marchmeena29/iStock via Getty Images

Ladder Capital Corporation (LADR) is another mortgage trust that has a good chance of outperforming the market in a high-inflation environment, with real estate investments acting as a natural hedge against inflation. With the risk of a recession increasing, Ladder Capital could be an attractive investment for yield-seeking investors looking for a combination of dividend stability and the potential for higher portfolio income. The trust recently increased its payout by 10%, and the stock began trading at a larger discount to book value in June.

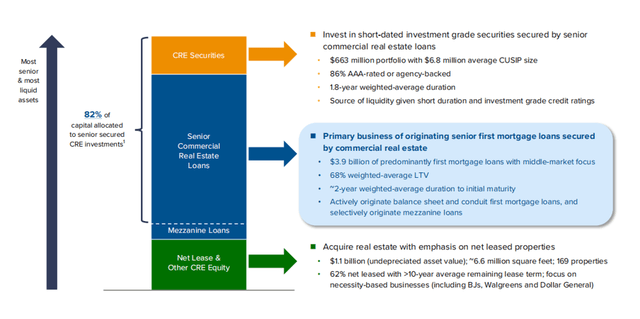

Ladder Capital’s Main Focus Is On Mortgage Loan Origination, Although It Also Makes Investments Throughout The CRE Capital Stack

Ladder Capital’s core business as a commercial mortgage trust is the origination of mortgage loans backed by commercial real estate. Hotels, offices, industrial, mixed-use, and multifamily properties are examples of commercial real estate that facilitate loan origination. Ladder Capital primarily originates mortgage loans, but it also invests in the commercial real estate market at all levels of the capital stack, including commercial real estate securities, mezzanine loans, and net lease commercial real estate investments.

Investments Overview (Ladder Capital Corp)

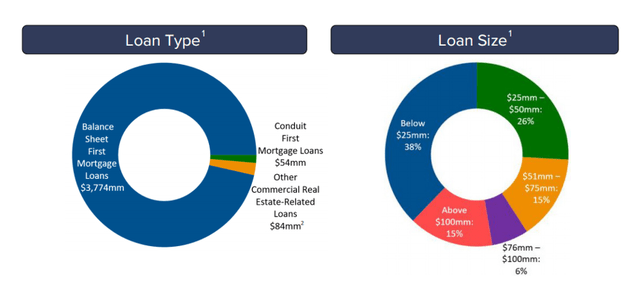

First mortgage loans are the foundation of Ladder Capital’s commercial real estate investment portfolio, and new originations are what are driving the trust’s growth. Ladder Capital originated $2.9 billion in new loans in 2021, a company record, due to strong demand in the commercial real estate industry. The loan portfolio of the trust was primarily made up of first mortgage loans, with an average loan size of $23 million. The vast majority of first mortgage loans, 98% in total, are senior secured loans.

Loan Types And Size (Ladder Capital Corp)

The majority of Ladder Capital’s first mortgage loans have floating rate interest rates rather than fixed rate interest rates, which I will explain in a moment.

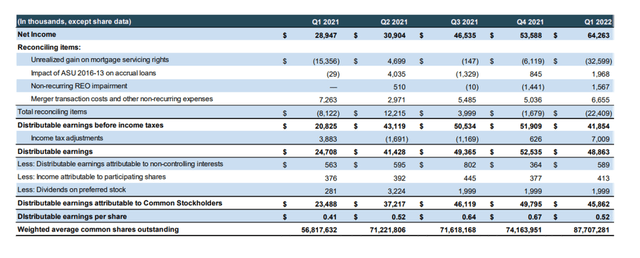

The trust’s distributable income, which quantifies how much money is available for distribution to shareholders, is the most important figure in Ladder Capital’s earnings release. Distributable earnings are also important in calculating pay-out ratios, which investors can then use to determine whether or not the yield is sustainable. Last year, the trust paid out $0.80 per share while reporting cumulative distributable earnings of $2.35 per share, resulting in a pay-out ratio of only 34%.

Ladder Capital just announced a 10% increase in its quarterly pay-out to $0.22 per share.

Distributable Earnings (Ladder Capital Corp)

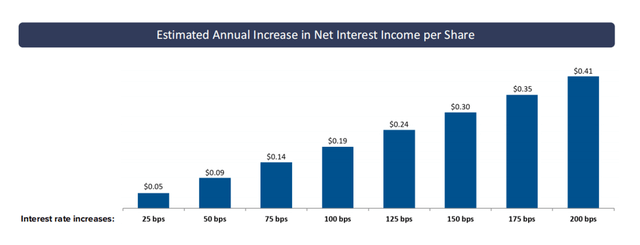

Let Interest Rate Hikes Begin

If interest rates continue to rise, Ladder Capital’s earnings will rise. With inflation at levels not seen since the 1980s, the central bank is poised to embark on an aggressive rate hike cycle, which could result in an increase in net interest income for Ladder Capital. With 95% of Ladder’s first mortgage loans floating rate and with interest rate floors, the trust provides some protection against inflation and higher interest rates.

Estimated Annual Increase in NII Per Share (Ladder Capital Corp)

Ladder Capital’s Stock Trades At A Discount

Ladder Capital’s stock began trading at a wider discount to book value in June, and the same is true for high-quality mortgage trusts such as Starwood Property Trust (STWD) and Blackstone Mortgage Trust (BXMT). Ladder Capital’s stock trades at an 18% discount to book value, whereas the other mortgage trusts trade at book value. Ladder Capital has the greatest upside potential because it trades at the largest book value discount.

Why Ladder Capital Could See A Lower Stock Price

Ladder Capital has established a solid operating platform and investment portfolio composed primarily of high quality senior (secured) first mortgage loans with a very low loss ratio. The trust is protected against borrower defaults because the first loans are secured by commercial real estate. A severe real estate recession, such as the one that destroyed the real estate market in 2007, will almost certainly be a major issue for Ladder Capital, as demand for originations will likely dry up quickly. In the absence of a major real estate collapse, the trust’s portfolio is well-structured and diversified, making risk appear to be limited.

My Conclusion

Ladder Capital is a mortgage trust that has recently begun to trade at a significant discount to book value, but this situation may actually be a good reason to purchase the trust’s stock. The stock is currently trading at an 18% discount to book value, while peers are trading at book value. Until recently, Starwood and Blackstone’s stocks traded at roughly a 15% premium to book value.

Having said that, Ladder Capital has a very well-covered dividend and recently increased its payout by 10%. Investors looking for yield should consider Ladder Capital because the trust’s strong origination business, as well as floating rate exposure, point to rising portfolio income in the future. The yield has risen to 9.3% as a result of the increase.

Be the first to comment