owngarden/E+ via Getty Images

Short video and livestreaming platform Kuaishou is seeing solid growth and prospects for further expansion are bright. Regulatory and competitive risks, however, could weigh on share performance.

Solid growth

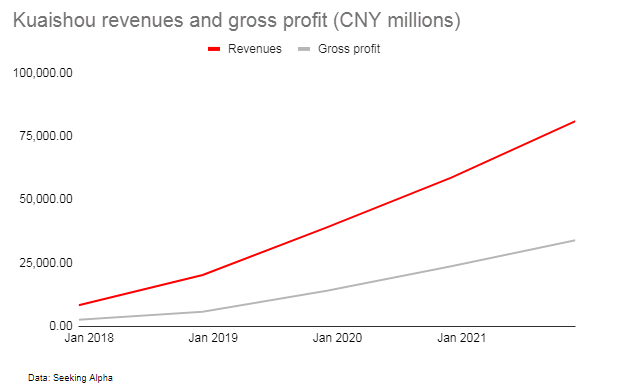

Tencent-backed (OTCPK:TCEHY) Kuaishou (OTCPK:KUASF), China’s second-largest short video and livestreaming platform, continues to see robust growth. Revenues and gross profits have been growing at double-digit growth rates over the past few years, albeit at a decelerating pace along with an expanding base.

Author

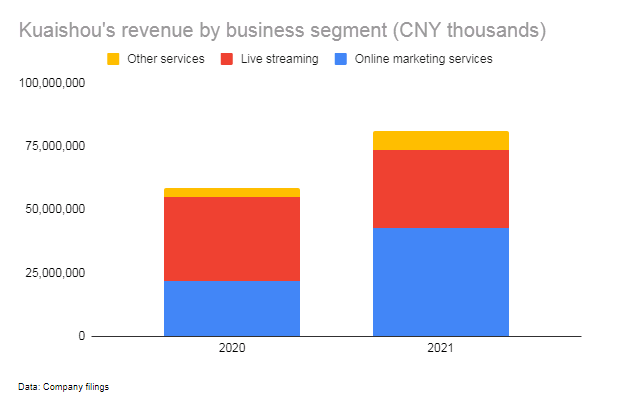

2021 revenues reached CNY 81 billion up 37.9% YoY, driven by Online Marketing Services – its biggest business segment – which saw revenues jump 95.2% YoY to CNY 42.6 billion, followed by Other Services which saw revenues soar 99.9% YoY to CNY 7.4 billion on the back of strong growth of its eCommerce business. Live Streaming, Kuaishou’s second-largest business segment, reported revenues of CNY 30.9 billion, down 6.7% as consumers spent less time online following easing lockdown restrictions.

Author

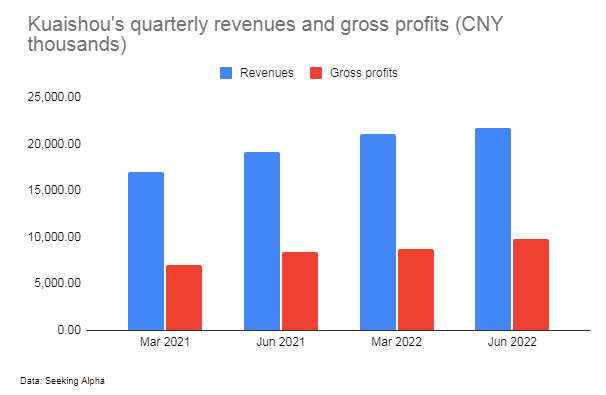

The momentum continued in 2022 with revenues and gross profits continuing to rise by double-digit percentages over the past two quarters.

Author

Going forward, the company stands to benefit from several growth drivers.

Strengths include a captive and highly engaged audience

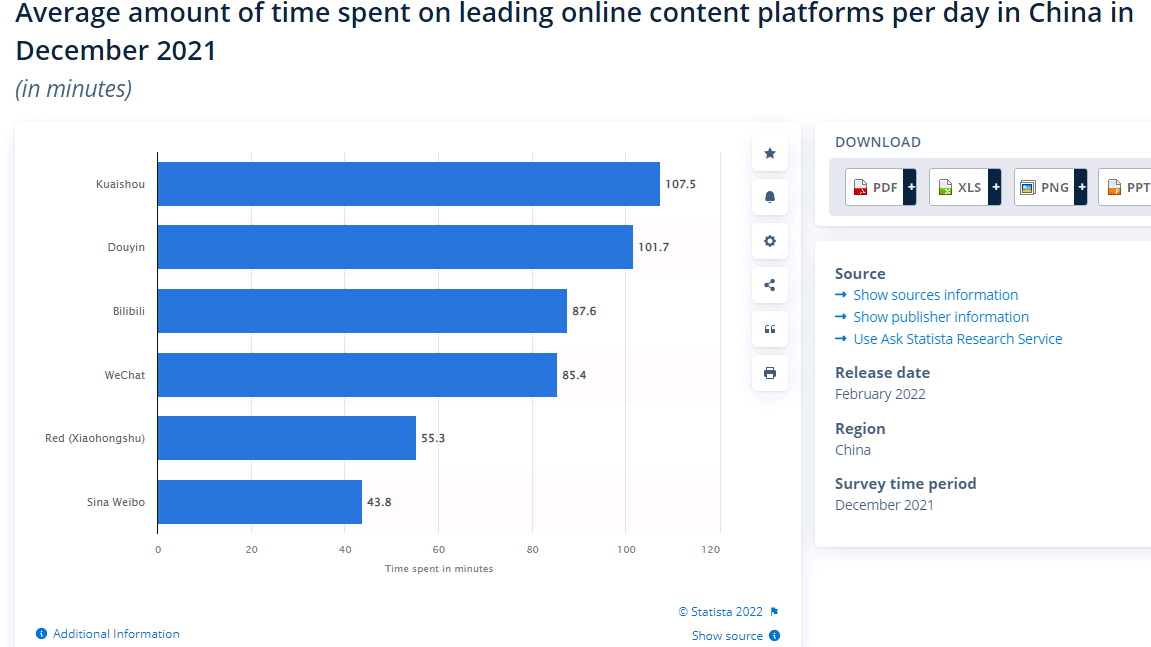

Although Kuaishou and its bigger rival ByteDance (owner of TikTok and Douyin) are often compared together, they are not entirely direct competitors; ByteDance focuses on users in first and second-tier cities while Kuaishou’s userbase is heavily concentrated in lower-tier cities and rural regions in China. With upper-tier residents having relatively more distractions in their lives, Kuaishou users spend on average more time on the app compared to Douyin users, and Kuaishou enjoys the highest user engagement in terms of average time spent daily.

Statista

Their contrasting audiences mean each platform’s respective video content is also vastly different with ByteDance’s platforms focusing on premium, aspirational content featuring upmarket brands and high-profile celebrities while Kuaishou’s videos tend to lean towards more realistic, authentic videos uploaded by rural folk recording their day-to-day activities. For advertisers, Kuaishou’s platform offers a unique, and as yet largely unrivaled value proposition for mass-market brands seeking to target lower-tier consumers. Although this customer demographic may have relatively lower spending power compared to their urban counterparts, their incomes are on the rise and are expected to double by 2035 in line with China’s Common Prosperity ambition, leaving room for consumption upgrades, a positive trend for Kuaishou.

Userbase diversification could open additional monetization opportunities in advertising and eCommerce

Kuaihsou’s unique positioning as a platform with a ‘rural’ flavor not only caters to its core userbase of rural and lower-tier city residents, but it is also becoming increasingly attractive to Chinese urbanites keen to explore rural life directly from rural folk (as opposed to scripted shows), as well as trace sources for products, notably agriculture products, which are largely produced in rural China (Kuaishou in fact strongly encourages videos related to product traceability and exclusive sales events). Billions of product orders were generated in China in 2021 through Kuaishou’s platform, of which more than half a billion (specifically 560 million) orders were for agricultural products. Traceability is fast becoming a topic of interest across a variety of industries from fashion to agriculture as consumers become increasingly demanding about supply chain transparency and Kuaishou’s stronghold over this segment of the supply chain better positions the company to connect rural producers directly with urban consumers, expanding its userbase in the process and opening monetization opportunities in advertising and eCommerce.

Kuaishou has also been luring first-tier users with mini-dramas “Kuaishou Playlet (快手短劇)” which according to the company has successfully attracted female users in higher-tier cities. Not only does this help with userbase diversification, but such appealing content helps drive user traffic as well, amplifying monetization opportunities in advertising.

International expansion could drive traffic and increase monetization opportunities

Douyin and Kuaishou have been recently expanding into overseas markets. While Douyin blazed into developed regions in the West, i.e., Europe and North America, Kuaishou’s strategy is focused on developing markets, where its advertiser base is likely to find better success (the majority of Kuaishou’s advertising revenue in Brazil and Indonesia – two of Kuaishou’s international markets where it has the highest DAU – are derived from Chinese businesses looking to expand overseas). On the eCommerce front, following in Douyin’s footsteps, Kuaishou began onboarding cross-border merchants onto its platform in May 2021.

Investing in strengthening logistics capabilities

Like Douyin, Kuaishou’s logistics capabilities are largely undeveloped and both platforms’ delivery service quality is far inferior to eCommerce leaders Alibaba (BABA), and JD.com (JD). Kuaishou however is working to address this weakness which should boost competitiveness as an eCommerce platform going forward and thereby drive its eCommerce business, a major growth engine for Kuaishou (eCommerce GMV reached CNY680 billion in 2021, up 78/4% YoY, helping drive revenues for its Other Services business segment – its fastest growing business segment – which saw revenues jump 99.9% YoY to CNY7.4 billion in 2021).

Risks

Near-term risks include economic headwinds that are already impacting consumer spending and therefore advertising budgets as well. Current projections expect China’s digital ad spending to grow this year but at a slower pace. With Kuaishou’s low and mid-tier audience being more sensitive to macro downturns, any impact to advertising budgets is likely to have a material impact on Kuaishou’s Online Marketing services business, its biggest business segment accounting for more than half of revenues.

Competitive risks could potentially limit Kuaishou’s growth. The company’s growth strategies including international expansion, and logistics development are very much similar to rivals such as Douyin.

Meanwhile, more established players with ecosystem advantages are also encroaching on Kuaishou’s turf. Riding on its massive one billion plus userbase, Tencent’s ‘WeChat Channels’ (its answer to short video and livestream eCommerce) has already reached 500 million DAUs (compared with 600 million for market leader Douyin, and 323 million for Kuaishou), an astounding increase considering WeChat Channels was launched in 2020, later than both Douyin and Kuaishou (Kuaishou launched livestreaming features in 2016 and eCommerce features in 2018).

Regulatory risks are also potentially a concern. China has been cracking down on the tech sector, including areas such as livestreaming. This month, the Chinese government acquired a stake in Kuaishou, and although the stake is small (just 1%), the move is expected to give the government more influence over the company and it remains to be seen what sort of influence Beijing would exert.

Summary

Kuaishou has been delivering robust growth and there is ample room for growth with the company continuing to invest in enhancing their platform (through investments in algorithm improvements among others), expanding and diversifying their userbase, and strengthening operational efficiencies such as logistics capabilities. The company has a unique position as a short video platform with a captive audience in rural and low-tier cities in China, and accordingly could be a beneficiary from consumption upgrades along with rising incomes in this consumer segment, in line with the Chinese government’s common prosperity ambitions.

Near-term macro headwinds along with long-term competitive and regulatory risks, however, could weigh on share price performance and investors may opt for a less risky alternative at this time.

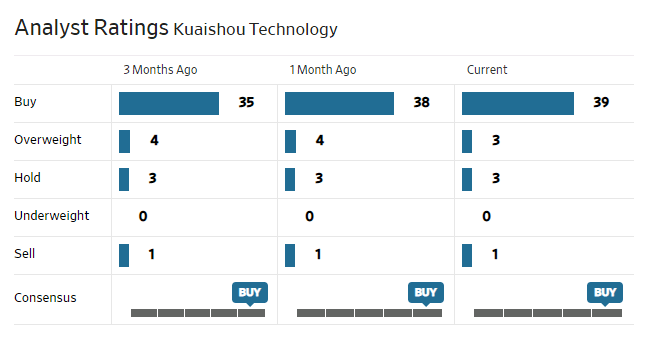

Analysts are largely bullish on the stock.

WSJ

Be the first to comment