gorodenkoff/iStock via Getty Images

Introduction

Lantronix (NASDAQ:LTRX) is now my second largest holding as shares have risen over 50% from my last article, I have not trimmed my position, and other assets remain weak. However, as the share price reaches all-time highs again, I wanted to dive into the financials again to make sure I am placing my money in the right spot. As so, I will share my thoughts on the recent and long-term financials with you.

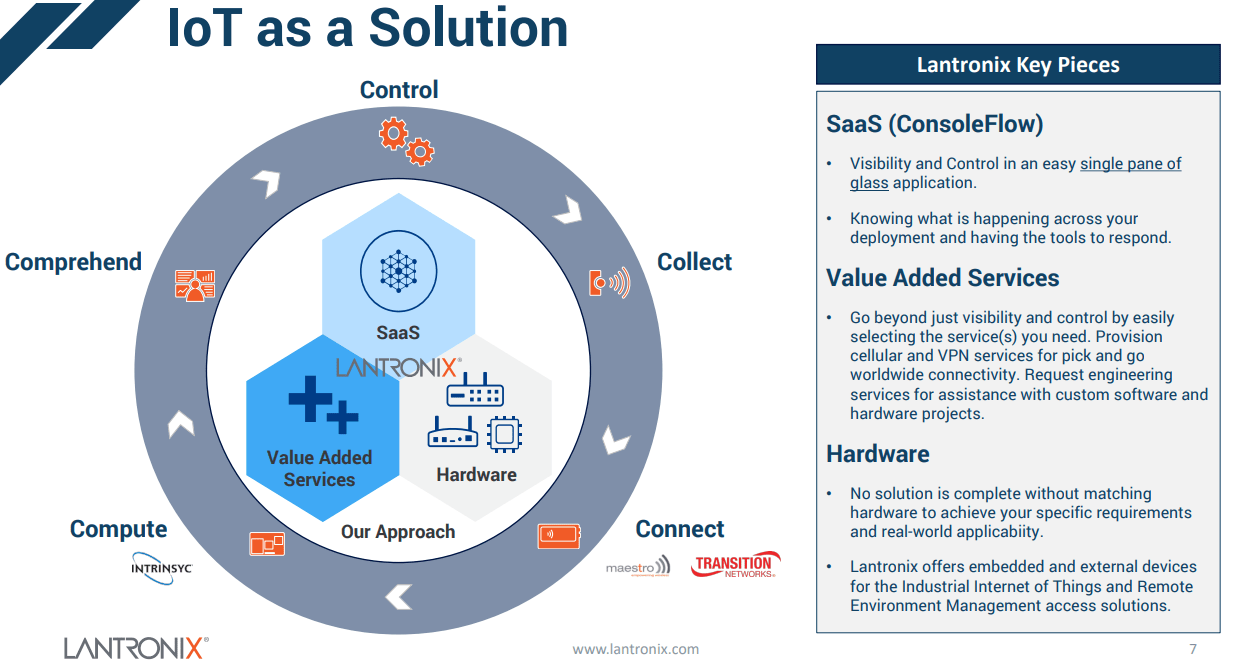

What is most important to consider for Lantronix is whether the company can break out of its historically volatile revenue cycle. As a small internet of things (IoT) hardware provider, the company had lumpy revenues as clients submitted bulk purchases or contracts. However, management wants more, and it is looking to drive a more circular and lasting platform. This is through combining its expertise in IoT hardware design with software solutions in order to drive recurring revenues. Then, as the platform expands in scope, more and more clients will spend on high “value added services” to incorporate both hardware and software into their ecosystems.

LTRX Investor Presentation August 2021

Growth

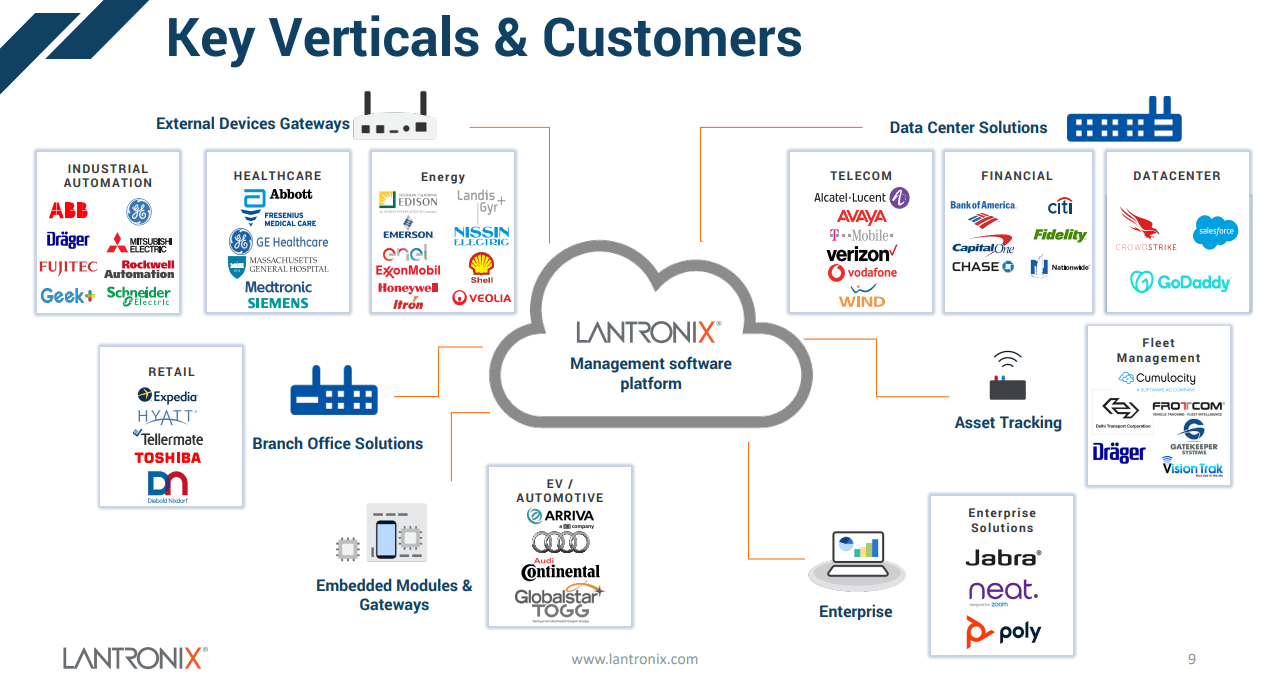

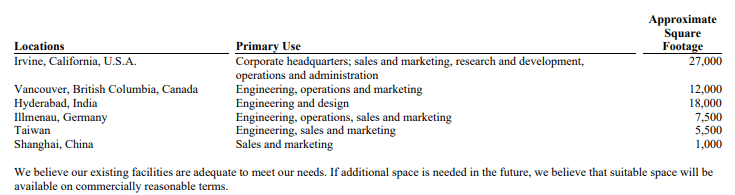

Over the past few years, Lantronix has performed a series of acquisitions to expand the platform, and while some issues have arisen, revenues do seem to have finally found the organic growth they need. To be sure, I will look at the current product mix and sales drivers as provided by the management. With over 2 million listed customers across the world, Lantronix is far more globalized than the sub-$300 million market cap would surmise. In fact, Lantronix has a wide mix of major corporations supporting the business and buying LTRX products. The problem is that these products are not the most expensive, are fairly niche, and are typically one-time purchases. As hardware sales typically see low growth and margins, this highlights why SaaS and service revenues are being sought.

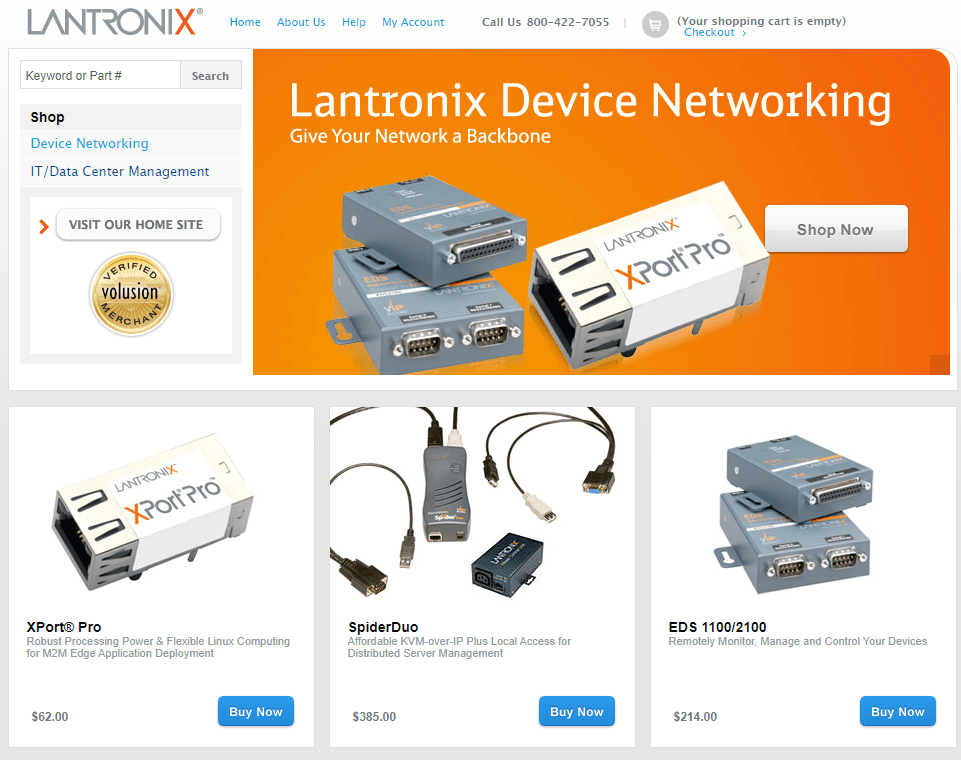

Lantronix Investor Presentation August 2021 Lantronix Store

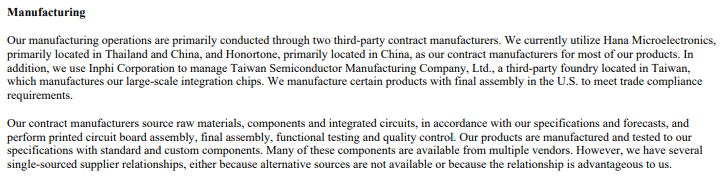

One reason for the strong share price performance of late is that the company has performed well despite global tech supply chain issues. This may be thanks to its relationships with its third-party contractors, or merely a result of higher volumes of sales. Most production is based in China, and this may be seen as a risk, but so are the majority of hardware sales in the US. As it seems supply chain issues are beginning to unwind, I believe that any risks associated with the pandemic are resolving, leading to true financial performance to be reflected moving forward.

LTRX FY 21 Annual Report LTRX FY 21 Annual Report

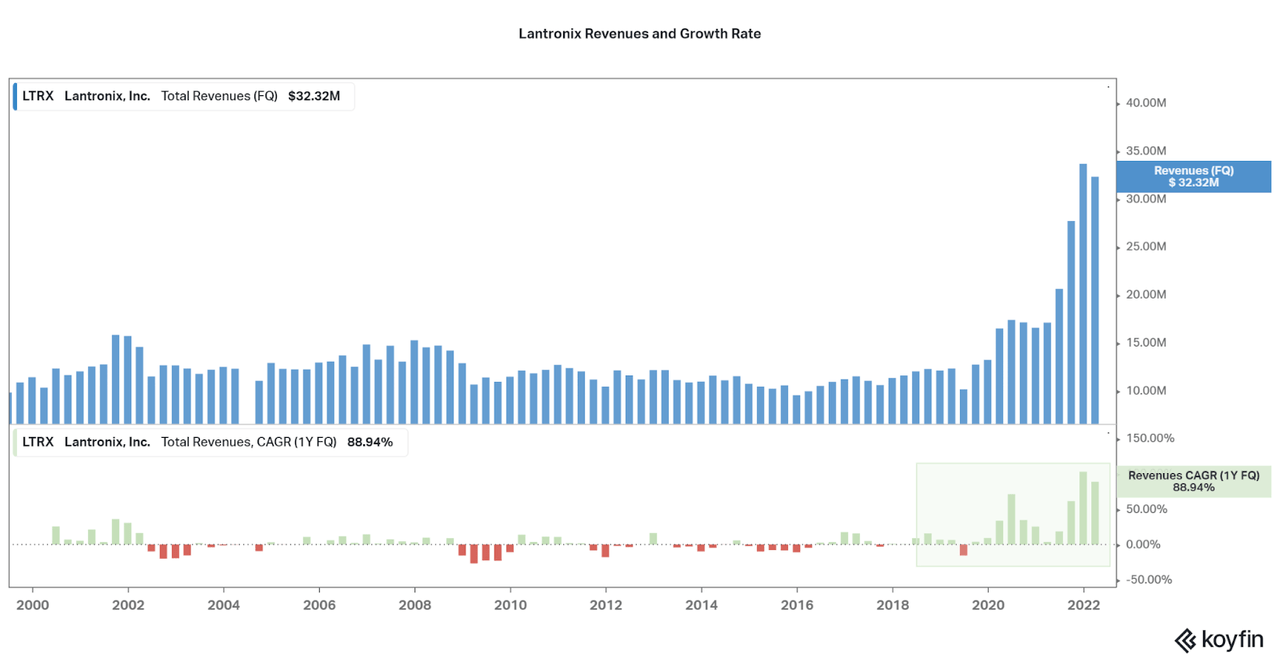

Beginning with the long-term data, we can see that Lantronix has a long operating history, but only until 2020 has growth taken off. A new CEO, Paul Pickle, took the reins in 2018, and so we perhaps can attribute the new success to the change in leadership. Proponents of the leader cite Pickle’s experience in leading his prior company, Microsemi, to be acquired by Microchip Technology (MCHP), and perhaps are looking for the same here at Lantronix. So far, significant changes have occurred and I believe the current revenue growth is a great first step.

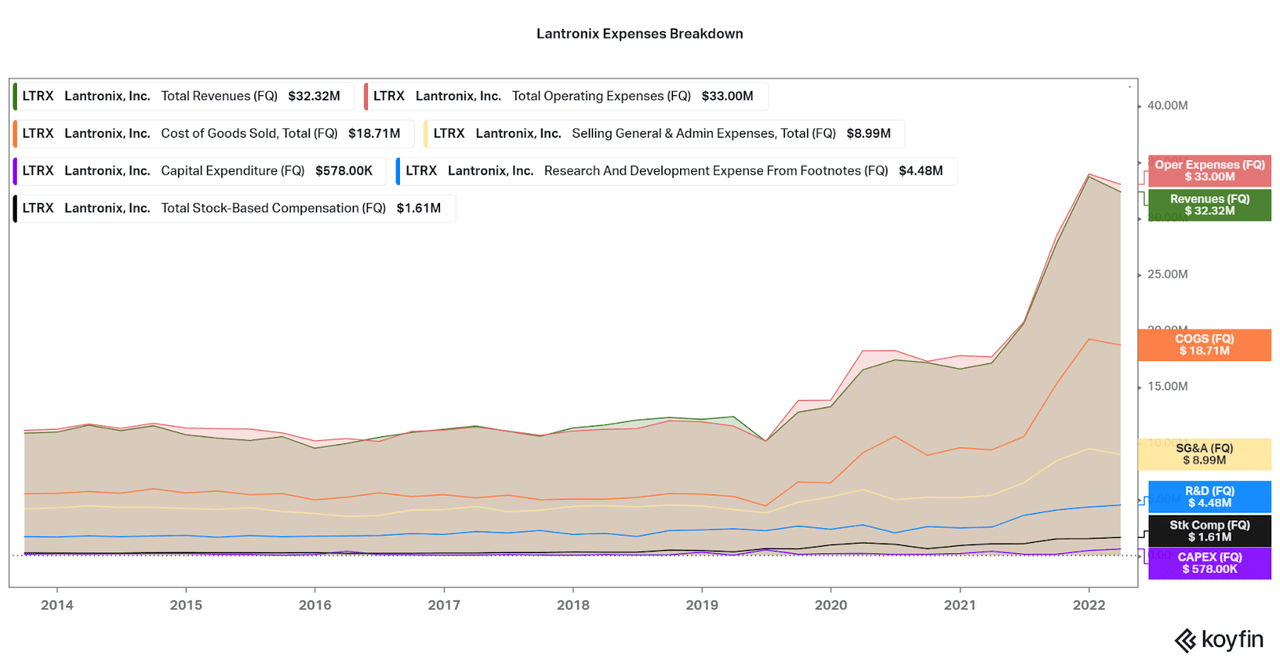

Koyfin

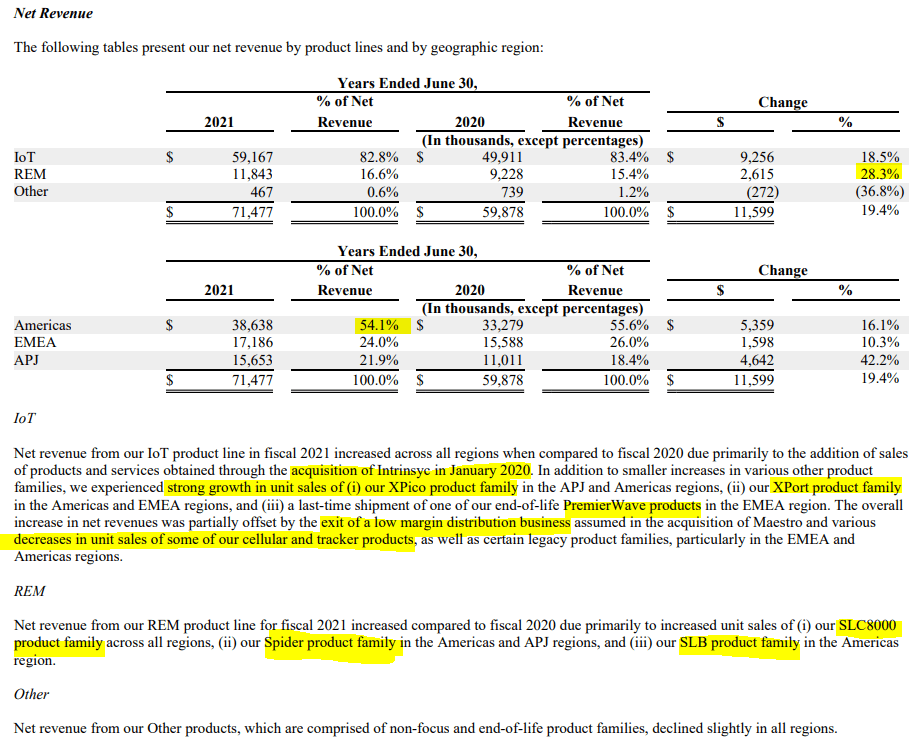

Now I will discuss the recent quarter. As of the May 4th earnings, the $23.3 million in revenues beat consensus by $2.8 million to drive 89% YoY growth. These are separated into two major segments, IoT products and radio environment map (REM) products. Both involve hardware sales, but REM is the new segment driving both growth and higher margin applications in software connectivity.

For the IoT segment, growth was seen most significantly across two product lines: XPico and XPort. XPico uses Wi-Fi embedding to connect hardware to servers, while XPort is a series of devices that embed operations systems to hardware. These are the important backbone devices that allow for non-operated machines to be connected to each other and a network in order to allow IoT to occur. Essentially, the advanced communication and data transfer that is required to increase efficiency now, and in the future.

In the REM segment, sales were driven by three main product groups: SLC 8000 family for data center console management, Spider for remote server connectivity, and SLB for IT device connection management. These products are seeing significant growth, although they hold a far smaller portion of total revenues. As these products aid in connectivity and remote access, I expect these product lines will have significant growth due to the range of viable applications. See the highlighted image below for more details.

With the flourishing growth of Internet-of-Things (IoT) applications, cellular-assisted IoT networks are promising to support the ever-increasing wireless traffic demands generated by various kinds of IoT devices. As one of the emerging technologies in next-generation cellular systems, small cells, or so-called “femtocells” in indoor environments, are expected to be densely deployed for ubiquitous coverage and capacity enhancement in a cost-effective and energy-efficient way…

REMs enable operators to detect existing coverage and capacity problems at any interested location. To verify the feasibility of indoor diagnoses, we collect real trace data from an indoor testbed and then conduct a series of experiments to evaluate the performance of the machine-learning algorithms in terms of the accuracy, the time complexity, and the sensitivity to data volumes.

LTRX FY 21 Annual Report

Profitability

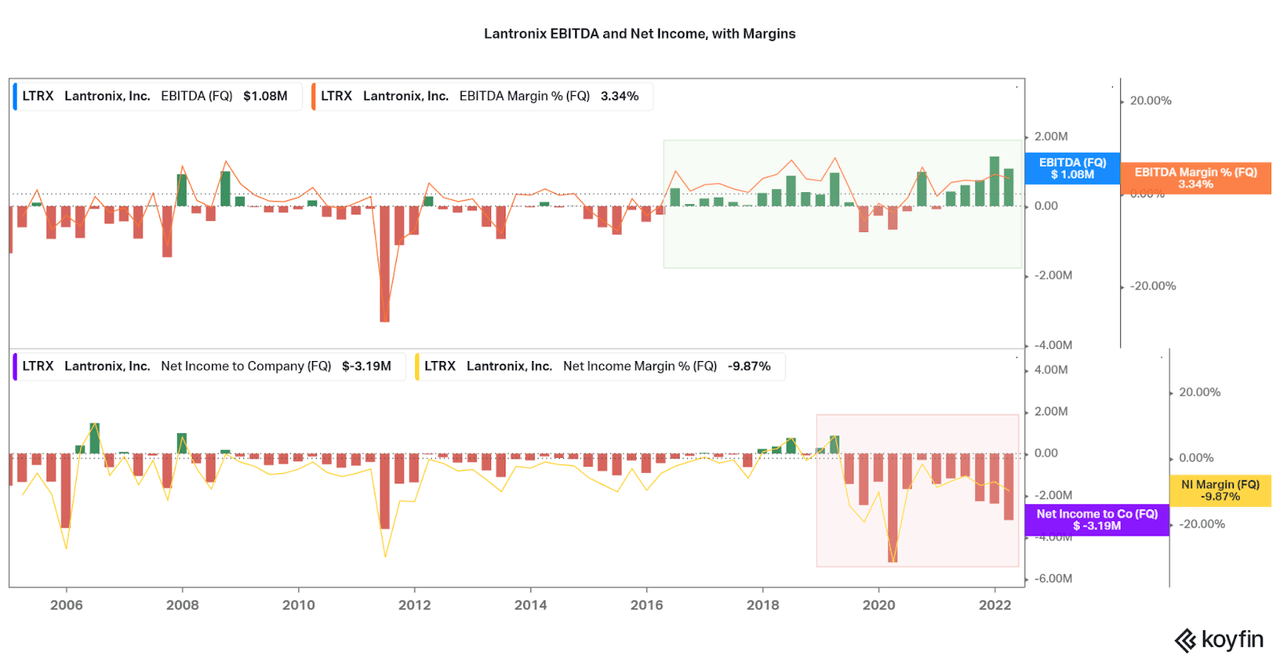

While speedy revenue growth is always welcome, it is also important to consider profitable growth. Unfortunately, this is where some of the cons show up for Lantronix. Historically, the company was skating on thin ice, barely making positive EBITDA. At the same time, net income losses were relatively tame at the same time, not too extreme. Then, beginning in 2016-2018, EBITDA began to rise to stable positivity. However, the current EBITDA margin is only 3.25%, and there are still meaningful improvements that must be seen. At the same time, as the result of acquisitions and investments, net income losses have remained elevated over the past two years. I will be looking to see both margins increase meaningfully over the following quarters as recurring revenues drive profitable growth.

Koyfin

To understand where the money is going, I broke down the total operating expenses in the chart below. Revenues typically are in-line with operating expenses, with the main driver being the cost of goods sold. It seems that Lantronix can react quickly to changing supply costs and offload them to customers. Also, as I will discuss in a bit, recent acquisitions have not damaged the expense profile to an extreme degree, but LTRX has sold off underperforming assets over the past two years.

I expect that margin expansion will occur when revenues are increasing at a faster rate than expenses, but this is not the case yet. However, it is good to see SG&A and stock-based compensation remain low. There is no issue of unnecessary expenditures on marketing or staff payments. The only problem is that the curse of hardware profitability and competition are driving the company to spend on reinvestments.

Koyfin

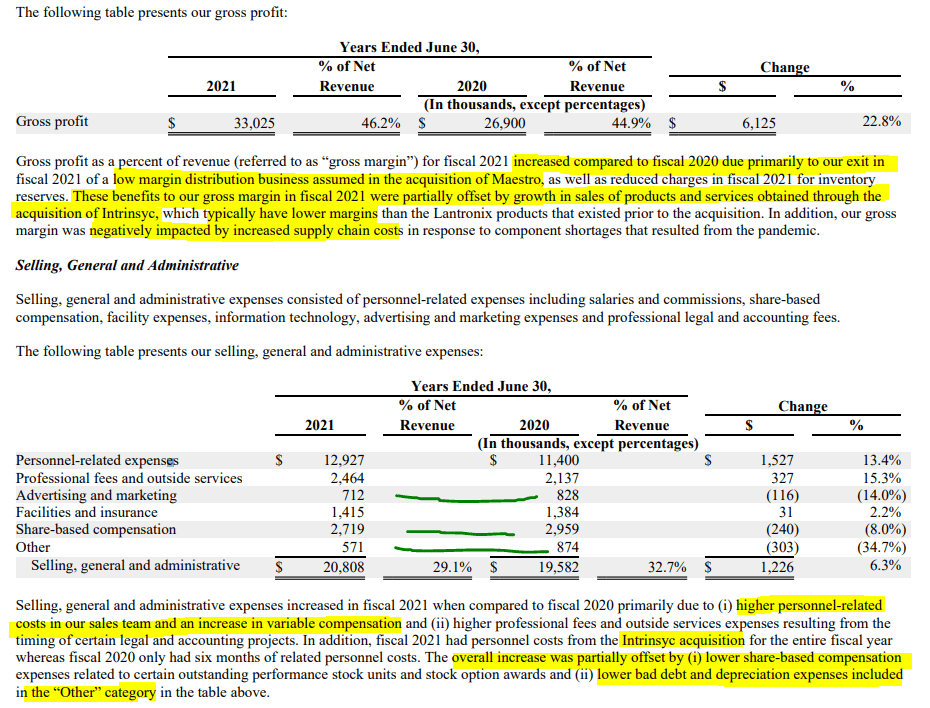

As of the most recent earnings, management claims recent profitability issues were the result of both underperforming assets that have been sold off plus supply chain costs. Also, the acquisition of Intrinsyc has brought in other low-margin product lines that have also impacted profitability. Thankfully, we can see that SG&A costs are being managed well, and we can in fact see a reduction in ad/marketing costs, share-based compensation, and other losses. If ads/marketing and SBC were up, I would feel less comfortable about the investment.

LTRX FY 21 Annual Report

Balance Sheet

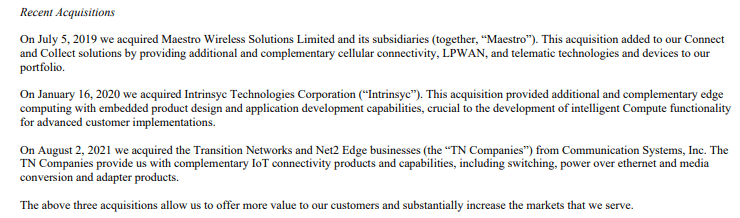

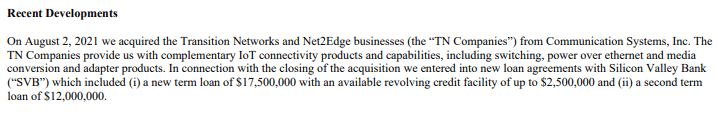

While profitability remains an issue due to the majority of hardware sales, I believe in the management’s ability to seek recurring revenues. However, one issue that has arisen of late is a weaker balance sheet off the back of acquisitions. There have been three major acquisitions of late, one in each year 2019, 2020, and 2021. These acquisitions are bolt-on processes for limited cost, but the most recent acquisition of Transition Networks and Net2Edge were partially funded by ~$30 million in debt. While management has more insights into the pros and cons of each acquisition and how they may improve performance moving forward, investors must consider the increase in leverage.

LTRX FY 21 Annual Report LTRX FY 21 Annual Report

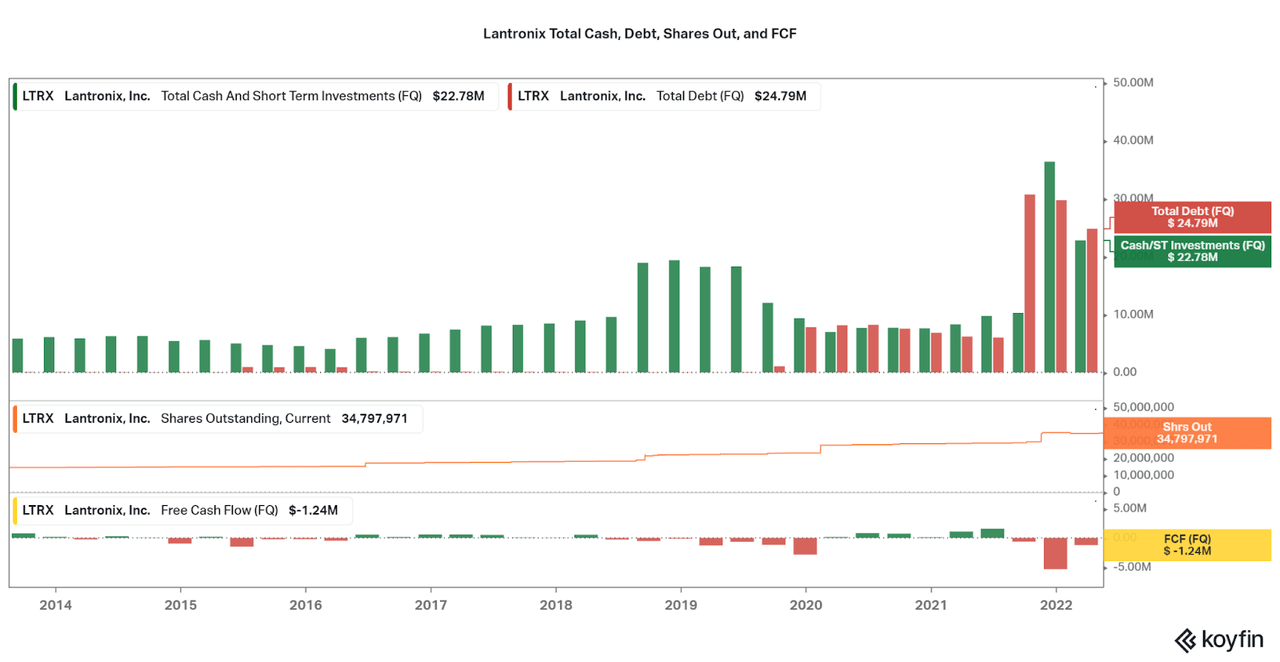

As shown in the chart below, Lantronix has historically held little cash or debt. Then as new management has driven towards growth, debt has increased. Thankfully, conservatism has kept cash and debt in step, reducing risk. Unfortunately for shareholders, this means dilution as shares outstanding have risen from 20 to 35 million in just a few years. Now, organic growth must be seen to make these changes to the balance sheet worthwhile. As revenues remain volatile, hard to track, and low margin, I remain waiting for continued maturity, but I believe it remains possible.

Koyfin LTRX FY 21 Annual Report

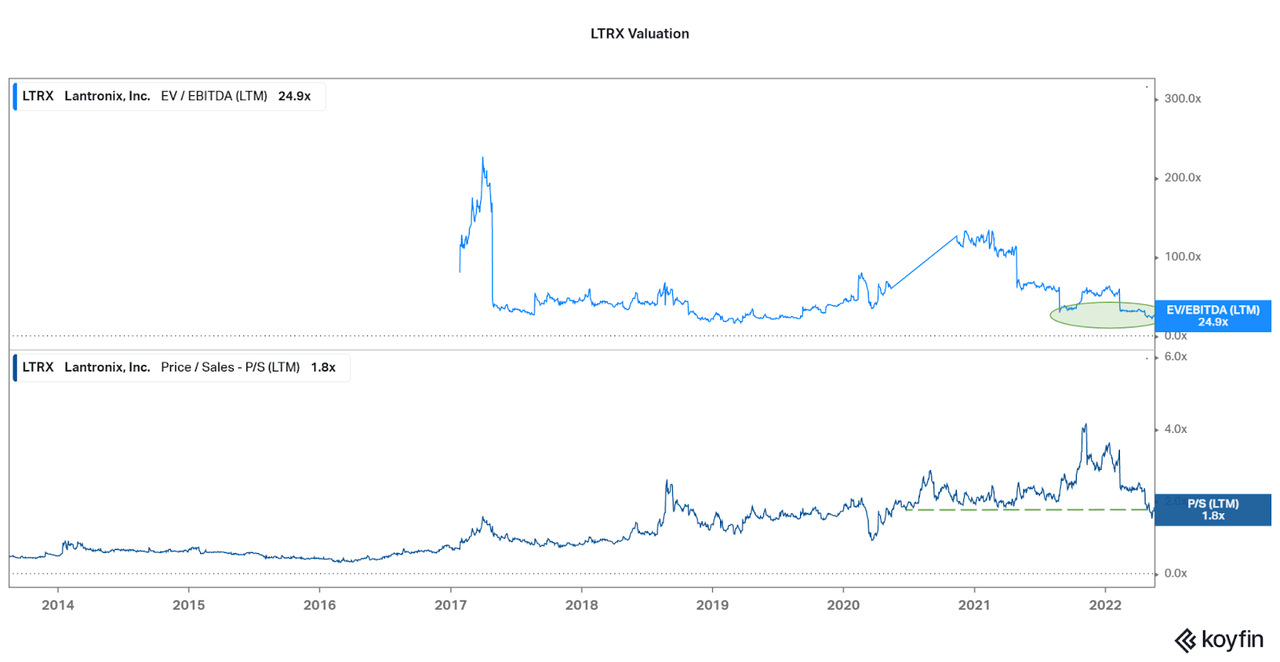

Why do I believe it is worth hanging in there for a while longer? Well, it mostly has to do with valuation. As the speculative growth market has tanked for the past year and a half, Lantronix has risen over 50%. At the same time, the current valuation remains close to all-time lows, and especially in terms of having Pickle at the helm. Although the lower valuation is partially the result of rising EBITDA and maintained net debt, the P/S remains slightly elevated. This is why I would only consider adding small amounts every so often, but not take a large stake. However, as long as improvements continue to occur, I expect the valuation is now at a low, in line with the rest of the small cap growth market. Considering management recently announced that it expects revenues greater than $35 million for next quarter, I believe there remains a significant chance for upside.

Koyfin

Stay tuned for earnings on August 18th. While I will not be trying to trade around the news, and do not expect a significant change to the thesis, I will share my thoughts here in the comments afterwards. I hope this article is insightful into what I look for in my investment, and how special situations may often play out in the long run. At least Peter Lynch agrees that a turnaround company will be unlikely to trade in line with the market, and offer significant diversification from other companies that trade with the market.

Thanks for reading. Feel free to comment below.

Be the first to comment