March was the most interesting month in quite some time, to say the least. We witnessed many down and up days of over 5%. As I am typing this, the market has had their best 4-day run since 1974, literally 46 years ago. This just goes to show you how low the market hit, and even with this, the market is still undervalued. Could this be a teaser upswing, to set us up for the next bear drop? Who knows. What I do know is that the dividend stock purchases continued through the month of March.

Investing consistently in dividend income stocks allows you to create and build another income source, with dividends. This is my primary vehicle on my road to financial freedom, which you can see through my dividend income and my dividend portfolio which continue to build and build.

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally’s investment platform.

How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe financial freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to financial freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals. Then, you rinse and repeat.

The stock purchases

Purchases were unusually small and frequent in the early parts of March. The month felt like a year, but still – triggers were pulled, even if the results were small. Thank goodness again for the new $0 in trading fees, allowing investors to make smaller purchases often. See March’s dividend stock purchases below.

Stock Purchase – General Dynamics (NYSE:GD)

General Dynamics is a worthy dividend aristocrat and they were recently on my Dividend Stock Watch List for April.

GD’s metrics were solid enough for me to purchase them four different times. See the statistics below from the Dividend Diplomat Stock Screener:

- Price to Earnings: 20 analysts are projecting $12.44 in earnings for 2020. The stock prices during the month, for when purchases were made, ranged from $126.80 to $159.34. That doesn’t happen too often, to say the least. This equates to a price to earnings ratio of 10.19 to 12.81; far lower than the market on average.

- Dividend Growth: GD is a dividend aristocrat baby! That means they have 25+ years of consecutively increasing their dividend. The 3-year and 5-year dividend growth rates are near 10%, with the most recent increase in March for 8%.

- Dividend Yield: At an annual dividend of $4.40, the yield range for the purchases was 2.76% to 3.47%. The dividend yield for GD pairs nicely with their dividend growth rate and this is definitely higher than the S&P 500 on average.

- Payout Ratio: Since General Dynamics pays $4.40 per year over $12.44 in earnings, this equates to a payout ratio of 35%. Due to the uncertainty, this provides plenty of safety to the dividend during this pandemic.

I purchased 8 more shares during March for a total cost of $1,182.50. The 8 shares added $35.20 to my forward dividend income projection. I now have approximately have 20 shares, producing $88 in dividends. I would be interested in purchasing a share or two more of General Dynamics.

My Stock Purchase Summary (Plus the ~$500 and Less)

Since the trading wars have heated up and fees now are $0 to trade, I am going to list out those dividend investments made, since they are purchased sporadically when prices were deemed right. That way – I’ll still go over significant results for the month above, but include all purchases below in one image.

Therefore, see my March Dividend Stock Purchases summary:

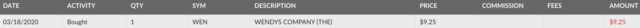

Taxable Account:

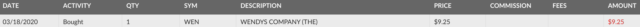

Traditional IRA:

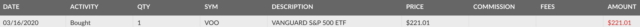

Roth IRA:

Only one new position, which was very small – Wendy’s (NASDAQ:WEN) – was added to my dividend portfolio. However, all other dividend stock purchases were additional adds to current positions. I love beefing up current positions in my portfolio at discounted prices.

In total, I deployed a total amount of $1,757.15 and added $67.57 to our forward dividend income, equating to an average dividend yield of 3.85%.

My Wife’s Dividend Stock Purchases

My wife has accounts that we also make dividend stock purchases into. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining. In March, as expected, we made quite a few dividend stock purchases for my wife’s account:

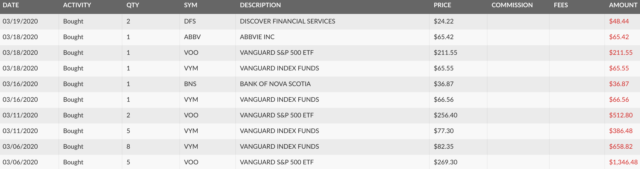

Traditional IRA:

Roth IRA:

We continued to add to positions, With AbbVie (NYSE:ABBV), Wendy’s, Discover Financial (NYSE:DFS) and Bank of Nova Scotia (NYSE:BNS) – even if it is a share here and a share there. Due to the significant volatility in the stock market from the coronavirus, it was harder to decide on the specific industry. Therefore, the dividend stock purchases focused on Vanguard funds – the Vanguard S&P 500 ETF (NYSEARCA:VOO) and the Vanguard High Dividend Yield ETF (NYSEARCA:VYM). Her portfolio is full of safe and sound dividend investments, and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

In total, $3,632.87 was put into investments, producing $104.12 in dividend income going forward. This is an average dividend yield of 2.87%.

Summary & Conclusion

Another solid, consistent month. Combined, my wife and I deployed a total capital amount of $5,390.02 for January and added $171.69 to our forward dividend income total (3.18% yield overall).

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you can and are able to. I am locked in and ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated.

Therefore, we managed to be very active during the month, especially as the coronavirus cases continued to spread and hit multiple countries, including our own. The market has been significant volatile as of late, and as long as you do your due diligence and stick to your consistent strategy, all should play out. Did you stay on the sidelines during the extreme volatility? Any dividend stock purchases you were surprised about, based on what you see above? Please share your thoughts and comments. Thanks again everyone, and, as always, good luck and happy investing!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment