sarayut/iStock via Getty Images

Much progress has been made in the DEB space in the past few years, from no approved treatment, i.e., only palliative care as the standard of care, to three potential treatments that have completed a phase 3 trial successfully.

In the order of the completion of a phase 3 trial, these potential DEB treatments are Amryt Pharma’s (AMYT) Filsuvez, Krystal Biotech’s (NASDAQ:KRYS) B-VEC and Abeona Therapeutics’ (ABEO) EB-101.

Currently, AMYT’s Filsuvez has been approved for DEB/JEB (Junctional EB) in the EU (June 2022), and in the UK (Sept 2022). In the US, AMYT received a CRL (complete response letter) in Q1 2022 and has since decided to “pursue a formal dispute resolution process with the FDA”, as the agency asked AMYT “to submit additional confirmatory evidence for the effectiveness of Filsuvez in EB.”

KRYS’s B-VEC’s application has been accepted in the US, with Feb 17, 2023 as the PDUFA date. The FDA does not currently plan to hold an advisory committee meeting. For the EU, KRYS is cleared to file their application in Q4, 2022.

On Nov 3, ABEO reported positive topline data from EB-101’s phase three RDEB (recessive DEB) trial. ABEO plans to file their application in the US in Q2, 2023.

Not all endpoints are created equal: Complete Wound Healing data at 6 months

Although these three DEB p3 trials are reported to be positive, i.e., meeting primary and/or secondary endpoints, it’s important to note that their wound healing* endpoints are not the same.

The table below summarizes the differences in the endpoints.

| Degree of wound healing | Duration | |

| AMYT | complete |

primary: at 45 days secondary: at 90 days |

| KRYS | complete |

primary: 6 months secondary: 3 months |

| ABEO |

primary: equal or greater than 50% secondary: complete |

primary: 6 months secondary: 6 months |

(by author from companies’ disclosures)

*Note: Besides wound healing, all three trials also measure reduction in pain severity, which ABEO has as a co-primary endpoint, while AMYT & KRYS have it as one of the secondary endpoints. For my purpose here, I will focus only on the wound healing data.

As wound healing is the most significant efficacy measurement in these trials, it is perhaps meaningful to have a cross-trial comparison using the most stringent criteria, i.e., complete, and the longest duration, i.e., 6 months.

In this regard, the table below lists a comparison between these three treatments:

|

Complete wound healing at 6 months (% in treatment group vs. % in placebo) |

p value | |

| AMYT | N/A* | N/A* |

|

KRYS (see slide 6) |

67.4% vs. 21.6% | <0.005 |

| ABEO (see slide 16) | 16% vs 0% | 0.016 |

(by author from companies’ disclosures)

*Note: AMYT did not have 6 months data. Their complete wound healing at 45 days is 41.3% vs. 28.9% (p=0.013), while it is 55.5% vs. 43.9% (p=0.296) at 90 days.

Please remember that this is a quick cross-trial comparison on one important efficacy measurement and not the results of any head-to-head comparison trials. Therefore, one should not take the comparison too literally or too far.

Suffice to say that the two root-cause targeting gene therapies, i.e., KRYS’s & ABEO’s, seem to show a more durable, clear efficacy than AMYT’s Filsuvez, for which the mechanism of action is more general.

In addition, at 6 months, KRYS’s complete healing data seems to be stronger than ABEO’s, i.e., a higher % of complete healing in the treatment group and a more significant p value for the difference between the treatment and the placebo groups.

The size of the large wounds from 11 RDEB patients in ABEO’s trial is >20 cm2 surface area (slide 10); compared to 15-30 cm2 at baseline (slide 7) in KRYS’s 31 patients trial (30 RDEB and 1 DEB patients).

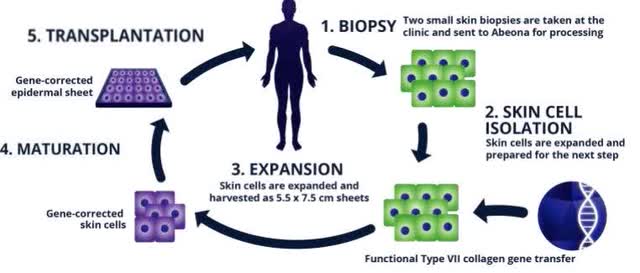

One more thing to note is that KRYS’s B-VEC is a re-dosable, topical treatment (gene therapy), while ABEO’s EB-101, a one-time gene therapy, that requires a much more involved procedure (see below).

Estimating KRYS’s DEB Market Potential

While one can never take an approval for granted, I think that KRYS’s B-VEC is highly likely to be approved, given the strong clinical data, including the p3 and p1/2.

If and when B-VEC is approved in the US in Q1 2023, B-VEC could be the first approved treatment for the US DEB patients, which definitely would give KRYS a clear lead time over ABEO and possibly even AMYT.

As stated before, AMYT’s Filsuvez is already in the EU and the UK, but not in the US. So in both the EU and the UK, KRYS probably will be around one year behind AMYT in terms of a regulatory approval and commercialization.

Given the strong 6-month complete wound healing efficacy data and the advantage of easy, re-dosable administration, I estimate that KRYS’s B-VEC would be very competitive in its adoption, if/when it’s approved.

For investment consideration, it’s helpful to estimate the upside potential.

According to AMYT (slide 15), they estimate the global EB market is >$1B, while KRYS’s DEB estimation (slide 18) is >$500M.

To get the P/S ratio, I’ll use two other commercial-stage biotech that have one or more approved drugs for orphan diseases, but which are not yet profitable: RARE and SRPT (see below).

|

Market Cap on 2022-11-04 |

TTM (trailing 12 months) Revenues |

P/S Ratio | |

| RARE | $2680 M | $343 M | 8 |

| SPRT | $9220 M | $876 M | 11 |

(compiled by author using info on SA)

The table below lists my estimation of B-VEC’s possible peak sales and the corresponding market cap.

| Market Cap using 8x Revenues | Market Cap using 11x Revenues | |

|

$167M (33% of market share) |

$1336 M | $1837 M |

|

$250M (50% of market share) |

$2000 M | $2750 M |

|

$300M (60% of market share) |

$2400 M | $3300 M |

(by author)

The current market cap of KRYS is $1.88B (2022-11-04), which is not cheap. From this simple exercise, it would suggest that if the peak sale of B-VEC can reach $250M or more, then the potential upside can range from a modest 6% to 75%, using P/S ration of 8 to 11.

Financials

According to KRYS Q2 report, the company has a cash runway of $429M and the net quarterly loss of $28M as of June 30, 2022.

Concluding Thoughts

It’s important to remember that small cap biotech stocks are highly volatile and risky to begin with, and certainly more so when the wider market this year is what it is, e.g. S&P -22% from its 52-week-high.

KRYS, as a long-term investment opportunity, is no exception. It’s down 29% from its 52-weeks-high vs. XBI -40%.

Besides the DEB, KRYS has an extensive pipeline using the same HSV-1 vector platform, including treating Cystic Fibrosis, other serious genetic skin diseases, and for aesthetic indications.

Company-specific risks include but are not limited to potential regulatory/commercial setbacks or failures, dilution risks, future trial setbacks or failures.

Lastly, in the current market condition, some may feel like fleeing from investing in a highly speculative/risky endeavor such as drug development.

I understand the sentiment, as I myself have known plenty of disappointments, mistakes and losses as an investor focuses on clinical-stage biotech companies.

For such a time as this, I like to remind myself of the approved drugs or vaccines that as an investor, I have been a part of, i.e., Liminal BioSciences (LMNL), Rigel Pharmaceuticals (RIGL), Pfenex (LGND), SIGA Technologies (SIGA), Moderna (MRNA), BioNTech SE (BNTX). So, if/when approved, KRYS will be my 7th approval that will help meet a serious unmet medical need, regardless the status of my investment returns.

I find encouragement from the thought.

Thanks for reading. Wishing you all the best!

Be the first to comment