Investment story

LafargeHolcim (OTCPK:HCMLF) posted record results for FY2019 in January 2020 as the coronavirus started to spread in China. Record cash flows, low leverage, and high liquidity put the company in a strong position to weather the current crisis. The exaggerated stock decline of the previous weeks makes the company an investment opportunity with potentially a >60% return.

A detailed write-up of the business and its competitive advantages are not repeated since they can be found here in an older post.

At the time of writing, 1 Swiss Franc = 1.03 USD.

Record performance in 2019 and strong financial stability

HCMLF’s 2019 performance indicates that the “Strategy 2022 – Building for Growth” is working and all financial targets for the year were exceeded. Like-for-like growth (adjusted for divestments) was 3.1% and EBITDA grew over-proportionally with 6.5%. At the same time, HCMLF had a record FCF conversion of almost 50% and achieved a ROIC of 7.6%. For the first time in years, HCMLF’s return on capital exceeded its cost of capital of around 7%.

Source: LafargeHolcim 2019 FY presentation

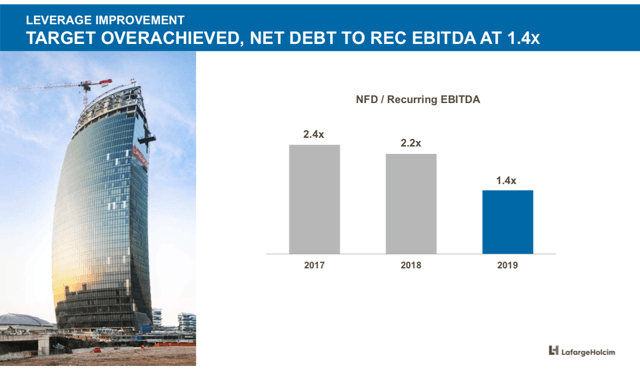

Not only did HCMLF return to growth and increase the profitability, but it also reduced the debt burden significantly from CHF 13.5bn in Dec. 2018 to CHF 8.8bn in Dec. 2019 (from 2.2x to 1.4x EBITDA).

Source: LafargeHolcim 2019 FY presentation

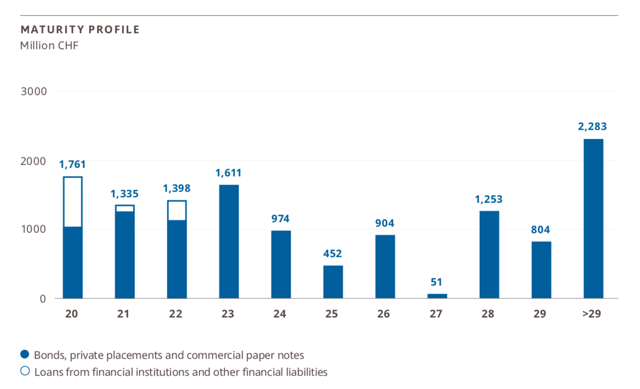

In addition to the small overall size of HCMLF’s debt, the maturity profile is advantageous and only CHF 3.1bn of financial liabilities are outstanding over the next 2 years. Lastly, HCMLF has a quick ratio of 1 and a liquidity position of CHF 8bn as of March 27, 2020.

All-in-all, HCMLF is a company with a very solid balance sheet and (up until January 2020) a very strong growth trajectory for a company of its size. It is in times of crisis like today when a conservatively managed balance sheet pays off – something that HCMLF will definitely experience over the coming months.

Source: LafargeHolcim 2019 Annual report

Impact of Coronavirus

While the coronavirus pandemic will most-likely not impact the mid- to long-term (2023+) global development, it has a tremendous short-term impact, bankrupting companies that are losing a high portion of their sales and/or are highly leveraged.

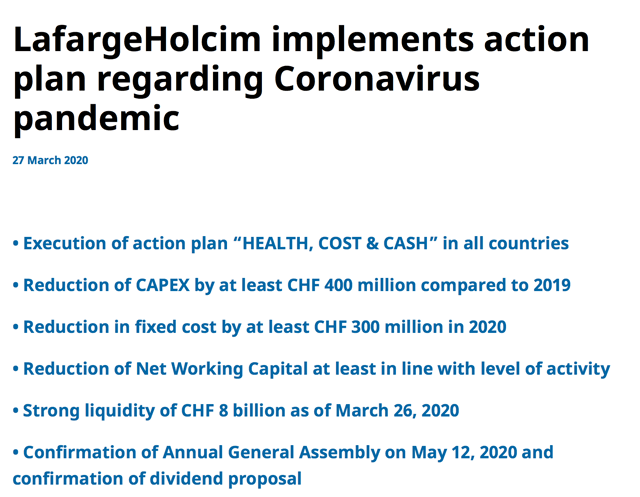

To mitigate the impact of the pandemic, HCMLF implemented an action plan with various measures to decrease costs and cash outflows. Fixed costs, capex, and net working capital will be reduced significantly compared to 2019. HCMLF plans, however, to maintain the CHF 2 dividend per share (5.6% yield, CHF 1.2bn in total) in 2020.

Source: LafargeHolcim Media Release

After assessing HCMLF’s overall financial stability, one must also analyse the specific liquidity impact and a potential bankruptcy risk from the coronavirus crisis.

To recap: HCMLF has a very conservative balance sheet with a net debt to EBITDA ratio of 1.4x, a quick ratio of 1, and a liquidity position of CHF 8bn.

