Juanmonino/E+ via Getty Images

Lakeland Industries (NASDAQ:LAKE) is a global manufacturer of personal protective equipment for a variety of industrial uses.

The company’s sales and profits soared during the pandemic pushed by COVID-related disposables and inventory building at the distributor level. These same forces hit back during the second half of 2021 and the first half of 2021, as COVID sales receded and distributors found themselves overstocked.

As of 2Q22, LAKE’s revenues are returning to pre-pandemic levels, albeit with lower operating margins caused by rising fixed costs. Considering LAKE’s relatively commoditized industry and historical performance, it does not seem to justify its current valuation.

However, the reader should follow closely the developments related to LAKE’s $42 million cash reserves. Most of these were locked in China and the company has already made the first move to relocate them. LAKE’s use of these funds can change its prospects for the future.

Note: Unless otherwise stated, all information has been obtained from LAKE’s filings with the SEC.

Industry characteristics

LAKE sells protective gear for a plethora of industries, including industrials (O&G, manufacturing, automotive), fire services, utilities and clean rooms. Its products are divided in seven lines ranging from relatively simple woven garments to specialized high-end chemical and heat protection equipment.

In the personal protective equipment (PPE) industry, it is difficult for companies to build a moat. The best they can resort to is to build a good position, based either on cost or quality. In all cases, its customers are probably going to compare on a quality to price basis, which is the antithesis of a moat.

LAKE has to compete with much larger companies like DuPont (DD), Honeywell (HON) or Kimberly-Clark (KMB). These competitors have much larger financial and developmental capabilities. Although LAKE has some 20 patents regarding protective coatings and manufacturing processes, it cannot compete with these R&D giants on that front.

This means that LAKE is not a price maker but rather a price taker. The company can choose in which product lines and quality segments to compete, in order to form a niche. But after that, it has to play by its competitors’ rules.

In an industry marked by price taking (for a particular quality positioning), cost management becomes the difference between under or excess profitability. LAKE seems to understand this, commenting on its 10-K report for 2021 that one of its most important competitive strategies is to control manufacturing facilities in the US, China, Vietnam, India and Mexico. By shifting production between facilities, LAKE tries to obtain the lowest cost for the particular quality it wants to sell. For example, in 2019 LAKE decided to move its core manufacturing capabilities from China to Vietnam, trying to benefit from lower labor costs and better trade terms.

Other costs are not as controllable. LAKE is a price taker in terms of most of its inputs, like raw materials, freight costs, and labor costs, given a particular manufacturing location. In some cases, LAKE probably has to purchase inputs from its competitors, for example with Kevlar from DuPont.

Finally, I believe the PPE industry is semi-cyclical. It is true that under a global recession sales can fall across the board, but in general global and industry diversification should provide protection against business cycles in a particular country. LAKE has demonstrated that it can sell to different industrial markets, with both the US and China as key markets.

Finally, LAKE’s operations can suffer from over-stocking cycles because its sales are conducted through distributors in many markets. This has been the case between 2020 and 2022. In 2020, LAKE’s distributors started building inventories expecting continued supply-chain bottlenecks. By 2021, and specially in 2022, some of these inventories proved difficult to sell. LAKE’s revenues peaked in 2Q20 and have fallen on a QoQ basis since.

As a summary, in the PPE industry LAKE is a small competitor. It can choose product lines and quality segments to serve, but after that it is a price taker. In a price taking context, cost control is the key to sustained profitability. LAKE controls costs by operating manufacturing facilities in key labor-intensive industrial markets (China, Vietnam, India, Mexico). Finally, the company’s revenues do not seem extremely exposed to business cycles, although they can be exposed to inventory cycles.

Cost structure and historical revenue

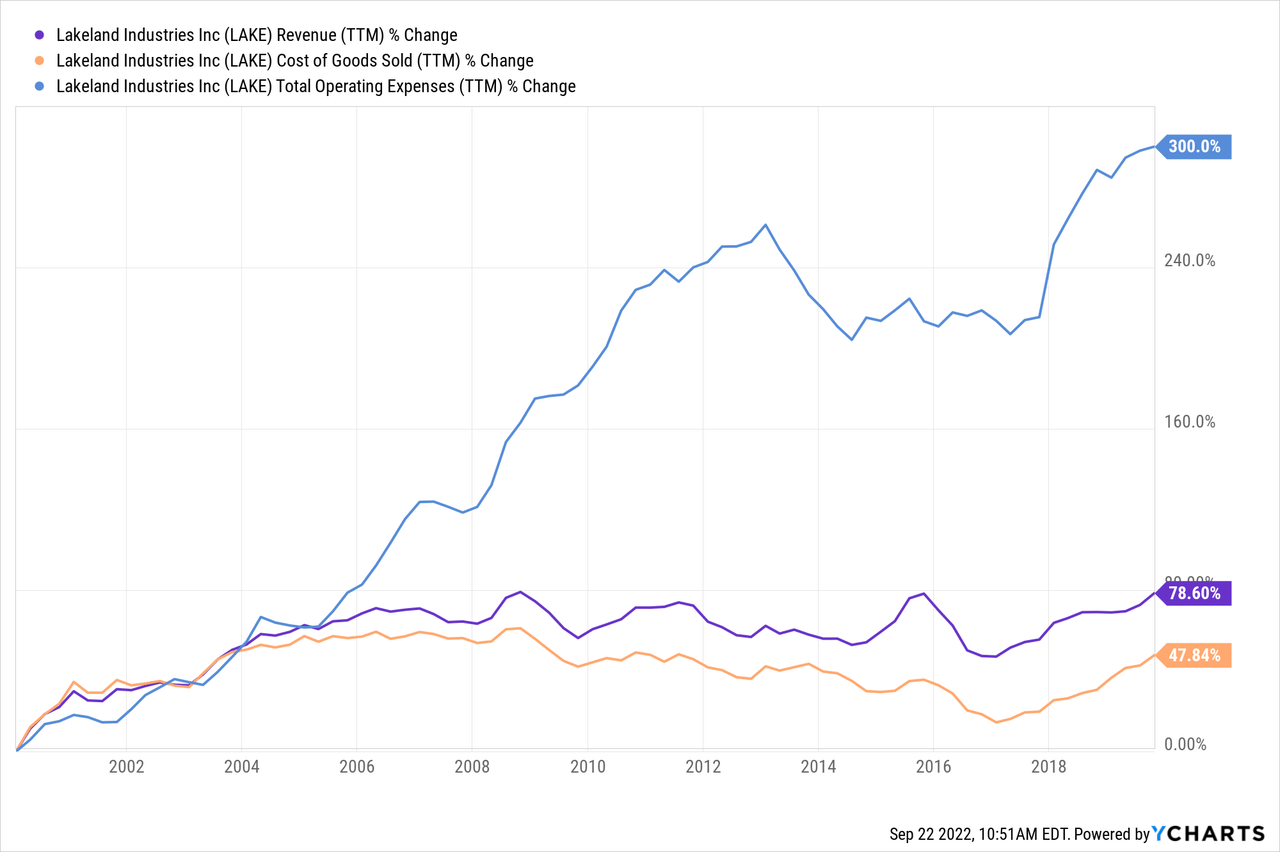

The operating history of LAKE can be summarized with the chart below.

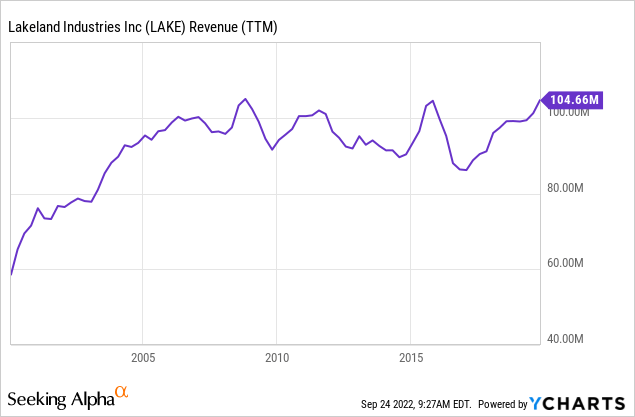

The first thing to notice is the low level of revenue growth in the two decades since the year 2000. An 80% revenue growth across two decades corresponds to a geometrical average of 3% per year. Also, as the chart below shows more clearly, even in the midst of the financial crisis, LAKE’s revenues did not fall significantly. This sustains the hypothesis that LAKE’s revenues is not exposed excessively to business cycles.

Total revenue also grew slowly or even decreased in the period from 2016 to 2020. During this period, the company was shifting its product line towards higher margin products. This can also be appreciated in the first chart above, as the gap between revenue and CoGS widens.

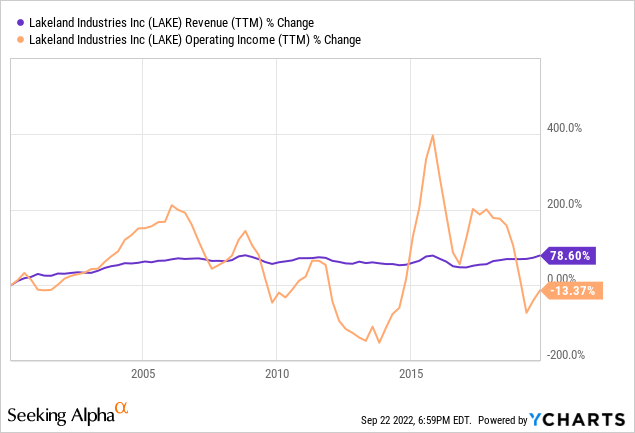

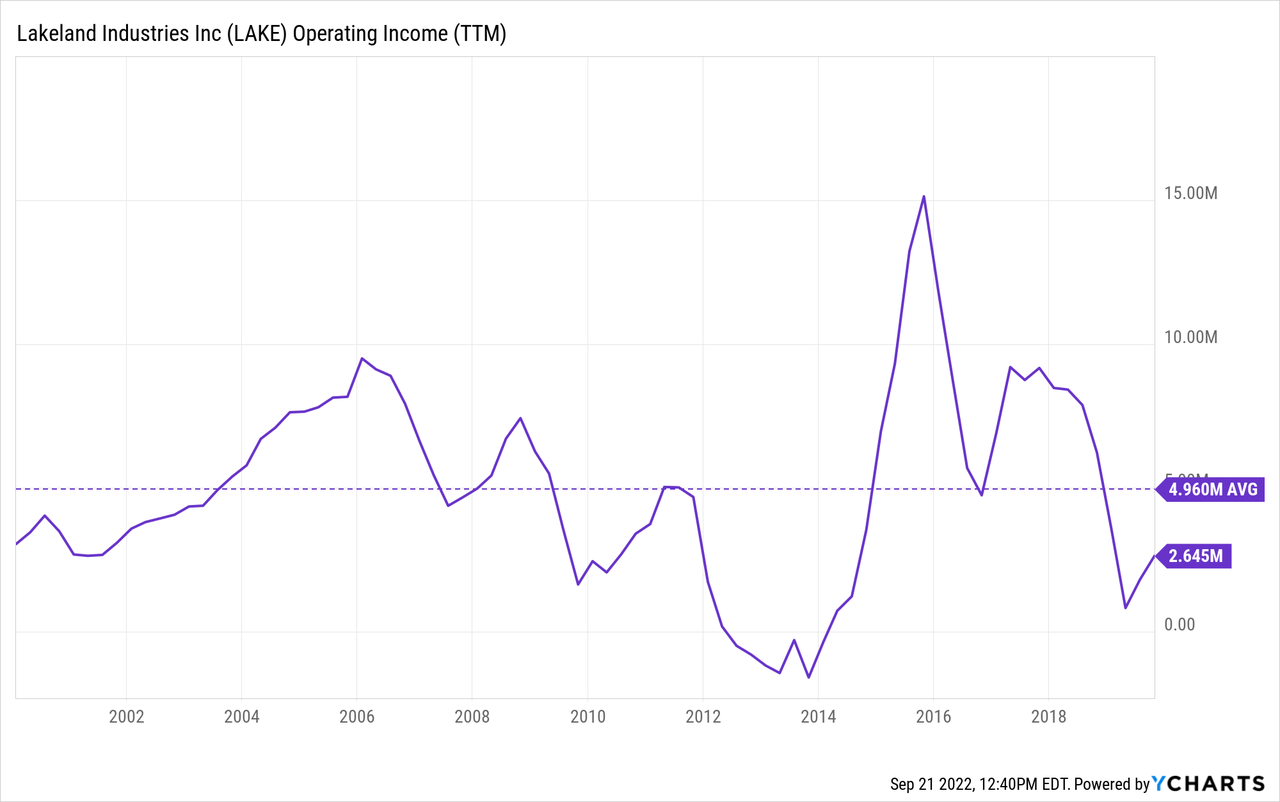

Finally, the chart shows a constant increase in operating expenses, signaling an efficiency issue. These operating expenses generate volatile movements in operating income, as can be seen in the chart below.

