Orietta Gaspari/E+ via Getty Images

Before we go deeper, let’s have a brief look at the retail market

E-commerce: several years of progress in a few months creates a disruptive effect on the retail market but it can be temporary

Surely every one of us understands that e-commerce has become a key trend of 2020 and 2021, especially this is true for the European market where governments of almost all countries tried to overcome the pandemic with the help of quarantines and various types of restrictions. Since almost everyone already knows that the central part of sales has flowed into e-commerce in 2020/21, let’s look at a couple of facts and try to understand what is happening with sales now.

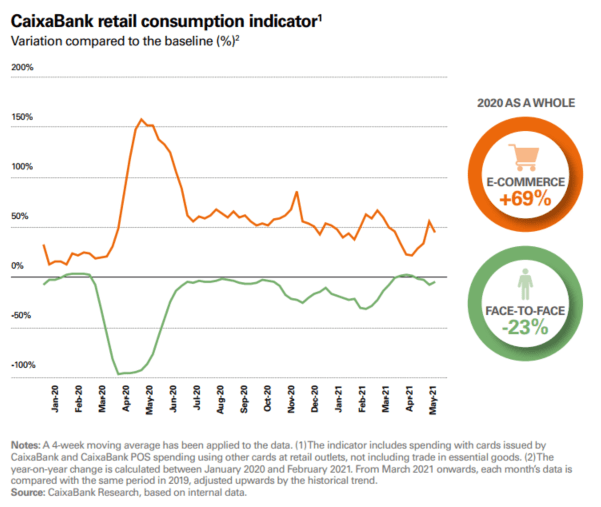

First is a retail consumption indicator: “face-to-face” against e-commerce sales.

As we see, there is the opposite peak in consumption in 2020, but at the same time, we have a clear trend towards the recovery of offline sales deeper in 2021. Although new restrictions because of the SARS-CoV-2 Omicron Variant can again boost online sales, it is clear that offline shopping survived, and so will retail.

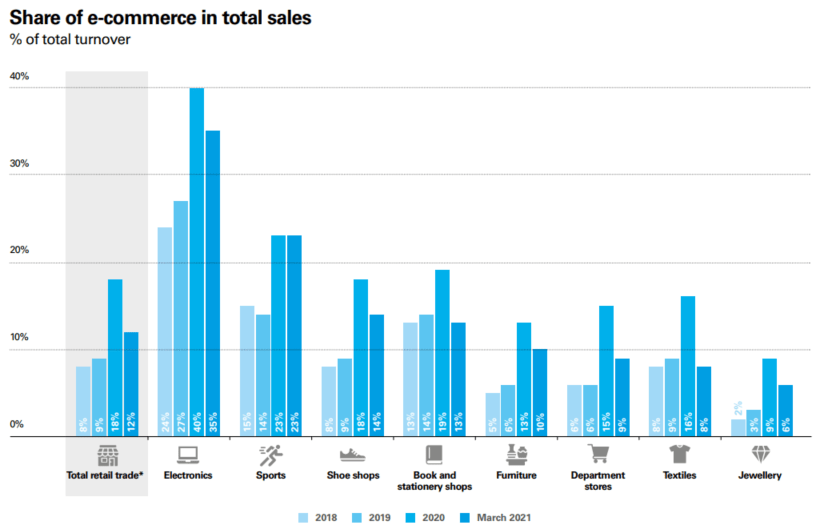

Another interesting chart to look at – share of e-commerce in total sales.

The same trend is here – rocket growth in 2020 and a significant decline in 2021 in the total retail trade. However, some branches are returning to 2019 levels, especially department stores, clothes (fashion), and jewelry. The rest of the branches of activity, part of the extraordinary gains made in 2020, was still visible in March 2021, to some extent suggesting a possible change in consumption patterns.

In conclusion, e-commerce has shown enormous growth as a share of retail sales. However, it is too early to judge how much of this structural change will dissipate once we get over the health crisis. The whole retail sector should adapt in terms of tenants (for instance, fashion, food, and department stores branches) and GLA usage, having in mind new strategic directions where offline is a “must” requirement.

The retail market suffers because of restrictions while supermarkets flourish

There is an exception to the rule – supermarkets and small street retail. The street retail sector proves its sustainability and demand from investors, tenants, and buyers. According to KF Q2 2021 Snapshot more than 70% of all investments in Spain were made in the high street retail and the supermarket segments. Analysts from JLL give similar views in Q3 2021. The most important indicator of commercial real estate – cap rate – shows that increasing yields continue. Prime yields have risen ten basis points on the High Street (~3.45%) and 15 bps in shopping centers (~5.3%). Still, retail parks and supermarkets stay stable in comparison with 2018-2020 years (~5.5%).

These years, retail is a challenging sector, but a selective approach may give lucrative returns

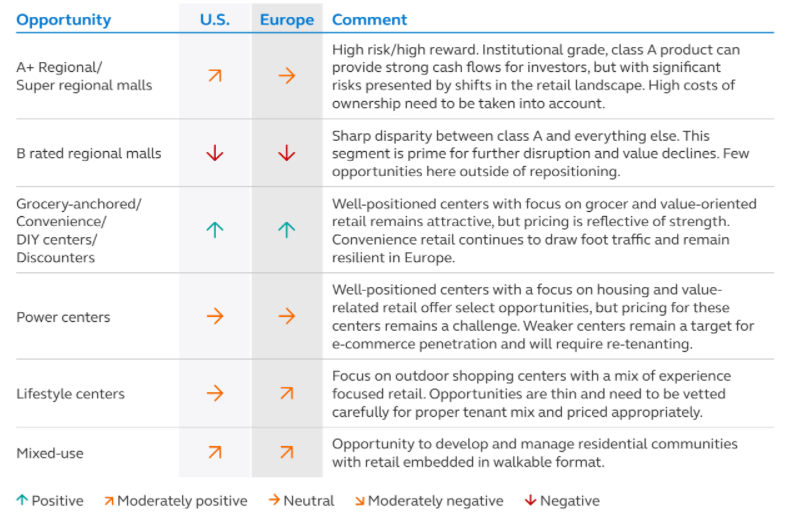

In general, the retail market remains vulnerable in the short term concerning the restrictions that may appear due to new mutations of the virus and the uncertain effectiveness of vaccines to new types. At the same time, in the long term, the market will have to struggle with e-commerce, which has shown its usefulness for the average buyer. Nevertheless, as Principal analysts show (see a chart below), the European real estate retail market in general (and Spanish, being a part of it) can be pretty attractive depending on a proper selection of high-quality assets.

Spanish SOCIMIs in general

Recently PWC has issued its annual yearly “Emerging trends” European report 2022. I noticed that in the top-10 rating this year, there are already two cities from Spain (Madrid and Barcelona) compared to last year. It provoked me to look at the Spanish REIT (or as they call it, SOCIMI) market in pursuit of undervalued targets.

Let me spend one minute on regulatory theory. Well, to have the privilege being a SOCIMI, an entity should pass…

-

Asset test

-

At least 80% of their assets must be invested in (A) urban real estate (acquired or developed) for rental or, (B) other SOCIMIs, (C) foreign REITs and (D) Spanish or foreign qualifying subsidiaries (‘Sub-SOCIMI’) and real estate collective investment schemes.

-

-

Revenue test

…and also have a:

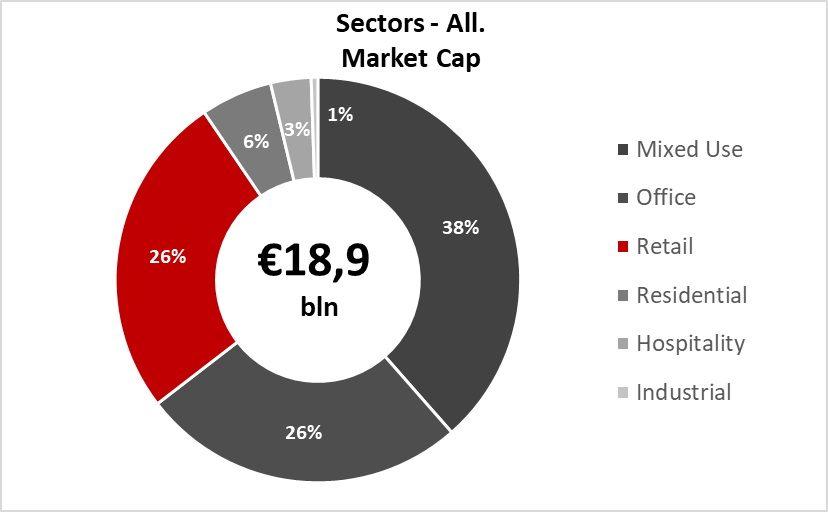

As Bolsa de Madrid shows, there are 79 REITs in the stock exchange at the moment. However, I have to say that most of them are in the SME category. So I decided to cross over all of them, got rid of delisted, extra-small / extremely non-liquid stocks, and assembled a table of 20 leading players in the market, out of which 4 REITs (26%) have only retail focus.

Author’s calculations

Undiscovered pure-play actor in Spanish SOCIMI Market – Lar España

Analyzing the variety of Spanish REITs, I found an interesting one amongst the crowd, which can be added to the deep value REIT portfolio. It is a retail SOCIMI Lar España (OTC:LAREF) [BME:LRE].

Lar España is in Spain’s #3 out of 4 major retail SOCIMIs in terms of market capitalization, right after General de Galerias [BME:YGGC] and Castellana Properties [BME:YCPS].

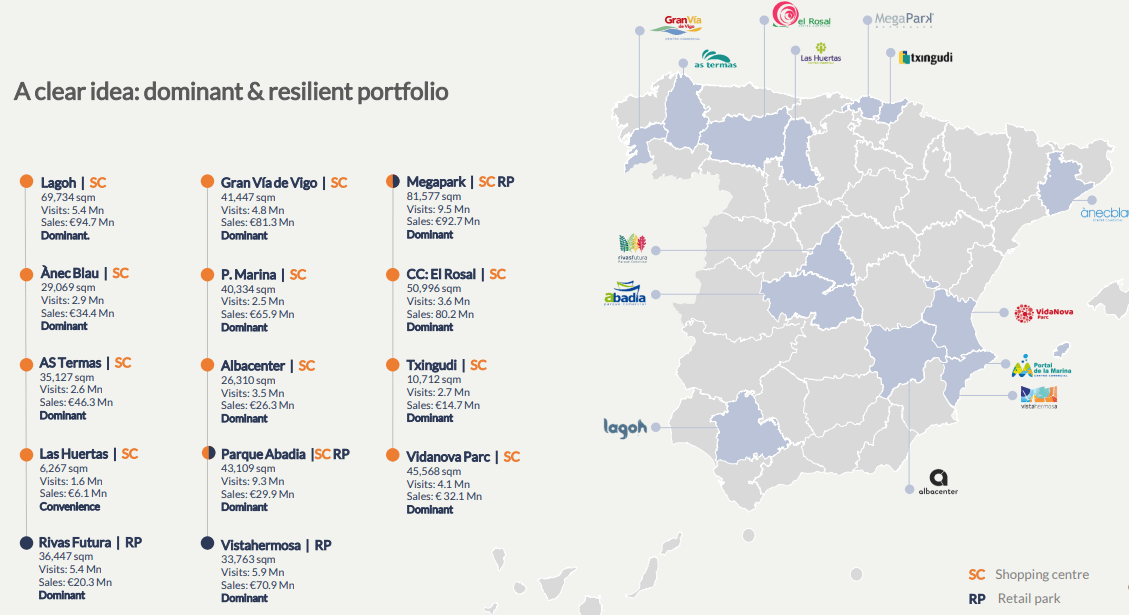

It has a portfolio of 14 real estate assets of ~579k sq.m. rentable area, current occupancy of 95.0% as of Q3 2021 and GAV value ~ €1.413 bln, including:

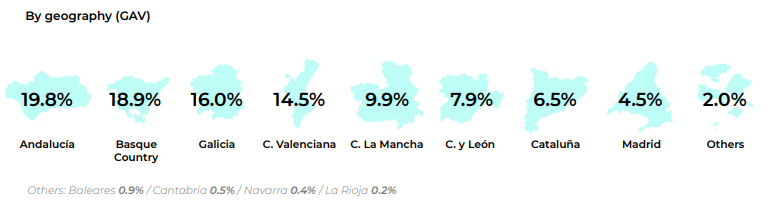

The portfolio is reasonably diverse in terms of geographical asset analysis, as you can see from the infographics below. The majority of assets have local dominance in Spanish Tier 2 locations which makes the Lar España real estate investment strategy quite unique in terms of portfolio management amongst Spanish REITs.

Also, looking at GAV analysis, we see no region with more than 25% contribution to the total GAV estimation, which tells about the decent local dispersion.

As of December 2021, Lar España has collected 97% of total 2020 invoiced amounts and heads towards collecting 93%-94% of invoiced amounts for 2021 in the very 2021 (and 4%-5% in 2022).

Tenant Analysis

It is essential to look through two layers of tenant analysis in the retail REIT business, in my opinion:

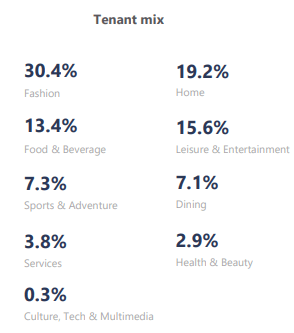

-

The first layer is a tenant mix by industrial allocation. For this REIT it is > than 50% tied to Lifestyle / DIY / Dining & Grocery. If you look above, Principal Research is positive about these types of retail categories in Europe in general, and I agree with them.

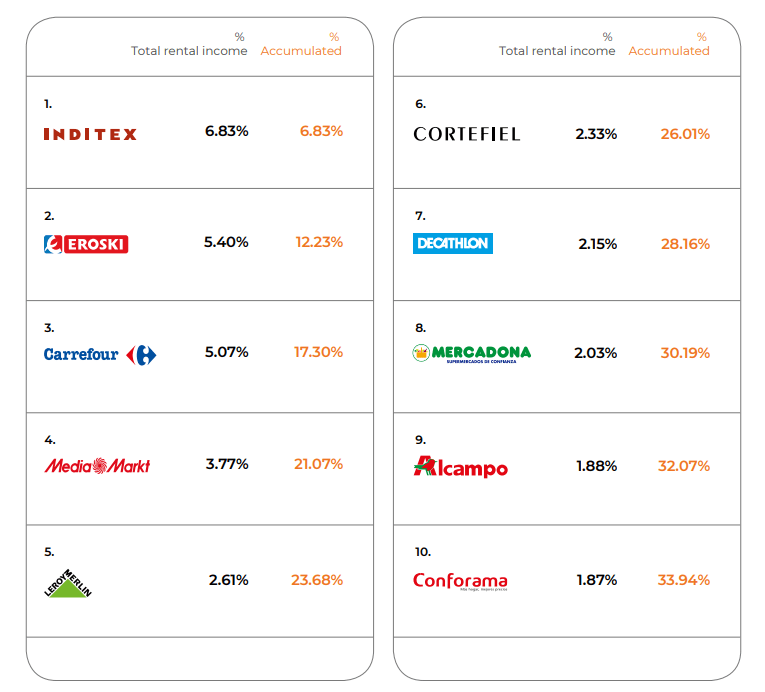

It shows that Lar España does not depend on any of its tenants more than 10% in terms of gross rental income (GRI).

Business Model

As stated in the presentational materials of the Lar España’s, its…

“…investment strategy focus is now entirely on retail properties that are poorly managed and that have strong upside potential, especially centres where there is an opportunity for repositioning or extending:

(They calibrated the portfolio and sold street retail assets previously)

(All of the current assets have either strong local monopoly or market power)

The management Team has a deep understanding of this sub sector and does not have a tendency to pursue the opportunity in other sectors they do not compete in.

Investment Thesis

Let me show what the catalysts are for extracting the value from Lar España. I see five main drivers to help the current price move to its fair value amount:

- Decent margin of safety in terms of ~ 50% discount to NAV based on the latest H1 2021 valuation

- Solid 2021 dividend yield of 6.8%-7.8%, based on the current performance

- Attractive P / EPRA Earnings multiple of 16.6x

- A positive ~2% cap rate spread

- Huge steps in terms of “ESG” REIT story and successful green bond refinancing as a result

Let’s briefly look at all the drivers:

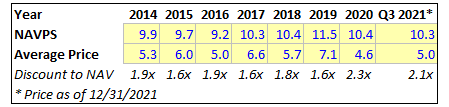

Discount to NAV

The 8-year historical analysis of Price vs. EPRA NAV per share shows that in the current market, there is a substantial amount of margin of safety for this REIT:

Source: Author’s calculations

Author’s Calculations

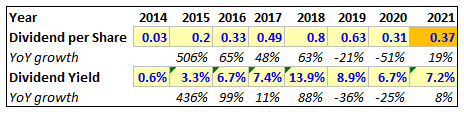

Dividends

Lar España has been growing the real estate business for the last eight years and has rewarded its shareholders with fruitful dividends, as you can see from the table below.

Source: Author’s calculations

Author’s Calculations

I forecast 2021 Dividend yield to be from 6.8% to 7.8% in EUR depending on the results of Q4 2021 performance.

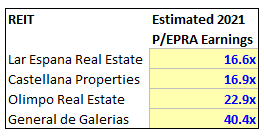

Multiples

Amongst its peers (by them, I mean liquid prime stocks) Lar España has the most attractive absolute valuation:

Source: Author’s calculations

Author’s Calculations

Positive Cap Rate Spread

My calculations show that there is ~2% positive cap rate spread for this REIT:

ESG Debt Story

Well, there is at least one reason why public companies should pursue the “Green / ESG agenda” in their corporate strategies – it is, by default, the cheaper cost of newly issued debt. As I see from the recent improvements in this field, Lar España did a great job in this field:

- October 2021 – Global Real Estate Sustainability Benchmark (GRESB) assessment of 86 out of 100 (peer average 73 out of 100)

- Lar España significantly decreased energy consumption and carbon emissions from its portfolio for the last three years

- 100% Shopping Centres are BREEAM Certified, “Excellent” or “Very Good”

It definitely helped Lar España to receive its first BBB with Stable Outlook rating from Fitch and, indeed, refinance its secured banking debt with unencumbered “green” bonds (€700 mln with two tranches in July and November 2021), having LTV Ratio ~ 41% with a superb average fixed cost of debt ~ 1.8% in EUR!

Conclusion

In my opinion, Lar España is a BUY target and can be added to the portfolio strategy of dividend hunters and deep value REIT investors.

Should even a part of the hidden value be extracted within a couple of years, the potential return can be in high double-digit figures (25% -30%), not speaking about a tasteful 6.5-8% dividend yield.

In terms of tax details and access:

- A basic CIT rate for Spanish non-residents without a permanent establishment is 19%.

- It is not available at Euroclear (you need a broker with access to alternative venues (e.g., Interactive Brokers)

Be the first to comment