bymuratdeniz

Laredo Petroleum (NYSE:LPI) took a hit after it reported poor early production performance from its six well Leech package. This resulted in Laredo reducing its oil production guidance for 2022 by around 6% at guidance midpoint, which reduced its free cash flow projection for 2022 by around $70 million.

Laredo still looks capable of generating over $750 million in positive cash flow in 2022 and 2023 combined at current strip prices. While its rate of debt paydown is a bit slower than I projected before, it still should be able to pay off its credit facility debt and redeem its 2025 notes via cash on hand by early 2024.

I’ve reduced Laredo’s estimated value to a range of $72 to $89 with long-term $70 WTI oil and $3.50 NYMEX gas. This is $10 lower than my previous valuation estimate and reflects the impact of the poor Leech package performance and some uncertainty around the future performance of nearby DSUs.

Leech Wells

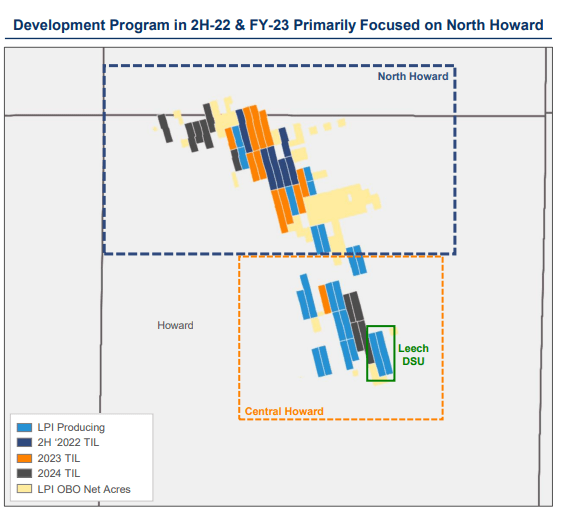

Laredo’s drop in share price can largely be attributed to the poor results from its six well Leech package. These wells are 15,000′ Wolfcamp A wells that are on the southeastern edge of Laredo’s Central Howard acreage.

Laredo considered the Leech DSU to be its highest-risk Howard County DSU due to its location in an area with weaker rock quality. It tried to mitigate this by not codeveloping the Lower Spraberry along with the Wolfcamp A in the Leech DSU as well as using wider spacing for its Wolfcamp A wells.

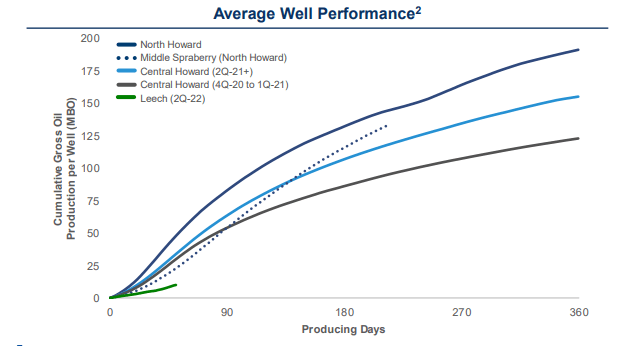

Despite this, the initial results have been quite poor. The Leech wells have produced around 70% less oil per well (adjusted to 10,000′ laterals) after 50 days of production compared to Laredo’s average Central Howard well from Q2 2021 onward.

Laredo’s Well Performance (laredopetro.com)

If that trend continues, the 15,000′ Leech wells will end up producing only around 70,000 barrels of oil per well after one year. These wells are also unlikely to pay off within two years at $90 WTI oil, although the related capex is a sunk cost.

Laredo did note that the westernmost Leech wells performed better than its eastern Leech wells, so there is some hope that Laredo’s remaining Central Howard locations will have much better production results.

Since the nearest DSUs to Leech aren’t scheduled to be turned-in-line until 2024, Laredo’s 2023 production targets probably aren’t at risk. However, it does also mean that it will take a while before we find out whether those DSUs will also produce relatively poorly.

Laredo’s Howard County Acreage (laredopetro.com)

Updated 2022 Outlook At Current Strip

The current strip for 2022 is now in the high-$90s for WTI oil. At that price, Laredo is now projected to generate $1.886 billion in oil and gas revenue with its revised guidance, while its hedges would have negative $529 million in value.

Laredo reduced its oil production guidance midpoint by 2,500 barrels and its total production guidance midpoint by 1,250 BOEPD. It now expects to average 82,750 BOEPD (47% oil) production during 2022, compared to its previous guidance for 84,000 BOEPD (49% oil).

The majority of the reduction in guidance appears to be due to the underperformance of the Leech wells, although excluding the Leech adjustments its oil production still looked to be trending towards the lower end of its original guidance range.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 14,052,500 | $98.50 | $1,384 |

| NGLs | 7,994,869 |

$31.00 |

$248 |

| Natural Gas | 48,938,288 | $5.20 | $254 |

| Hedge Value | -$529 | ||

| Total Revenue | $1,357 |

Laredo has maintained its capital expenditure budget at $550 million for 2022 after previously increasing it from $520 million. Lease operating expenses have crept a bit higher to $5.70 per BOE.

This results in a projection that Laredo can generate $274 million in positive cash flow in 2022 at current strip prices.

| $ Million | |

| Lease Operating Expense | $167 |

| Production and Ad Valorem Taxes | $122 |

| Marketing and Transportation | $52 |

| Cash G&A | $70 |

| Interest | $122 |

| Capital Expenditures | $550 |

| Total Expenses | $1,083 |

Notes On Debt And Valuation

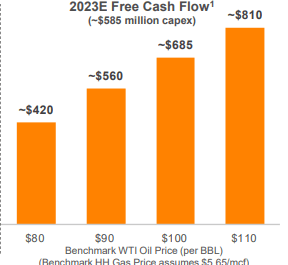

The current WTI strip for 2023 is around $85, which is a level at which Laredo could generate around $490 million in positive cash flow. This would result in it ending 2023 with approximately $640 million in net debt, not including the effect of spending on further share repurchases. Laredo is aiming for low-single digits oil production growth in 2023 with a $585 million capital expenditure budget.

Laredo’s 2023 Free Cash Flow (laredopetro.com)

I had previously estimated Laredo’s value at $82 to $99 per share in a long-term $70 WTI and $3.50 NYMEX gas scenario. I am now revising this estimate down by approximately $10 to a new range of $72 to $89 per share. These long-term commodity prices may be on the conservative side, given that WTI oil strip is above $70 until 2027 currently.

Part of this downward revision in Laredo’s estimated value is due to the weak performance of the Leech DSU, while the other part is due to the uncertainty around the future performance of some of Laredo’s other Central Howard locations.

Conclusion

Laredo Petroleum’s Leech wells have significantly underperformed so far, and that has resulted in a downward revision to Laredo’s 2022 production and free cash flow guidance. Despite this, Laredo still looks capable of generating over $750 million in positive cash flow in 2022 and 2023 combined.

While I have reduced my estimate of Laredo’s value, it still appears to be a reasonably good value at its current share price.

Be the first to comment