gguy44/iStock via Getty Images

This article was co-produced with Williams Equity Research (WER).

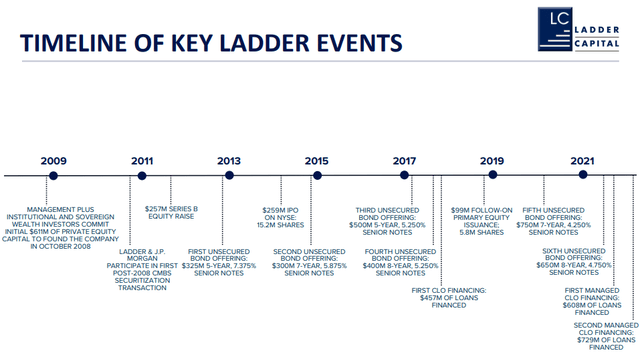

Ladder Capital Corp. (NYSE:LADR) – a commercial mortgage real estate investment trust (REIT) I wrote about in February – has made over $44 billion of investments since its inception in 2008. Its total assets today are approximately $6 billion.

So we’re not talking about tiny amounts of change. Maybe not massive, but still…

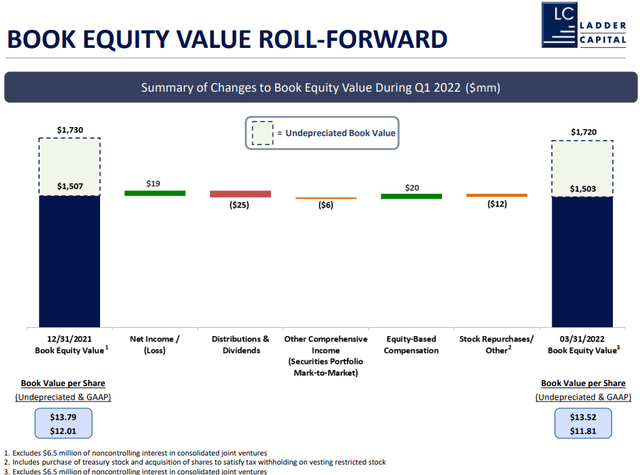

(Source: Ladder Capital Q1 2022 Presentation)

Since its founding, Ladder has conducted:

- 6 unsecured bond offerings

- 2 collateralized loan obligation (‘CLO’) offerings

- 1 equity issuance.

And the mREIT’s originated record loan volumes in the trailing 12 months ended March 31, totaling $3.5 billion. Incidentally, its management team has been underwriting real estate loans for a long, long time.

A full 75% of Ladder’s current portfolio was originated in the post-Covid environment – a testament to its short-duration strategy. Critically, 95% of balance sheet loans are floating-rate. Only about half of its debt is floating rate.

More on that later.

Ladder is unusual in several positive ways. For one thing, it’s one of a mere few internally managed mREITs. Better yet, insider ownership is high, with management owning 11% of shares worth over $160 million.

The leverage levels it relies on is also below average. And Ladder’s material exposure to physical commercial real estate is relatively rare for the sector, with Starwood Property Trust (STWD) being a notable exception.

Ladder’s operations are off to a good start this year. It’s collected 100% of interest so far. Though that’s no surprise to those familiar with Ladder’s long-term track record.

It boasts less than 0.1% losses on all investments originated. Ever.

Is the Portfolio Recession and Inflation Resistant?

Knowing that, let’s analyze Ladder’s portfolio, cash flow, and balance sheet. Obviously, we want to determine if the stock is attractive in today’s challenging environment.

When we do, we’ll find that it’s truly in a “plusses and minuses” situation. Let me explain…

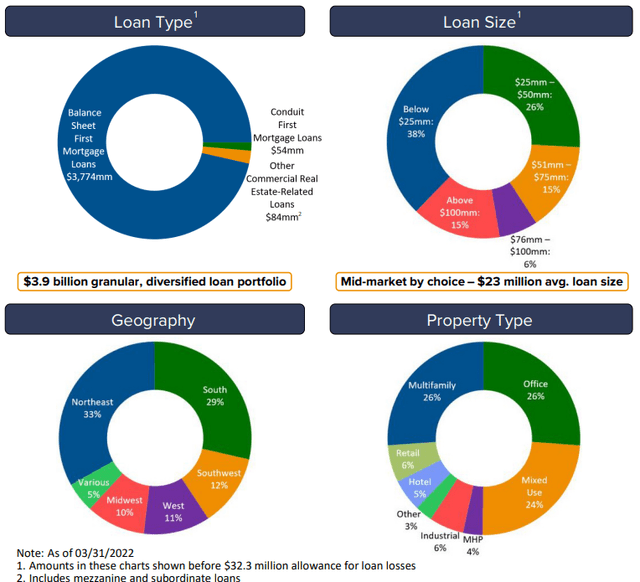

(Source: Ladder Capital Q1 2022 Presentation)

Ladder’s loan portfolio consists of 98% first-lien mortgage loans. That tells us it’s generally first in line to get paid if something goes wrong.

