bjdlzx

(Note: This article was in the newsletter on September 12, 2022.)

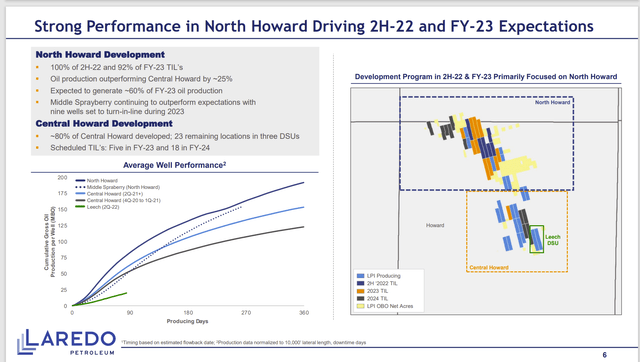

And that same Laredo Petroleum (NYSE:NYSE:LPI) management came up with a princely deal. The Howard County acreage has been a sorely needed gift for some time. That is likely to remain the case even with the latest news that was unfavorable about a 6 well package. The wonderful thing about averages is some come in below average, and some come in above average. You would never know that from the reaction of the market. As long as that continues, this deal will be worthy of any prince.

This happened when so many managements claim they can kiss a toad successfully while shareholders end up with a backyard full of the little critters instead of the promised princely deal.

One of the indications that management was on to something was the announcement of some non-operated acreage (1650 acres to be exact) to Northern Oil and Gas (NOG) for $110 million (and adjustments). Just how good this is can be compared to the purchase price of $710 million (and adjustments) for 30,000 Howard County acres about a year earlier in May 2021.

A series of transactions like this demonstrates how opportunistic optimization of the portfolio adds value to the company results. There are times to buy and times to sell. Patience in this industry is often worth a lot of money.

Market Worries

In the meantime, Mr. Market has been worried about the Leech (a 6 well pad) results:

Laredo Petroleum Howard County Well Results (Laredo Petroleum September 2022, Investor Presentation)

These fears are way overblown. For starters, most managements give out average expected results for a reason. That reason is that little surprises like below average results happen. Management notes that they have gained some Middle Sprayberry locations that were not part of the reserve reports in the past. Along with that there may be some acreage that either will not live up to expectations in an interval (or even multiple intervals) while management gained some reserves elsewhere.

Generally, technology keeps moving forward in oil and gas. I still remember when the unconventional business was not a thought. Then the business became viable at relatively high prices. But technology kept going and I believe it will continue to advance. Therefore, acreage that poses difficult challenges today may become tomorrow’s Tier one acreage.

Management keeps estimating about 8 years of drilling inventory. But that same management keeps adding locations for potential wells in the future. For as long as I have followed this industry, drilling possibilities rarely if ever decline over time. Sometimes advancing technology is a little slow providing answers to current challenges which means we go through a period of high oil prices. But the fact remains that we have produced very little of the earth’s resources. Therefore, investors can expect drilling possibilities to keep climbing over time to offset production. Future growth is likely to be slower than the past. But growth still appears to be an industry future.

So, we are nothing close to running out of anything. The only question that is reasonable is the future cost to get some of these resources. The future cost keeps coming down and over time I believe it will continue to come down.

Laredo Petroleum’s Free Cash Flow Effect

That well pad that concerns the market will likely continue its already dismal trend. Whether management can rework the wells or do something to fix the situation remains to be seen. Many times, information on these types of things is available through the service companies as they often transmit solutions found elsewhere.

But what the market forgets is there are already plenty of out-performing locations that will likely at least bring the fiscal year to an average expected by management. Now timing is such that management may adjust at least a quarter (or two) for the unexpected results. But the long-term picture has probably not been affected materially by one result. Lost in the conversation is that well productivity has been climbing in the industry and keeps climbing. Simple technology advances alone can wipe out a disappointing well package with better production from those advances.

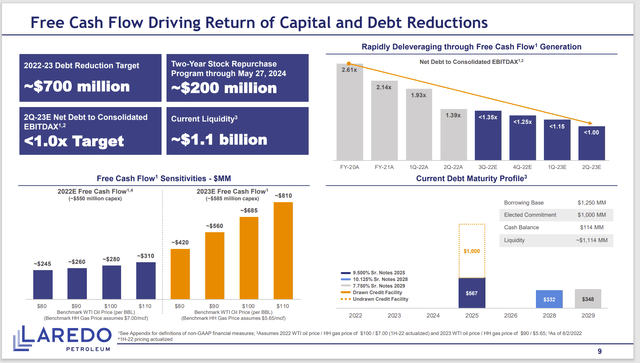

Laredo Petroleum Free Cash Flow And Debt Guidance (Laredo Petroleum September 2022, Corporate Presentation)

Probably the assumption of average commodity selling prices will have far more effect on the company cash flow fortunes than any one set of well pads.

The common stock is suffering from a historical reverse split combined with a management that used to be far more happy experimenting on acreage that was nothing nearly as profitable as the current acreage.

The bond market has already recognized the improved cash flow. But Mr. Market is still smarting from past moves. It is going to take some time to get used to the results of the higher average percent of oil production. But most investors have plenty of time for that kind of good news.

The other consideration is shown in the slide above. Management promised a more flexible hedging program as the debt situation improved. Proof of that is the change in free cash flow in the next fiscal year. Sooner or later, Mr. Market will take notice of that free cash flow difference at each pricing level.

As long as drilling continues on the oil-rich leases, then the percentage of oil produced will continue to climb. Management has also included a slide showing a steady improvement in the amount of well activities completed. As drilling times (for example) improve, then cost per foot declines. This company also has its own sand source to save quite a bit of money for the next several years.

LPI’s Potential

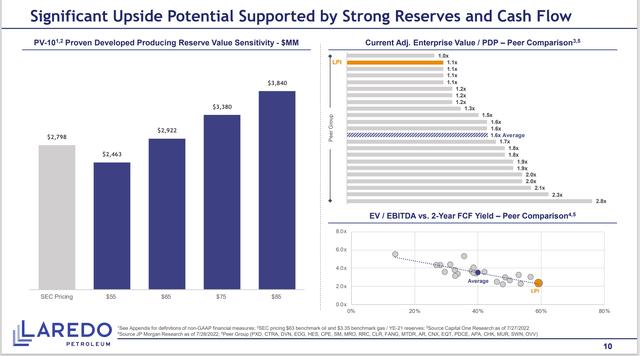

That means as management establishes a different track record from the past, the stock price is very likely to respond.

Laredo Petroleum Enterprise Valuation Comparison Using Free Cash Flow Yield (Laredo Petroleum September 2022, Investor Presentation)

The company finds itself in an unaccustomed place. It is currently generating far more free cash flow than was the case in the past by drilling wells on acreage that has a much lower breakeven than was the case in the past.

Mr. Market is not exactly one to reward changes promptly. Generally, Mr. Market wants a track record. The company is very likely to provide that track record by continuing to drill on the most profitable acreage first. The current available locations that will last 8 years provide management with plenty of time to decide the next strategic move.

More importantly, the legacy acreage is profitable at current commodity prices and a hedging program can ensure adequate returns on that acreage should management choose to take that path. The years of inventory at current prices are not mentioned because that legacy acreage is not nearly as profitable as the new acreage.

Some additional years will happen (with the new acreage) by continuing to unlock new intervals as was the case so far with the Middle Sprayberry. But there is no reason that management will not continue to optimize the portfolio while looking for some deals. The expansion into places like Howard County began with small acreage purchases that by themselves were too small to really be cost efficient or even viable. Those have now been combined with other purchases to make a far more profitable situation. Shareholders can expect management to continue to build upon the situation as chances appear.

In the meantime, the legacy acreage is definitely profitable to develop in the current environment. Management has a goal of a lower breakeven than is currently estimated for that acreage. Continuing technology improvements will likely make such a goal realistic for that acreage.

The other thing is that the unconventional business is very young. Therefore, recovery rates are estimated at relatively low levels when compared to the conventional business. That will likewise change as technology continues to advance. This will give new lives to some older producing wells through potential reworks.

In short, the market has a lot of worries about this stock that the current management can easily overcome. This management recently demonstrated its savvy through the sale of some non-operated acreage.

Usually, management is the best asset that shareholders can have that is not on the balance sheet. It is also the asset that the market generally undervalues. That probably makes for a lot of upside potential as this management continues to bring good deals to the attention of shareholders.

Be the first to comment