was not that the property was unprofitable, it was that management did not have a good handle on costs (up and down the line). This management has clearly been taking to heart that costs need to come under control and stay under control.

What that means is the “slimming down process” that the relatively new management has pursued has made the legacy acreage increasingly profitable at various industry pricing points. The acquired acreage will benefit as well. As a result, that acquired acreage retains a profitability advantage. The key here is that the legacy acreage probably has a value that was not the case when management had a higher cost operating environment.

This is an industry where costs continuously head downwards. That is unlikely to change in the future. So, management appears to be getting into place a cost control program that would allow the company to keep up with the competition. Before this, previous management had a reserve strategy combined with lots of experimenting that left the company poorly placed for an industry downturn. The increase of the debt rating appears to signal that the past is not going to happen again.

Of course, it goes without saying that the company will also likely work on well completion and hence initial flow rates to enlarge the first year recovery of commodities. The comprehensive program pursued by management is going to make this company a very different one going forward than was the case in the past.

Normally a typical investment strategy would be to assume that the company will bypass previous stock price high points by the amount of inflation. The moves made by management may make that a conservative assumption.

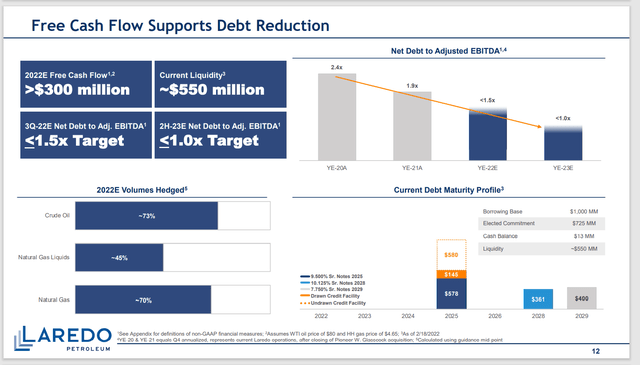

Laredo Petroleum Has A New Debt Reduction Strategy (Laredo Petroleum March 2022, Corporate Presentation)

Management has definitely improved the debt due profile enough for the company to engage in small acquisitions. Shareholders should therefore expect that small acquisitions should occur in the current fiscal year.

Admittedly, the strong commodity price atmosphere is likely to make the acquisition strategy go much slower than was the case when the strategy began. But as noted before, reduced prices of smaller, bolt-on, acreage positions should allow the strategy to continue. The market is concerned about the relatively small amount of acreage management owns. But management will be actively looking for expansion opportunities. Management is likely to find those opportunities over time.

Most likely any extra cash flow generated by the strong commodity price environment would go to repay bank debt. That would increase liquidity to fund any bargain acquisitions that become available.

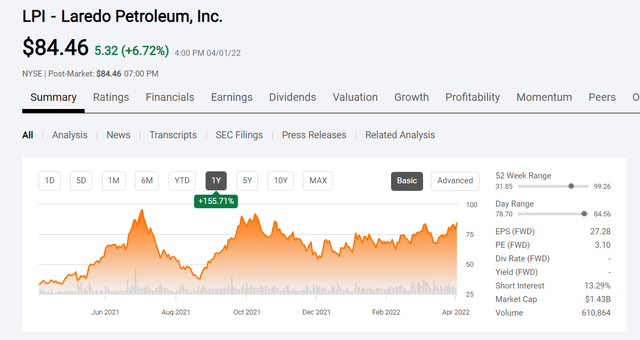

Laredo Petroleum Stock Price History And Key Valuation Metrics (Seeking Alpha Website April 3, 2022)

The stock price reached a peak in the second quarter of fiscal year 2021 that it has not surpassed since then. Mr. Market is likely waiting for proof that the acquisitions are “pulling their weight”. That proof is likely to begin with the fourth quarter report.

This is a company that has the ability to earn at least $5 per quarter per share in fiscal year 2022. If the currently strong pricing persists, that per share figure could end up significantly higher. So, the forward price-earnings ratio is pretty low. Such a forecast would represent an abrupt change from the immediate past.

Generally, material acquisitions to a company lead to market demands for history as the company is now organized (complete with the acquisitions). Such history will not take any dramatic action by management. Management clearly acquired good acreage and the results should bear it out. Any reasonable result is likely to lead to a considerably higher stock price than the current price. More accretive acquisitions would continue to improve the future outlook. This new management appears to have the company properly structured for more accretive acquisitions.

Good management usually surprises on the upside. There is currently a lot of new acreage to provide considerable upside. This management is likely to add to that potential over its tenure. That makes this stock one of the more undervalued companies that I follow.

Be the first to comment