Meanwhile, its 68% loan-to-value (LTV) indicates an approximate 32% of equity would need to be erased before principal value is at risk. That’s healthy – and in line with or slightly better than its quality peer average.

These loans are also well diversified and generally less than $25 million in value.

Ladder doesn’t do construction loans, which are usually considered the riskiest. But it does engage in “lightly transitional” projects involving renovation or repurposing.

Moving right along on the list of its qualifications, Ladder’s geographical exposure is excellent. Its portfolio is now most heavily weighted to:

- Multifamily property loans (26%)

- Office property loans (25%)

- Mixed-use property loans (24%).

This means it has among the lowest exposure to the more cyclical retail (6%) and hotel (5%) subsectors of any mREIT.

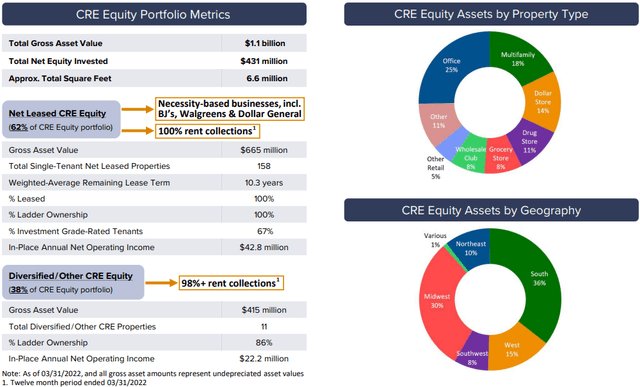

(Source: Ladder Capital Q1 2022 Presentation)

The property portfolio consists of two categories:

- Net-lease gross assets of $655 million

- Diversified/other of $415 million.

For the record, Ladder used $431 million in equity to acquire these assets.

Its physical properties have performed well in terms of rent collections. For example, its net-lease division recorded 100% collections in the last reporting period. And appreciation is noteworthy as well, with a $50 million gain above undepreciated book value from 2020 through 2022.

Two thirds of its net-lease properties are leased to investment-grade tenants like Bank of America (BAC) and Dollar General (DG).

Just like with the loan portfolio, Ladder has done a good job diversifying its properties by geography and individual building. We suspect it sees value in the potential net asset value (NAV) appreciation and portfolio stability that comes with a meaningful allocation to physical properties.

While not the exact same skill set, there is considerable overlap in the due diligence process involved in underwriting a property for a loan or equity investment.

Cash Flow and Dividend Matter, Especially for mREITs

Ladder is one of several mortgage REITs that cut its dividend in 2020.

It had been steadily increasing its quarterly dividend to $0.34 before that. But it reduced it to $0.20 in the aftermath of the pandemic… which is where it stayed until a very recent increase to $0.22.

That’s good to know. And dividends are an obviously critical aspect about REITs, whether equity or mortgage. But they’re not the most important element of a high-yield stock.

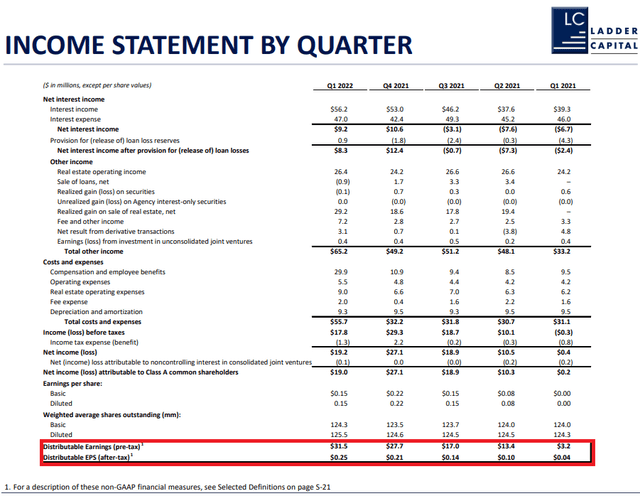

That metric would be cash flow yield, which takes the dividend and adjusts for the payout ratio. And Ladder generated $31.5 million, or distributable earnings per share (EPS) of $0.25.

At first glance, that’s not bad versus the dividend amount. Many quality mREITs have payout ratios significantly higher than Ladder’s 80%-85%, after all. Upon closer examination, however, we note that $15 million – approximately $0.12 per share – was created through the sale of two commercial real estate investments for $78 million.

While Ladder has a strong track record of generating steady positive returns from its property portfolio, we can’t consider that recurring income sufficient in frequency to support a quarterly dividend.

(Source: Ladder Capital Q1 2022 Supplemental)

Here’s some more math for you…

The mREIT generated between $0.04 and $0.21 in quarterly distributable EPS between Q1-21 and Q4-21. But net interest income declined in Q1-22 compared to Q4-21.

It’s therefore clear that more than just traditional interest contributed to last quarter’s unusually strong $0.25 in distributable EPS.

As a final note on this subject, non-cash, stock-based compensation rose from an average $4 million quarterly for 2021 to $20.4 million in Q1-22. These stock grants will eventually become a real cost to shareholders, but it’s excluded from distributable EPS.

This also serves as a prelude to what we’ll discuss in the final section of today’s article.

Maybe All That Liquidity Will Pay Off After All

From a balance sheet perspective, Ladder was known as having a ton of liquidity coming out of 2020. This was a result of taking a conservative route and selling off problematic portions of the portfolio.

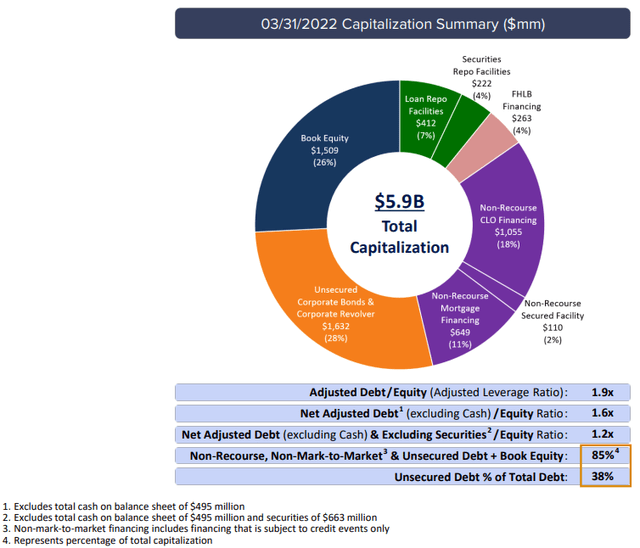

(Source: Ladder Capital Q1 2022 Presentation)

Unbeknownst to even most experienced mREIT investors, Ladder carries sector-leading BB+/Ba1 credit ratings from Fitch and Moody’s. That’s only one notch from investment-grade.

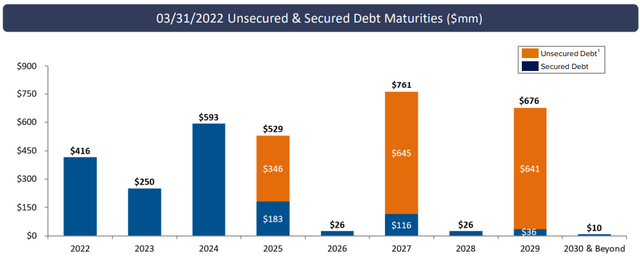

The conservative leverage ratios cited above – coupled with the favorable debt maturity schedule captured below – are major reasons for Ladder’s comparatively strong credit ratings.

(Source: Ladder Capital Q1 2022 Presentation)

In fact, Ladder has no corporate bond maturities before 2025. From a balance sheet perspective, it features an obvious conservative structure. And it’s positioned to capitalize on market dislocations rather than be subjected to them.

That’s a big change compared to Q1-20.

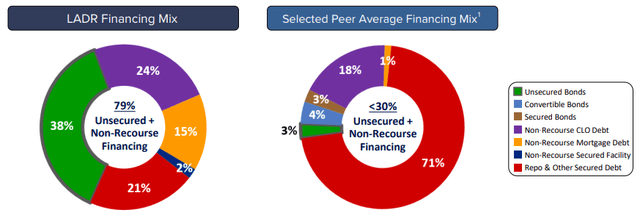

(Source: Ladder Capital Q1 2022 Presentation)

This is further illustrated by Ladder’s debt composition compared to peers. It has far higher unsecured and non-recourse debt and uses more diversified funding sources.

All this adds up to a less risky and more adaptable balance sheet compared to most peers.

LADR Stock Valuation And Risk

Let’s begin with the ever-expanding elephant in the room: interest rates. Most yield-oriented investments get hammered when rates rise.

That’s because most don’t have a mechanism to increase their cash flows alongside interest rates.

But some do.

In fact, many of my favorite investments have that capability: mREITs and business development companies (“BDCs”) – though, as I wrote in “Warning: Do Not Chase Yield,” you have to be very careful when investing in the former.

The details vary, but the formula is essentially the same.

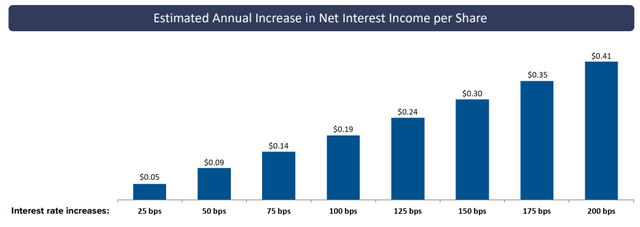

When it comes to Ladder, its balance sheet includes 95% first-lien loans comprised of floating-rate loans with interest rate floors.

The liability side of the balance sheet, however, is a 52% fixed-rate debt. That leaves a large portion of its balance sheet that ratchets higher alongside interest rates.

(Source: Ladder Capital Q1 2022 Presentation)

As shown above, Ladder is structured to generate considerable per-share net interest income as rates rise. Management estimates $0.14 for a 75 basis-point increase… which is where we stand today.

As for the future, it sees $0.24 for 125 basis points – where we’ll likely end up in 6-12 months – and $0.41 for 200 basis points.

Remember that Ladder generated $0.13 in distributable EPS in Q1-22 after removing realized gains from property sales. That means the recent 75 basis-point increase in rates may generate a full quarter’s worth of incremental earnings.

There’s no guarantee that’s how the math will work out, of course, but I’m confident it’ll be in that direction.

The other major risk for mREITs is non-accruals. Ladder’s portfolio has a near 100% payment rate, and that includes the real estate portfolio. Leverage ratios are also conservative and don’t warrant special mention.

This leaves us with cash flow per share. If we use quarterly average realized gains from the property portfolio of $7.5 million, we land at about $24 million or around $0.19 per share in recurring cash flow.

Adjusting for the fact that Ladder has originated substantial net new loans in recent quarters, it’s reasonable to assume this has the potential to increase 5%-10% quarterly for the next year. That results in about $0.25 at the low end and $0.28 on the high end.

This bodes well for the payout ratio for the current dividend. It also means Ladder is no longer expensive on a cash flow basis. With a current stock price of approximately $10 per share, the stock is trading between 10x and 8.9x forward earnings estimates.

That is IF the new loans are accretive as we anticipate they’ll be.

In Conclusion…

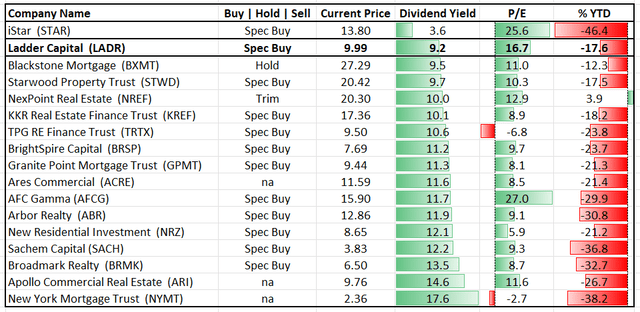

On the surface, this looks good versus the broader stock market and vast majority of equity REITs. Versus other mREITs, however, the situation changes.

Starwood Property Trust – which never cut its distribution during 2020 and has a current yield of 9.4% – has a forward multiple of 8.8x.

Blackstone Mortgage Trust (BXMT) – which also maintained its dividend throughout 2020 and 2021 – trades at 10.7x and yields 9.1%.

KKR Real Estate Finance Trust (KREF) – yet another large mREIT backed by a Wall Street heavyweight that sustained its payout – trades at a forward earnings multiple of only 8.1x with a 9.9% yield.

This makes Ladder’s stock price of $10 a lot more logical. That’s what’s needed to get its 8.8% dividend in line with peers.

Where Ladder shines, however, is price-to-book value.

(Source: Ladder Capital Q1 2022 Supplemental)

Ladder trades at a 20%-30% discount to book value while many peers still trade near par with several at modest premiums.

So, what’s the verdict?

If you believe Ladder’s management team will continue increasing EPS in the coming quarters… the stock is likely 20%-30% undervalued provided a reasonable hold time.

If you believe cash flow per share is where the rubber meets the road, Ladder is fairly priced against its peers or slightly overvalued. This is the camp I usually hang out in.

Now, that wasn’t necessarily the story a few weeks ago. But with all the mREITs I’ve cited so far in this article down 12%-20% year-to-date?

Things change.

That’s just how the stock market cookie crumbles.

I’m working on a deep dive commercial mREIT article now for iREIT on Alpha members.

(iREIT on Alpha)

Be the first to comment