It also seems that operating expenses started growing in 2006, around the time when revenues stopped growing. Operating expenses grew fast until 2014, when they seem to have been controlled more strictly. The combination of stagnant revenue and growing operating expenses generated a constant fall in operating income between 2006 and 2014. Conversely, as gross profits grew by margin expansion while operating expenses were kept in line, between 2014 and 2018, operating income recovered. This all shows how important cost control is in LAKE’s position.

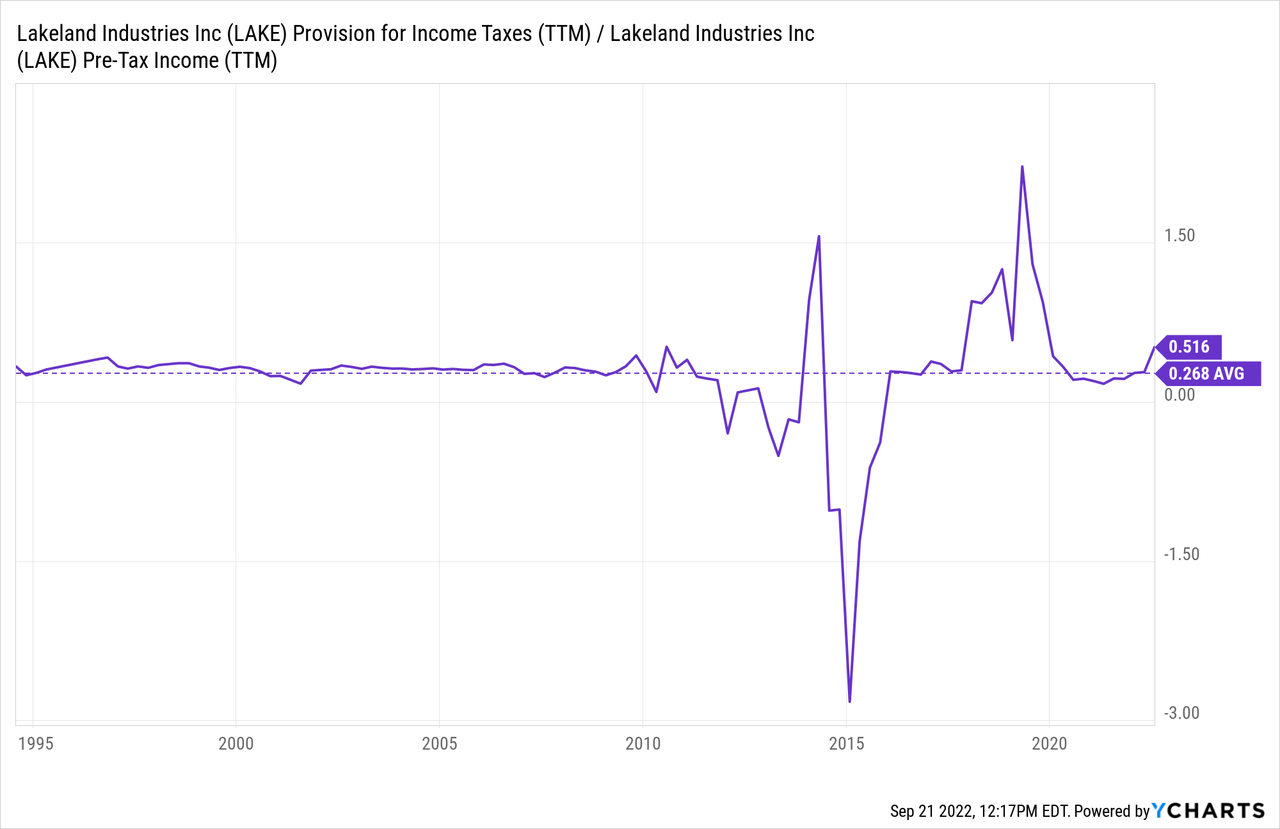

Finally, as a cost component, taxes are usually higher for global companies. Losses in one country cannot be matched against the income in other country. The average effective tax rate for the company has been 27% but in many cases it has been well above that.

Financing, capital allocation and cash reserves

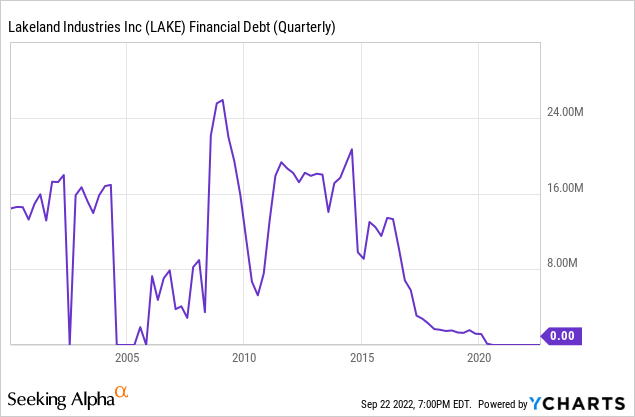

In terms of financing, LAKE has rarely used substantial debt. The chart below shows peaks of $25 million in debt, not a lot for a company generating $5 million in average operating income. It is more probable that LAKE uses debt from time to time to finance working capital, mostly during Q1.

As of 2Q22, LAKE has an open credit facility for $25 million, plus $5 million in trade credit letters, but the company has not made use of any funds from the facilities.

The company does not need financing because it accumulated a substantial amount of cash after the windfall generated by the pandemic. As of 2Q22, LAKE holds $42 million in cash. Cash reserves should grow even more as the company reduces inventory by 3Q22.

That much cash represents half of LAKE’s current market capitalization, and with no debt, imply an EV of only $45 million. The question is what will management do with so much cash.

First, we need to understand which subsidiaries hold the cash. Sometimes these global companies have a lot of cash but it’s permanently fixed in foreign subsidiaries in order to avoid taxes. This phenomenon has a lower impact after the TCAJ Act of 2017 that eliminated repatriation taxes for US foreign subsidiaries.

In the case of LAKE, $30 million out of the $42 million are in China. Some other $8 million are located in other foreign subsidiaries as permanent reinvestments and only $4 million are in the US.

In 2Q22, LAKE announced the first step to free some of the cash retained in China, by expensing a tax provision for $2 million. Given that China’s withholding tax for repatriation is 10%, those $2 million correspond to $20 million that will become available to the US subsidiary.

The remaining $10 million in China may be repatriated later, but they may also function as working capital given that China is the second biggest manufacturing hub of the company. The $8 million locked in other foreign subsidiaries are still in ‘permanent reinvestment’ mode, according to the company, and cannot be considered real free cash to distribute. These $8 million will also probably be used for working capital in the foreign subsidiaries.

Considering the $20 million available from China, plus $4 million already in the US, the company has almost $25 million to allocate. There are three possible uses: dividends, share repurchases and investments.

A one-time-dividend might be a possibility, but the company has never done something like that, and it has not given any announcements relating to that option. Therefore, it remains an improbable scenario.

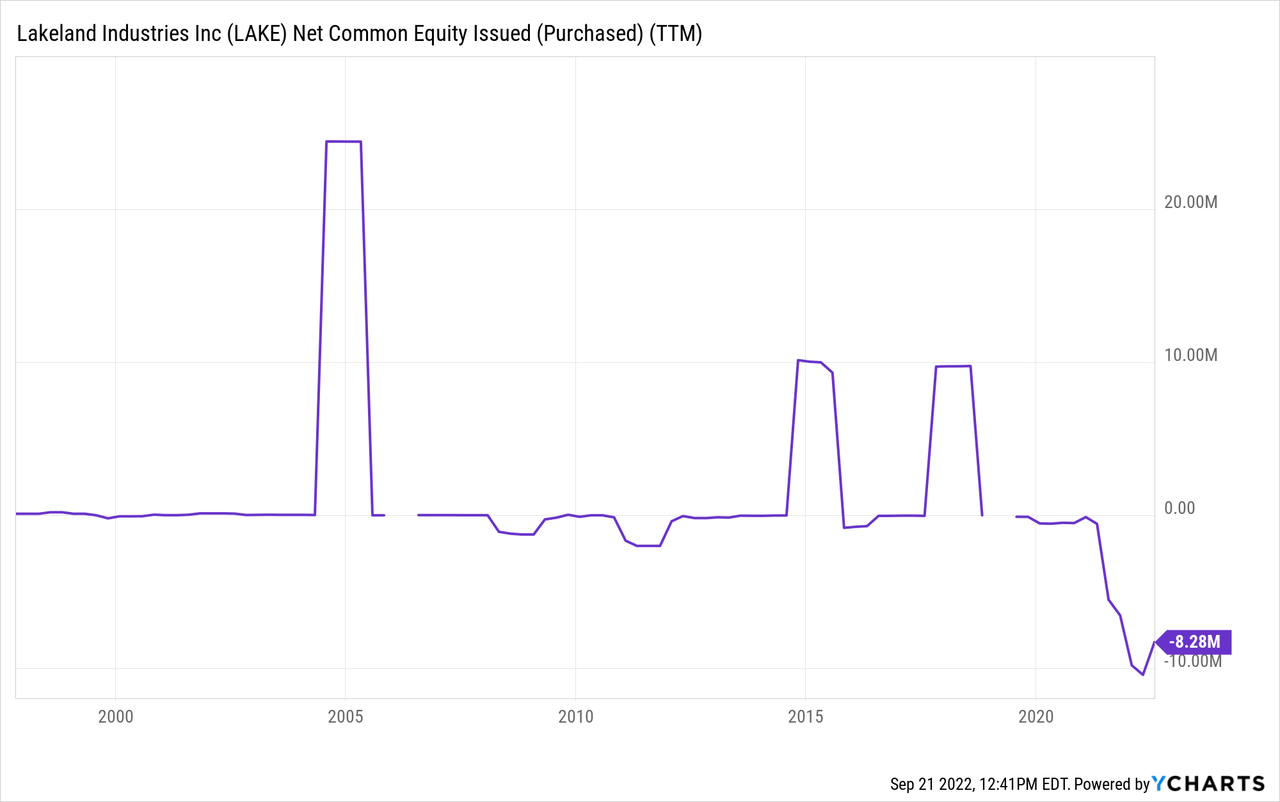

Share repurchases are a more natural option, given that LAKE has already purchased $10 million in stock in 2021, and another $3 million in the first two quarters of 2022. As the chart below shows, it is the first time that the company is doing significant share repurchases.

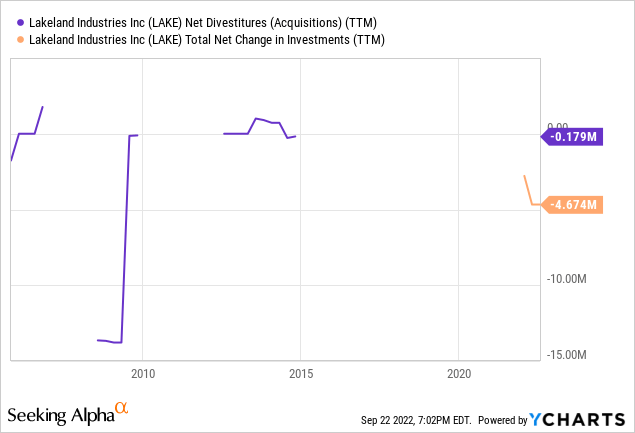

Finally, the company may invest some of those funds. LAKE lacks a definite history of doing acquisitions or investments, as the chart below shows. This means that acquisitions are less probable than share repurchases, at least to allocate $25 million.

However, the company did use some of the funds from the pandemic to invest in acquisitions. LAKE acquired 18% of Inova Design Solutions for $5 million. Inova is a UK company that develops a product called BodyTrak, a digital platform for monitoring worker health remotely using an earplug. The earplug can monitor heath, noise and fatigue.

The price paid by LAKE for Inova’s 18% implies a valuation close to $30 million, or one third of LAKE’s market cap. This price for a company that is still in the growth stage. LAKE does not provide financial information on Inova, but it does declare that in 2H21, it recognized an $0.1 million equity loss (for then 10% of the company owned), representing a $1 million loss for Inova for the period. A similar loss is calculated for 1H22 from the reported equity loss as of 2Q22.

In my opinion, LAKE would be better off repurchasing shares than doing this kind of expensive acquisitions. Investing privately in growth companies requires sufficient funds to build a diversified portfolio, given the high rate of failure. By investing in a single growth company, LAKE is not investing in growth, it is gambling.

Going forward

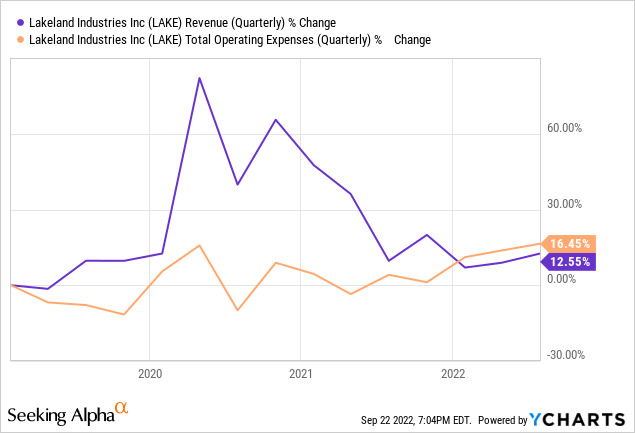

LAKE’s revenues showed the first sign of recovery in 2Q22. For the first time since demand started falling after COVID, revenues were higher on a QoQ basis. Quarterly revenue is also higher than in 2019, but by a slight 12.5%, barely enough to cover inflation.

While gross margins have resisted around 40%, operating expenses started climbing again, pushed by inflation. As of 2Q22, the YoY change in operating expenses is 12.5%, eating all of the revenue improvement between 2019 and 2022.

As I usually like to do, we can invert the company’s current market cap and find out how much it needs to earn to justify that price. LAKE currently has a market cap of $85 million.

Considering that it uses the $25 million available in cash to do share repurchases, the company can reduce its outstanding shares by 30%, to a total of 5.3 million shares.

This is a relatively risky assumption given that the company has not announced share repurchases for $25 million. However, it seems the most probable scenario (compared to acquisitions or dividends) given that the company has already repurchased $15 million in stocks, invested $5 million, and paid no dividends.

With a share price of $12 and our usual required rate of 10%, the company has to generate $1.2 per share in net income, or $6.4 million at the consolidated level (after repurchases). Using an effective 30% income tax rate, the company has to generate $9 million in pre-tax income.

With no debts, financial costs are negligible. Operating expenses are probably going to close the year at $38 million at least. Two data pieces point in this direction. First, 1H22 operating expenses were $19 million, projecting $38 million for the whole year. Second, 2021 operating expenses were $35 million. If we add 8% yearly inflation to $35 million we also arrive to $38 million.

That means the company has to generate $47 million in gross profits ($38 million operating expenses, $0 financial expenses, $9 million in pre-tax income). With a 40% gross margin rate, $47 million in gross profits translate to $120 million in revenue.

This goal seems difficult to achieve this year, but it is still possible, and may be reached next year. There are both positive and negative indications regarding this goal. On the negative side of data, LAKE had never generated $120 million in revenue before the pandemic. Even in 2021, with the help of still substantial COVID demand, the company only reached $118 million. On the positive side, 2Q22 results show revenue growth on a YoY basis, something that had not occurred since the pandemic. If the trend continues in 2H22, the company may reach the $120 million milepost.

Operating leverage plays an important role in these calculations. Reducing revenue expectations by $10 million (10%), to $110 million for 2022, reduces net income to $4.2 million, or a 35% fall compared to $120 million in revenue. The reader is also warned that the above calculations assume $25 million in share repurchases that have not been announced by the company.

Conclusions

In my opinion, there is not sufficient data to support purchasing LAKE. Even assuming significant share repurchases, the company may have trouble reaching minimum profitability to justify its current market price.

On a longer-term perspective, although LAKE operates in a competitive industry with much more prepared competitors, its strategy of moving towards higher margin items has worked in the past. The company was able to increase its gross profit margins, and to control operating expenses temporarily. The company’s lack of debt provides an additional margin of safety. That is, I do not have a negative opinion on LAKE as a company, but I do not like the current share price.

In the future, on the company side, I would look closely to both YoY revenue growth and operating expenses growth, as that will determine profitability at the corporate level. At the share level, the most important announcement would be a big share repurchase program.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment