Michael Derrer Fuchs

Published on the Value Lab 11/8/22

Kyndryl Holdings (NYSE:KD) is the GTS segment that has been spun off from IBM (IBM). It’s not an exciting business like Red Hat is, which is likely one of the reasons it’s been made into a NewCo. The relationship with IBM meant that GTS was sacrificed in terms of margin to generate business elsewhere. Initiatives to reprice old accounts will add to gross margin. Moreover, the proposition is that the company is trying to streamline things with automation and to generate SG&A savings as an individual entity. There’s a lot going right with Kyndryl as it goes from the mire of being a new going concern into profitability. The business isn’t exciting, but it’s cheap all things considered. A buy.

Quick Kyndryl Primer

Kyndryl is about applying its people to designing and managing infrastructure of companies like financial services for their cloud, whether multicloud, private cloud, public cloud or hybrid cloud, as well as their databases and their security, to generate revenue and profits on accounts. They have people with lots of IBM certifications but also for other types of clouds, and it’s all for putting solutions together for clients leveraging whatever technology is on the market.

Kyndryl was spun off from IBM. Why was this a decent move?

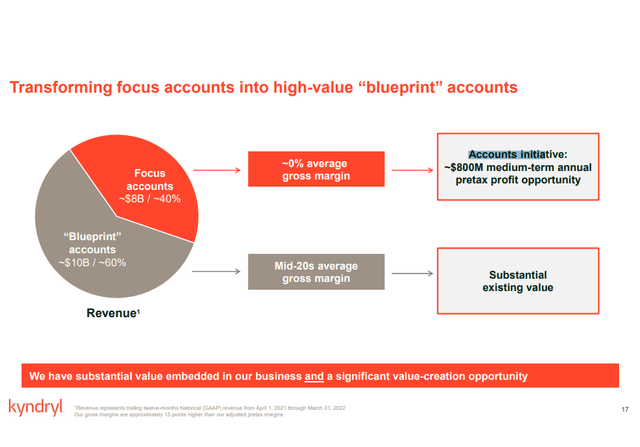

- GTS (global technology services) was a terrible segment in IBM results prior to the spin off. It was always in decline and contributed poorly to the mix. This is because they were essentially part of the 2-for-1 special so to speak. When IBM created business in more interesting segments, GTS would be tacked on at a ‘competitive’ price and the segment became a clunker for it. Operating alone will give it the chance to price itself properly, and there is scope for repricing on current business. In fact, almost half of their accounts are unprofitable and add nothing even to the gross margin. These are focus accounts and $800 million or 20% of current revenue could be added to the bottom line with a revision of some of these accounts.

- The other reason is that they’re not married to IBM cloud or IBM Watson anymore. Neither of these were premier in their markets, which is why IBM needed to buy Red Hat, so at least somewhere they had a leading product. They can do more now and offer more competitive solutions.

Kyndryl is not an exciting business. It is mostly commodity tech, make no mistake. In fact, it’s actually in a slight secular decline on account of that. Still, there is scope for automation, optimization, and they are still mission critical, so resilient to macro forces as a necessary cost-center.

The Q2

The quarterly results were quite bad but mostly due to currency effects. 9% was taken off revenue growth due to foreign exposures not measuring up to a strengthening dollar and the lack of hedges. Without those they’d be up 2%, which is not bad considering the business profile.

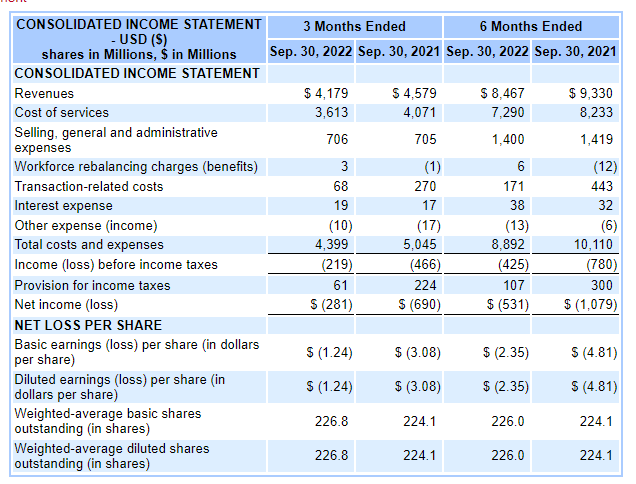

IS KD (sec.gov)

What’s more are the savings they still achieved. About $400 million in gross margin savings thanks to various optimization programs. Half of that was from the aforementioned accounts initiative, which is the revision of poor economics in current unprofitable accounts.

Accounts Initiative (Q2 2022 Pres)

They are aiming for cloud integration and consulting markets as well. This is slightly at odds with what IBM already offers, but it’s a growing pie so it should give them some cloud headwinds.

Valuation

There are risks. Corporate spending is finally falling even for marquee players. Growth could be harder to come by. Moreover, revision of current accounts could be unpopular, they may not fully deliver savings. Finally, currency effects are real effects if the dollar stays as strong as it is which it likely will if inflation isn’t well dealt with. Then the market will also have big problems, and KD will similarly suffer.

Still, the multiple is very low. Even with 10% dilution from outstanding options and warrants, the multiple remains very low if you take the adjusted EBITDA figures at face value. It is not much more than 2x EV/EBITDA. Moreover, the company is clearly emerging into profitability, and the adjusted EBITDA is converting fully into operating cash flow, which is positive as opposed to last year when tax effects affected it. Also, for current accounts it’s still resilient barring solvency of clients. 75% are fortune 500 so the chances are low in most cases.

This is not a company that excites us, but a spinoff usually creates opportunities because markets are slow to react when it’s not an IPO and there wasn’t a roadshow to stir interest. Moreover, the timing wasn’t great for Kyndryl to become a going concern. It is also still unprofitable, and you have to trust management to deliver on the cost savings to emerge the company into the promised adjusted EBITDA figures on a more GAAP basis. You may not want to trust management, since IBM arguably had a penchant for making things look a little rosier than they were in the earnings materials. Still, at these levels and in this special situation Kyndryl looks quite interesting.

Be the first to comment