JHVEPhoto

Dear readers/followers,

Investing in defense has been a rocky road this year – but it’s still mostly outperformed the index. Investments in most of them are slightly negative. L3Harris (NYSE:NYSE:LHX) isn’t the highest yielder of the bunch, but at the right valuation, it’s still “undervalued cash flows”, as I see it, and can offer some impressive RoR.

However, it’s crucial not to be blind to peaks and overvaluations either. Each of your investments should have a point where you state that it’s time to sell off the stock in favor of something cheaper – even if that price is monstrously high.

That’s what happened when I sold L3Harris close to March when the entire conflict started, and the company triggered a “SELL” alert when it jumped over $265/share. It wasn’t the biggest stake – around 1.6% of my portfolio at the time. But it still brought considerable profit. I still own a small stake in L3Harris, and now I’m looking to expand it.

Why?

Here is why.

Updating on L3Harris

For those of you not remembering my first or base articles on the company, that one was one I wrote many months ago – over 1.5 years, in fact. The company has been on an upward trajectory since then, yielding returns of around 15.7%. In the face of today’s market, that’s still a good upside. However, my sold position was well over 25% RoR.

L3Harris Article (Seeking Alpha)

This once again shows you the importance of investing at what I would call “undervaluation”. The best – and even worst – companies can deliver good RoR if these considerations are made.

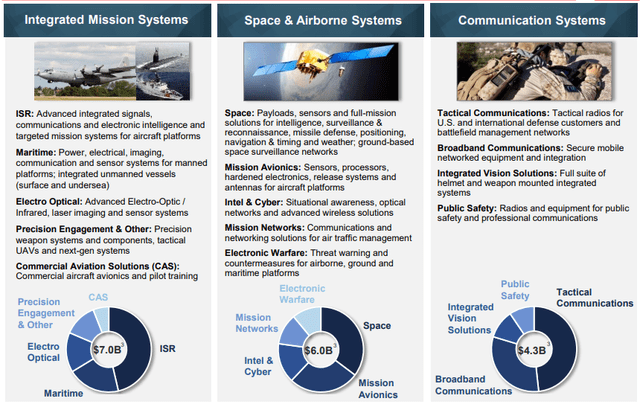

L3Harris is a bit of an odd man out when it comes to what they do. The company doesn’t manufacture planes, subs, vessels, tanks, or ammunition to the aforementioned assets, aside from some UAVs.

Instead, the company specializes in specialized systems, like Surveillance, Electronic Warfare, and microwave-based weapon systems. They’re also heavily invested in wireless equipment, tactical radios, avionics, night vision systems, and antennas. But just because they don’t build tactical planes doesn’t mean they’re not a force to be reckoned with. In terms of overall size, LHX is still amongst the top 10 defense contractors in the entire world, and its roots go back over 125 years. Its real size came in a doubling back in -15, when it bought Exelis.

Here are the company’s updated sectors, after a small adjustment on a YoY basis.

As you can see, these are some well-balanced overall sectors in terms of mix and appeal.

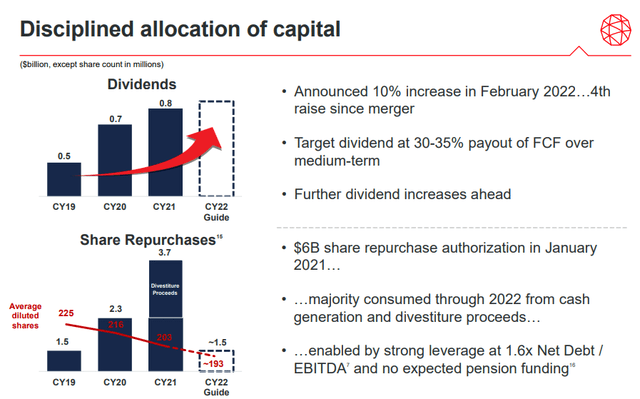

And as the current share price trends would clearly imply, things are going quite well for LHX. The company boasts one of the best margins in the entire industry while combining this with one of the healthiest balance sheets in the entire sector. The Ukraine crisis hasn’t changed the company’s targets, but enhanced them, rather. This has only enhanced the company’s cash conversions in terms of FCF, which is over 105%, making only one peer even close in terms of competition.

Threats are accelerating and military budgets across this international player’s market are increasing. This is a natural tailwind to LHX. The company is a major player in NATO, and the ex-US NATO budget has been pushing $370B now with threats increasing. The company is a major player with focus on 12 countries, many of which are major players in the current geopolitical space.

LHX IR (LHX IR)

In fact, rather than expecting margin compression due to input issues and inflation, the company is expecting margins to rise to above 2021 levels due to demand, pricing, and better bidding. Cash generation is expected to remain robust, and without R&D Tax capitalizations, would come in higher than 2021. With that included, we’re still looking at around $2.15B on the low end, continued EBIT growth, and a reduction in average working capital (down to 40 days from 52 due to efficiency and management improvements).

Dividends are also expected to rise, with 2021 being a perfect time for share repurchases. Now, less so – but still a target for the company.

There are multiple ways for the company to deliver the EPS growth I will show you in the forecasts. Increased winning and bidding on contracts, further international expansion in line with the current geopolitical macro as the west is increasingly pushing Russia back, optimization in manufacturing and SCM as well as overhead to keep pushing the company’s best-in-class margins, continued EBIT growth, and focus on growing that FCF as much as possible while delivering the quality and reliability that customers have come to expect from LHX.

The company’s systems are being used in the most advanced reconnaissance aircraft, in Air Force One and Nuclear Command, and in the world’s most advanced transport aircraft. The company’s marine offerings are being used in modern frigates, including in aviation, electric, systems integration, bridge and design, steering controls, sonars, auxiliary systems, and other areas. Any modern sort of military equipment, and you can put money on that there’s some part manufactured by LHX in there.

