JHVEPhoto/iStock Editorial via Getty Images

This article was published for members of Leads From Gurus on March 09.

This article was prepared by Ubaidulla Sathar, CFA in collaboration with Dilantha De Silva.

On April 22, 2019, The Kraft Heinz Company (NASDAQ:KHC) Board of Directors appointed Miguel Patricio as Chief Executive Officer following which we have witnessed a turnaround in the operating performance of the company. In fiscal year 2020, the company benefitted from the pandemic situation with lockdown measures leading people to rely on packaged meals. Amid these extraordinary circumstances, in the following year, Kraft Heinz was still able to grow, and the company posted 1.8% organic sales growth. On an overall basis, sales declined 0.5% in 2021, but this negative development was primarily driven by the company disposing of some of its businesses resulting in a 3.5% negative impact on sales. Despite benefitting from the pandemic situation, the company has also implemented fundamental changes in its operating model and is currently reaping the rewards. The change in fortunes can be traced back to September 15, 2020, when the company unveiled its strategic transformation plan, and, in this article, we will discuss these changes in more detail and determine whether the company is making progress toward achieving its ambitious goals.

The operating model introduced by the company incorporates five primary elements:

- People with purpose: Under this strategy, experienced talent was brought in to reshape the culture to fill the gap in critical skill sets, and the company has so far hired 100 new executives with digital experience since the announcement of this strategy.

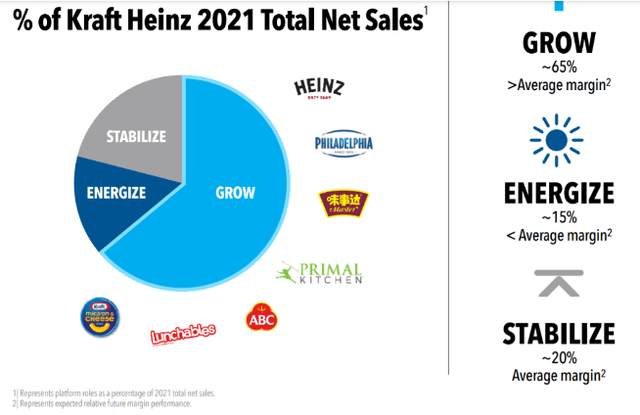

- Consumer Platforms: The company has trimmed its portfolio from more than 55 individual categories to six consumer-driven platforms. Each of these platforms will help the company Grow, Energize, or Stabilize.

- Ops Center: The company’s Ops Center brings together the value chain on an end-to-end basis, creating a fast, adaptable, integrated supply chain with greater visibility by deploying technology and data analytics for continuous improvement. Kraft Heinz has announced that, through 2024, the company’s Ops Center will target approximately $2 billion of gross productivity efficiencies. The company achieved $400 million from this target in 2020 and another $400 million is believed to have been achieved in 2021.

- Partner Program: Kraft Heinz set up dedicated teams to improve customer partnerships and to build new strategic partnerships.

- Fuel Our Growth: This is one of the more important strategies of Kraft Heinz which includes measures to accelerate growth, strengthen its long-term market position, provide a strong rate of return and reduce net leverage to below four on a consistent basis. Under this pillar, the company divested the nuts and natural cheese businesses that have significant exposure both to private labels and commodities. As a result of the divestitures, Kraft Heinz has reduced its U.S. private label exposure from 17% to 11%. The company also has a focus on expanding its portfolios using technologically advanced products, and these efforts are categorized into Taste Elevation and Easy Meals Made Better. As a result of the above changes, almost two-thirds of Kraft’s business now is centered on consumer platforms that are enjoying relatively attractive growth profiles, and these categories also enjoy higher gross margins as well.

Company presentation

Below are two other steps taken by the management to transform Kraft Heinz into a growth-oriented company that is continuing to focus on innovative products loved by consumers.

- Transform Kraft Heinz into an innovative and consumer-driven company: this has resulted in the company winning 123 marketing, product, and innovation awards in 2021. AdAge ranked Kraft Heinz as the fourth best marketer in the United States in 2021 as well, which goes on to show how the company is once again focusing on maintaining its brand value after a few years of disappointing marketing efforts.

- Investments to build the global Taste Elevation platform: The acquisition of Assan Foods, Hemmer, BR Spices, and Just Spices will accelerate the company’s expansion into the Middle East and Brazil. The company expects these deals to improve its direct-to-consumer capabilities, and Kraft Heinz is also planning to leverage the AI capabilities of Just Spices to drive innovation in the future.

The Impact of Agile@Scale

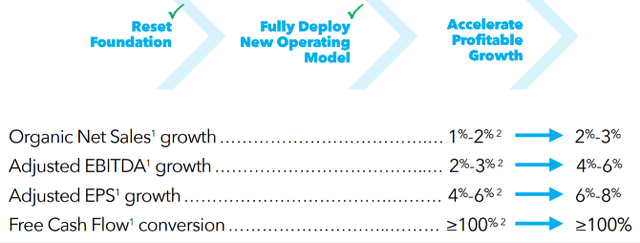

On February 22, Kraft Heinz boosted its long-term financial targets with an ambitious long-term organic growth rate target of 2%-3% from 1%-2% previously. The company also boosted the adjusted EPS growth target to a range of 6%-8% compared to the 4%-6% guided previously.

Company presentation

The company’s focus is on accelerating profitable growth and unlocking efficiencies across the value chain. As part of this strategy, Kraft Heinz is developing in-house digital capabilities in partnership with leading edge-tech companies to incorporate data analytics in how they work, collaborate, and go to the market in the future. This strategy is expected to accelerate the pace of innovation and lead to an increase in consumer intimacy with the help of granular, real-time consumer data. Initiatives such as demand planning at stores and stock-keeping using AI-powered tools are expected to reduce out-of-stock risk, improve working capital flow, and ultimately enable Kraft Heinz to take more products to customers in less time.

To achieve sustainable growth, Kraft Heinz is focused on increasing volumes of its business over the long term locally, while also expanding to international markets. Currently, just over 71% of revenue is generated in the United States, and including Canada, North America accounts for 78% of sales. The company, however, has already completed several strategic acquisitions to expand its presence into high-growth emerging markets where the consumption of packaged goods is expected to grow faster in comparison to the developed world, and these strategic initiatives will start paying off in the next couple of years.

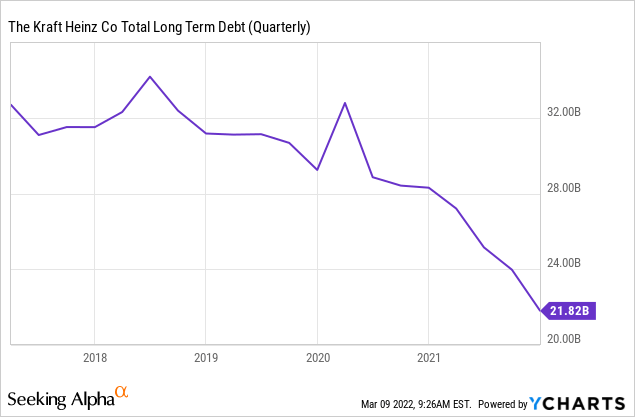

One of the key risks raised by investors in the past was the inefficient management of the balance sheet. The improved cash-flow position in the last few years, however, has enabled the company to reduce its debt burden, which is another positive sign for long-term investors.

YCharts

Although the company seems to be moving in the right direction, it should be mentioned that risks remain for the company with regard to near-term inflationary pressures. Raising prices of end products to secure organic sales growth might end up resulting in a larger-than-expected volume decline, which in return could exert pressure on the company’s bottom line this year.

Our take

We believe Kraft Heinz is laying the foundation to turn around its prospects in the next few years, and we believe the international business will play a critical role in helping the company reignite growth. Since the appointment of the new CEO, Kraft Heinz has made progress on several fronts, and we believe the company is staying true to the promises given a couple of years ago. The dividend yield of 4% today might entice income investors to initiate a long position on Kraft Heinz stock, but in our opinion, the company is not yet out of the woods, which leaves us in doubt regarding the company’s ability to maintain or raise the dividend in the foreseeable future. That being said, we believe Kraft Heinz might be a good pick for our model value portfolio. Before investing in the company, however, we are planning to use a discounted cash flow model to establish a sufficient margin of safety, and we will share our findings in a separate article.

Be the first to comment