Joe Raedle/Getty Images News

Thesis

Kohl’s Corporation (NYSE:KSS) stock has struggled close to the lows last seen in July after the company ended its strategic review, which we highlighted in our previous update.

It attempted a brief rally toward its August highs but was aptly rejected by sellers at a critical moment in its recovery. Hence, the bears are given another opportunity to run amok against KSS, setting up more potential downside volatility.

Notwithstanding, we assessed that the company has likely de-risked its FY22 guidance in its recent Q2 earnings release. We also postulate that the market has likely priced in a recession as investors anticipate the extent of the economic damage spurred by the Fed’s accelerated rate hikes.

However, we must caution investors that KSS remains in a long-term consolidation range with a downward bias. Therefore, we deduce that the market has not been convinced with the structural drivers underpinning Kohl’s long-term growth prospects. Hence, we urge investors to be nimble in their allocation in KSS, using appropriate long/short opportunities to leverage its long-term range possibilities.

We remain cautious over the prospects of a deeper-than-expected recession. However, we posit that the reward-to-risk profile on KSS looks skewed to a upward mean-reversion opportunity from here. Coupled with well-battered valuations and a seemingly secure dividend yield, we believe a speculative position is justified, despite potential near-term downside volatility.

Accordingly, we revise our rating on KSS from Hold to Speculative Buy, with a medium-term price target (PT) of $35, implying a potential upside of 33%.

However, investors are urged to use appropriate risk management strategies to cut losses if the position becomes untenable.

KSS’s Well-Battered Valuations

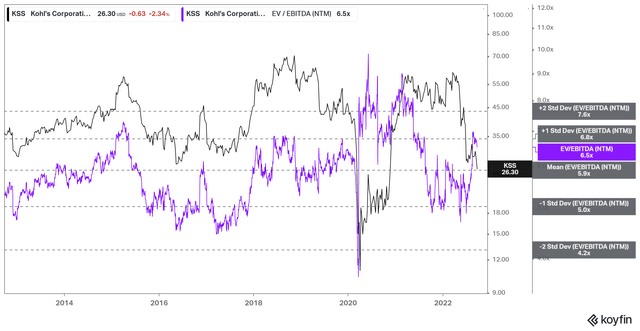

KSS NTM EBITDA multiples valuation trend (koyfin)

KSS last traded at an NTM EBITDA multiple of 6.5x, above its 10Y mean of 5.9x. It’s important to note the revision to Kohl’s FY22 guidance impacted its profitability estimates markedly, leading to lower forward adjusted EBITDA projections. As a result, it led to an increase in its EBITDA multiple, even though its price levels traded in line with its July lows.

Notwithstanding, our analysis suggests that Kohl’s profitability decline has likely bottomed out in FQ2. As such, we are also confident that the bottom seen in its EBITDA multiple has also formed its bottom in July, at the one standard deviation zone under its 10Y mean.

Hence, we postulate that the market has de-risked KSS’s valuation, despite the worsening macro headwinds.

Kohl’s Guidance Suggests The Worst Is Likely Over

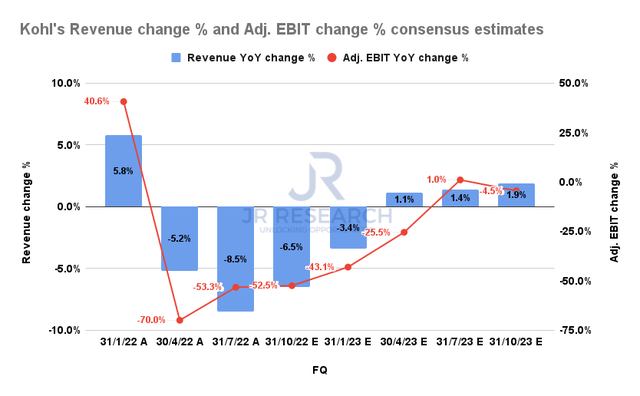

Kohl’s Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Management stunned investors with a revision in its FY22 guidance that fell well short of its previous estimates. However, we believe management is also setting up better comps prospects moving forward by de-risking its guidance, given worsening macro headwinds.

Therefore, we believe it was a prudent move by Kohl’s as it attempts to navigate multitudinous headwinds exacerbated by the Fed’s hawkish attempts to combat inflation.

Moreover, management’s revised guidance for FY22 suggests that Q2 was likely the nadir in its revenue and adjusted EBIT decline. The consensus estimates above show that Kohl’s underlying growth metrics should recover through FY23. Therefore, we believe it should support our thesis of a constructive reward-to-risk balance for Kohl’s at the current levels.

Furthermore, global supply chains have eased significantly, with pressure in the supply chain snafu down to levels last seen in early 2021. Commodity prices, as measured by the GSCI Commodity Index (SPGSCI), have also pulled back to January 2022 levels. Therefore, we believe the market is likely pricing in a recessionary scenario, reducing the cost pressures impinged by supply chain snarls.

Therefore, we deduce that investors’ focus has likely turned to Kohl’s execution through the cycle, leveraging its recent success with Sephora driving sales uplift.

Nevertheless, given the macro impact on its customer base, we are still tentative over management’s execution. However, our thesis is predicated mainly on a mean-reversion opportunity from well-beaten down valuations.

Is KSS Stock A Buy, Sell, Or Hold?

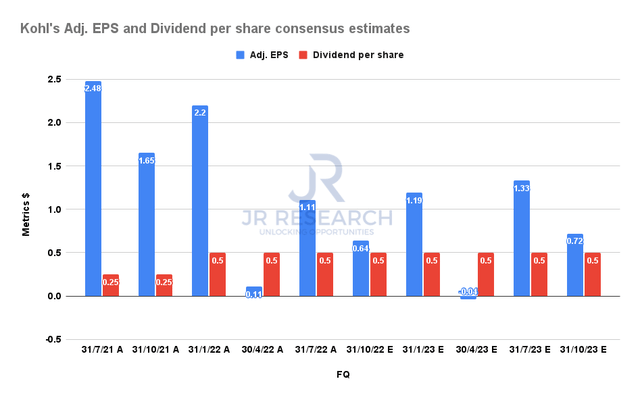

Kohl’s Adjusted EPS and Dividend per share consensus estimates (S&P Cap IQ)

Kohl’s dividends are expected to remain generally well-covered by its adjusted EPS through FY23. Therefore, its robust dividend yields should continue to underpin its valuations as the company attempts to recover its profitability growth cadence.

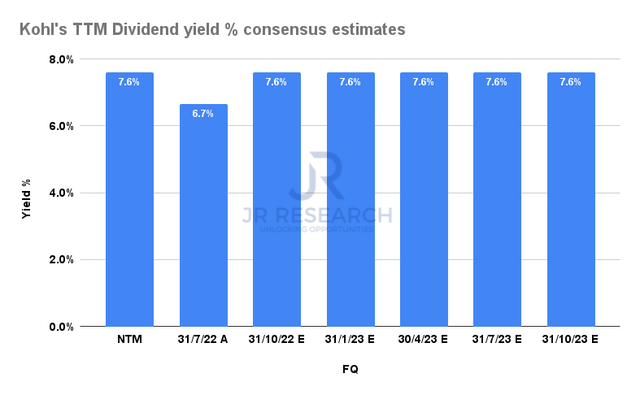

KSS NTM Dividend yields % consensus estimates (S&P Cap IQ)

Therefore, Kohl’s forward dividend yields are expected to remain stable, which is also relatively attractive at 7.6%.

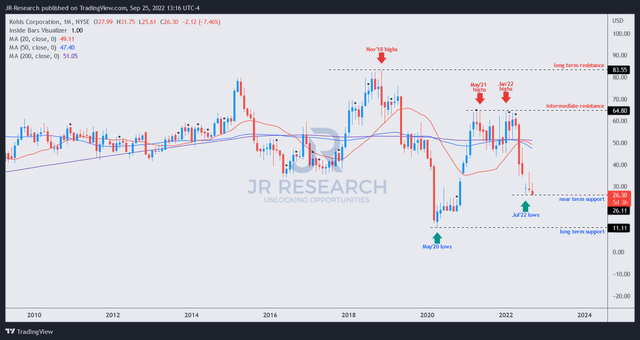

KSS price chart (monthly) (TradingView)

As seen in KSS’s long-term charts, it’s still trading within a broad consolidation range. The pummeling in July sent it further down, closer to its COVID lows. However, we deduce that it’s unlikely for Kohl’s to revisit those lows.

Furthermore, Kohl’s is projected to improve its underlying metrics through FY23. As a result, we believe that the opportunity for a significant mean-reversion opportunity is substantial.

We revise our rating on KSS from Hold to Speculative Buy, with a medium-term PT of $35.

Be the first to comment