jetcityimage

During these uncertain times, investing can be more difficult than it normally would be otherwise. Because of the high levels of inflation we have seen so far this year, it’s not uncommon to see companies generate stronger revenue than ever before. But at the same time, profits can be constrained as well. Add on top of this the fact that while profitability might be hindered, a firm that still manages to beat expectations despite a year-over-year decline could still be looked at in a favorable light, and it makes sense that investors would find current market conditions challenging. A great example of this all in action can be seen by looking at Kroger (NYSE:KR), one of the largest retail chains on the planet. Despite the fact that the company is experiencing some volatile results as of late, the stock still does represent an attractive opportunity for long-oriented investors.

A look at Kroger’s Q3 earnings results

On December 1st of this year, the management team at Kroger announced financial results covering the third quarter of the company’s 2022 fiscal year. This quarterly data presented all of the wild disparities that I highlighted in the introducing paragraph of this article. For starters, revenue for the company came in strong at $34.20 billion. That’s 7.3% higher than the $31.86 billion the company generated the same time last year. In addition to posting a nice increase year over year, the sales figures reported by the company came in $277.67 million higher than what analysts anticipated. Excluding fuel, of which the enterprise sells a great deal, sales still would have increased an impressive 6.4%.

There were multiple drivers behind this sales increase. Although a small portion of the company’s revenue, delivery sales grew by 34% year over year thanks to programs like Kroger Boost and the firm’s fulfillment centers. It also benefited from the launch of floral and sushi delivery in collaboration with DoorDash (DASH) at more than 1,000 locations. The introduction of new offerings, called Our Brands, including 147 that were made public in the third quarter, also helped. And as a whole, the Our Brands category of products all grew revenue 10.4% year over year.

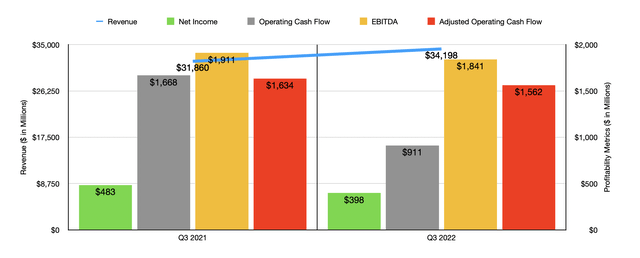

Although it was great to see such robust top line results, profitability for the company worsened. Net income for the enterprise fell from $483 million in the third quarter of last year to $398 million the same time this year. On a per-share basis, it dropped from $0.64 to $0.55, missing expectations by $0.28 per share. But if we make certain adjustments, then earnings of $0.88 per share beat expectations by $0.06 per share. Modest increases in costs relative to revenue negatively impacted the company’s bottom line. For instance, its merchandise costs, excluding certain items, rose from 78.3% revenue to 78.6%. Meanwhile, general and administrative costs for the company grew from 16.2% of sales to 16.3%. These figures may not seem like much. But consider, using revenue from the latest quarter, that a change in margin of just 0.1% would translate to pretax profit changes of $34.2 million, and the company doesn’t need to see much volatility in its income statement to see some pain or some positive results. Naturally, other profitability metrics followed suit. Operating cash flow fell from $1.67 billion to $911 million. If we adjust for changes in working capital, it would have fallen from $1.63 billion to $1.56 billion. Meanwhile, even EBITDA declined, dropping from $1.91 billion to $1.84 billion.

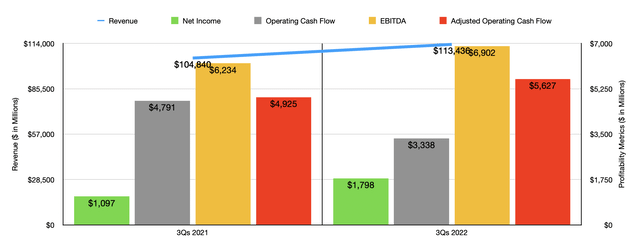

The results experienced during the third quarter were comparatively worse than what the company has experienced for much of this year. For the first nine months of 2022, sales came in at 8.2% above what they were at last year, growing from $104.84 billion to $113.44 billion. Net income jumped from $1.10 billion to $1.80 billion. Yes, operating cash flow has taken a hit, falling from $4.79 billion to $3.34 billion. But if we adjust for changes in working capital, it would have risen from $4.93 billion to $5.63 billion. And over that same window of time, even EBITDA improved, climbing from $6.23 billion to $6.90 billion.

In addition to posting revenue and profit figures that exceeded expectations, the management team at the firm announced an increase in guidance for the current fiscal year. Adjusted identical sales should come in between 5.1% and 5.3% above what the company achieved last year. Earnings per share should be between $4.05 and $4.15. At the midpoint, that would translate to $2.94 billion, representing a nice improvement over the $1.66 billion the company achieved in 2021. Operating cash flow, meanwhile, should be a bit weaker, totaling $5.7 billion compared to the $6.19 billion achieved last year. Though management did say that roughly $300 million represented deferred taxes that are now being paid. So if we make an adjustment there, it would be a bit better this year at $6 billion. Management did not provide any guidance when it came to EBITDA, but if we annualize results experienced so far for the year, we should get a reading of $9.04 billion.

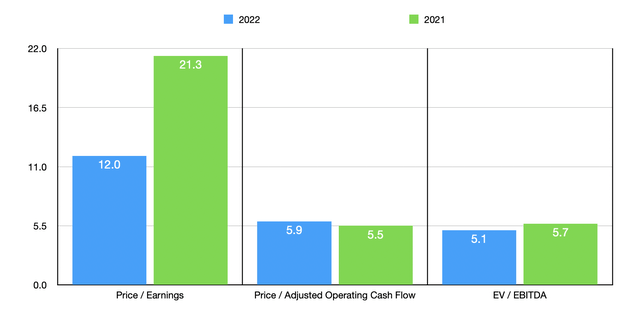

Using these figures, it’s not difficult to value the company. On a forward price-to-earnings basis, the multiple of the company comes in at 12. This is down from the 21.3 reading that we get using data from last year. The price to operating cash flow multiple should rise from 5.5 to 5.9, while the EV to EBITDA multiple should come in at between 5.1 compared to the 5.7 achieved using data from last year. As part of my analysis, I also compared Kroger to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7 to a high of 47.4. Using the price to operating cash flow approach, the range was from 3.8 to 30.3. And when it comes to the EV to EBITDA approach, the range was from 3.1 to 23.7. In all three scenarios, Kroger was cheaper than all but one of the companies.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Kroger | 12.0 | 5.9 | 5.1 |

| Albertsons Companies (ACI) | 7.0 | 3.8 | 3.1 |

| Walmart (WMT) | 47.4 | 17.9 | 17.8 |

| Costco Wholesale (COST) | 38.4 | 30.3 | 23.7 |

| Casey’s General Stores (CASY) | 23.5 | 10.7 | 12.3 |

| Sprouts Farmers Market (SFM) | 14.9 | 10.1 | 6.0 |

One fair question that some might point out involves rival Albertsons, which Kroger announced in October the pending acquisition of. Valuing Kroger with Albertsons for the purpose of this article may not make the most sense. After all, the key point of discussion here is how healthy Kroger as a whole is and whether or not it makes for a good standalone prospect as is. I say this for two reasons. First and foremost, the Albertsons transaction is still quite a way into the future and the picture for either firm or both firms could change considerably between now and the time the deal is expected to be completed in early 2024. And second, the initial terms of the merger between the two companies look favorable for all parties involved. With Albertsons bringing 2,273 store locations and 402 fuel centers, not to mention its own portfolio of branded products that generate around $15 billion a year in sales collectively, the move will create a behemoth in the retail space capable of achieving robust synergies. Already, Kroger is forecasting $1 billion in annual cost savings from the transaction within four years of its closing, with half of that achievable in the first 24 months. So the completion of such a transaction should likely be considered a significant bonus on top of the high quality that is Kroger on a standalone basis today.

Takeaway

Based on the data provided, I must say that I find myself impressed with the results that Kroger has achieved in light of the current economy. Sales continue to rise, though profits have taken a bit of a hit. Cash flows have also been negatively impacted most recently, even though they remain robust for the first nine months of the 2022 fiscal year as a whole. Add on top of this growth the fact that the company is already trading on the cheap, both on an absolute basis and relative to similar firms, and factor in other positive items like its merger with Albertsons and the fact that management recently raised guidance, and I see no reason to be anything other than bullish for now.

Be the first to comment