This is a very advantageous situation for LHX to be in, and by extension, LHX investors as well. The company is of course also somewhat exposed to commercial aviation, in areas like TCAS systems, Standby systems, flight recorders and transponders. The company also develops training solutions, including simulators – so when the market bounces back fully, we’re like as not to see even further growth here.

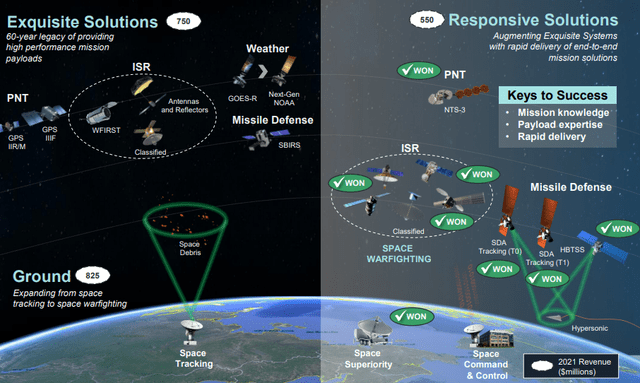

The company also has future-bound growth vectors – such as Space.

The fact is that with Russia’s military clearly (as battle reports suggest), still at a 1960-1970s technological level with some extreme exceptions of modern equipment, USA and NATO are in a position to dominate not only the land and sea-bound military areas, but space as well. It’s my view that this should be done in all haste, to protect NATO, the USA, and Europe as well as allies such as Taiwan and Japan, in order to ensure protection not only from Russia but from China as well who are starting to push the envelope on space.

LHX is a major part of such a strategy.

For me, this is a major reason to invest in LHX.

The age of singing Kumbaya with the former Soviet Union is over. We’ve entered an age of albeit currently, indirect military confrontation (in that NATO is not yet physically involved in the conflict). In the event that a physical confrontation is inevitable (which by the way I do not believe – my stance is that Russia will back down eventually) and if not, a good offense is the best defense.

Europe, NATO, and the USA and its allies need to be at the forefront of military development and expanding our military coverage, infrastructure, and might on land, in the air, in the sea, and in space. I believe this is the best way to ensure safety and our interests being shielded from harm. (And this is coming from someone in Sweden, highly in favor of joining NATO)

LHX is a direct contributor to this aim, and it seems that governments, NATO, and our allies understand this in their allocation to military budgets and safeties.

Let me show you why in terms of valuation, an investment here makes sense.

L3Harris Valuation

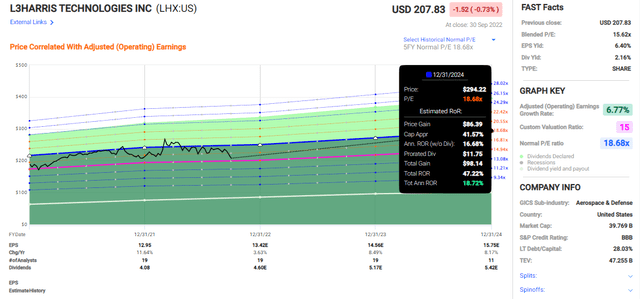

In my previous article, I made a point of stating that L3Harris looked very good and ripe for investing at around a 15.4x P/E. The somewhat amusing thing is that we have almost the exact same situation here.

L3Harris is now trading at a valuation of around 15.6x, meaning any premium consideration (the company typically trades at closer to 18.5x), means that the upside here is closing in on 19% per year.

L3Harris Upside (F.A.S.T graphs)

This is very good upside – and it’s realistic for the long term. But even at 15-16x P/E, you’re still being mostly protected from a significant downside of sub-par development.

The company’s yield is certainly not the highest out there. But it does have decent dividend growth which means that my YoC is above 3%, in line with comps here such as General Dynamics (GD) and Lockheed (LMT). And, as you can also see, the company’s dividend is expected to expand to around $5.42 in 2024, which would imply a 2.6% YoC for today’s share price.

LHX is a great long-term play with, to me, very clear “BUY” and “SELL” targets. I “BUY” the closer to 15x P/E it gets, and I “SELL” when the number reaches 20x – though the company can in some cases, go well above 20x P/E for long periods of time.

I do think that we’ll see higher valuation compression as we move forward in the current rate and inflation environment, which justifies my capping LHX at 20x.

Income investing is all well and good, my friends. However, we must also grow our principal safely. At these growth rates, it wouldn’t be incorrect to characterize L3Harris as a “growth” type dividend stock, and this is excellent pricing for such a stock.

I also want to emphasize, again, that L3Harris doesn’t miss estimates – they beat or hit them with a 10% MoE-adjusted target, for the past 10 years. This is a superbly safe company with investment-grade credit, less than 1.65X net debt/EBITDA, and active on an international basis.

Analysts agree that the stock is currently undervalued. Current S&P Global targets go for a PT between $198 to $333, or an average of $276 per share. That gives us an upside of 32.9%, which is higher than I would personally go. But still, 13 out of 17 analysts have a “BUY” or equivalent rating here, which mirrors my high degree of confidence in the company at this time.

For myself, my PT on LHX is $250/share – no higher, but also no less than that.

That makes LHX a “BUY” here.

Thesis

My thesis for LHX is as follows:

- L3Harris is a major global defense contractor with a portfolio that is well-suited to the current geopolitical macro. I believe it will do extremely well for the next 10-20 years based on its current positioning, and this leads me to a positive thesis, in those scenarios where the valuation “agrees” with our thesis.

- I would give the company a valuation target of a 17-18x P/E range, normalized. This brings the PT to around $250, meaning a double-digit upside at the current valuation.

- That makes LHX a “BUY” to me.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment