onurdongel/E+ via Getty Images

Investors in Kosmos Energy Ltd. (NYSE:KOS) have celebrated. As its NYSE stock trading anniversary (May 2011) approaches, shares are pushing up from $4.23 in February ’22 to $7.91 at the close of March. There is still time to join the party. Extrinsic circumstances and good management give KOS shares a potential opportunity to climb near $10 per share, in our opinion.

Conditions for Growth

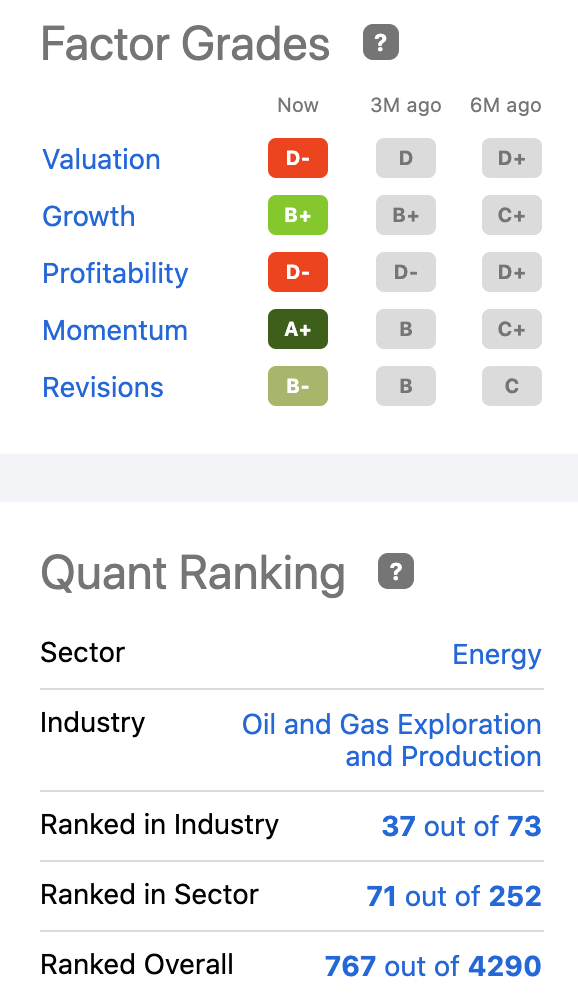

The consensus among Wall Street analysts is bullish. The few Seeking Alpha authors covering the stock are preponderantly bullish. However, the Seeking Alpha Quant Rating is a Hold. We think investors who are risk intolerant should proceed cautiously.

KOS has Momentum. The average price target among analysts is $9.50 over the next 12 months. That is an implied upside of 16%. Shares were at a high of $9.48 before the pandemic tanked the global economy. Shares have risen 158.5% over the past 12 months. The yearly gain is significantly higher than similar stocks in the oil and gas industry. You can subscribe to SA here if you want to read the reasons and other articles about KOS.

Factor Grades/Quant Rating (seekingalpha.com/symbol/KOS)

Kosmos Energy is a deep-water independent oil and gas exploration and production company. Primary assets include production offshore Ghana, Equatorial Guinea, and the U.S. Gulf of Mexico. Offshore Mauritania and Senegal gas development is a second asset. It maintains a proven basin exploration program.

Kosmos Energy is in the right business at the right time, run by a notable management team. Steeped in oil and gas exploration and production experience, they are short on pretense and long on business acumen. KOS gets an outperform rating from most analysts.

The Q4 ’21 numbers reported in February, ’22 came in stronger than expected. For the quarter, free cash flow was about $136M on earnings of $572.6M. Management will report Q1 ’22 earnings on May 8th.

We expect the EPS will meet the consensus forecast of $0.27 compared to -$0.8 of last year. The recent quarter EPS was a positive $0.10 in contrast to -$0.12 last year. That is an improvement of 208.33%. Earnings can grow 25% or more over the next year.

Technicals are in positive territory. News sentiment is bullish. Hedge funds increased their holdings by 9M shares in the last quarter. KOS shareholder returns beat returns in the oil and gas industry. Short interest is a moderate 5.4%.

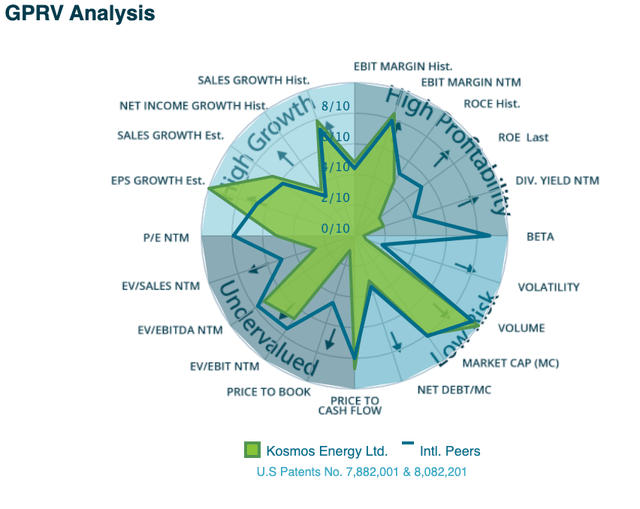

Analysis (infrontanalytics.com/fe-EN/40078WB/Kosmos-Energy-Ltd-/market-valuation)

Another factor driving the share price are the marauding swarms of government leaders scouring the globe for alternative oil and gas sources from the Russians. Western leaders are engaged in a global quest after sanctioning Putin’s supplies. KOS attributes its strong Q4 results partly to its “West Africa and Gulf of Mexico producer beating Street estimates.”

The Institute for Security Studies claimed on March 22nd that “Africa holds the answers to Europe’s wartime energy crisis.”

The European Commission’s REPowerEU plan is to reduce demand for Russian gas by two-thirds in 2022 and make Europe independent from Russian fossil fuels by 2030. In 2021 the European Union (EU) imported…close to 40% of its total gas consumption. Constraints on Russian oil and gas will inevitably ignite the search for new supplies in Africa, the most unexplored region globally…In 2021 alone, oil and gas were discovered in Angola, Namibia, Ghana, Côte d’Ivoire, Egypt, South Africa and Zimbabwe.

The strong quarterly report and the position Kosmos Energy is in supplying oil and gas in these times may have encouraged lenders to refinance the company. Its revolving line of credit has a capacity of $250M and a maturity date to the end of 2024. Interest rates are still low, so will not be much of a draw on the net. The company got a boost in liquidity, though it is far from luscious.

Caveats

The Seeking Alpha Factor Grades paint a hazier picture than other analysts. Profitability and Valuation get low marks, continuing a trend. KOS has a low profile, gets little news coverage, and has a relatively small base of followers and investors.

The financials are dicey. Short-term liabilities are near equal to short-term assets; long-term assets are $4.4B and liabilities are ~$3.9B. Earnings grew less than a tenth of one percent over the past five years.

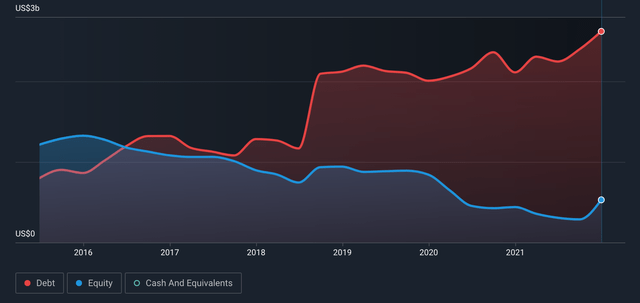

Debt to Equity (simplywall.st/stocks/us/energy/nyse-kos/kosmos-energy#health)

KOS carries a heavy debt load. Debt ($2.62B) to equity ($529.3M) is a ratio of 495%. The ratio increased from 122% five years ago. Earnings grew less than a tenth of one percent over the past five years. The cash runway maybe 18 months, but it is not crystal clear. They do not pay a dividend.

Insiders bought heavily in 2020 when shares hit a cheap price; they bought more shares than sold in subsequent years. Corporate insiders took profits in the last three months when the price popped. Insider sales totaled $1.8M. Institutions own +80% of the shares. They diluted shareholders this past year when the total outstanding shares grew by 11.6%.

Takeaway

We expect shares will continue moving up as the war in Ukraine wages. Oil gas, wheat, and other commodities are the dream team moving markets. KOS moved on to the threat of war. Actual war and attacks on oil depots set the price aflame. The company reported a strong Q4, could refinance, and has A+ momentum.

But there remain vulnerabilities that are caveats for retail value investors. Making money off a brutal dance led by ghastly men (to paraphrase) requires a high-risk tolerance. KOS financials are dicey without a lot of cushions. So buyer beware.

Be the first to comment