In the situation where HCMLF would not make any sales in an entire year, it would have cash-costs of CHF 12.1bn (total costs – pure production-related costs such as material and fuel – depreciation + fixed cost reduction from action plan). In a very pessimistic scenario, where HCMLF would not make any sales for 6 months and break-even the other 6 months of the year, it would generate a cash-loss of ca. CHF 6bn. With the above-stated liquidity of CHF 8bn, HCMLF could comfortably survive such a scenario (and still pay the dividends). I also assume that if this extreme scenario should manifest, additional measures such as plant closures and layoffs could further reduce HCMLF’s cost base.

While it’s not a perfect comparison, looking at a company’s performance during the financial crisis of 2008 can provide some additional color. Since the construction boom and mortgage crisis led to the financial crisis, one might argue that this comparison is not too bad for a construction materials company. HCMLF’s predecessors Holcim and Lafarge had during the financial crisis between 2007 and 2010 a maximal revenue decline of -17% (Lafarge in 2009, adjusted for acquisitions and divestments) and a maximal FCF decline of -39% (Holcim in 2008), while neither net income nor FCF was negative for both companies for any year in this period.

Consequently, the 6 months at zero sales and a cash-loss of CHF 6bn – which HCMLF would survive – seem extremely negative, and hence, the risk of bankruptcy from the coronavirus seems highly unlikely (and this scenario does not yet include any newly issued loans or government emergency funds).

Long-term prospects and valuation

The fact that a company does not go bankrupt in the current situation is not enough to make an investment decision. Consequently, one must also analyse the long-term (post-coronavirus pandemic) prospects of the company and adjust the valuation for the impact of the crisis.

As there are virtually no alternatives (in terms of physical characteristics and price) to concrete and cement and construction activity will eventually pick-up again in the future, the business model of cement manufacturers is still very viable after the pandemic. HCMLF’s global position combined with strong competitive advantages and a great CEO (see previous write-up) will allow the company to strive again once the current situation has passed.

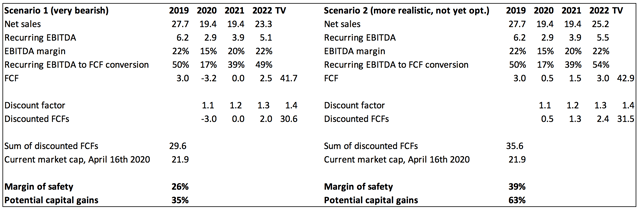

For a high-level valuation, two different scenarios are assessed. Both scenarios account for the coronavirus impact but differ by a magnitude of the impact. For both scenarios, a discount rate of 8% and a conservative terminal growth rate of 1% is taken.

- In a very bearish scenario, HCMLF suffers a massive -30% sales decline, of which 75% are directly translated into FCF losses, resulting in an FCF of CHF -3.2bn in 2020. This is followed by a slow recovery with FCF of CHF 0 in 2021 and CHF 2.5bn from 2022 onwards (vs. CHF 3bn FCF in 2019).

- In a more realistic scenario, HCMLF suffers a -20% sales decline (still strong decline than any predecessor during the financial crisis), of which 50% are translated directly into FCF losses, resulting in an FCF of CHF 0.5bn in 2020. This is followed by a faster recovery with CHF 1.5bn in 2021 and a “return to normal” in 2022 with CHF 3bn FCF.

With the current market cap of CHF 22bn, scenario 1 would still lead to a margin of safety of 26% and the potential for capital gains of 35%. Scenario 2 would have a margin of safety of 39% and potential capital gains of 63%. If these capital gains are realised over 3 years, scenario 1 would yield 11% p.a. and scenario 2 yields 18% p.a.

Additionally, to the valuation above, a few qualitative factors and potential value creation opportunities should be considered:

- While bankruptcy seems extremely unlikely for HCMLF, other companies in the cement and construction materials industry might get into more troubles due to the impact of the coronavirus and might become suitable acquisition targets for HCMLF at bargain prices and thus creating value for HCMLF shareholders.

- Thanks to the regional/local characteristics of HCMLF’s business, the company is not dependent on any global supply chains or sales contributions from single countries (largest country contribution is 15% of sales). Consequently, HCMLF can maintain production in countries where the coronavirus has not (yet) spread or the spread could already be contained and people and the economy start returning to normal. On March 27th, the management estimated that production volume in April 2020 in China will be at 70% of the previous year.

Also, from an EV/EBITDA perspective (5.4x), HCMLF is attractively priced today.

Risks

The current uncertain economic environment poses a risk for the construction materials industry, in general, and HCMLF in specific. A prolonged depression with significantly reduced construction activity around the globe would have significant revenue and cash flow impact on HCMLF and thereby reducing its valuation. While I don’t think that the long-term prospects of HCMLF would substantially deteriorate, it certainly reduces the margin of safety for investing in HCMLF. Consequently, an investor must continuously monitor the outlook for HCMLF’s business and update the valuation accordingly to see whether an investment makes still sense.

Another risk factor is the fact that HCMLF plans to maintain its dividend, which will be a cash drain of ca. CHF 1.2bn in 2020. I believe that the current management, which seems cautious and very cash-focused, thoroughly evaluated the risk of this liquidity drain and considered it not to be threatening to the company.

Catalysts

Countries communicating their post-shutdown plans and outlining a “slow return to normal” could give a further boost to global stock markets. If HCMLF still achieves its 2022 targets, this should further support the stock.

Conclusion

With HCMLF, investors buy a conservatively financed company that is well-positioned to weather the current storm. A strong stock decline due to the current pandemic allows for attractive returns for investors who have a long-term perspective and are now afraid of some further volatility along the ways.

Disclosure: I am/we are long HCMLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment